District of Columbia Non-Disclosure Agreement for Potential Investors

Description

How to fill out Non-Disclosure Agreement For Potential Investors?

You can devote hours online looking for the legal document template that meets the state and federal requirements you desire.

US Legal Forms provides a vast array of legal documents that have been vetted by experts.

It is easy to obtain or print the District of Columbia Non-Disclosure Agreement for Potential Investors from the service.

If you wish to find another version of the form, utilize the Search box to locate the template that suits your needs and requirements.

- If you currently have a US Legal Forms account, you may access it and select the Download button.

- Subsequently, you can fill out, modify, print, or sign the District of Columbia Non-Disclosure Agreement for Potential Investors.

- Every legal document template you purchase is yours indefinitely.

- To request an additional copy of the purchased form, navigate to the My documents section and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice. Check the form description to confirm you have chosen the right one.

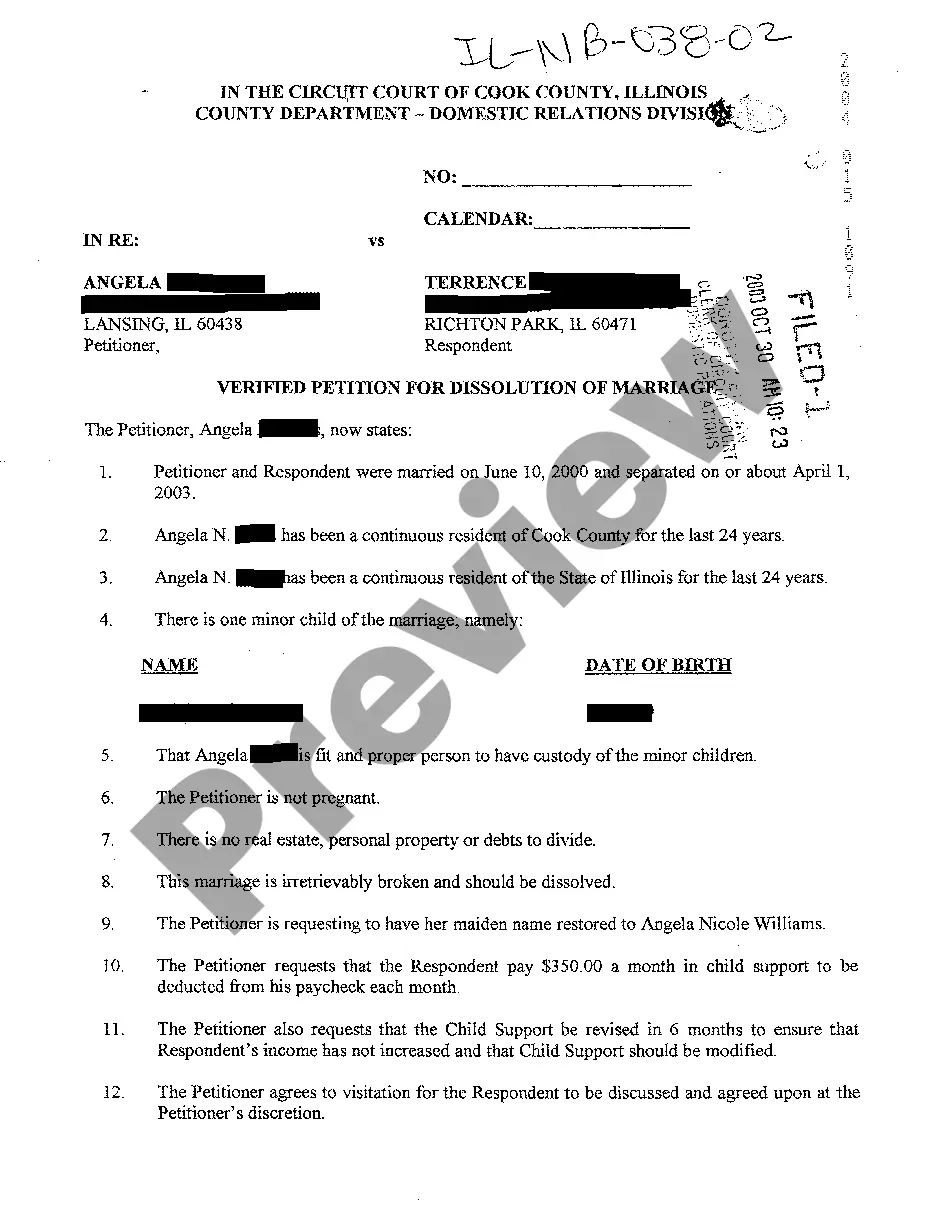

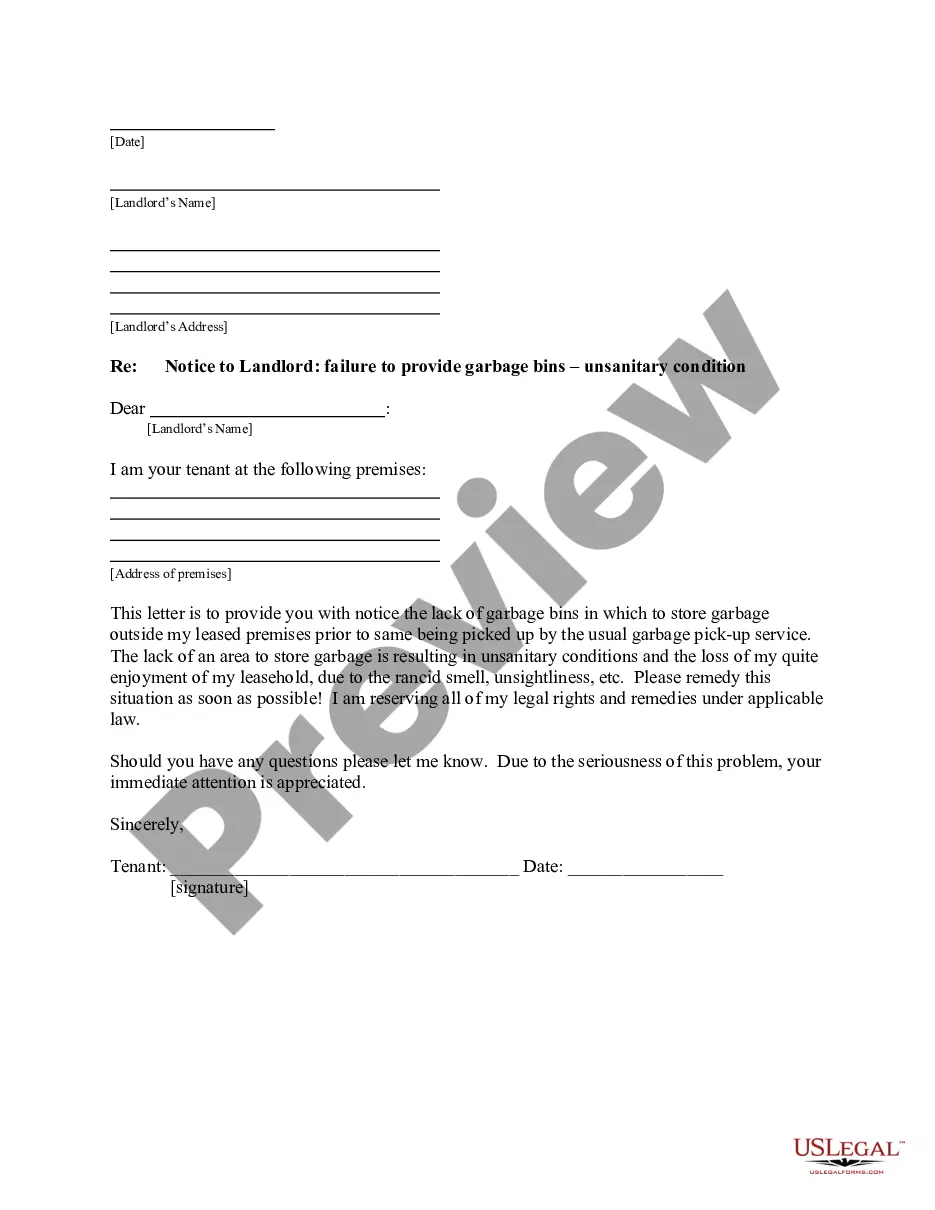

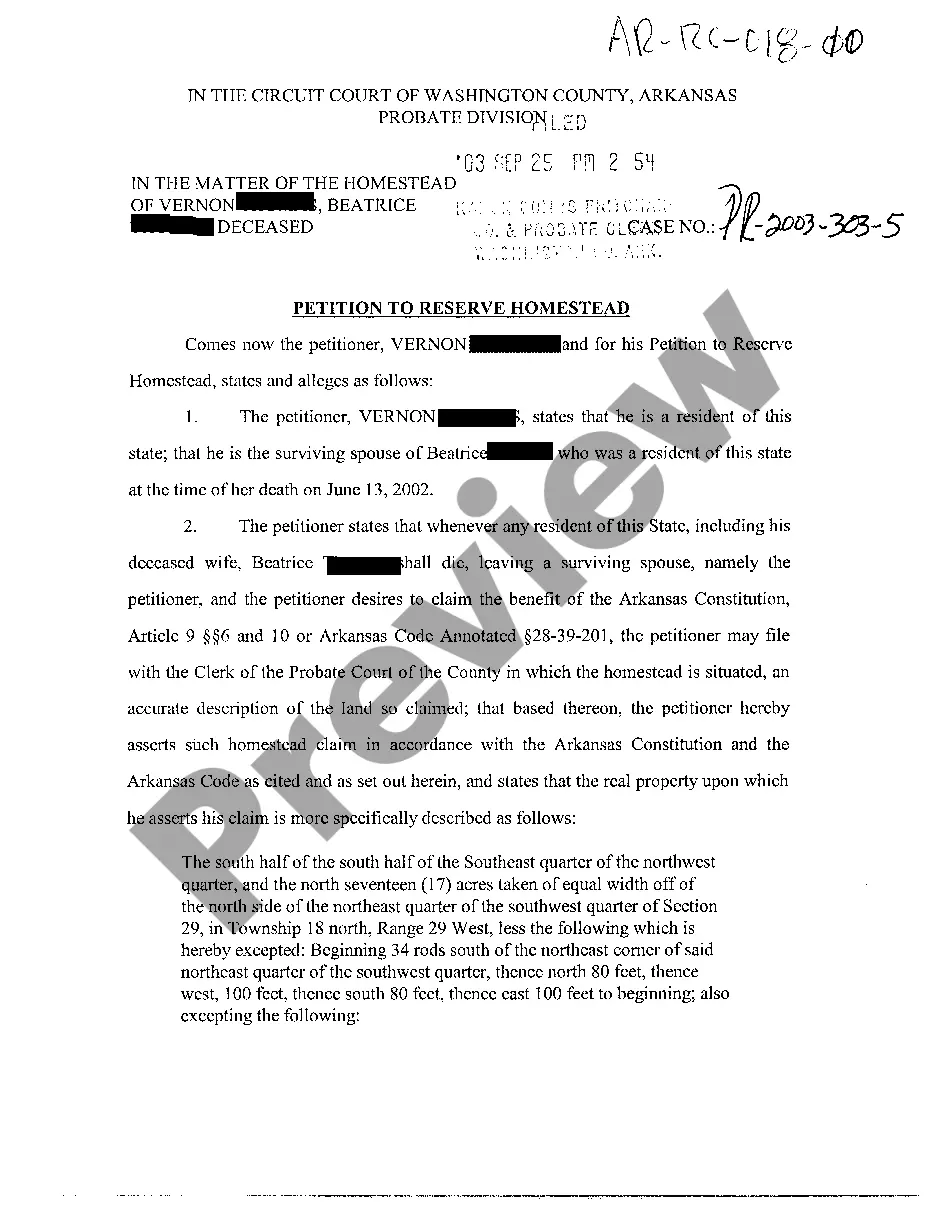

- If available, use the Review button to examine the document template as well.

