District of Columbia Certificate of Trust for Mortgage

Description

How to fill out Certificate Of Trust For Mortgage?

Are you currently in a situation that you need files for possibly business or person functions virtually every day? There are plenty of legitimate file layouts accessible on the Internet, but locating types you can rely is not simple. US Legal Forms provides 1000s of form layouts, much like the District of Columbia Certificate of Trust for Mortgage, which are created in order to meet state and federal needs.

Should you be currently familiar with US Legal Forms internet site and possess an account, merely log in. Afterward, you may download the District of Columbia Certificate of Trust for Mortgage design.

If you do not offer an accounts and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you need and ensure it is for your right city/region.

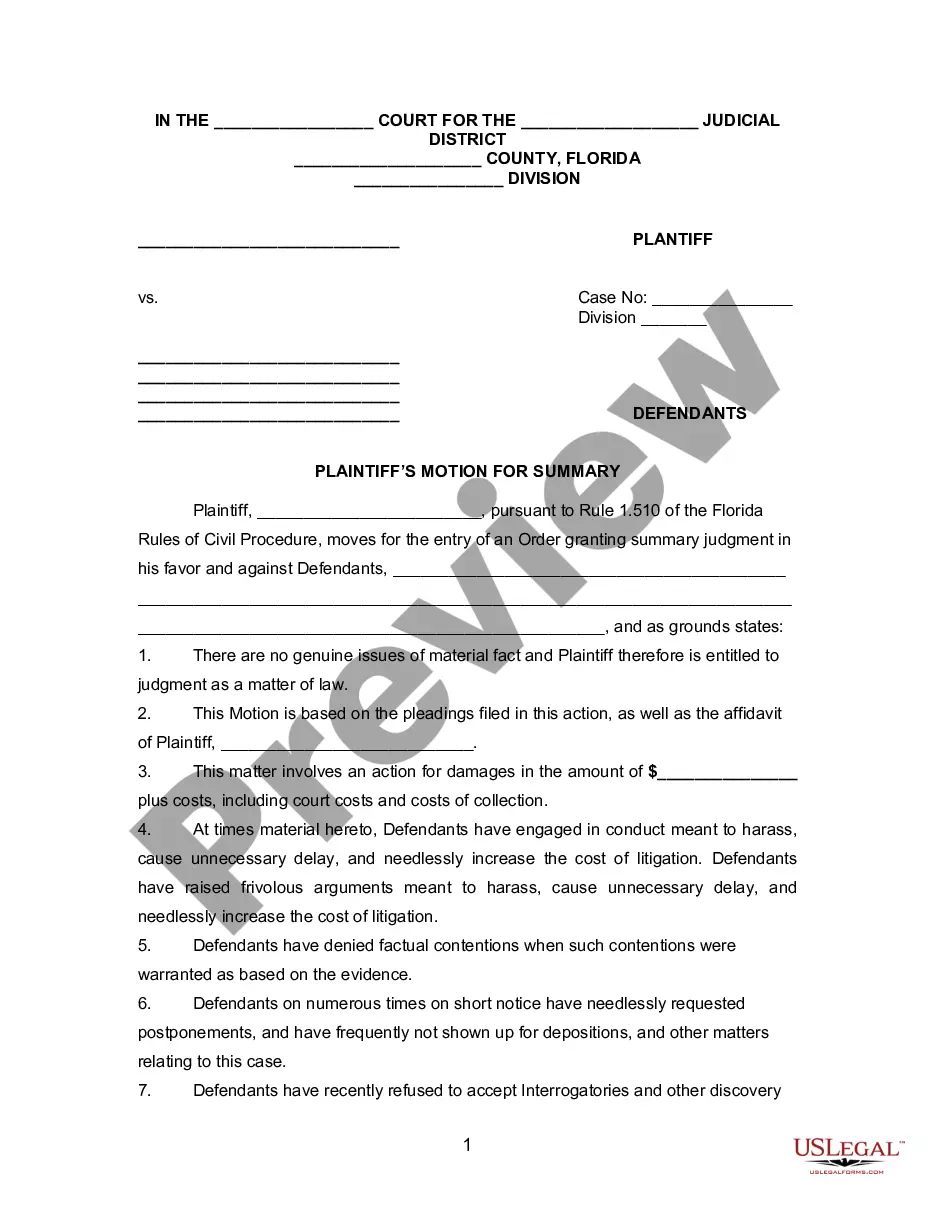

- Utilize the Review switch to analyze the form.

- Look at the information to actually have chosen the right form.

- If the form is not what you`re looking for, make use of the Search industry to get the form that fits your needs and needs.

- When you get the right form, click on Acquire now.

- Choose the pricing program you desire, submit the desired information to produce your money, and pay for the transaction making use of your PayPal or charge card.

- Decide on a handy file format and download your backup.

Discover all of the file layouts you might have purchased in the My Forms food selection. You can aquire a more backup of District of Columbia Certificate of Trust for Mortgage anytime, if possible. Just select the required form to download or print the file design.

Use US Legal Forms, by far the most extensive collection of legitimate kinds, to save time and prevent blunders. The support provides appropriately manufactured legitimate file layouts which can be used for an array of functions. Make an account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

A Security Affidavit is required on all Residential Deeds of Trust and Modifications. All Judgments, Orders, etc. must be certified by the DC Superior Court. All notarized documents must include the notary seal (if applicable), signature, name and expiration date.

In exchange for a deed of trust, the borrower gives the lender one or more promissory notes. A promissory note is a document that states a promise to pay the debt and is signed by the borrower. It contains the terms of the home loan including information such as the interest rate and other obligations.

A Washington, DC, deed must identify by name the current owner (the grantor) transferring the property and the new owner (the grantee) receiving it. Party addresses. A deed should include the new owner's address. DC law does not strictly require the current owner's address, but it is often included.

(2) ?Deed of trust? means a mortgage or a deed of trust encumbering real property located in the District of Columbia as the same may be modified, amended, supplemented, or restated. (3) ?Land records? means the land records in the Office of the Recorder of Deeds of the District of Columbia.

Deed Recordation DC Code Citation: Title 42, Chapter 11. 1.45% of consideration or fair market value on the entire amount, if transfer is $400,000 or greater. Note: Fair market value is used when the consideration is nominal, i.e. less than 30% of FMV.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

You can get a Certificate of Good Standing in person or online from the D.C. Department of Licensing and Consumer Protection. Online: Go to to CorpOnline and create an account. Once your account is created you can choose ?Request a Certificate of Good Standing.?