Title: District of Columbia Sample Letter for Employer's Verification on Loan Application — A Comprehensive Guide Introduction: District of Columbia (D.C.) residents often require loans to meet various financial needs. To secure a loan, individuals must provide supporting documents, including an employer's verification letter. This article provides a detailed description of what a District of Columbia Sample Letter for Employer's Verification on Loan Application entails, ensuring loan applicants understand its purpose and importance. 1. What is a District of Columbia Sample Letter for Employer's Verification on Loan Application? — Definition: A District of Columbia Sample Letter for Employer's Verification on Loan Application is a formal document issued by an applicant's employer stating the individual's employment details, income, and other relevant information for loan approval purposes. — Objective: The letter helps lenders assess an applicant's financial stability and employment status, ensuring their ability to repay the loan. 2. Key Elements in a District of Columbia Sample Letter for Employer's Verification on Loan Application: — Employee Information: The letter includes the employee's full name, job title, employment start date, and contact details. — Company Information: It includes the official name, address, and contact details of the employer or company. — Employment Details: The letter verifies the employment status, whether the employee is permanent, part-time, or contracted, along with the job responsibilities. — Salary or Income: The letter confirms the employee's regular income, including any additional benefits or allowances. — Employment Duration: The letter specifies the duration of employment and whether it is ongoing or fixed-term. — Signature and Date: It is essential for the employer to sign and date the letter to validate its authenticity. 3. Types of District of Columbia Sample Letter for Employer's Verification on Loan Application: — Standard Verification Letter: This is the most common type, issued for various loan applications, including personal, auto, or mortgage loans. — Specific Loan Purpose: Some lenders may require additional details specific to the loan type, such as student loans or home improvement loans. The letter must be tailored accordingly. — Address Verification: Lenders may request address verification when the applicant's current address on record differs from the employer's address. Conclusion: District of Columbia Sample Letter for Employer's Verification on Loan Application is a crucial document for securing loans in the region. Lenders rely on this letter to verify an applicant's employment details, income, and stability. This article has outlined the key elements and different types of District of Columbia Sample Letter for Employer's Verification on Loan Application, ensuring loan applicants can fulfill the necessary requirements with confidence. Remember to format the letter professionally and seek the employer's cooperation while being truthful and accurate in all provided information.

District of Columbia Sample Letter for Employer's Verification on Loan Application

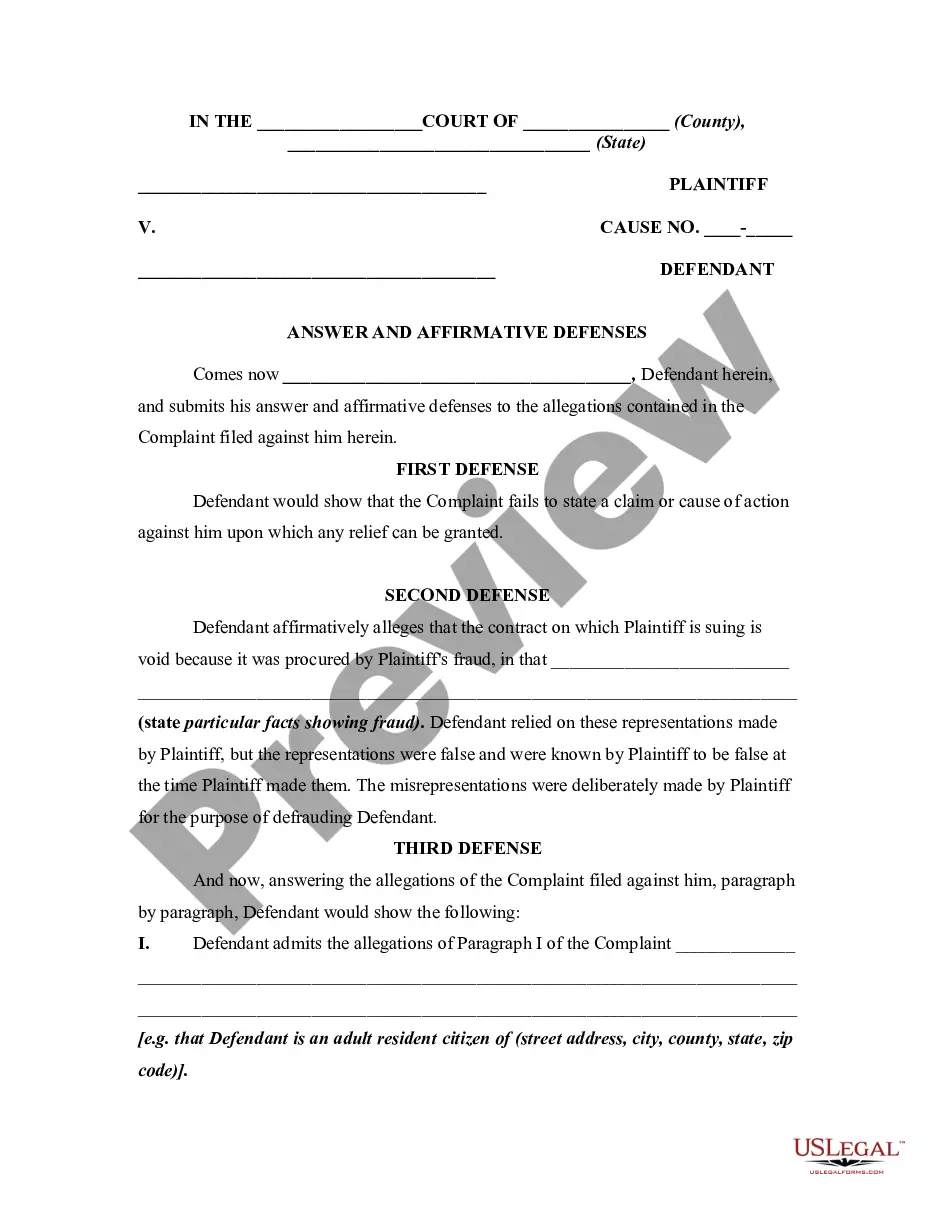

Description

How to fill out District Of Columbia Sample Letter For Employer's Verification On Loan Application?

You can invest hours online searching for the legal papers format that suits the state and federal demands you need. US Legal Forms supplies 1000s of legal types which can be evaluated by specialists. You can actually obtain or printing the District of Columbia Sample Letter for Employer's Verification on Loan Application from your support.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Down load key. Afterward, it is possible to comprehensive, revise, printing, or indicator the District of Columbia Sample Letter for Employer's Verification on Loan Application. Each and every legal papers format you get is your own forever. To get another duplicate for any bought kind, proceed to the My Forms tab and then click the related key.

Should you use the US Legal Forms site the first time, keep to the basic instructions listed below:

- Initial, make sure that you have chosen the right papers format for your area/town of your choosing. Look at the kind information to ensure you have selected the correct kind. If readily available, use the Review key to check throughout the papers format also.

- If you would like get another edition in the kind, use the Research discipline to obtain the format that meets your needs and demands.

- When you have located the format you want, just click Get now to move forward.

- Choose the rates prepare you want, type in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to fund the legal kind.

- Choose the file format in the papers and obtain it for your device.

- Make alterations for your papers if possible. You can comprehensive, revise and indicator and printing District of Columbia Sample Letter for Employer's Verification on Loan Application.

Down load and printing 1000s of papers web templates while using US Legal Forms Internet site, which offers the greatest assortment of legal types. Use expert and status-particular web templates to tackle your business or personal demands.