District of Columbia Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

Finding the appropriate legal document template can be a challenge.

Certainly, there are many templates accessible online, but how do you obtain the legal version you require? Access the US Legal Forms website.

The service offers thousands of templates, including the District of Columbia Sample Letter for Compromise on a Debt, suitable for business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

Once you are confident that the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan that suits you and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired District of Columbia Sample Letter for Compromise on a Debt. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to download professionally crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the District of Columbia Sample Letter for Compromise on a Debt.

- Use your account to browse the legal forms you have previously acquired.

- Navigate to the My documents tab of your account and retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

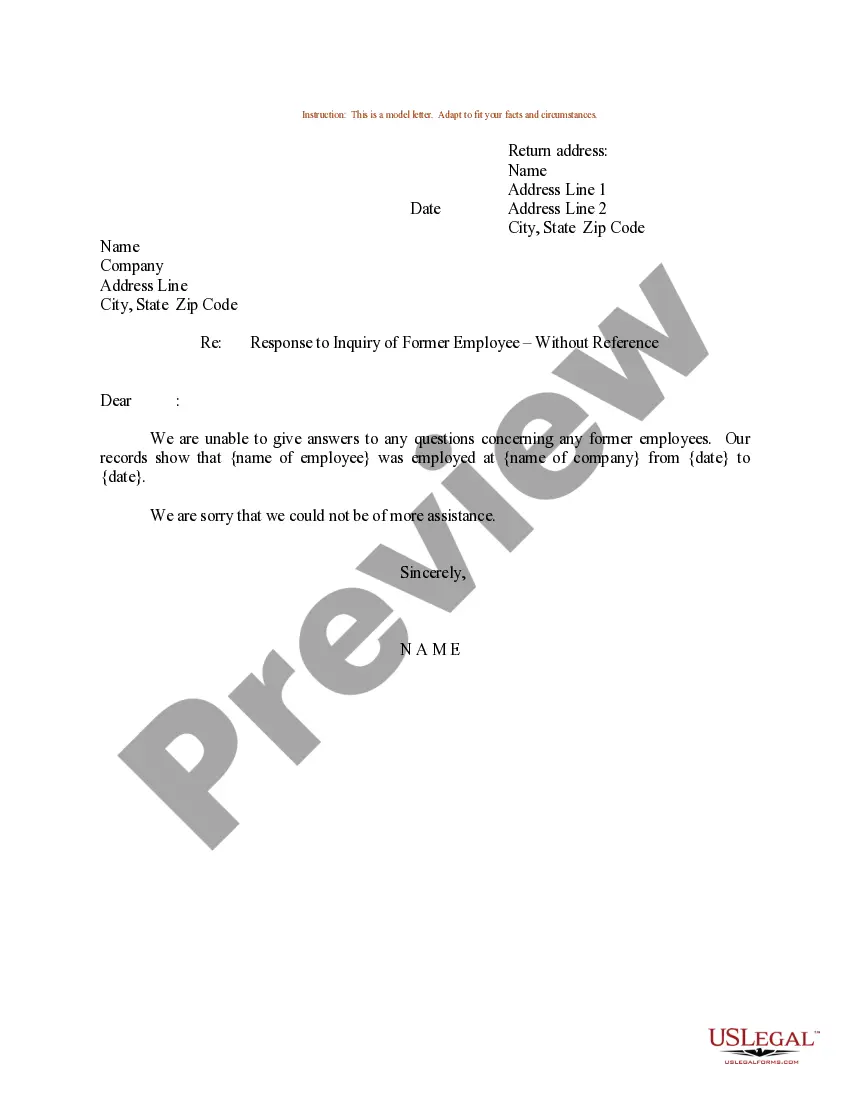

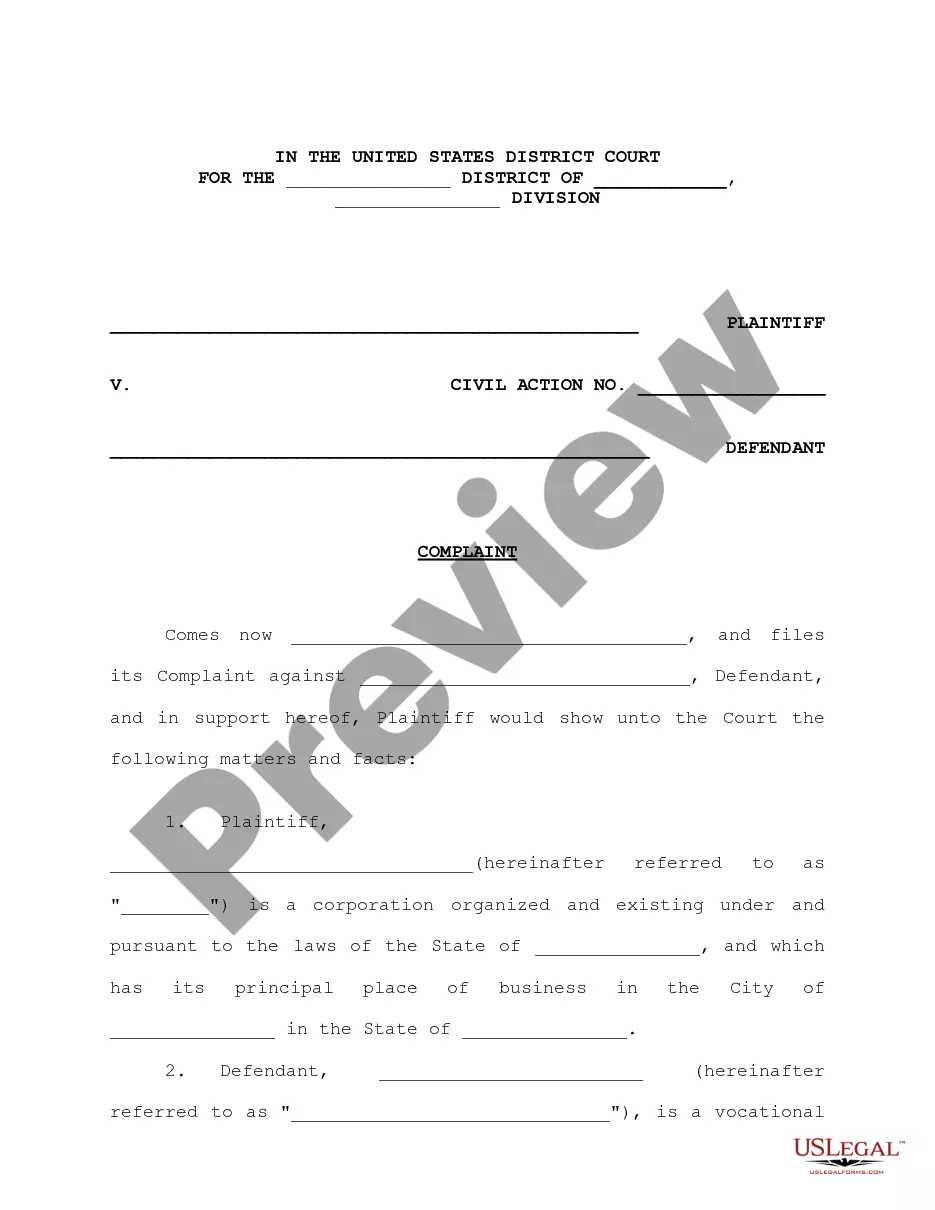

- First, confirm that you have chosen the correct form for your city/state. You can view the form using the Preview button and examine the form outline to ensure it is suitable for you.

- If the form does not meet your needs, use the Search field to locate the correct form.

Form popularity

FAQ

To craft a good debt settlement letter, keep it brief, clear, and professional. Start with your contact information and account details, then outline your settlement proposal and reasons why you believe it should be accepted. Using a District of Columbia Sample Letter for Compromise on a Debt can enhance your chances of making a compelling case.

Yes, the District of Columbia is considered a tax lien state. This means that if property taxes remain unpaid, the District can place a lien against the property. Understanding this can help you navigate your financial responsibilities, especially if you're working on debt settlement in relation to your property.

To write a letter to a debt collector for settlement, begin by identifying yourself and the debt in question. Clearly state your proposal for settlement, including the amount you can afford. Engage the debt collector with a respectful tone and mention the District of Columbia Sample Letter for Compromise on a Debt as a template to follow for creating a more effective letter.

