District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out Resolution Selecting Bank For Corporation And Account Signatories - Corporate Resolutions?

You can dedicate hours online searching for the legal document template that meets the state and federal requirements you need. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can download or print the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions from the service.

If you have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, modify, print, or sign the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions. Every legal document template you purchase is yours indefinitely.

Complete the transaction. You can utilize your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your device. Make adjustments to your document if needed. You can complete, modify, and sign, as well as print the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions. Access and print a wide selection of document templates using the US Legal Forms Website, which offers the largest assortment of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of any purchased form, go to the My documents section and click on the relevant link.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice. Review the form information to confirm you have chosen the appropriate form.

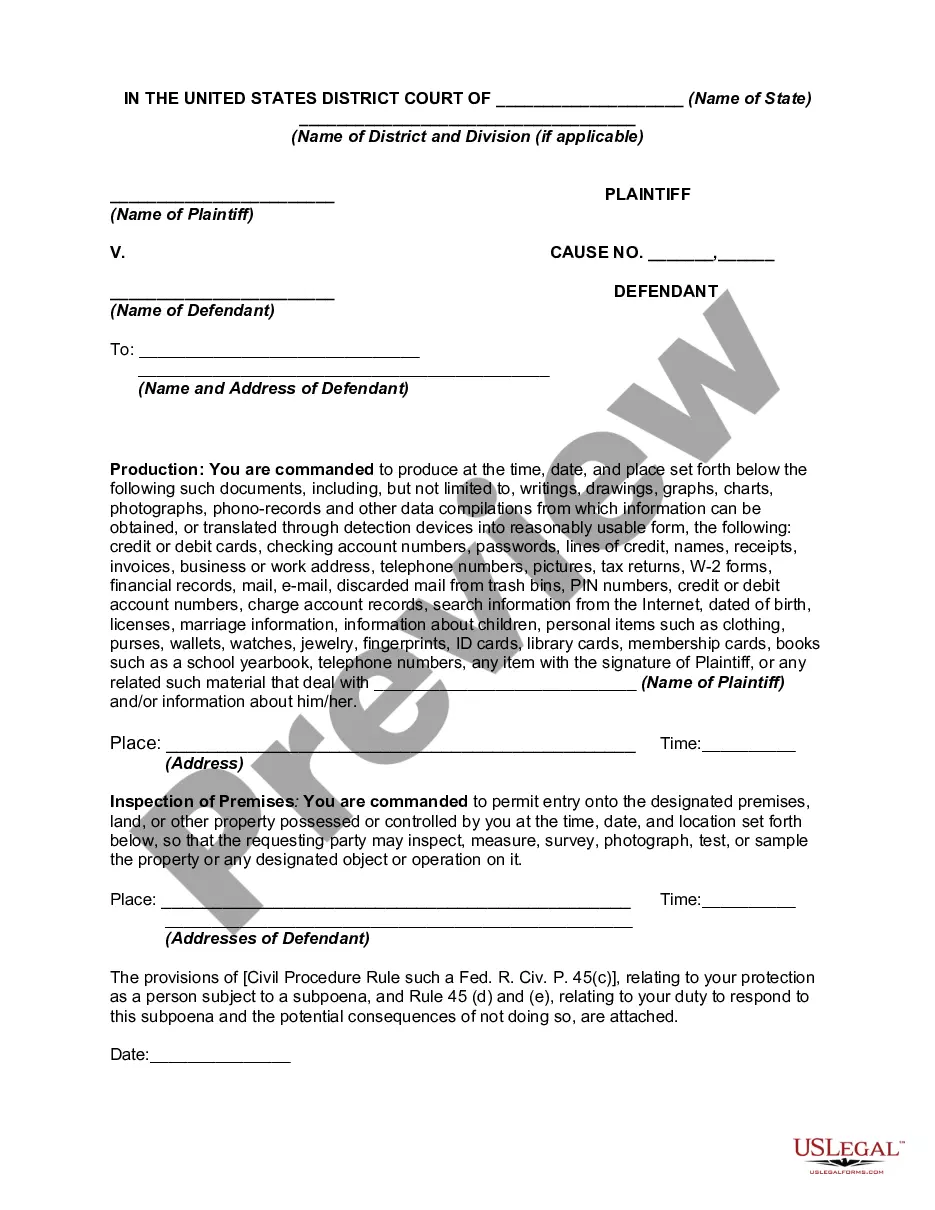

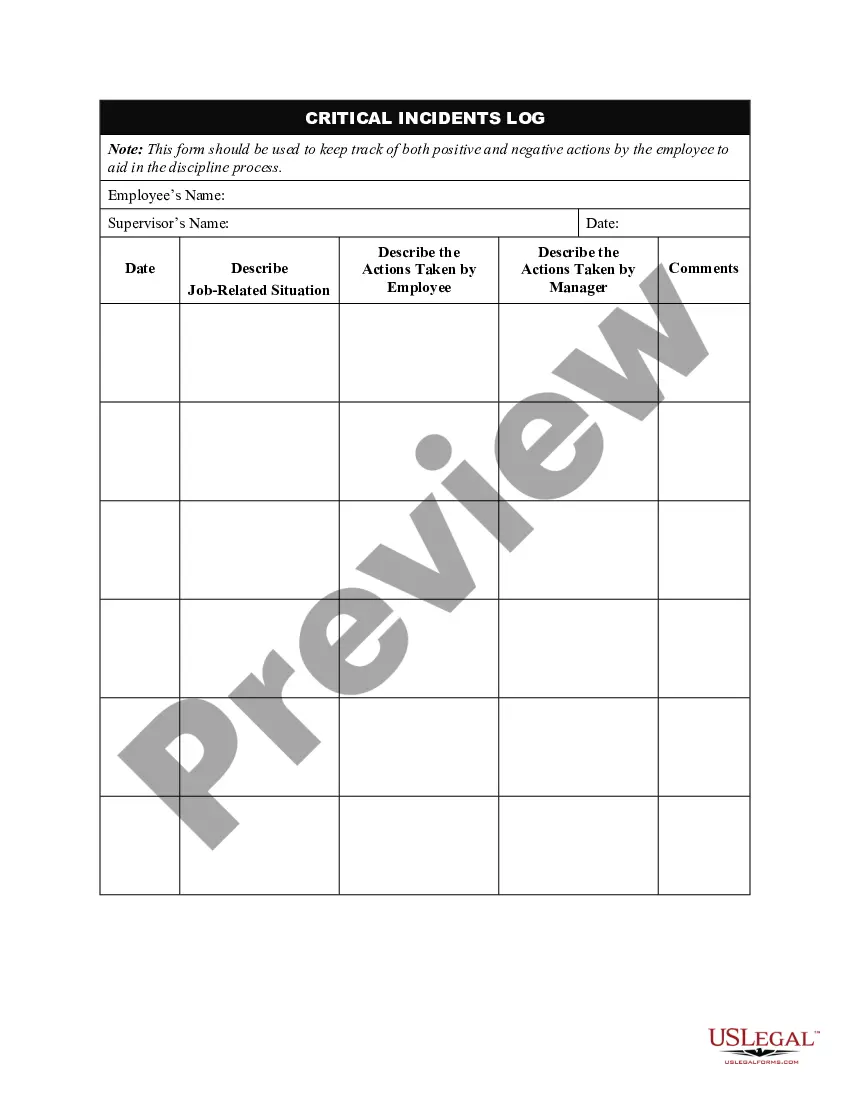

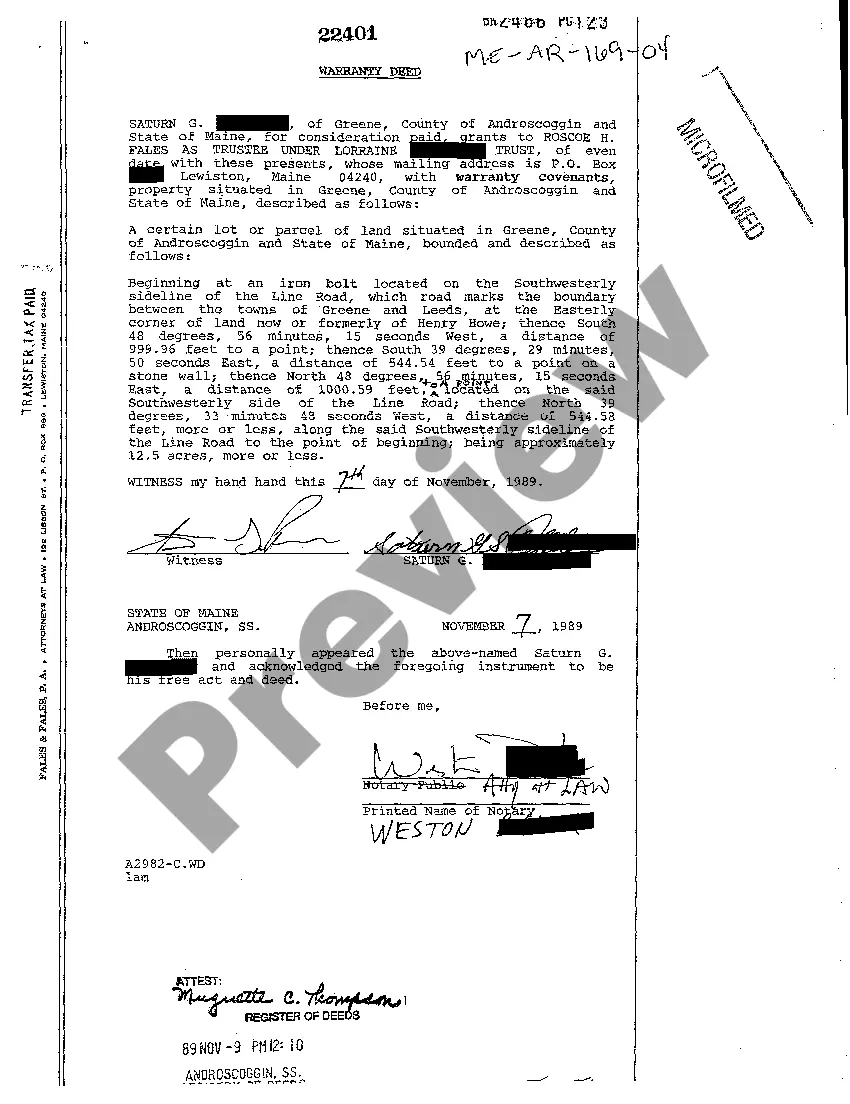

- If available, use the Preview option to browse through the document template as well.

- To find another version of your form, use the Search box to locate the template that satisfies your needs and requirements.

- Once you find the template you want, click Acquire now to proceed.

- Choose your payment plan, enter your details, and create your account on US Legal Forms.

Form popularity

FAQ

To write a corporate resolution, start by identifying the specific action your corporation needs to take, such as appointing officers or authorizing financial transactions. Detail the resolution's contents, including the date, the involved parties, and the specific actions authorized. It's important to use clear language to ensure that everyone understands the resolution's intent. For those seeking assistance, uslegalforms offers templates for crafting effective District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions, simplifying the process for your corporation.

