The District of Columbia Contract — Sale of Goods is a legal document that governs the transaction and transfer of ownership of goods between a seller and a buyer in the District of Columbia. This contract outlines the terms and conditions that both parties must adhere to ensure a fair and lawful sale. In the District of Columbia, there are several types of contracts related to the sale of goods: 1. Uniform Commercial Code (UCC): The UCC is a set of standardized laws that have been adopted by most states, including the District of Columbia, to regulate commercial transactions. Under the UCC, contracts for the sale of goods are subject to specific rules and regulations. 2. Express Contract: An express contract is a type of contract where the terms and conditions of the sale of goods are clearly stated and agreed upon by both parties. This type of contract is usually in writing and includes explicit details such as the description of the goods, the price, payment terms, delivery terms, and any warranties or guarantees. 3. Implied Contract: An implied contract is a contract that is formed based on the parties' conduct, rather than any explicit agreement. In the sale of goods context, an implied contract can arise when the seller delivers the goods and the buyer accepts them without any specific written agreement. 4. Installment Sales Contract: An installment sales contract is a type of contract where the purchase price of the goods is paid in installments over a specified period. This type of contract is often used when the buyer cannot afford to pay the full purchase price upfront. It includes terms and conditions related to the installment payments, interest rates (if applicable), and consequences of non-payment. 5. Conditional Sales Contract: A conditional sales contract is a contract where the transfer of ownership of the goods is contingent upon the buyer meeting certain conditions, such as making all the payments or fulfilling other obligations specified in the contract. This type of contract is commonly used when the seller wants to retain a security interest in the goods until full payment is made. When entering into a District of Columbia Contract — Sale of Goods, it is crucial to include key provisions to protect the rights and interests of both parties. These provisions may include the description and specifications of the goods, pricing and payment terms, warranty or guarantee details, delivery terms, remedies for breach of contract, dispute resolution mechanisms, and any applicable local and federal laws governing the sale of goods. In summary, the District of Columbia Contract — Sale of Goods is a legally binding agreement that facilitates the transaction and transfer of ownership of goods. It functions to establish the rights and obligations of both the buyer and seller, and ensuring compliance with relevant laws and regulations. Various types of contracts, such as the UCC, express contract, implied contract, installment sales contract, and conditional sales contract, may be utilized depending on the specific circumstances of the sale.

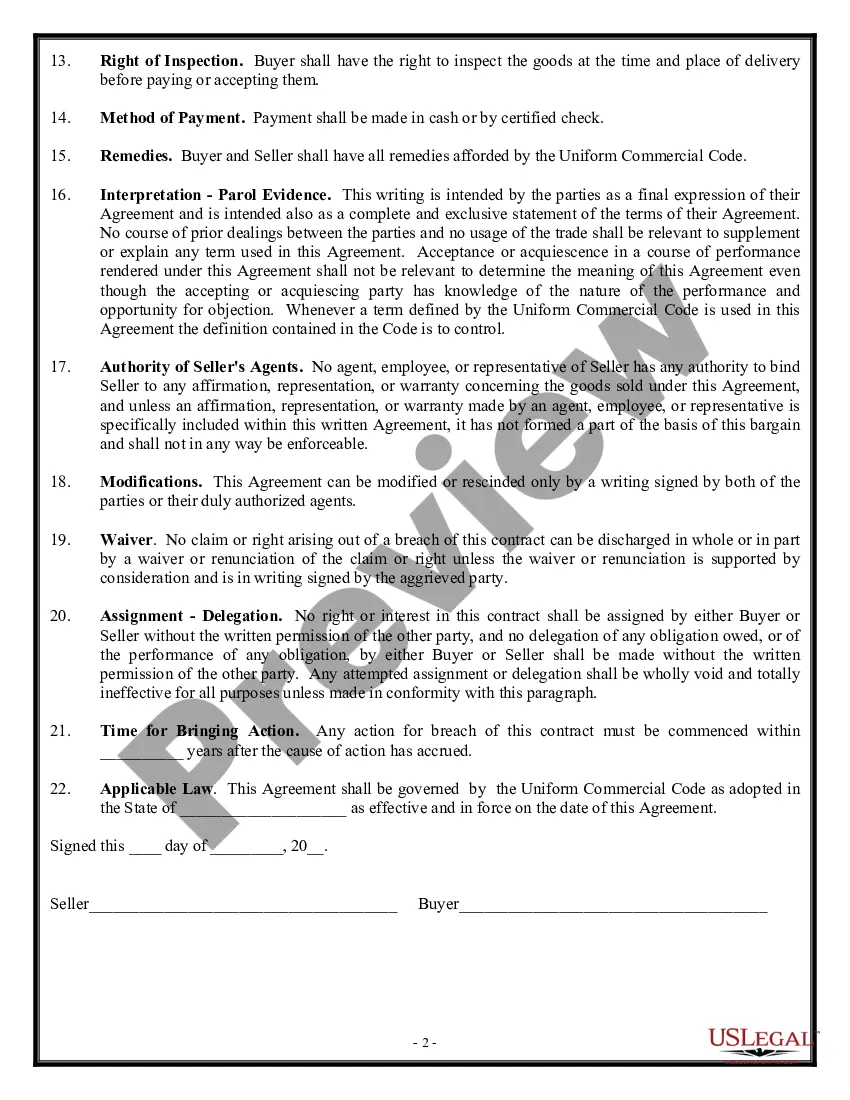

District of Columbia Contract - Sale of Goods

Description

How to fill out District Of Columbia Contract - Sale Of Goods?

Are you presently in the placement the place you will need documents for sometimes business or personal functions virtually every time? There are a lot of legal document templates available on the net, but locating kinds you can rely isn`t easy. US Legal Forms provides thousands of type templates, just like the District of Columbia Contract - Sale of Goods, which are published to fulfill federal and state specifications.

Should you be presently familiar with US Legal Forms website and get an account, simply log in. Next, you are able to download the District of Columbia Contract - Sale of Goods format.

Should you not offer an account and would like to begin to use US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for the proper city/region.

- Make use of the Preview option to analyze the shape.

- Read the description to ensure that you have selected the correct type.

- If the type isn`t what you`re looking for, make use of the Lookup area to get the type that meets your requirements and specifications.

- When you obtain the proper type, click Acquire now.

- Opt for the rates strategy you desire, fill in the desired information and facts to produce your bank account, and purchase the order using your PayPal or charge card.

- Decide on a practical paper file format and download your duplicate.

Locate all of the document templates you have purchased in the My Forms menu. You can get a extra duplicate of District of Columbia Contract - Sale of Goods whenever, if needed. Just go through the needed type to download or printing the document format.

Use US Legal Forms, the most comprehensive assortment of legal varieties, to save lots of time as well as steer clear of faults. The service provides professionally made legal document templates that you can use for an array of functions. Create an account on US Legal Forms and start producing your way of life easier.