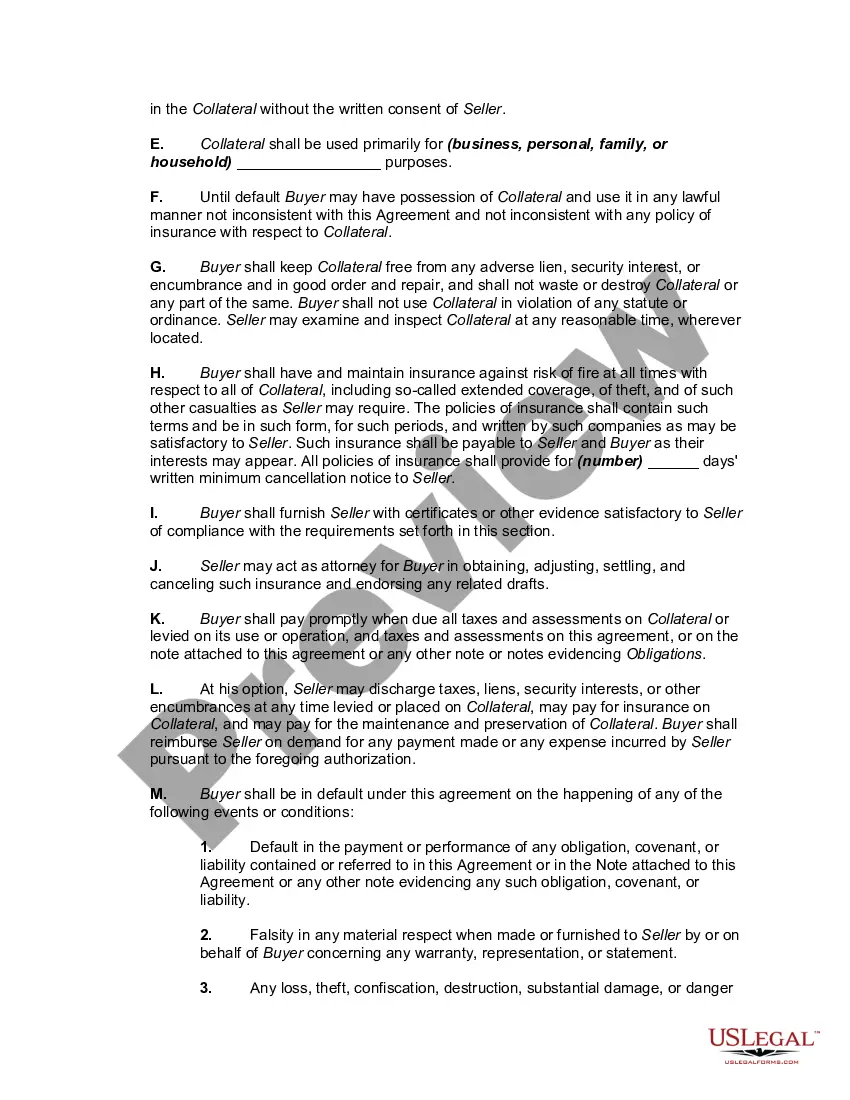

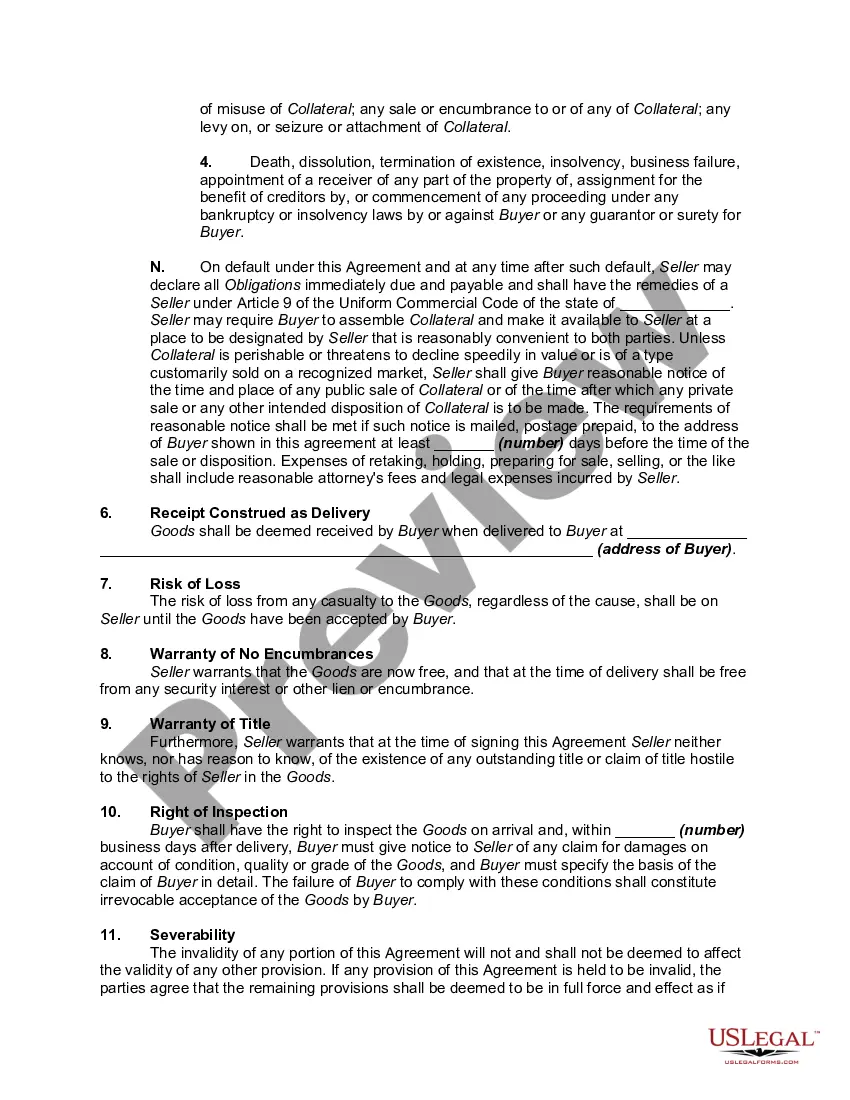

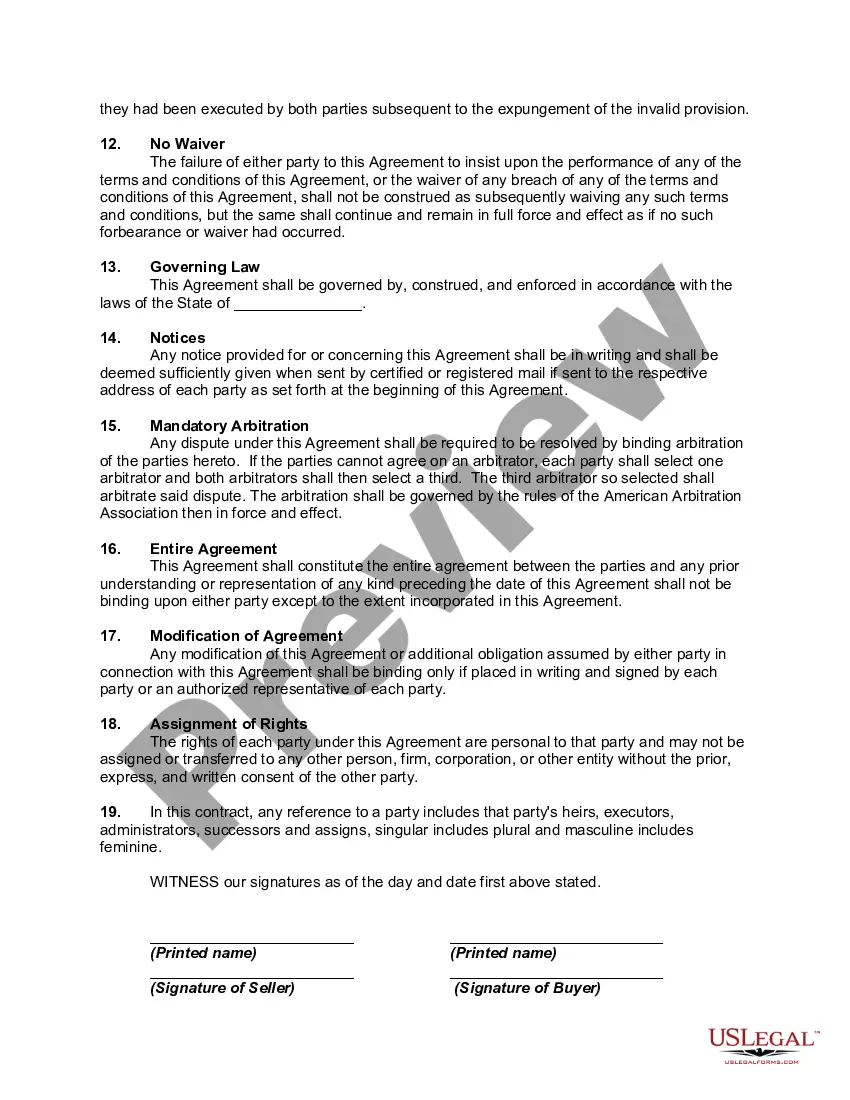

Title: Understanding the District of Columbia Owner Financing Contract for Home: Exploring Types and Key Components Introduction: The District of Columbia (D.C.), the capital of the United States, offers homebuyers the option of owner financing contracts. Owner financing contracts are an alternative purchasing method where the seller acts as the lender, allowing buyers to directly acquire a property without traditional mortgage financing. This article aims to provide a comprehensive overview of the District of Columbia owner financing contract for homes, discussing its different types and crucial components. 1. Understanding Owner Financing: Owner financing, also known as seller financing, is a real estate transaction approach where the seller assumes the role of the lender. Instead of relying on financial institutions, buyers negotiate terms and conditions directly with the property owner. 2. District of Columbia Owner Financing Contracts for Homes: In D.C., several types of owner financing contracts are commonly used to facilitate home buying. These contracts include: a) Contract for Deed: Also known as a land contract or