A triple net lease is a type of lease arrangement commonly used in commercial real estate, where the tenant is responsible for paying not only the rent but also all costs associated with the property, including property taxes, insurance, and maintenance expenses. In the District of Columbia, triple net leases can also be applicable to residential properties in certain cases. The District of Columbia triple net lease for residential property operates similarly to its commercial counterpart, but with a few key differences. In this type of lease, the tenant assumes additional financial responsibilities, typically associated with property ownership, on top of their monthly rent payment. These additional expenses often include property taxes, property insurance premiums, and maintenance costs. By placing such obligations on the tenant, the landlord can transfer some financial risk and mitigate their expenses, while the tenant gains greater control over their rented space. However, it is important to note that the use of triple net leases for residential properties in the District of Columbia is less common compared to commercial real estate. Residential triple net leases are typically found in specific situations such as high-end luxury properties or long-term leases involving wealthy tenants. In general, triple net leases for residential properties are not as prevalent and widely used as they are in commercial real estate transactions. It is worth mentioning that the District of Columbia has various types of triple net leases, which may differ in terms of the specific allocation of financial responsibilities and obligations. These include: 1. Absolute Triple Net Lease: In this type of lease, the tenant assumes full financial responsibility for property taxes, insurance premiums, and maintenance costs, in addition to paying the rent. 2. Ground Lease: A ground lease is a long-term lease where the tenant leases the land from the landlord and is responsible for all expenses related to the property, including property taxes and maintenance. This type of triple net lease is commonly used for residential properties situated on valuable land in prime locations. 3. Modified Triple Net Lease: A modified triple net lease is a lease agreement where the tenant pays the rent along with a portion of the property taxes, insurance, and maintenance expenses. The specific allocation of costs is negotiable between the landlord and tenant. In conclusion, while triple net leases are more commonly associated with commercial real estate, they can also be used for residential properties in the District of Columbia. The terms and specific financial responsibilities of these leases may differ, and examples include absolute triple net leases, ground leases, and modified triple net leases. However, it's important to remember that triple net leases for residential properties are not as widespread as in the commercial real estate market.

