A District of Columbia Revocable Trust for Estate Planning is a legal arrangement where an individual (the granter) transfers their assets into a trust, which is managed by a trustee for the benefit of designated beneficiaries. This type of trust is flexible and can be modified or terminated by the granter during their lifetime, hence the term "revocable." It is an estate planning tool commonly used in the District of Columbia to efficiently transfer assets, avoid probate, and provide for the smooth transfer of property upon the granter's death. Benefits: 1. Avoidance of Probate: One of the key advantages of establishing a District of Columbia Revocable Trust is its ability to bypass probate. Upon the granter's death, the trust assets are distributed according to the trust terms, without the need for court involvement or lengthy legal procedures. 2. Privacy: Unlike probate, which is a public process, a revocable trust allows for the privacy of estate distribution. As the trust documents are not made public, details regarding asset distribution and beneficiaries remain confidential. 3. Flexibility and Control: The granter retains full control over the trust and can make changes, add or remove assets, or even revoke the trust entirely if desired, providing flexibility during their lifetime. 4. Incapacity Planning: A revocable trust enables the granter to plan for potential incapacitation. In the event the granter becomes unable to manage their affairs, the designated trustee can step in and administer the trust on their behalf, ensuring the continuity of asset management and minimizing disruptions. Types of District of Columbia Revocable Trusts: 1. Individual Trust: This is the most common type of revocable trust, established by an individual for their own benefit. The granter typically acts as the initial trustee, maintaining control over the assets until their incapacity or demise, at which point a successor trustee takes over to manage the trust on behalf of the beneficiaries. 2. Joint Trust: A joint revocable trust is created by a married couple, in which both spouses transfer their assets into a single trust. This type of trust allows for efficient transfer of assets upon the death of the first spouse while maintaining control and flexibility for the surviving spouse. In conclusion, a District of Columbia Revocable Trust for Estate Planning is a versatile tool that offers numerous benefits for individuals seeking to plan their estate efficiently. With the ability to avoid probate, provide privacy, maintain control, and plan for incapacity, it is no surprise that revocable trusts are widely used in the District of Columbia. The two primary types of trusts available are individual trusts and joint trusts, each tailored to the specific needs of the granter and their family situation.

District of Columbia Revocable Trust for Estate Planning

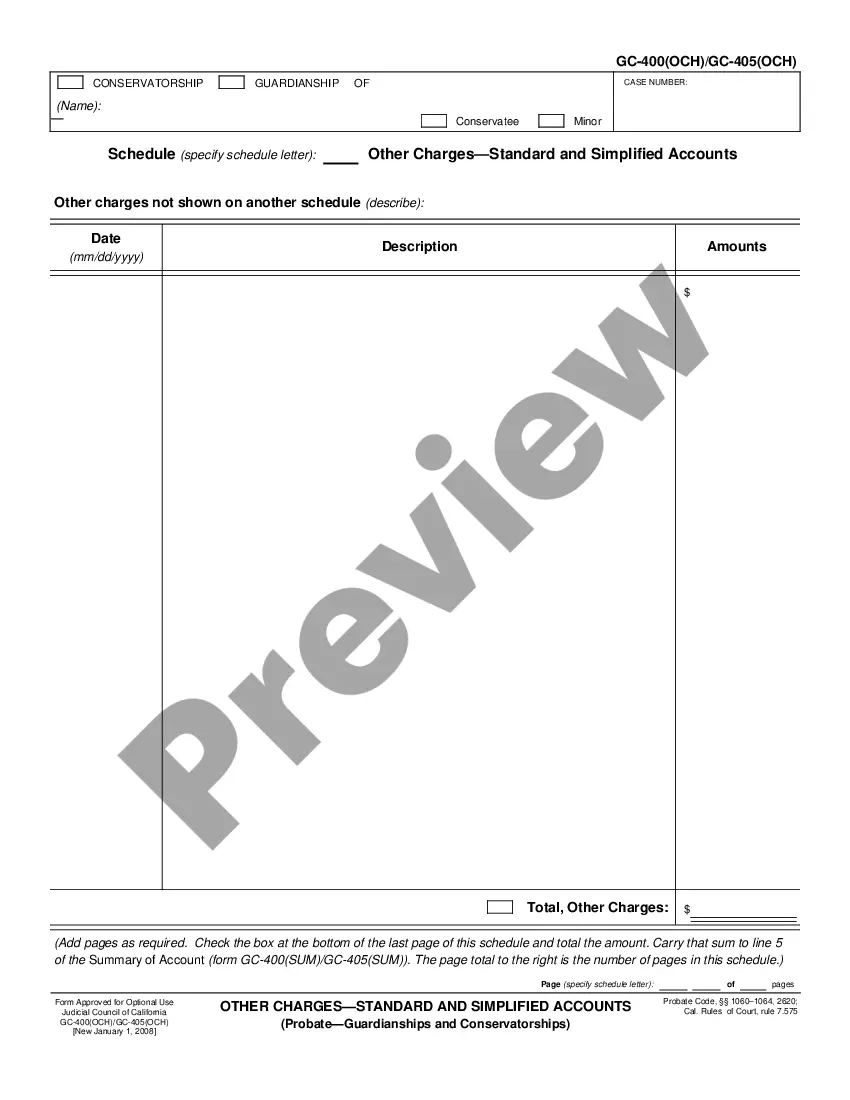

Description

How to fill out District Of Columbia Revocable Trust For Estate Planning?

Are you in the placement where you need documents for sometimes organization or person functions nearly every day? There are tons of legal papers templates available on the Internet, but finding kinds you can depend on isn`t simple. US Legal Forms delivers a large number of develop templates, like the District of Columbia Revocable Trust for Estate Planning, that are written in order to meet federal and state specifications.

If you are previously knowledgeable about US Legal Forms internet site and also have a merchant account, merely log in. Next, you may down load the District of Columbia Revocable Trust for Estate Planning template.

Should you not come with an profile and want to start using US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for that right city/area.

- Take advantage of the Review switch to check the form.

- Look at the information to ensure that you have selected the proper develop.

- If the develop isn`t what you are looking for, make use of the Look for industry to obtain the develop that suits you and specifications.

- If you get the right develop, click on Acquire now.

- Opt for the rates prepare you desire, fill in the necessary info to make your money, and buy an order utilizing your PayPal or credit card.

- Choose a handy data file file format and down load your version.

Discover every one of the papers templates you have purchased in the My Forms food selection. You can aquire a further version of District of Columbia Revocable Trust for Estate Planning anytime, if required. Just go through the necessary develop to down load or print out the papers template.

Use US Legal Forms, by far the most considerable selection of legal kinds, to conserve efforts and avoid errors. The support delivers skillfully produced legal papers templates that can be used for a selection of functions. Produce a merchant account on US Legal Forms and initiate producing your lifestyle easier.