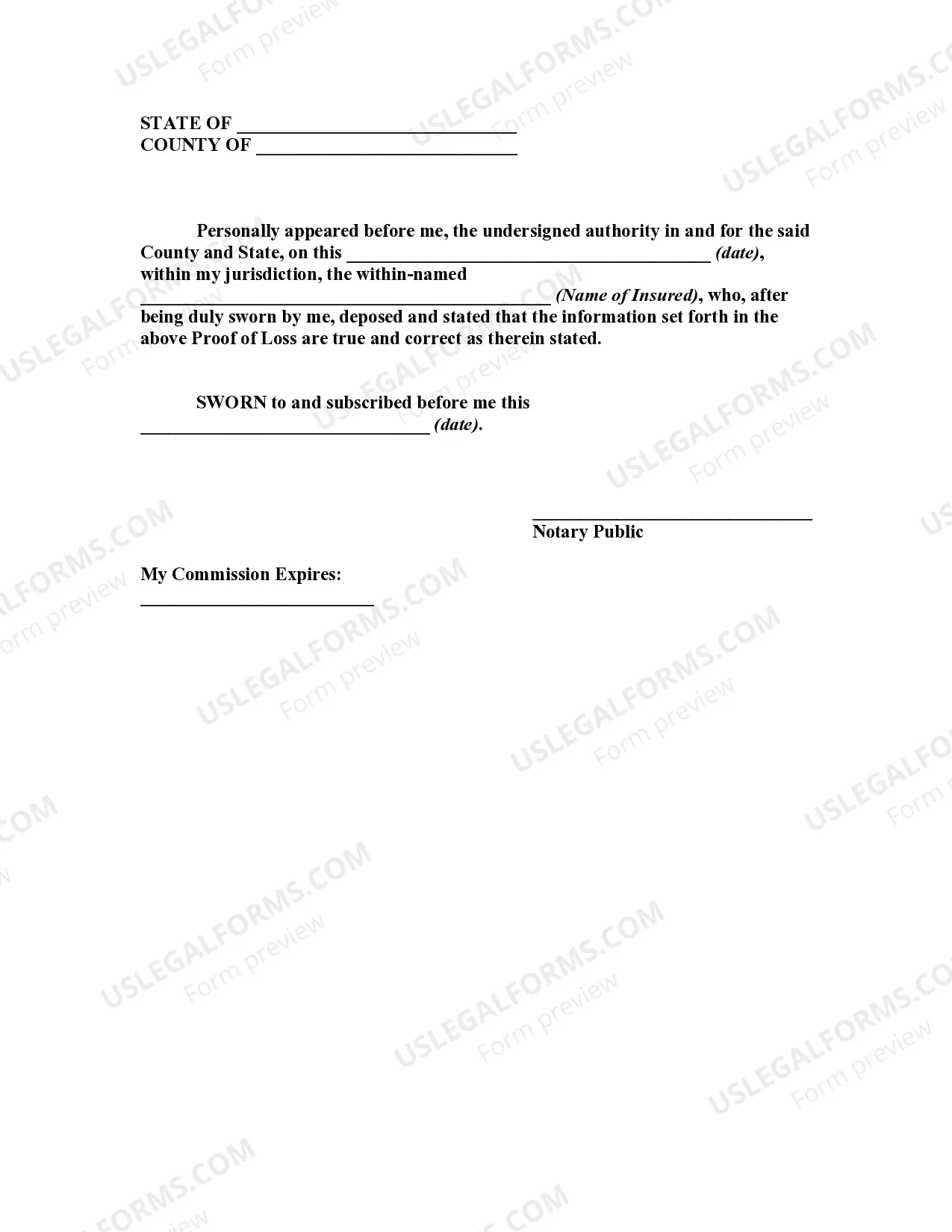

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

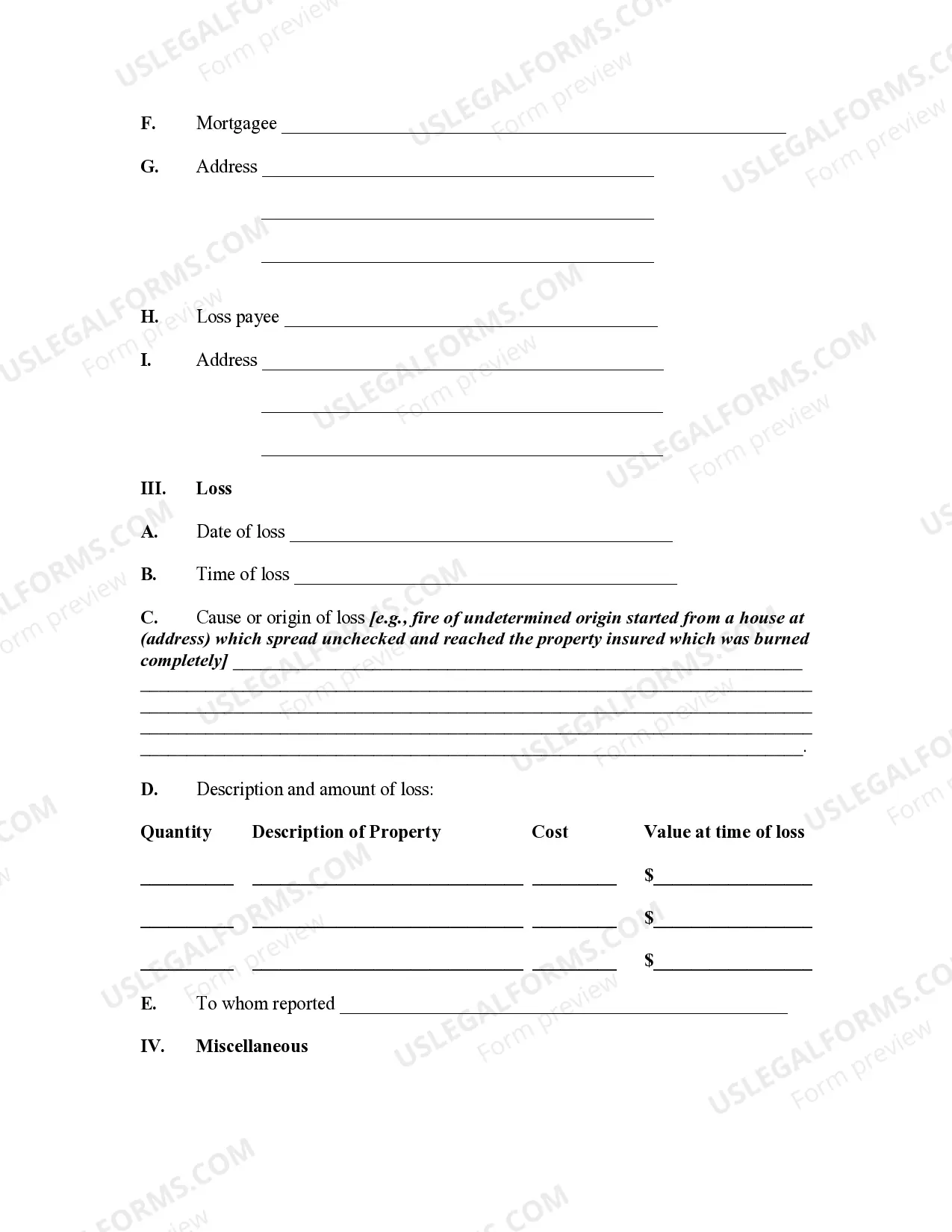

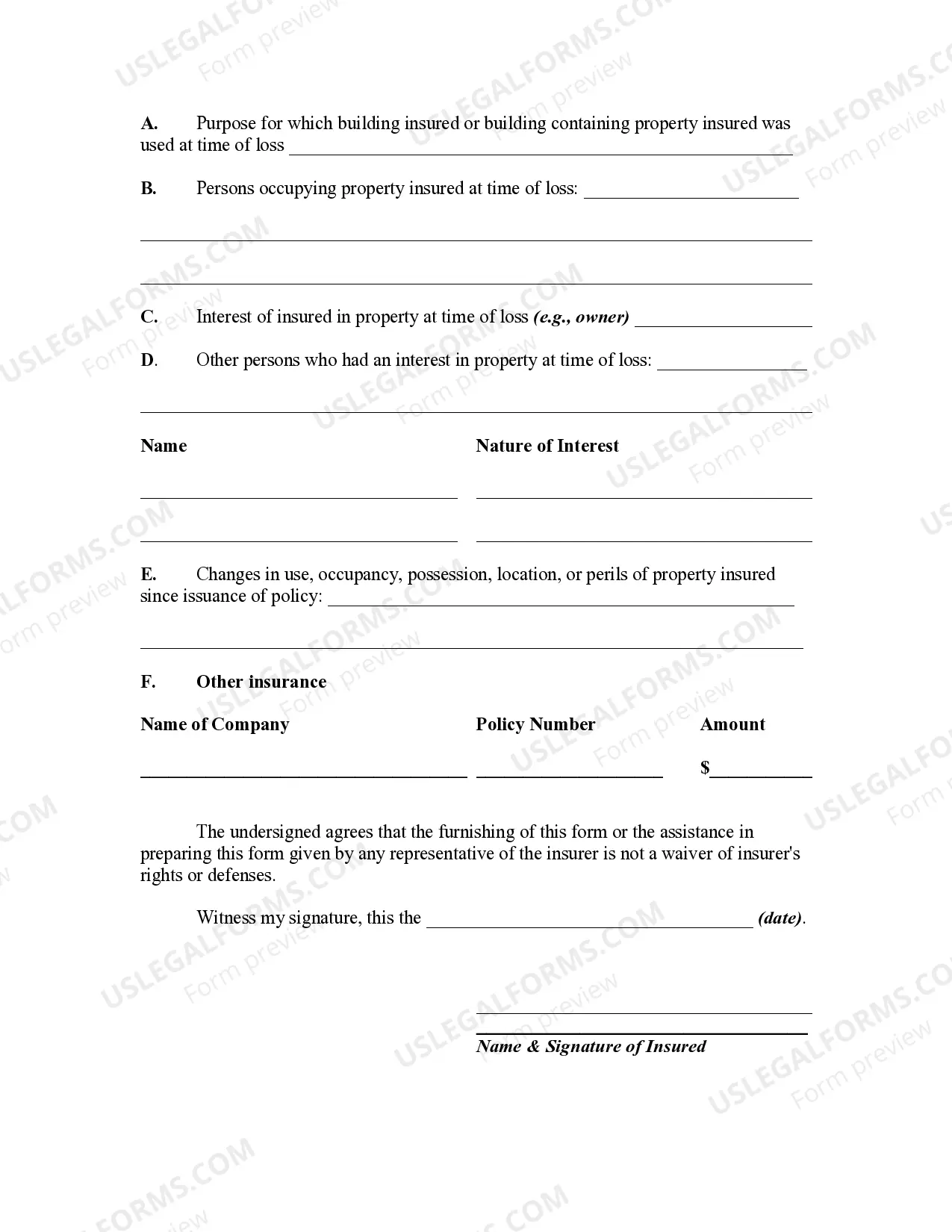

District of Columbia Proof of Loss for Fire Insurance Claim is a critical document required when filing a fire insurance claim in the District of Columbia. This detailed description aims to explain the purpose, process, and different types of proof of loss forms available. The District of Columbia Proof of Loss is an official statement submitted by the insured to the insurance company, providing detailed information about the fire incident and the claim being made. It serves as evidence of the damages suffered, ensuring that the insurance company accurately evaluates the losses and compensates the policyholder accordingly. To ensure a successful fire insurance claim in the District of Columbia, it is essential to complete the Proof of Loss form accurately and in a timely manner. The document typically consists of various sections, each requiring specific information to support the claim. These sections commonly include: 1. Policyholder Information: This section captures the insured individual or entity's details, such as name, address, contact information, and policy number. Providing accurate and up-to-date information is crucial for efficient claim processing. 2. Fire Incident Details: Here, the insured must describe in detail the fire incident, including the date, time, location, and cause of the fire. It is vital to provide specific and factual information to authenticate the claim. 3. Property and Content Description: This section requires a comprehensive list of damaged or destroyed property and contents. It is crucial to provide detailed descriptions, quantities, and estimated values of each item to support the claim's validity. 