Title: Understanding District of Columbia Liability Waiver for Homeowners: Types and Detailed Description Introduction: In the District of Columbia, liability waivers for homeowners are legal documents that protect homeowners from legal liability in case of accidents, injuries, or property damage occurring on their premises. These waivers play a crucial role in ensuring homeowners are safeguarded against potential lawsuits. This article aims to provide a comprehensive overview of District of Columbia Liability Waivers for Homeowners by discussing their purpose, key elements, and different types. 1. Why are District of Columbia Liability Waivers important for homeowners? Liability waivers are essential for homeowners in the District of Columbia as they mitigate the risk of potential lawsuits and financial damages for accidents or injuries that might occur on their property. By signing a waiver, individuals voluntarily assume the risks associated with participating in activities or events on the homeowner's premises. 2. Key elements of District of Columbia Liability Waivers: — Clear language: A valid waiver must use clear and concise language, ensuring that the signer fully understands the terms and assumes the risks involved. — Voluntary agreement: The waiver should clearly indicate that the signer is entering into the agreement voluntarily without any coercion or duress. — Scope and description: The waiver should outline the specific activities, events, or areas of the homeowner's property to which it applies, leaving no room for ambiguity. — Right to legal representation: The signer should be informed of their right to seek legal advice before signing the waiver. — Severability clause: This clause ensures that even if one part of the waiver is deemed unenforceable, the other parts remain valid. 3. Different types of District of Columbia Liability Waivers for Homeowners: a. General Liability Waivers: These waivers protect homeowners against claims arising from accidents or injuries that may occur during general use of their property, such as slips and falls, accidents on stairs, or injuries caused by faulty infrastructure. b. Activity-Specific Liability Waivers: These waivers are tailored to a particular activity or event on the homeowner's property. Examples include swimming pool usage, trampoline jumping, or participation in sports events or recreational activities. Activity-specific waivers help homeowners ensure they are safeguarded against risks associated with the specific nature of each activity. c. Rental Waivers: These waivers are used when homeowners rent out their property temporarily, such as through platforms like Airbnb. Rental waivers typically outline the responsibilities and liabilities of both the homeowner and the tenant, reducing potential conflicts should any accidents or damages occur. Conclusion: District of Columbia Liability Waivers for Homeowners are crucial legal documents that protect homeowners from potential lawsuits and financial liabilities arising from accidents and injuries on their premises. By educating themselves about the purpose, key elements, and different types of waivers available, homeowners can ensure they effectively mitigate risks and maintain a safer environment for themselves and their guests.