installment sale agreement, this type of contract allows the buyer to occupy the property while making payments to the seller over an agreed-upon term. The buyer gains equitable interest in the property, but the seller retains legal title until the contract is fully satisfied. b) Lease Option: A lease option contract combines elements of a lease agreement and an option to purchase. The buyer initially leases the property from the seller, paying a rent premium that can be credited toward the purchase price if the buyer opts to exercise the purchase option within a specific time frame. c) All-Inclusive Trust Deed (AID): Under this type of contract, the seller assumes the existing mortgage on the property and creates a new trust deed for the buyer. The buyer makes monthly payments to the seller, who then transfers the funds required to pay off the assumable mortgage and retains the remaining amount as seller financing. 3. Key Components of the Owner Financing Contract: District of Columbia owner financing contracts typically include the following key components: a) Purchase Price and Down Payment: The agreed-upon purchase price of the property, which may involve negotiations. The contract outlines the down payment amount, if any. b) Interest Rate and Payment Terms: The interest rate applied to the remaining balance, along with the duration and frequency of payments. c) Default and Remedies: Describes the consequences of default, including potential foreclosure or cancellation of the contract. d) Title and Ownership: Specifies the condition for transferring the legal title to the buyer upon fulfilling the terms of the contract. e) Property Maintenance and Insurance: Outlines responsibilities for property upkeep, insurance coverage, and payment of property taxes. f) Seller and Buyer Obligations: Defines the obligations of both parties regarding property inspections, repairs, and other specific requirements. g) Dispute Resolution: Outlines the mechanism to resolve conflicts, such as arbitration or mediation, before resorting to legal action. Conclusion: The District of Columbia owner financing contract for homes provides buyers with flexible alternatives to traditional mortgage financing. Understanding the different types of contracts and their key components is crucial to ensure a smooth and successful transaction. By familiarizing themselves with the ins and outs of these contracts, buyers can make informed decisions and negotiate favorable terms while purchasing their dream home in the District of Columbia.