District of Columbia Triple Net Lease for Residential Property

Description

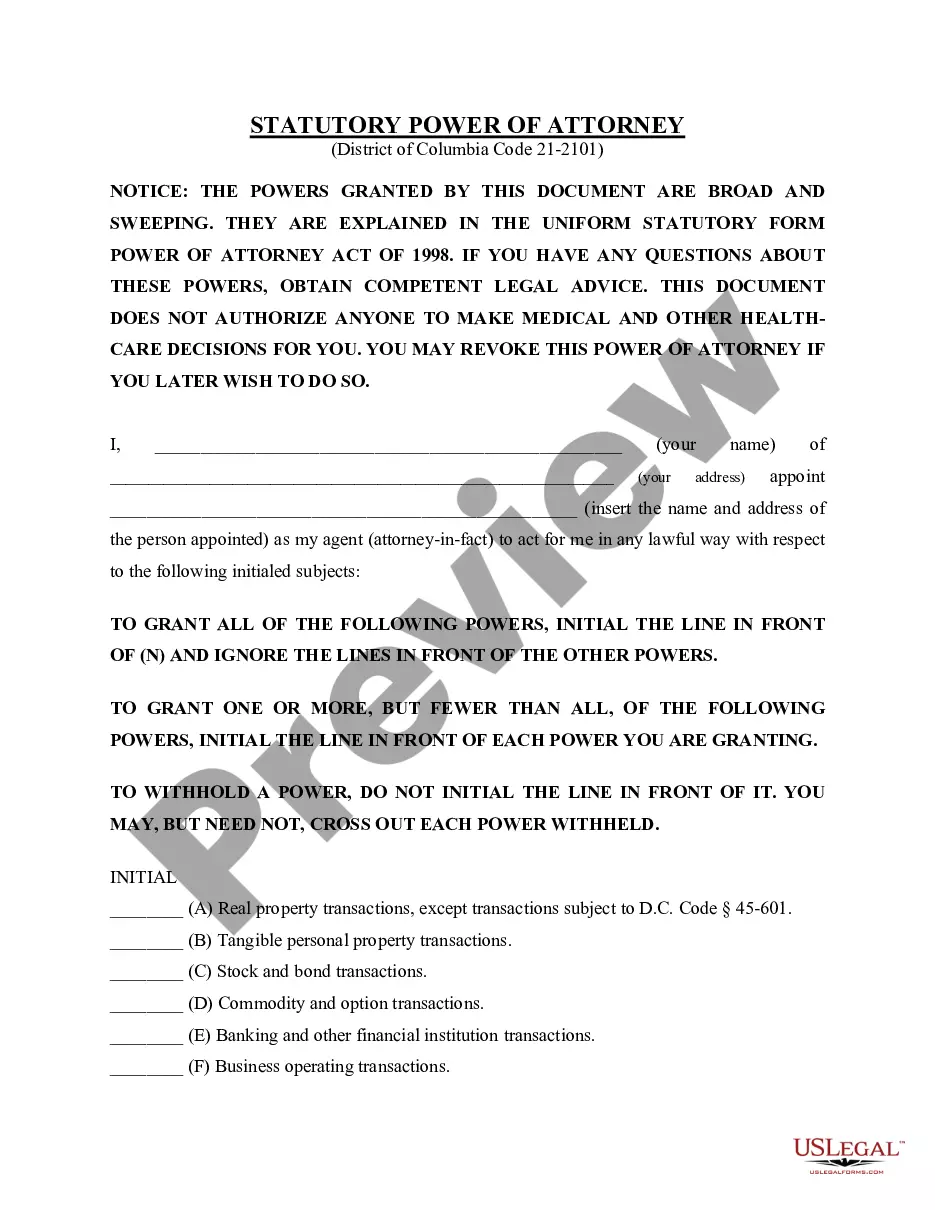

How to fill out District Of Columbia Triple Net Lease For Residential Property?

Are you presently in a circumstance where you require documents for either business or personal purposes daily.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a large selection of form templates, including the District of Columbia Triple Net Lease for Residential Property, which are crafted to comply with federal and state regulations.

Once you find the appropriate form, click Acquire now.

Choose a payment plan you prefer, fill out the necessary information to create your account, and complete your purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the District of Columbia Triple Net Lease for Residential Property template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Retrieve the form you need and ensure it is for the correct county/region.

- Utilize the Review option to examine the form.

- Check the summary to confirm you have selected the right form.

- If the form does not meet your needs, use the Search field to find the form that matches your specifications.

Form popularity

FAQ

Structuring a District of Columbia Triple Net Lease for Residential Property involves clearly defining tenant and landlord responsibilities in the lease agreement. Typically, the tenant covers property taxes, insurance, and maintenance fees. Including renewal options and termination clauses can protect both parties. Consider using templates from uslegalforms to ensure your lease is comprehensive and legally sound.

A District of Columbia Triple Net Lease for Residential Property can influence your tax obligations in several ways. Typically, rental income is taxable, while the costs covered by tenants might be deductible. Landlords can deduct property-related expenses, while tenants can remove costs from their income statements. It's wise to consult with a tax professional to make the most of these benefits.

To account for a District of Columbia Triple Net Lease for Residential Property, begin by establishing clear terms in your lease agreement. Ensure all parties understand their responsibilities regarding property expenses. Record all income and expenses regularly to maintain accurate financial records. Using tools available on uslegalforms can help you structure and manage your lease effectively.

Accounting for a District of Columbia Triple Net Lease for Residential Property involves recognizing base rent and additional costs. Landlords typically report rental income when received, while tenants manage expenses such as property tax, insurance, and maintenance. This clear division simplifies financial statements. Using a reliable accounting software, like the solutions offered by uslegalforms, can streamline this process.

Qualifying for a District of Columbia Triple Net Lease for Residential Property usually involves demonstrating stable income, good credit history, and an understanding of the leasing responsibilities. Many landlords look for tenants who can show they can manage the additional costs associated with the lease. Utilizing resources from uslegalforms can simplify the leasing process and provide guidance on eligibility requirements.

Many tenants opt for a District of Columbia Triple Net Lease for Residential Property due to its clarity in financial responsibilities. This type of lease often results in lower initial rents, as tenants assume additional costs like maintenance and insurance. Ultimately, it provides an opportunity for tenants to have greater control over their living space while allowing landlords to secure stable income.

To get approved for a District of Columbia Triple Net Lease for Residential Property, you typically need to present a solid financial history and demonstrate your ability to cover the associated costs. This may include providing proof of income and creditworthiness. Being well-prepared can streamline the approval process and increase your chances of securing your desired lease.

Yes, renting property in the District of Columbia may require obtaining a business license, depending on your situation. If you plan to engage in residential leasing activities, it's essential to comply with DC regulations. Using platforms like uslegalforms can help you navigate these requirements and secure the necessary licenses.

A District of Columbia Triple Net Lease for Residential Property generally involves three critical expenses: property taxes, insurance, and maintenance fees. In this type of lease, the tenant agrees to cover these costs, which allows the property owner to have a more predictable income stream. Understanding these criteria can help you make the best decision when considering a lease agreement.

DC residency typically requires that an individual lives in the District for at least 183 days within a year. Additionally, maintaining a permanent residence, registering to vote, or obtaining a DC driver's license can establish residency. Understanding the implications of residency is vital, particularly for those holding property under a District of Columbia Triple Net Lease for Residential Property, as it can influence tax obligations and eligibility for various local programs.