4. Supporting Documentation: To strengthen the claim, the insured must attach relevant documents, such as photographs, videos, invoices, receipts, or any other evidence of ownership and value. This evidence substantiates the losses and helps determine the appropriate settlement. 5. Estimated Losses: The insured should provide an estimate of the total losses suffered due to the fire incident. This estimation should consider both the property's actual value and any additional expenses incurred, such as temporary housing or storage costs. In the District of Columbia, there are several types of Proof of Loss forms applicable to fire insurance claims. These may include: 1. Standard Proof of Loss Form: This is a generic form implemented by most insurance companies in the District of Columbia. It encompasses all the necessary sections discussed above and can be obtained from the insurer or downloaded from their website. 2. Specific Insurance Company Forms: Some insurance companies may have their customized Proof of Loss forms. Thus, policyholders should check with their insurer to obtain the correct form, ensuring compliance with their requirements. 3. Additional Forms for Complex Claims: In certain cases where the fire insurance claim involves complex situations or significant losses, additional forms or supplementary documentation may be required. These extra forms aim to gather more detailed information to accurately assess the claim. Submitting a complete and accurate Proof of Loss is essential for a successful fire insurance claim in the District of Columbia. Failing to provide the necessary details and supporting documents may delay the claim process or even result in claim denial. Therefore, policyholders should diligently follow the insurer's guidelines and seek professional