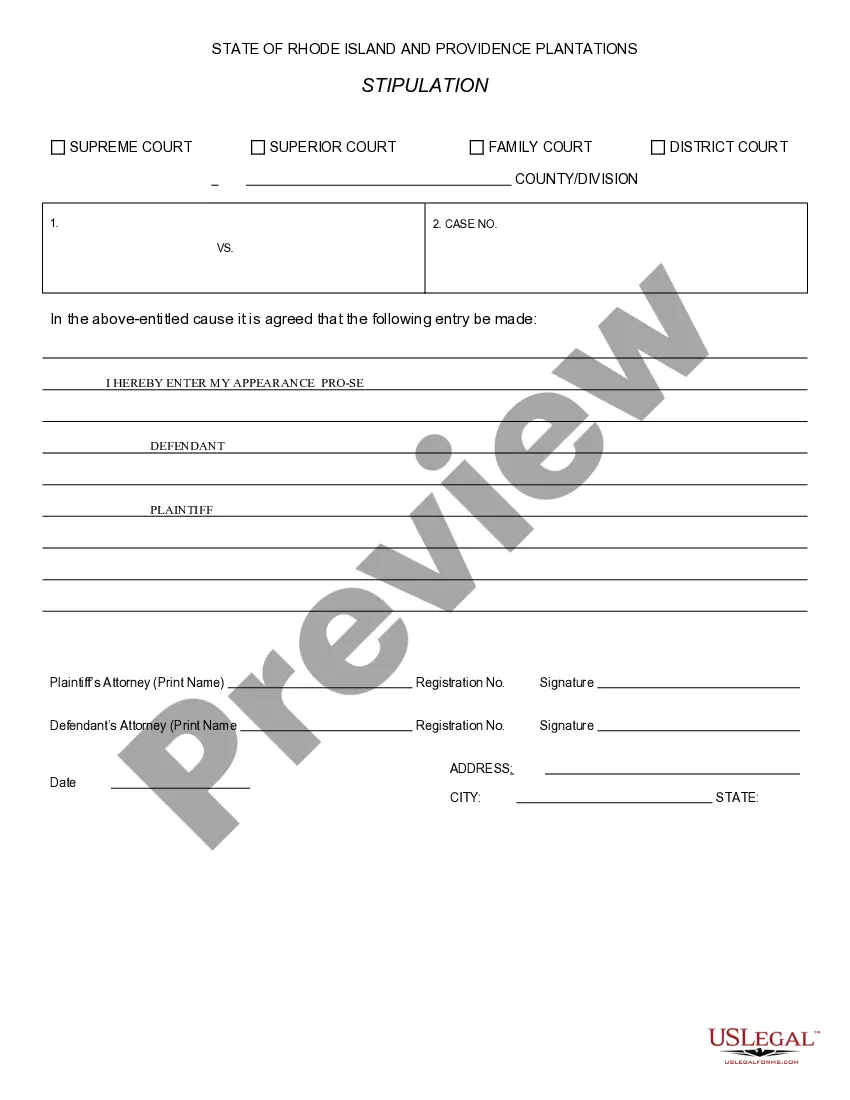

District of Columbia Liability Waiver for Homeowner

Description

How to fill out District Of Columbia Liability Waiver For Homeowner?

US Legal Forms - one of the finest collections of legal paperwork in the United States - offers a range of legal document templates that you can either download or create.

By utilizing the website, you can access thousands of forms for both business and personal uses, categorized by types, states, or keywords. You can quickly find the latest versions of documents like the District of Columbia Liability Waiver for Homeowners.

If you already have a monthly membership, Log In and obtain the District of Columbia Liability Waiver for Homeowners from the US Legal Forms library. The Download button will be visible on every form you view.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your information to sign up for an account.

Process the payment. Use a credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make edits. Fill out, modify, and print or sign the downloaded District of Columbia Liability Waiver for Homeowners.

Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the District of Columbia Liability Waiver for Homeowners with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize numerous professional and state-specific templates that cater to your business or personal needs and requirements.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Preview button to review the form's content.

- Read the form details to confirm you have chosen the correct one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

Form popularity

FAQ

Generally, you do not need a lawyer to create a liability waiver in the District of Columbia. However, consulting with a legal professional can provide peace of mind, especially when dealing with complex situations. For many homeowners, using a service like US Legal Forms can be an excellent alternative to hiring a lawyer. These platforms offer easy-to-use templates that can help you draft a waiver that meets your needs.

While anyone can technically write a release of liability, it is essential to include specific legal terms to make it enforceable. In the District of Columbia, your waiver should address the relevant activities and include clear language that outlines the release of liability. To ensure compliance and accuracy, seeking templates or assistance from platforms like US Legal Forms can greatly help, especially for homeowners looking for clarity.

Yes, you can write your own waiver in the District of Columbia. However, it is crucial to ensure that the waiver contains all necessary elements to be enforceable. This includes clear language specifying the rights being waived and the consideration exchanged. Utilizing templates from services like US Legal Forms can save you time and help ensure your waiver covers all legal bases.

To write a letter of release of liability in the District of Columbia, start by clearly stating the purpose of the document. Include essential details, such as the names of the parties involved, the specific activities covered, and a statement releasing liability. Make sure to conclude with signatures from all parties. Using a reliable platform, like US Legal Forms, can simplify the process and ensure that your release meets all legal requirements.

In the District of Columbia, not all liability waivers require notarization. A liability waiver for homeowners can be effective without notarization if it includes clear language and signatures from both parties. However, notarizing the document can add an additional layer of validity and help prevent disputes. Always consider your specific situation when deciding whether or not to have your waiver notarized.

Waivers may not hold up in court if they do not meet specific legal standards. Factors such as ambiguity in the language or the presence of coercion can lead a judge to invalidate a waiver. In situations involving the District of Columbia Liability Waiver for Homeowner, ensuring that the waiver is thorough and legally sound is crucial.

A liability waiver is enforceable when it is properly constructed and clearly states the risks involved. For the District of Columbia Liability Waiver for Homeowner to be valid, it should be easy to understand and signed willingly by both parties. It’s advisable to seek assistance for clarity and compliance with local laws.

A waiver can become void for specific reasons. For instance, if it lacks mutual consent or if it was signed under coercive circumstances, it may not hold up. Also, if the waiver attempts to release a party from liability for actions that are against public policy, like intentional harm, it can be deemed void.

Liability waivers do have limitations. They cannot protect against gross negligence or intentional misconduct. Additionally, the District of Columbia Liability Waiver for Homeowner may not cover all types of injuries, especially those that arise from a violation of law or public policy.

Waivers can be enforceable, particularly if they meet legal requirements. For a District of Columbia Liability Waiver for Homeowner to be valid, it must be clear and specific about the risks involved. It's essential that both parties voluntarily agree to the terms without any duress.

Interesting Questions

More info

Quick & Easy Quick Look Quick View Product Catalog.