District of Columbia Hippa Release Form for Insurance

Description

How to fill out Hippa Release Form For Insurance?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast array of legal form templates that you can obtain or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest forms such as the District of Columbia Hippa Release Form for Insurance within seconds.

If you already have a subscription, Log In and download the District of Columbia Hippa Release Form for Insurance from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the payment.

Retrieve the format and download the form onto your device. Make edits. Fill, modify, print, and sign the saved District of Columbia Hippa Release Form for Insurance. Every template you add to your account has no expiration date and is yours indefinitely. Thus, to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the District of Columbia Hippa Release Form for Insurance with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a wide variety of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your location/region.

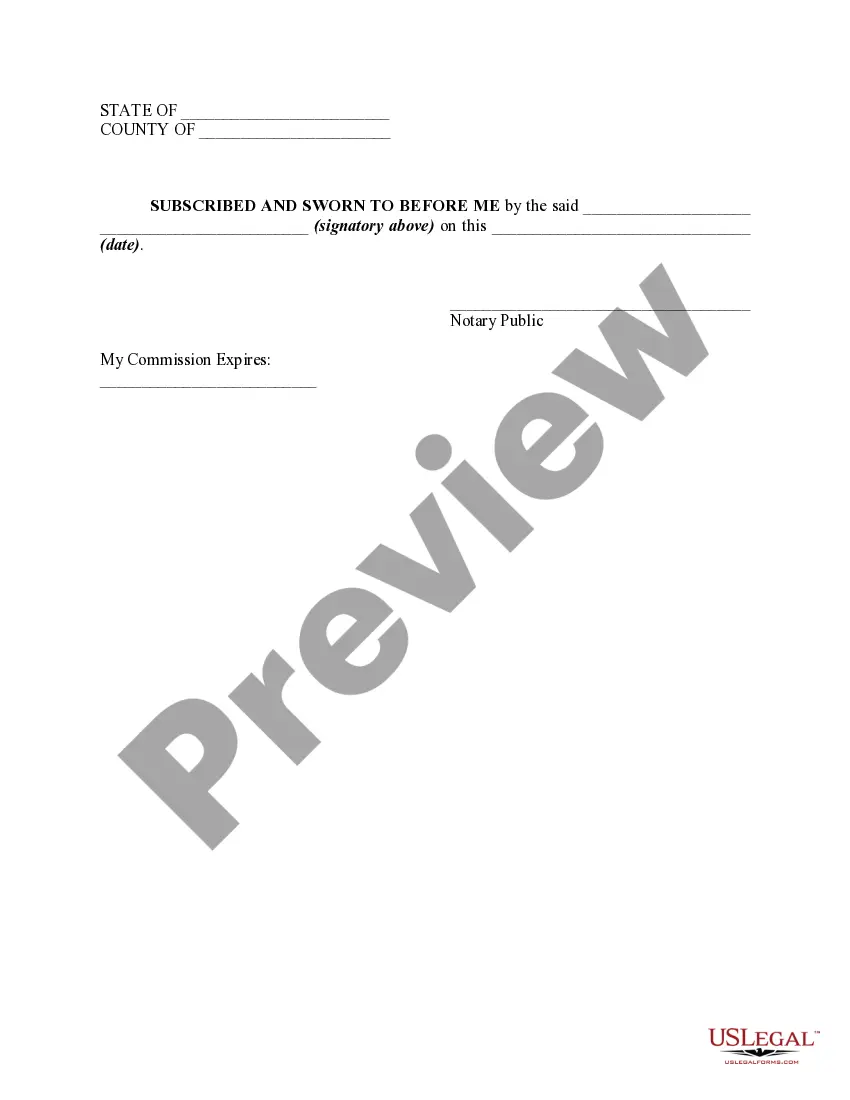

- Click on the Preview button to review the content of the form.

- Check the form summary to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Next, choose your pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Yes, HIPAA allows for the release of information, but only under specific circumstances. Consent is a requirement for any medical information sharing, usually via a signed release form like the District of Columbia HIPAA Release Form for Insurance. This ensures that your health information is protected and shared only with authorized individuals, maintaining your privacy and control.

To obtain your medical records in Washington D.C., you typically need to submit a request directly to your healthcare provider. This request should include a completed District of Columbia HIPAA Release Form for Insurance to authorize the release of your information. Providers are obligated to respond to your request in a timely manner, allowing you to access your important health information.

HIPAA does not require signage to be posted; however, healthcare providers and facilities must inform patients of their rights regarding privacy. This is often done through pamphlets or posters that educate patients about the District of Columbia HIPAA Release Form for Insurance. Maintaining transparency and clear communication helps build trust with patients while adhering to HIPAA regulations.

Creating a HIPAA release form involves several key steps. First, identify the specific information you want to be released and the parties involved. Next, you can utilize templates available through platforms like USLegalForms, which provides comprehensive District of Columbia HIPAA Release Forms for Insurance tailored to your needs. Finally, ensure all parties sign the document to validate their consent.

The three rules of HIPAA are the Privacy Rule, the Security Rule, and the Breach Notification Rule. The Privacy Rule establishes standards for handling protected health information, while the Security Rule focuses on safeguarding this information electronically. Lastly, the Breach Notification Rule requires that individuals be informed when their information is compromised, thereby ensuring accountability and trust.

Before releasing any information from your medical records, a signed authorization must be obtained. This is crucial for compliance with the District of Columbia HIPAA Release Form for Insurance regulations. The signed form acts as legal proof of your consent and protects your privacy while allowing necessary information to be shared.

The duration of a HIPAA release form varies depending on the specifics mentioned in the document. Generally, a District of Columbia HIPAA Release Form for Insurance remains effective until the patient revokes it or the specified expiration date is reached. It's essential to carefully review the form for any stipulations regarding its validity to ensure appropriate usage.

Yes, HIPAA release forms can be signed electronically, as long as the electronic signature adheres to the requirements of the law. Many individuals and healthcare providers prefer electronic signing due to its convenience and additional security measures. Utilizing a reliable platform like USLegalForms allows you to complete the District of Columbia Hippa Release Form for Insurance efficiently and securely with electronic signing options available. This method saves time and provides easy access to your documents.

Writing a HIPAA release form involves clearly stating the individual's permission to share their medical information. Begin with the patient’s full name and details of the person or entity receiving the information. Include the specific medical records to be released and the duration for which the authorization is valid. A well-structured District of Columbia Hippa Release Form for Insurance, found on USLegalForms, simplifies this writing process and ensures compliance with all legal requirements.

To create a medical release form, you can start by gathering the necessary patient information, including their name, date of birth, and contact details. Next, specify the purpose of the release, clearly indicating to whom the information may be disclosed. It is essential to ensure that the release complies with HIPAA regulations. For convenience, you can utilize resources like the District of Columbia Hippa Release Form for Insurance available on USLegalForms, which guides you through the creation process.