District of Columbia Owner Financing Contract for Home

Description

How to fill out District Of Columbia Owner Financing Contract For Home?

If you want to complete, obtain, or print out authorized record web templates, use US Legal Forms, the greatest variety of authorized kinds, that can be found on-line. Use the site`s easy and hassle-free look for to get the paperwork you will need. Different web templates for company and individual uses are categorized by classes and claims, or keywords. Use US Legal Forms to get the District of Columbia Owner Financing Contract for Home within a number of mouse clicks.

Should you be currently a US Legal Forms buyer, log in to the accounts and click the Acquire switch to find the District of Columbia Owner Financing Contract for Home. You can also gain access to kinds you in the past delivered electronically from the My Forms tab of your accounts.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape for that right city/land.

- Step 2. Make use of the Preview option to look through the form`s content material. Never overlook to see the information.

- Step 3. Should you be not satisfied with the kind, utilize the Research area near the top of the screen to get other models in the authorized kind format.

- Step 4. Upon having identified the shape you will need, go through the Acquire now switch. Select the rates plan you choose and put your references to register to have an accounts.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Find the format in the authorized kind and obtain it on your own product.

- Step 7. Complete, revise and print out or indication the District of Columbia Owner Financing Contract for Home.

Each and every authorized record format you acquire is your own for a long time. You may have acces to every single kind you delivered electronically in your acccount. Click on the My Forms area and pick a kind to print out or obtain once again.

Be competitive and obtain, and print out the District of Columbia Owner Financing Contract for Home with US Legal Forms. There are thousands of skilled and condition-specific kinds you can utilize for the company or individual requirements.

Form popularity

FAQ

The DC Home Owner Program aims to promote affordable housing by assisting residents in purchasing homes through various financing options. These programs often include assistance with down payments and closing costs. Engaging with the District of Columbia Owner Financing Contract for Home can be a strategic way to leverage these benefits and fulfill your homeownership goals.

DC Code 26-1113 A outlines regulations regarding owner financing and helps set clear parameters for residents engaging in such agreements. This legislation is a key part of understanding the legal framework surrounding home buying in the district. It is beneficial to familiarize yourself with the District of Columbia Owner Financing Contract for Home to ensure compliance with these regulations.

First-time homebuyers in D.C. can access various programs with specific income limits set based on household size and area median income. Typically, for many of these programs, the limit may be around 120% of the area median income. Knowing these limits is crucial when considering the District of Columbia Owner Financing Contract for Home, as it can determine eligibility for different assistance programs.

The DC Homeownership Program provides resources and financial assistance to help residents buy homes within the district. This includes down payment assistance and other financing options that are beneficial for first-time buyers. Utilizing the District of Columbia Owner Financing Contract for Home can be an excellent way to navigate these offerings and secure your new residence successfully.

In Washington, D.C., the typical down payment can vary widely, but many financing options allow for down payments as low as 3% to 5%. When considering the District of Columbia Owner Financing Contract for Home, it is essential to evaluate your financial situation and explore programs that assist with down payments. Such assistance can make homeownership more accessible for potential buyers.

To qualify for a District of Columbia Owner Financing Contract for Home, you generally need to demonstrate a steady income, a reasonable credit history, and a reliable source of funds for the down payment. Lenders may also review your debt-to-income ratio to ensure you can manage monthly payments. Each situation is unique, so it's beneficial to consult with an expert familiar with owner financing options in Washington, D.C. Utilizing platforms like US Legal Forms can simplify the process by providing tailored legal documents and guidance.

In Washington, D.C., a for sale by owner contract (FSBO) is an agreement where the property owner sells their home without involving a real estate agent. This type of contract outlines the sale terms, conditions, and contingencies agreed upon by both the buyer and seller. When navigating this process, consider how a District of Columbia Owner Financing Contract for Home can help secure financing without traditional lender interference.

Interesting Questions

More info

Research Economy Research Report Economy View Investing Essentials Trading Essentials Markets Stocks Mutual Funds ETFs Options Roth Fundamental Analysis Technical Analysis View Trade View Trading Results — Online Portfolio Trade View Trading Results — Live Portfolio View Virtual Tour.