In Washington, DC, you can file your articles of incorporation with the Department of Consumer and Regulatory Affairs (DCRA). This office manages business registrations in the city. You can either file online or in person, depending on your preference. Using the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions ensures you comply with all necessary steps.

Writing a Board Resolution for an authorized signatory includes drafting a formal document that identifies the signatory by name and outlines their specific powers regarding banking transactions. Start by mentioning the corporation's name and the context of the resolution. Be sure to include signatures from the board members who approve this resolution. The District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions can provide helpful examples.

Filling out a banking resolution involves entering your corporation's name, the date, and specifics regarding the authorized individuals. Ensure you list all new signatories clearly and indicate the powers granted to them regarding transactions and account management. Finally, have the document signed by the necessary parties to enforce it. Using resources like the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions can make this process smoother.

To draft a letter requesting a change of signatories in a bank, begin with your corporation's letterhead and include the date and recipient's information. Clearly state the intent of the letter, specifying the names of the current signatories and the proposed new signatories. Lastly, ensure it is signed by authorized personnel to validate the request. For more structured guidance, refer to the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

A corporate resolution for a bank is a formal document that grants authority to specific individuals within a corporation to act on behalf of that corporation in banking matters. It typically outlines which signatories can open accounts, transfer funds, and make financial decisions. This resolution is crucial for maintaining clear and legal banking operations. You can find templates through the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

