Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

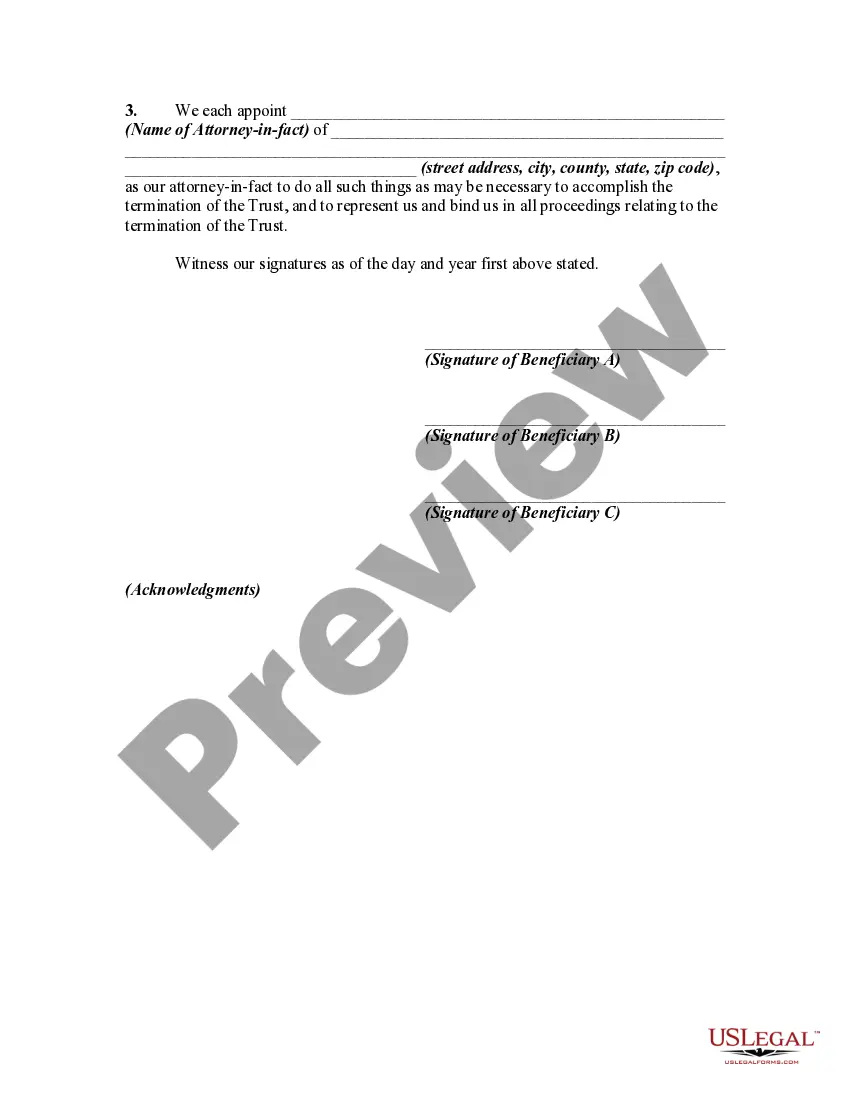

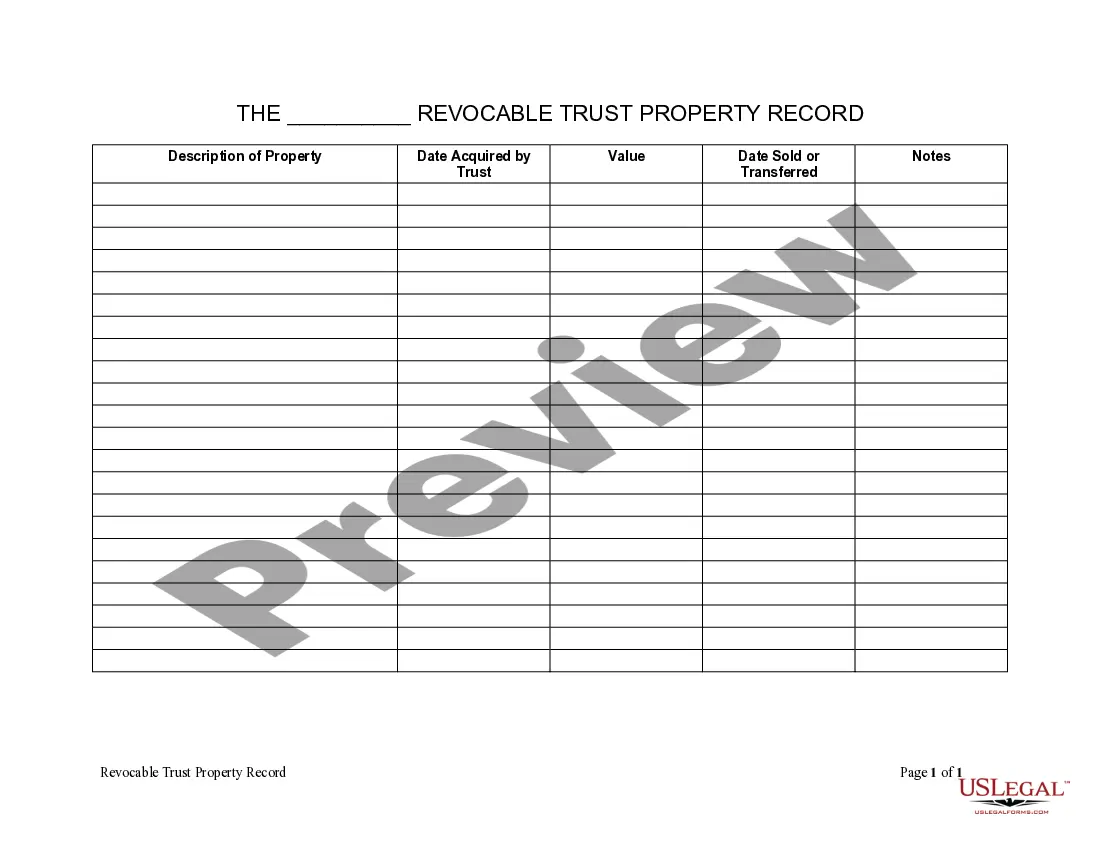

Title: District of Columbia Agreement Among Beneficiaries to Terminate Trust: Explained in Detail Introduction: The District of Columbia Agreement Among Beneficiaries to Terminate Trust is a legal instrument designed to dissolve a trust arrangement within the jurisdiction of the District of Columbia. This article provides a comprehensive overview of this agreement, highlighting its purpose, requirements, and any variations that may exist. Key Terms and Definitions: 1. District of Columbia: Refers to the federal district and capital of the United States, Washington, D.C., which operates under unique laws and regulations. 2. Agreement Among Beneficiaries to Terminate Trust: A legally binding document signed by all beneficiaries of a trust, outlining their unanimous decision to terminate the trust and distribute its assets accordingly. Purpose and Procedure: The District of Columbia Agreement Among Beneficiaries to Terminate Trust serves various purposes, including the orderly dissolution of a trust. It allows beneficiaries to collectively decide to terminate the trust, providing a straightforward process for the final disposition of the trust's assets. To initiate the agreement, all beneficiaries, as defined in the trust instrument, must come to a unanimous decision regarding the termination. They must carefully review the trust's provisions, legal obligations, and tax implications before finalizing the agreement. The agreement may include provisions related to asset distribution, tax considerations, and any other special arrangements specific to the trust being terminated. By signing the agreement, beneficiaries acknowledge