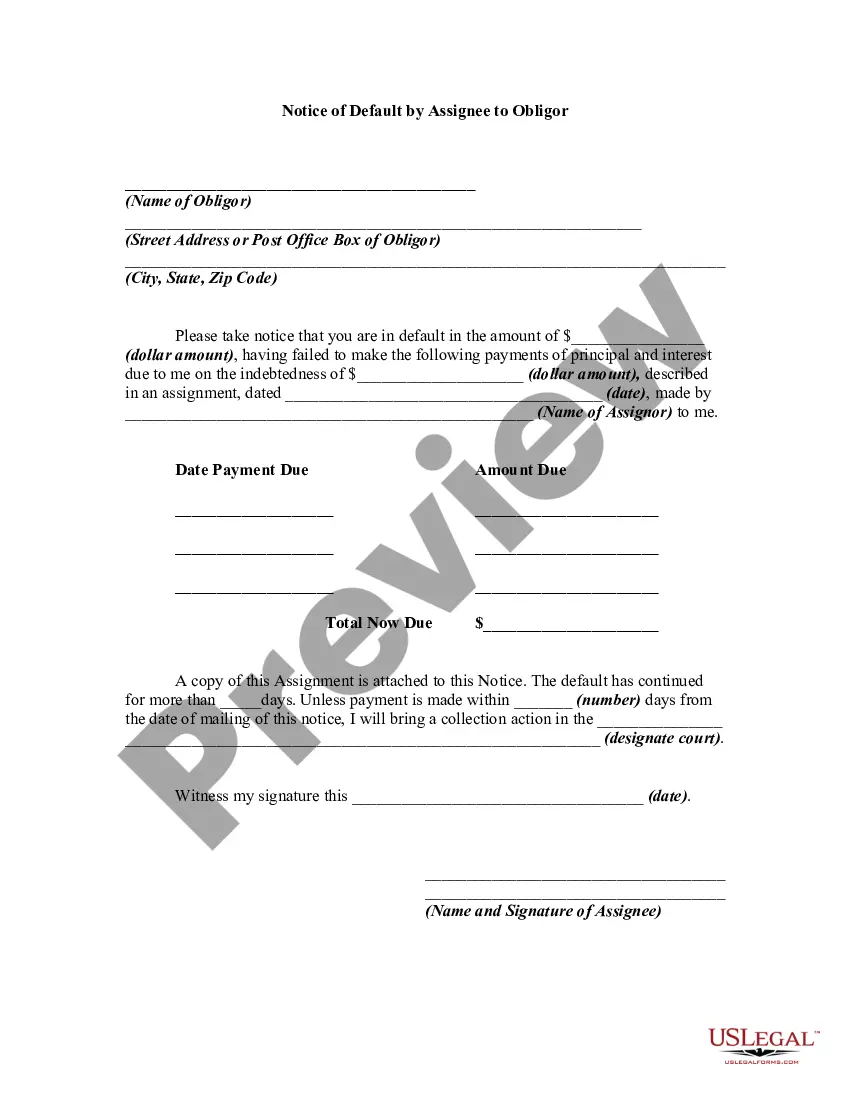

An assignment is a transfer of rights that a party has under a contract to another person, called an assignee. The assigning party is called the assignor. An assignee of a contract may generally sue directly on the contract rather than suing in the name of the assignor. The obligor is the person responsible to make payments to the assignee.

District of Columbia Notice of Default by Assignee to Obligor

Description

How to fill out Notice Of Default By Assignee To Obligor?

US Legal Forms - one of many greatest libraries of authorized forms in America - gives a wide array of authorized file templates it is possible to down load or print. Utilizing the site, you can get a large number of forms for organization and specific reasons, categorized by types, states, or keywords and phrases.You can find the latest variations of forms much like the District of Columbia Notice of Default by Assignee to Obligor within minutes.

If you currently have a monthly subscription, log in and down load District of Columbia Notice of Default by Assignee to Obligor from your US Legal Forms collection. The Down load option will appear on each and every type you view. You have access to all in the past saved forms in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, here are easy recommendations to help you get began:

- Ensure you have picked the best type for your town/area. Select the Preview option to analyze the form`s content material. Look at the type outline to actually have chosen the right type.

- When the type does not match your requirements, take advantage of the Search industry towards the top of the monitor to get the the one that does.

- If you are happy with the shape, affirm your option by clicking on the Acquire now option. Then, pick the prices strategy you want and provide your accreditations to sign up for the accounts.

- Method the financial transaction. Utilize your credit card or PayPal accounts to perform the financial transaction.

- Select the file format and down load the shape on your own gadget.

- Make changes. Fill up, revise and print and signal the saved District of Columbia Notice of Default by Assignee to Obligor.

Each web template you added to your account does not have an expiry particular date and is the one you have permanently. So, if you wish to down load or print an additional copy, just visit the My Forms area and then click about the type you require.

Get access to the District of Columbia Notice of Default by Assignee to Obligor with US Legal Forms, the most comprehensive collection of authorized file templates. Use a large number of professional and express-distinct templates that meet your company or specific requirements and requirements.