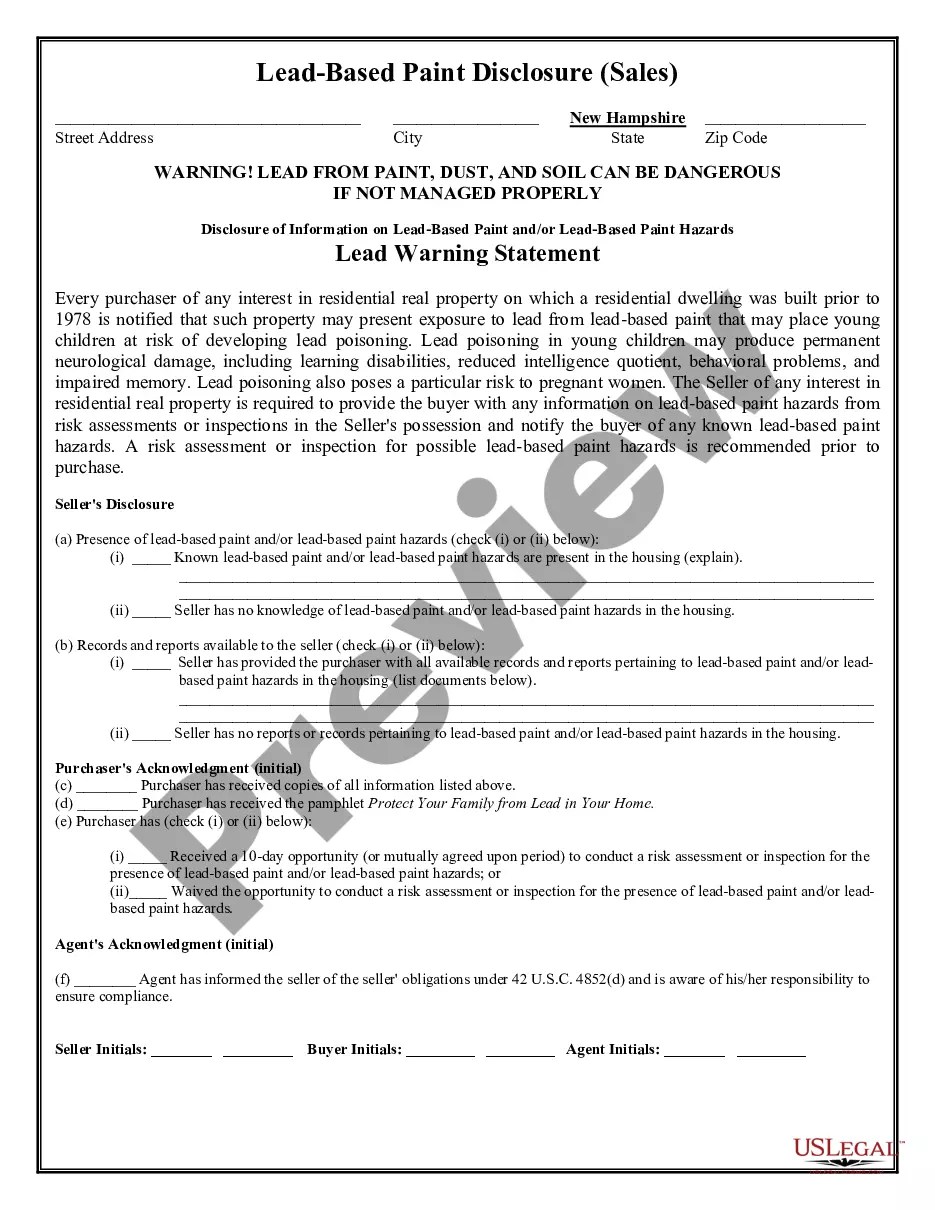

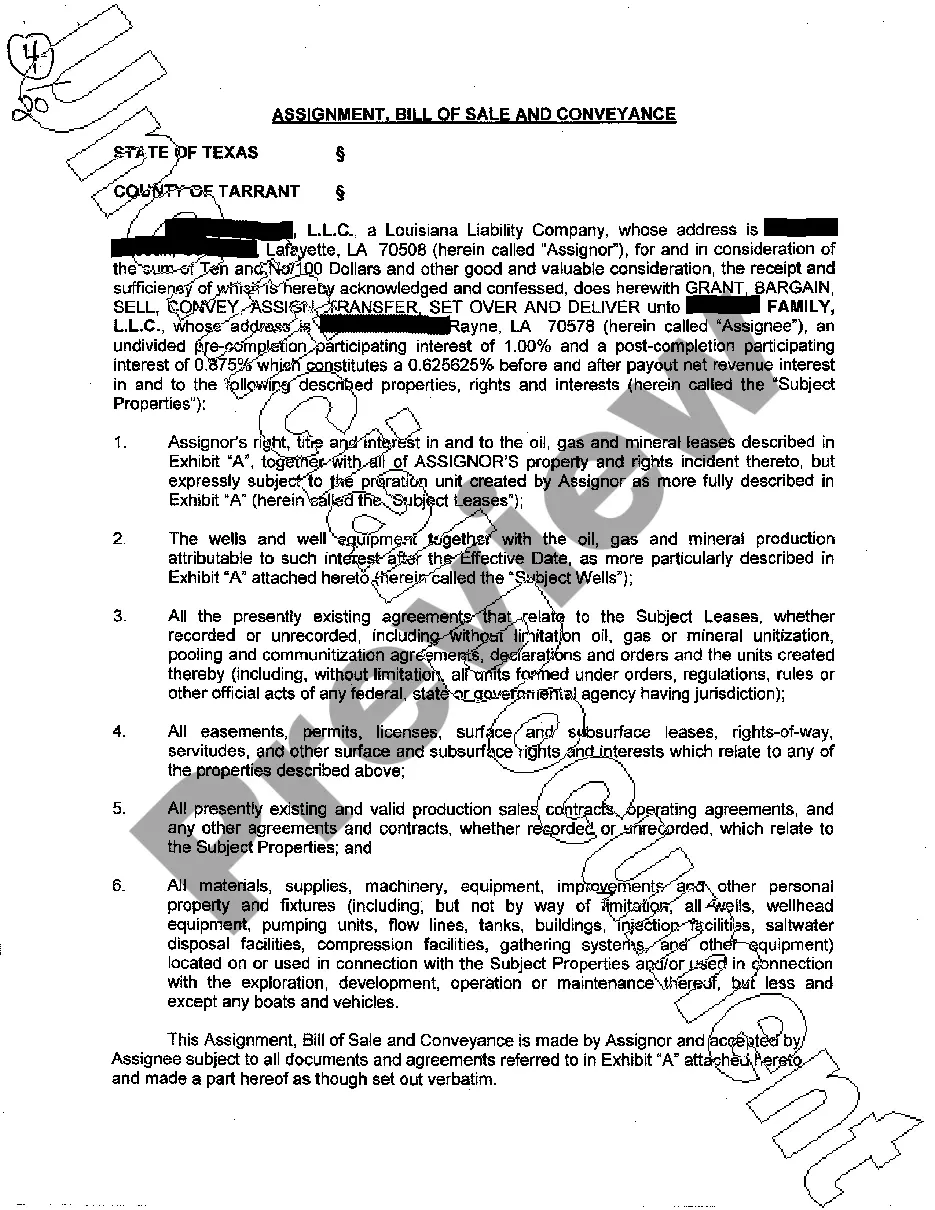

The District of Columbia Pledge of Shares of Stock is a legal document used in the District of Columbia to secure a loan or debt with shares of stock. This agreement allows an individual or entity, known as the "pledge," to pledge their shares of stock as collateral in order to obtain financing. The pledge of shares of stock serves as a mechanism to protect the lender's interests and ensure the debt is repaid. By pledging the shares, the lender has a right to take possession of the stock if the pledge fails to fulfill their obligations under the loan agreement. There are several types of District of Columbia Pledge of Shares of Stock that can be used in various situations: 1. Open-End Pledge: This type of pledge allows the pledge to continue adding additional shares of stock to the pledge agreement over time. It provides flexibility to the pledge and ease of administration for both parties. 2. Closed-End Pledge: In contrast to an open-end pledge, a closed-end pledge is a one-time arrangement wherein the pledge pledges a fixed number of shares of stock. No additional shares can be added to the pledge after it is created. 3. Floating Lien Pledge: This type of pledge is designed to secure all shares of stock that the pledge currently owns or may acquire in the future. The specific shares that are pledged may change over time, but the overall quantity of shares remains constant. 4. Specific Lien Pledge: A specific lien pledge is created when the pledge explicitly designates certain shares of stock to be pledged as collateral. The pledge retains ownership of any unfledged shares. 5. Non-possessory Pledge: This type of pledge allows the pledge to retain physical possession of the share certificates, while granting the lender a security interest in the stock. This arrangement may provide convenience to the pledge as they can freely trade or transfer the shares, as long as the lender's security interest is satisfied. It is important to note that the District of Columbia Pledge of Shares of Stock must comply with applicable laws and regulations governing security interests and financing transactions within the District. Legal advice should be sought to ensure compliance and protect the interests of both parties involved in the pledge agreement.

