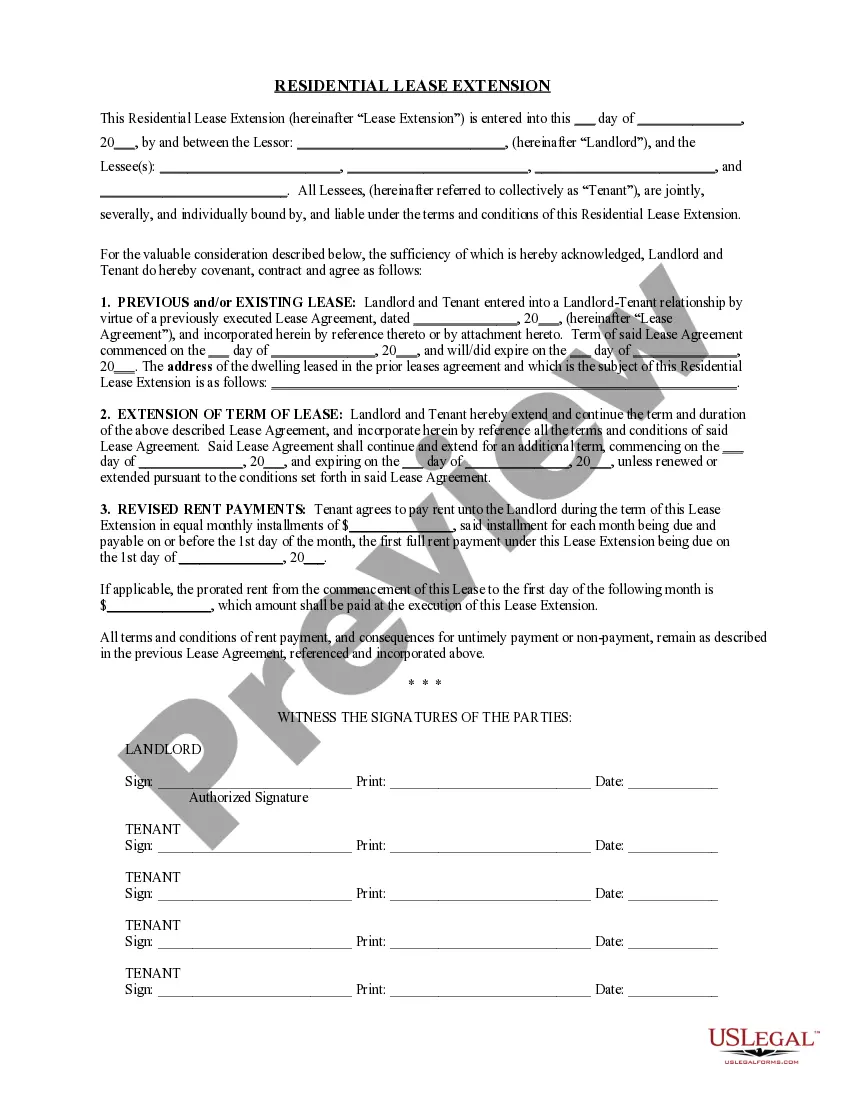

The District of Columbia Rental Lease Agreement for Business is a legally binding contract that outlines the terms and conditions between a landlord and a business tenant for the rental of a commercial property within the District of Columbia. This agreement is specifically designed for business purposes, and it contains various clauses that are tailored to meet the unique needs of renting commercial space. It serves as a crucial legal document that protects the rights and interests of both parties involved. The District of Columbia Rental Lease Agreement for Business typically includes key elements such as the identification of the parties involved, a detailed description of the leased property, the lease term, rental payment provisions, security deposit requirements, maintenance responsibilities, sublease and assignment restrictions, and dispute resolution methods. Additionally, this agreement may also address additional factors such as the permitted use of the space, compliance with zoning and licensing regulations, insurance requirements, utilities responsibilities, and any specific terms agreed upon by the landlord and the tenant. There are several types of District of Columbia Rental Lease Agreements for Business, each serving distinct purposes and accommodating various business needs. Some common types include: 1. Gross Lease Agreement: In this type of agreement, the tenant pays a fixed amount of rent, and the landlord assumes the responsibility for all operating expenses like property taxes, insurance, and maintenance costs. 2. Net Lease Agreement: Here, the tenant is responsible for paying not only the base rent but also a portion or all of the operating expenses associated with the property, such as property taxes, insurance, and maintenance costs. 3. Percentage Lease Agreement: This agreement structure is commonly used for retail businesses. In addition to a base rent, the tenant pays a percentage of their gross sales as a form of rent. 4. Fixed-Term Lease Agreement: This type of lease has a defined start and end date, and the tenant agrees to occupy the space for a specific period. The terms and conditions remain consistent throughout the agreed-upon term. 5. Month-to-Month Lease Agreement: In this agreement, either party has the flexibility to terminate the lease with proper notice, typically 30 days. It provides more flexibility for short-term business arrangements. 6. Sublease Agreement: This type of agreement occurs when a tenant chooses to lease out a portion or the entire space to another party, known as the subtenant. The original tenant retains liability for the lease but becomes a landlord to the subtenant. It is important for both landlords and business tenants in the District of Columbia to carefully review and understand the terms and conditions of the rental lease agreement before signing it. Seeking legal counsel or utilizing template agreements customized for the District of Columbia can ensure a smooth and well-protected business leasing experience.