their consent and agreement to dissolve the trust, ultimately relieving all parties of their obligations and responsibilities under the trust arrangement. Types of District of Columbia Agreement Among Beneficiaries to Terminate Trust: While the primary focus is on the general District of Columbia Agreement Among Beneficiaries to Terminate Trust, there could potentially be variations based on the specific nature and purpose of the trust being terminated. These variations may include: 1. Charitable Trust Termination Agreement: For trusts established for charitable purposes, this agreement outlines the beneficiaries' joint decision to terminate the trust and direct its charitable assets to alternative qualified organizations or specific causes. 2. Testamentary Trust Termination Agreement: Specifically applicable to trusts created through a will, this agreement enables all beneficiaries to dissolve the testamentary trust and distribute the assets according to the decedent's wishes or as agreed upon collectively. 3. Revocable Living Trust Termination Agreement: Pertaining to revocable living trusts, this agreement allows beneficiaries to terminate the trust during the granter's lifetime, either by executing a written agreement or by following procedures outlined in the trust document itself. Conclusion: The District of Columbia Agreement Among Beneficiaries to Terminate Trust is a vital legal instrument that facilitates the dissolution of trusts in the District of Columbia. By understanding its purpose, requirements, and potential variations depending on the nature of the trust being terminated, beneficiaries can ensure a smooth and efficient resolution, aligning with the beneficiaries' shared interests while conforming to the legal framework in the District of Columbia.