To write a resolution for changing bank signatories, start by clearly stating your corporation's name and the purpose of the resolution. Include the specific changes being made to the signatories, along with their names and positions. This document should be signed by the board of directors and dated for validity. Utilizing the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions can simplify this process.

To change an authorized signatory in a bank, you must first prepare a formal resolution that indicates the intended changes. Submit this resolution, along with any required identification and corporate documents, to the bank. The bank may also request additional verification from the current signatories to ensure compliance. Utilizing guidance from platforms such as US Legal can assist in swiftly managing the process, particularly concerning the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

A corporate resolution for a bank account is a document that authorizes specific individuals to act on behalf of the corporation regarding its bank account activities. It typically includes details about the account, the roles of authorized signers, and any limitations on their authority. Such resolutions are essential for establishing clear responsibility and preventing unauthorized transactions. To make this process easier, consider using the templates provided by US Legal that cater specifically to the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

A board resolution for change of bank signatories is a formal declaration made during a meeting of the board of directors that outlines the intention to modify who can authorize transactions on behalf of the corporation. This resolution must detail the current signatories, the proposed new signatories, and their roles. It should be drafted and adopted according to the corporation's bylaws and typically requires a vote by the board members. Resources available on the US Legal platform can guide you in correctly drafting this important document related to the District of Columbia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.