District of Columbia Rental Lease Agreement for Business

Description

How to fill out District Of Columbia Rental Lease Agreement For Business?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal document templates you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the District of Columbia Rental Lease Agreement for Business in seconds.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

When you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you desire and provide your credentials to sign up for an account.

- If you have a subscription, Log In and download the District of Columbia Rental Lease Agreement for Business from your US Legal Forms account.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- To use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure that you have selected the correct form for your city/region.

- Click the Review button to evaluate the form’s content.

Form popularity

FAQ

The perception that there are few Airbnbs in Washington, D.C. may stem from strict regulations governing short-term rentals. Many hosts find it challenging to navigate the registration process or comply with local laws. However, with a District of Columbia Rental Lease Agreement for Business in place, property owners can clarify their rights and responsibilities. Proper documentation can make your Airbnb experience much more feasible and successful.

To host on Airbnb in Washington, D.C., you first need to complete online registration and obtain a short-term rental license. Once you have the license, create a listing that complies with local guidelines. Using a District of Columbia Rental Lease Agreement for Business can help formalize the rental process and set clear expectations. Always keep your property compliant with D.C. laws to ensure smooth hosting.

The Rental Accommodations Division in Washington, D.C. manages rental housing regulations, including tenant rights, rent control, and registration compliance. This division provides resources for both landlords and tenants to understand their responsibilities. A District of Columbia Rental Lease Agreement for Business can align with these regulations and protect all parties involved. Staying informed through this division can also enhance your rental experience.

Yes, short-term rentals are legal in Washington, D.C., but they come with specific regulations. Hosts must register their properties and adhere to the rules established by the District. Utilizing a District of Columbia Rental Lease Agreement for Business can clarify the terms for both hosts and guests. This agreement can help ensure that you meet all legal obligations while renting out your property.

To register a rental property in Washington D.C., the owner must complete a registration form with the Department of Consumer and Regulatory Affairs (DCRA). This step ensures compliance with local rental laws. A District of Columbia Rental Lease Agreement for Business can be beneficial, as it outlines the terms of the rental arrangement. Make sure to keep all required documents ready for a smooth registration process.

Yes, you need a license to manage rental properties in the District of Columbia. Property managers must obtain a real estate license if they are handling leases and managing tenants. Utilizing tools like uslegalforms, you can find the necessary templates, such as the District of Columbia Rental Lease Agreement for Business, which simplify the process and ensure that you comply with licensing requirements.

Yes, Washington, DC requires a business license for anyone engaging in business activities, including renting out property. This license ensures that you meet local standards and protects both you and your tenants. Having a valid business license is crucial when you create a District of Columbia Rental Lease Agreement for Business, as it demonstrates your credibility and adherence to regulations.

To register as a landlord in the District of Columbia, you must first ensure compliance with local regulations. Start by obtaining a basic business license if required, then register your rental properties with the Department of Consumer and Regulatory Affairs. By completing this process, you can effectively manage agreements such as the District of Columbia Rental Lease Agreement for Business, aligning with legal obligations and protecting your rights.

The best lease type for commercial property largely depends on your specific business needs. Common lease types include gross leases, net leases, and modified gross leases, each with its own advantages. Consider the implications of the District of Columbia Rental Lease Agreement for Business when selecting a lease type to ensure it aligns with your financial goals and operational requirements.

Yes, to rent a commercial space in Washington, D.C., you generally need a business license. This license is crucial for ensuring that your business operates legally and adheres to local regulations. When you engage with a District of Columbia Rental Lease Agreement for Business, it’s vital to have all necessary licenses to avoid legal complications.

Interesting Questions

More info

In your legal files, you will need to keep documents related to: Title, Liability, Legal Action, Civil Action, Contracts, Business Organization, and Contracts. These documents will help you better prepare yourself for the case you are in.