Subject: District of Columbia Sample Letter Sending Check for Copying Expense Dear [Recipient's Name], I hope this letter finds you well. As per our recent correspondence, I am sending you a check to cover the expenses incurred for copying documents related to our project in the District of Columbia. Please find enclosed a check for the total amount of [amount], payable to [Recipient's Name/Company]. In accordance with our agreement, the copying costs for the aforementioned documents are reimbursable. The copies were necessary for the successful completion of our project, and I have attached the relevant receipts and invoices for your reference. Kindly confirm the receipt of the check and ensure that it is deposited into your account within a reasonable timeframe. Upon completion of the transaction, please provide me with an acknowledgment of payment for our records. Should you have any questions or require further documentation, please do not hesitate to contact me at [Your Contact Information]. I appreciate your prompt attention to this matter and your cooperation throughout our project. Thank you for your assistance, and I look forward to receiving your confirmation soon. Sincerely, [Your Name] [Your Title/Position] [Your Company/Organization] Keywords: District of Columbia, sample letter, sending, check, copying expense, reimbursement, receipts, invoices, confirmation, project, documentation, contact information, prompt attention, cooperation.

District of Columbia Sample Letter sending Check for Copying Expense

Description

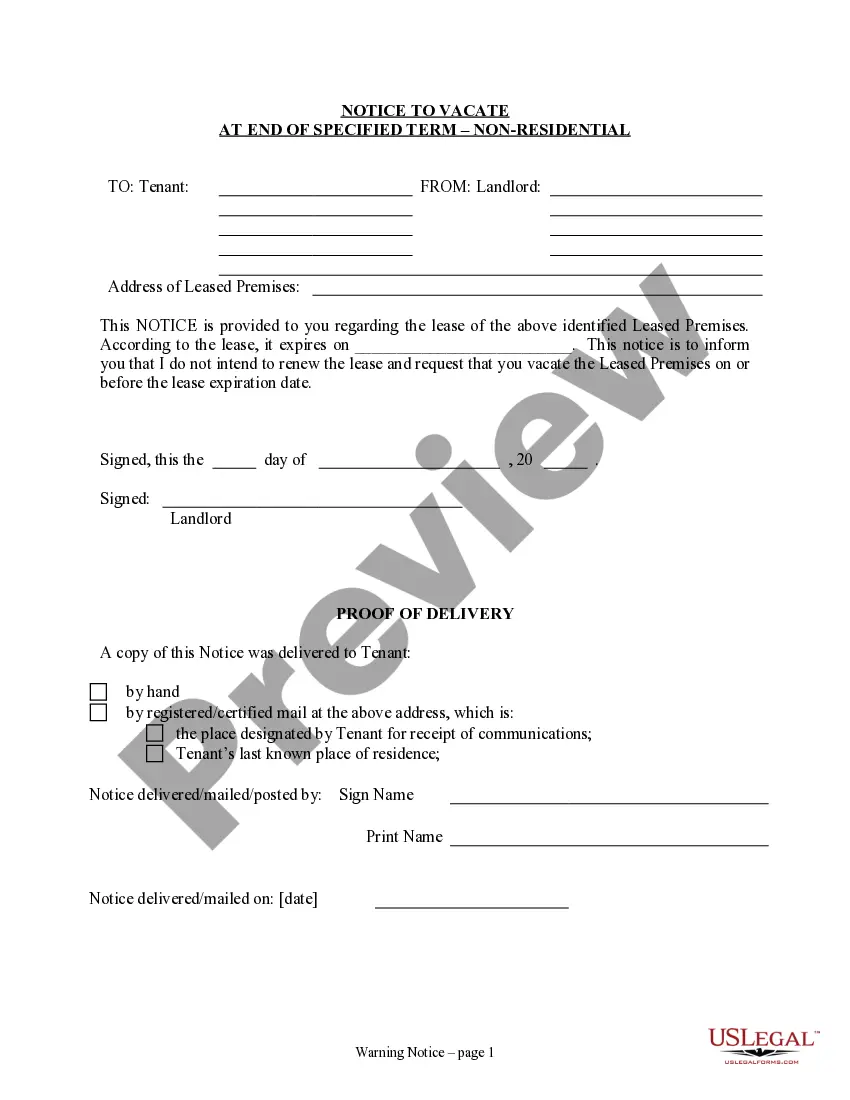

How to fill out District Of Columbia Sample Letter Sending Check For Copying Expense?

US Legal Forms - among the largest libraries of authorized forms in the States - offers a wide array of authorized file layouts it is possible to obtain or produce. Making use of the website, you can get thousands of forms for organization and individual functions, categorized by groups, claims, or keywords.You will find the most recent models of forms just like the District of Columbia Sample Letter sending Check for Copying Expense in seconds.

If you already have a monthly subscription, log in and obtain District of Columbia Sample Letter sending Check for Copying Expense through the US Legal Forms collection. The Acquire button will appear on every develop you see. You get access to all formerly acquired forms in the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, allow me to share simple directions to obtain started out:

- Be sure to have selected the proper develop for the area/region. Click the Review button to analyze the form`s content. Browse the develop description to actually have selected the right develop.

- In the event the develop does not match your needs, use the Look for industry at the top of the display screen to obtain the the one that does.

- In case you are happy with the shape, verify your decision by clicking the Acquire now button. Then, choose the pricing strategy you favor and provide your qualifications to sign up for the profile.

- Process the transaction. Utilize your credit card or PayPal profile to finish the transaction.

- Select the format and obtain the shape on your product.

- Make modifications. Fill up, change and produce and signal the acquired District of Columbia Sample Letter sending Check for Copying Expense.

Every single format you included in your money lacks an expiry date and is your own permanently. So, in order to obtain or produce another version, just go to the My Forms portion and then click around the develop you require.

Obtain access to the District of Columbia Sample Letter sending Check for Copying Expense with US Legal Forms, one of the most substantial collection of authorized file layouts. Use thousands of expert and state-distinct layouts that meet up with your organization or individual requirements and needs.

Form popularity

FAQ

After adjustments have been made, you can apply deductions. The standard deduction in D.C. for the 2022 tax year is $12,950. Married couples filing jointly can claim a standard deduction of $25,900. District of Columbia Income Tax Calculator - SmartAsset smartasset.com ? taxes ? district-of-columbia-tax-c... smartasset.com ? taxes ? district-of-columbia-tax-c...

The District of Columbia (DC) has a graduated individual income tax, with rates ranging from 4.00 percent to 10.75 percent. DC has a flat 8.25 percent corporate income tax rate. DC also has a 6.00 percent sales tax rate. The District of Columbia Tax Rates & Rankings taxfoundation.org ? location ? the-district-of-colu... taxfoundation.org ? location ? the-district-of-colu...

Under Section 47-1801.04(17) of the DC Official Code, also known as the ?183-Day Rule,? anyone who maintains a home in the District of Columbia for at least 183 days a year is considered a legal Washington, DC resident and must pay DC income taxes. Nonresidents do not have to pay this tax. Payroll tax in Washington, DC: What employers need to know [2023] rippling.com ? blog ? payroll-tax-in-washin... rippling.com ? blog ? payroll-tax-in-washin...

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year. Individual Income Tax Filing | otr - Office of Tax and Revenue - DC.gov dc.gov ? book ? individual-income-tax-fili... dc.gov ? book ? individual-income-tax-fili...

If I claimed itemized deductions on my federal return, must I also itemize on my DC return? Yes. If you claim itemized deductions on your federal tax return, you must itemize on your DC tax return. You must take the same type of deduction (itemized or standard) on your DC return as taken on your federal return.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.