Getting clean hands in the District of Columbia involves resolving outstanding debts or legal issues that may affect your credit or standing. It's crucial to address these concerns, often through negotiations or settlements, to demonstrate responsible behavior. Utilizing tools like the District of Columbia Sample Letter for Compromise on a Debt can facilitate positive communication with creditors.

To write a letter asking for a settlement, start by clearly stating your intent and the specific debt you wish to settle. Include personal information, such as your name and contact details, followed by the account number. Use a polite tone, and make sure to mention the District of Columbia Sample Letter for Compromise on a Debt for guidance on format and language.

Writing a debt collection dispute letter involves stating your intent to dispute the debt clearly. Include your personal details, the date, and specifics about the debt, such as account numbers. It is also useful to request the collection agency to provide documentation related to the debt. Using a District of Columbia Sample Letter for Compromise on a Debt will help ensure you include all important elements in your letter.

To write a good dispute letter, organize your information clearly and be direct. Begin with your contact information, and state the purpose of the letter right away. Use facts to support your dispute and include any supporting documentation. Consider using a District of Columbia Sample Letter for Compromise on a Debt as a guideline for structure and content.

When writing a letter of dispute to a collection agency, ensure you include your personal details and the specifics of the disputed debt. Clearly state the reasons for your dispute and request validation for the debt. Keeping your tone professional and concise is crucial. You could use a District of Columbia Sample Letter for Compromise on a Debt to shape your letter appropriately, making sure you cover all necessary points.

To fill out a debt validation letter, start by including your contact information and the date. Clearly state that you are requesting validation of the debt in question and provide relevant details such as account numbers. Specify your rights under the Fair Debt Collection Practices Act. For guidance on the specifics, refer to the District of Columbia Sample Letter for Compromise on a Debt.

Disputing a collection effectively involves gathering evidence and presenting your case confidently. First, review your credit report for any inaccuracies and document your findings. Then, send a dispute letter to the collection agency. Using a District of Columbia Sample Letter for Compromise on a Debt can guide you through the proper format and language needed to make your case stronger.