District of Columbia Pledge of Shares of Stock

Description

How to fill out District Of Columbia Pledge Of Shares Of Stock?

You can spend several hours online attempting to locate the legal document template that satisfies the federal and state requirements you have. US Legal Forms provides thousands of legal forms that are vetted by experts.

It is easy to download or print the District of Columbia Pledge of Shares of Stock from the service.

If you already possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the District of Columbia Pledge of Shares of Stock. Each legal document template you download is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to the document if necessary. You can complete, modify, sign, and print the District of Columbia Pledge of Shares of Stock. Download and print thousands of document templates using the US Legal Forms Website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of any purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- Firstly, ensure that you have selected the correct document template for the region/city of your choice. Review the form details to make sure you have chosen the correct form.

- If available, use the Preview button to view the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that fulfills your requirements and specifications.

- Once you have located the template you need, click Buy now to proceed.

- Choose the pricing plan you want, enter your information, and create an account on US Legal Forms.

Form popularity

FAQ

The owners of a corporation are shareholders (also known as stockholders) who obtain interest in the business by purchasing shares of stock. Shareholders elect a board of directors, who are responsible for managing the corporation.

Section 3.02 of the Revised Model Business Corporation Act (RMBCA) sets out a number of express powersPowers granted to a corporation through statute and its articles of incorporation., including the following: to sue and be sued in the corporate name; to purchase, use, and sell land and dispose of assets to the same

What must be included in articles of incorporation?the corporation's name and business address.the number of authorized shares and the par value (if any) of the shares.the name and address of the in-state registered agent.the names and addresses of its incorporators.

A corporation consists of shareholders, a board of directors, and officers.

The Articles of Incorporation are a legal document submitted to the Provincial, Territorial or Federal Government within Canada which establishes a business within Canada. This formation of a business structure is a separate entity from the individuals who own the business.

Corporations acquire their capital by issuing shares of stock; these are the units into which corporations divide their ownership. Investors buy shares of stock in a corporation for two basic reasons.

There are three primary methods of dividing a corporation tax-free: (1) spin-off, (2) split-off, and (3) split-up.

A Stock Pledge is the transfer of stocks against a debt. It is an agreement. The debtor pledges the stocks as an asset against the amount of money taken from a lender and promises to return the amount. The debtor pledges the stocks as a security against the debt.

Explanation: Articles of incorporation must contain (1) the name of the corporation, (2) the number of authorized shares, (3) the address of the initial registered office of the corporation, (4) the name of its first registered agent at that address, and (5) the names and addresses of the incorporators.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Interesting Questions

More info

Wannabe Investors How to pledge Shares to Investors and Pledging Stocks Related Resources About Pledging Shares Financial Advisors Related Topics Finance Investors Pledging Shares Investment Options.