Form popularity

FAQ

Yes, you can write your own non-disclosure agreement, but it's essential to ensure that it covers all necessary legal bases. A well-structured District of Columbia Non-Disclosure Agreement for Potential Investors should clearly define the terms, obligations, and consequences for breaches. To simplify the process, consider using platforms like US Legal Forms that offer customizable templates and legal guidance to create an effective NDA tailored to your needs.

The most expensive non-disclosure agreements (NDAs) typically involve high-stakes negotiations, significant business secrets, or intellectual properties. In the context of the District of Columbia Non-Disclosure Agreement for Potential Investors, the value arises from protecting sensitive financial information and proprietary business strategies. Entering into a detailed and well-crafted NDA can help avoid costly legal battles or information leaks that could damage your business's reputation and finances.

Filling out a District of Columbia Non-Disclosure Agreement for Potential Investors involves providing specific details about the parties, defining what constitutes confidential information, and stating the terms of the agreement. It is wise to review each section thoroughly and consider using user-friendly templates from platforms like USLegalForms. This approach can help streamline the process and minimize errors.

Red flags for a District of Columbia Non-Disclosure Agreement for Potential Investors include overly broad definitions of confidential information, unclear obligations, and excessively long durations of confidentiality. You should also be cautious of any clauses that may limit your rights or impose unfair penalties. Recognizing these red flags can help you negotiate a fairer agreement.

The five key elements of a District of Columbia Non-Disclosure Agreement for Potential Investors are: 1) Identification of the parties involved, 2) Definition of confidential information, 3) Obligations of the receiving party, 4) Duration of confidentiality, and 5) Remedies for breach. Each element plays a vital role in enforcing the NDA and securing your business interests.

The key points of a District of Columbia Non-Disclosure Agreement for Potential Investors include the definition of confidential information, the obligations of the receiving party, and the duration of confidentiality. Additionally, the agreement should specify any exclusions from confidentiality and the consequences of breach. Understanding these points can help you protect your sensitive information effectively.

The rules of a District of Columbia Non-Disclosure Agreement for Potential Investors primarily revolve around confidentiality and the obligations of the parties involved. This agreement outlines what information remains confidential and for what duration. Breaching these rules may have legal consequences, so it's important to understand your responsibilities clearly.

Yes, you can write your own District of Columbia Non-Disclosure Agreement for Potential Investors. However, it's crucial to ensure it includes all necessary legal components to protect your interests effectively. Using templates from reliable platforms, like USLegalForms, can help simplify the process and ensure compliance with state laws.

Disclosure Agreement (NDA) is a legal document that ensures confidentiality between parties, especially in business situations where sensitive information is shared. In contrast, a Mutual NonDisclosure Agreement (MNDA) is a twoway agreement where both parties agree to protect each other's confidential information. When considering a District of Columbia NonDisclosure Agreement for Potential Investors, it is essential to choose the right type based on your needs. A welldrafted agreement from uslegalforms can help you establish clear boundaries and protect your interests effectively.

Yes, it is advisable to have an NDA for investors when discussing sensitive business information, financial data, or strategies. An NDA helps protect your business interests and prevents potential misuse of your valuable insights. By using a District of Columbia Non-Disclosure Agreement for Potential Investors, you can establish clear boundaries and expectations with potential investors, ensuring your information remains secure.