assistance if needed to ensure their rights are protected throughout the claims process.District of Columbia Proof of Loss for Fire Insurance Claim is a critical document required when filing a fire insurance claim in the District of Columbia. This detailed description aims to explain the purpose, process, and different types of proof of loss forms available. The District of Columbia Proof of Loss is an official statement submitted by the insured to the insurance company, providing detailed information about the fire incident and the claim being made. It serves as evidence of the damages suffered, ensuring that the insurance company accurately evaluates the losses and compensates the policyholder accordingly. To ensure a successful fire insurance claim in the District of Columbia, it is essential to complete the Proof of Loss form accurately and in a timely manner. The document typically consists of various sections, each requiring specific information to support the claim. These sections commonly include: 1. Policyholder Information: This section captures the insured individual or entity's details, such as name, address, contact information, and policy number. Providing accurate and up-to-date information is crucial for efficient claim processing. 2. Fire Incident Details: Here, the insured must describe in detail the fire incident, including the date, time, location, and cause of the fire. It is vital to provide specific and factual information to authenticate the claim. 3. Property and Content Description: This section requires a comprehensive list of damaged or destroyed property and contents. It is crucial to provide detailed descriptions, quantities, and estimated values of each item to support the claim's validity. 4. Supporting Documentation: To strengthen the claim, the insured must attach relevant documents, such as photographs, videos, invoices, receipts, or any other evidence of ownership and value. This evidence substantiates the losses and helps determine the appropriate settlement. 5. Estimated Losses: The insured should provide an estimate of the total losses suffered due to the fire incident. This estimation should consider both the property's actual value and any additional expenses incurred, such as temporary housing or storage costs. In the District of Columbia, there are several types of Proof of Loss forms applicable to fire insurance claims. These may include: 1. Standard Proof of Loss Form: This is a generic form implemented by most insurance companies in the District of Columbia. It encompasses all the necessary sections discussed above and can be obtained from the insurer or downloaded from their website. 2. Specific Insurance Company Forms: Some insurance companies may have their customized Proof of Loss forms. Thus, policyholders should check with their insurer to obtain the correct form, ensuring compliance with their requirements. 3. Additional Forms for Complex Claims: In certain cases where the fire insurance claim involves complex situations or significant losses, additional forms or supplementary documentation may be required. These extra forms aim to gather more detailed information to accurately assess the claim. Submitting a complete and accurate Proof of Loss is essential for a successful fire insurance claim in the District of Columbia. Failing to provide the necessary details and supporting documents may delay the claim process or even result in claim denial. Therefore, policyholders should diligently follow the insurer's guidelines and seek professional assistance if needed to ensure their rights are protected throughout the claims process.