District of Columbia Sale of Deceased Partner's Interest

Description

How to fill out Sale Of Deceased Partner's Interest?

If you need to compile, obtain, or create sanctioned document templates, utilize US Legal Forms, the leading repository of legal forms, accessible online.

Leverage the website's straightforward and convenient search feature to locate the documents you require.

Various templates for commercial and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Download now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the District of Columbia Sale of Deceased Partner's Interest in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the District of Columbia Sale of Deceased Partner's Interest.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Confirm you have selected the form corresponding to the correct city/state.

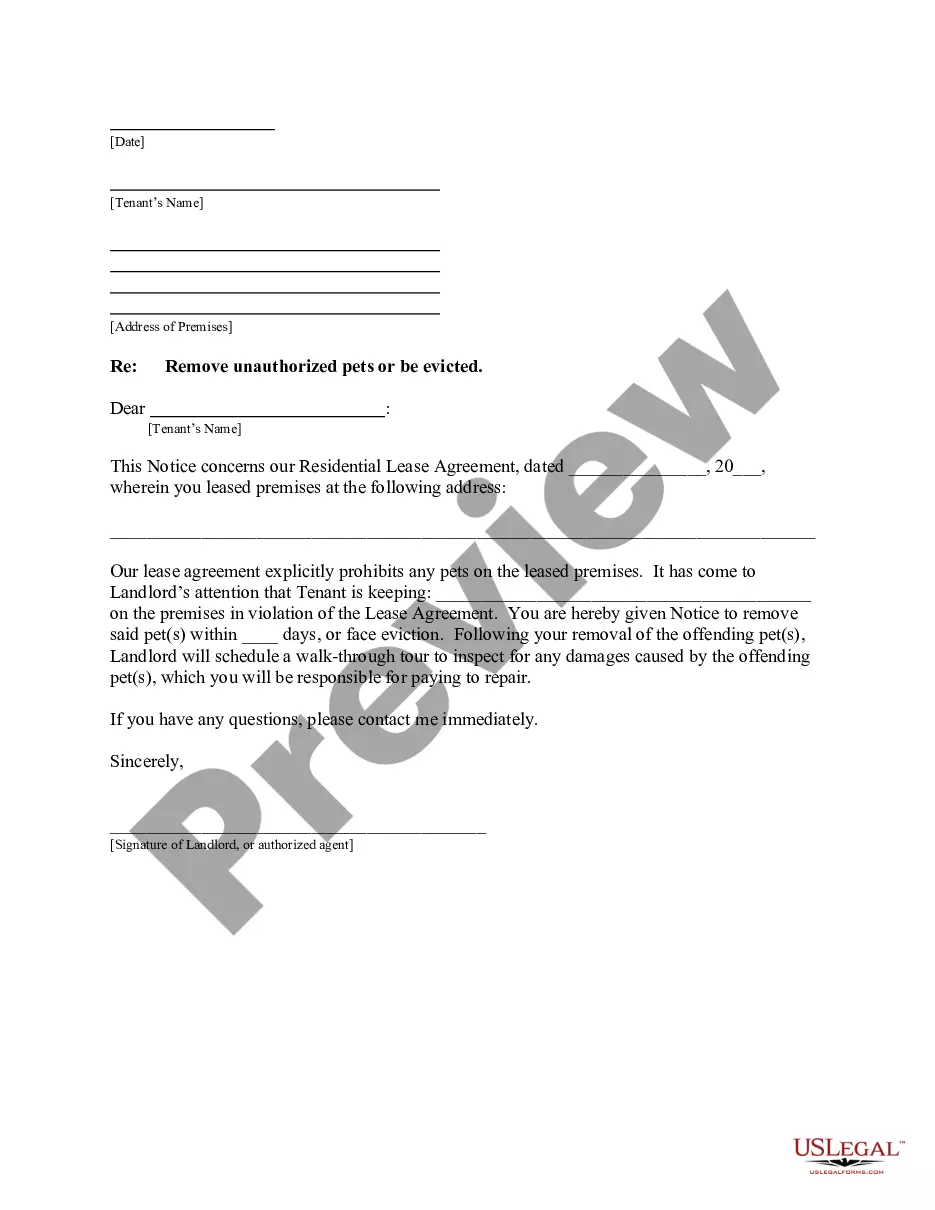

- Step 2. Utilize the Preview option to review the details of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document design.

Form popularity

FAQ

Use the not so simple method to close the estate, Send Notice of Filing of Declaration of Completion, Wait until the expiration of the 30-day notice period, and. THEN MAKE DISTRIBUTION AFTER your Declaration of Completion has become final and the time for filing any Objection has expired.

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

When a legal resident of the District of Columbia dies without a Will, that person's property must be probated through the same Probate Court process as the property of a person who died with a Will.

Probate Legal process through which a personal representative is appointed and the assets of someone who has died are collected and distributed and the decedent's debts are paid. Register of Wills The person in charge of the D.C. Superior Court Probate Division staff.

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.

Generally, an unincorporated business, with gross income (Line 11) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Unless otherwise provided by an order of the Court for good cause shown in a particular case, an estate administered in an unsupervised administration shall be closed in one of 2 ways: (A) by the personal representative's filing with the Court a Certificate of Completion as described in section 20-735, and the

WHO MUST FILE A D.C. PARTNERSHIP FORM D-65. Except for partnerships required to file an unincorporated business fran- chise tax return, D.C. Form D-30, all partnerships engaged in any trade or business within the District of Columbia or which received income from sources within the District, must file a D.C. Form D-65.

For the purposes of this chapter (not alone of this subchapter) and unless otherwise required by the context, the term unincorporated business means any trade or business, conducted or engaged in by any individual, whether resident or nonresident, statutory or common-law trust, estate, partnership, or limited or