An option is a contract to purchase the right for a certain time, by election, to purchase property at a stated price. An option may be a right to purchase property or require another to perform upon agreed-upon terms. By purchasing an option, a person is paying for the opportunity to elect or "exercise" the right for the property to be purchased or the performance of the other party to be required. "Exercise" of an option normally requires notice and payment of the contract price. The option will state when it must be exercised, and if not exercised within that time, it expires. If the option is not exercised, the amount paid for the option is not refundable.

District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer

Description

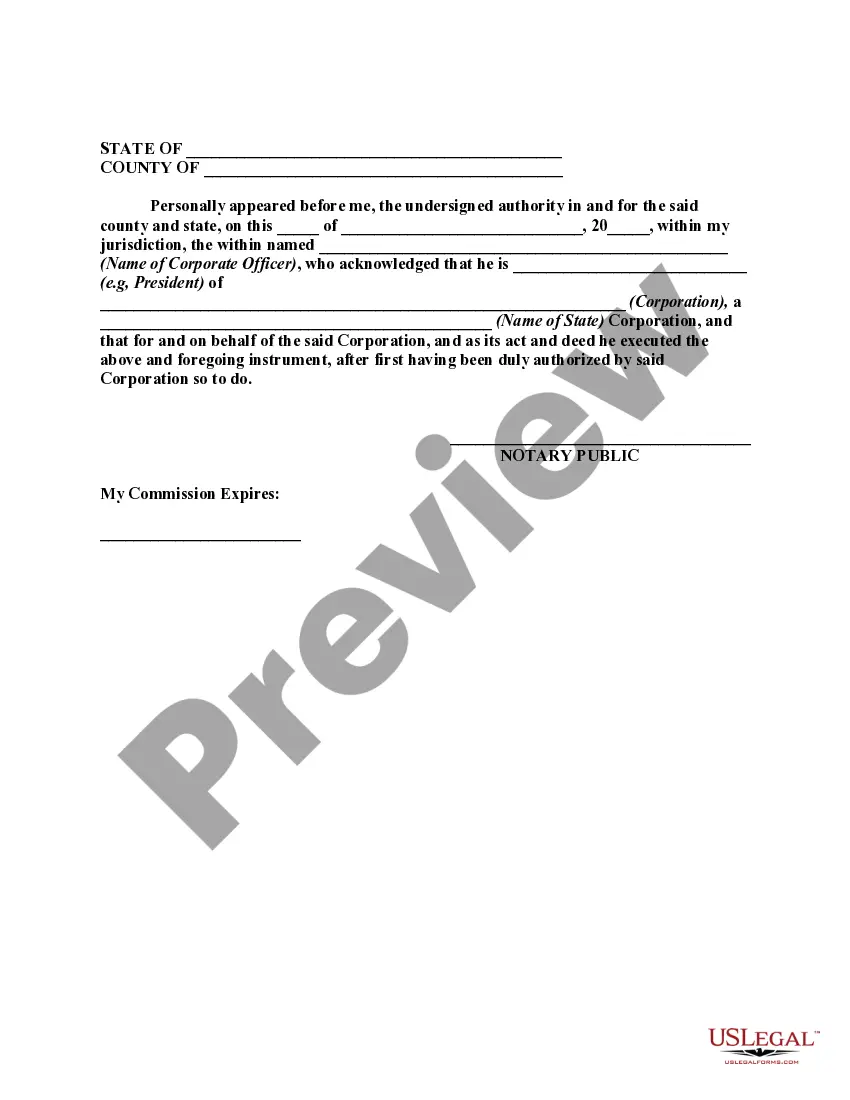

How to fill out Option To Sell Real Property If Option Executed Within Certain Period Of Time - Continuing Offer?

US Legal Forms - one of the top compilations of legal documents in the USA - provides a wide selection of legal template documents that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of forms such as the District of Columbia Option to Sell Real Property if the Option is Executed within a Defined Period of Time - Continuing Offer in just minutes.

If you possess a subscription, Log In and download the District of Columbia Option to Sell Real Property if the Option is Executed within a Defined Period of Time - Continuing Offer from your US Legal Forms collection. The Download button will appear on each form you view. You have access to all your previously saved forms in the My documents section of your account.

Select the format and download the form to your device.

Make alterations. Fill out, modify, print, and sign the saved District of Columbia Option to Sell Real Property if the Option is Executed within a Defined Period of Time - Continuing Offer. Each template saved to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for the area/county.

- Click the Review button to verify the form's details. Check the form summary to confirm you have chosen the right form.

- If the form does not align with your needs, utilize the Search field at the top of the screen to find the suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your credentials to register for an account.

- Complete the acquisition. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

The statute of frauds in the District of Columbia requires certain contracts to be in writing to be enforceable. This includes agreements related to the sale of real estate, such as the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer. Understanding this statute is essential for safeguarding your property interests.

Sales tax in the District of Columbia is a consumption tax imposed on the sale of goods and services. The current rate is 6% for most transactions, with some exceptions applying to specific goods. If you're considering selling property or goods in DC, understanding how sales tax interfaces with the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer is essential for compliance and maximizing your assets.

In the District of Columbia, the shortest redemption period for a tax lien is typically six months. After this period, the tax lien can be sold, allowing the lien holder to begin foreclosure proceedings. For property owners navigating this process, exploring the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer can be advantageous.

The District of Columbia operates as a tax lien state. This means that if property taxes are unpaid, a lien is placed against the property, providing the government a legal claim. Understanding the implications of tax liens is critical, especially in connection with the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, which may offer a pathway for resolution.

In the District of Columbia, the statute of limitations for sales tax is generally three years from the due date of the tax. This means that the tax authorities can require payment of unpaid sales tax within this time period. If you find yourself needing assistance with tax-related issues, consider the legal avenues provided under the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

A deed in Washington, DC, must include specific information to be considered valid. These requirements include the names of the grantor and grantee, a property description, and the grantor's signature. Meeting these requirements is vital for executing the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer seamlessly.

Form D 20 is a real property transfer tax return required when selling property in Washington, DC. This form captures the necessary details concerning the sale and the transfer taxes applicable. Familiarity with Form D 20 is beneficial when considering the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

In the District of Columbia, the redemption period for tax sales is typically 6 months from the date of the sale. During this time, the original property owner can reclaim their property by paying the outstanding taxes. Understanding the redemption period is crucial if you explore the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.

The DC D 30 tax form is used to report the sale of real property for tax purposes in Washington, DC. This form captures essential financial details related to the sale, ensuring compliance with local tax laws. If you plan to exercise the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer, you will likely need to complete this form.

To obtain a copy of your deed in Washington, DC, you can visit the Office of the Recorder of Deeds or access their online services. You will need to provide details such as your property address or the recorded date of the deed. Having a copy of your deed is essential, especially when considering the District of Columbia Option to Sell Real Property if Option Executed within Certain Period of Time - Continuing Offer.