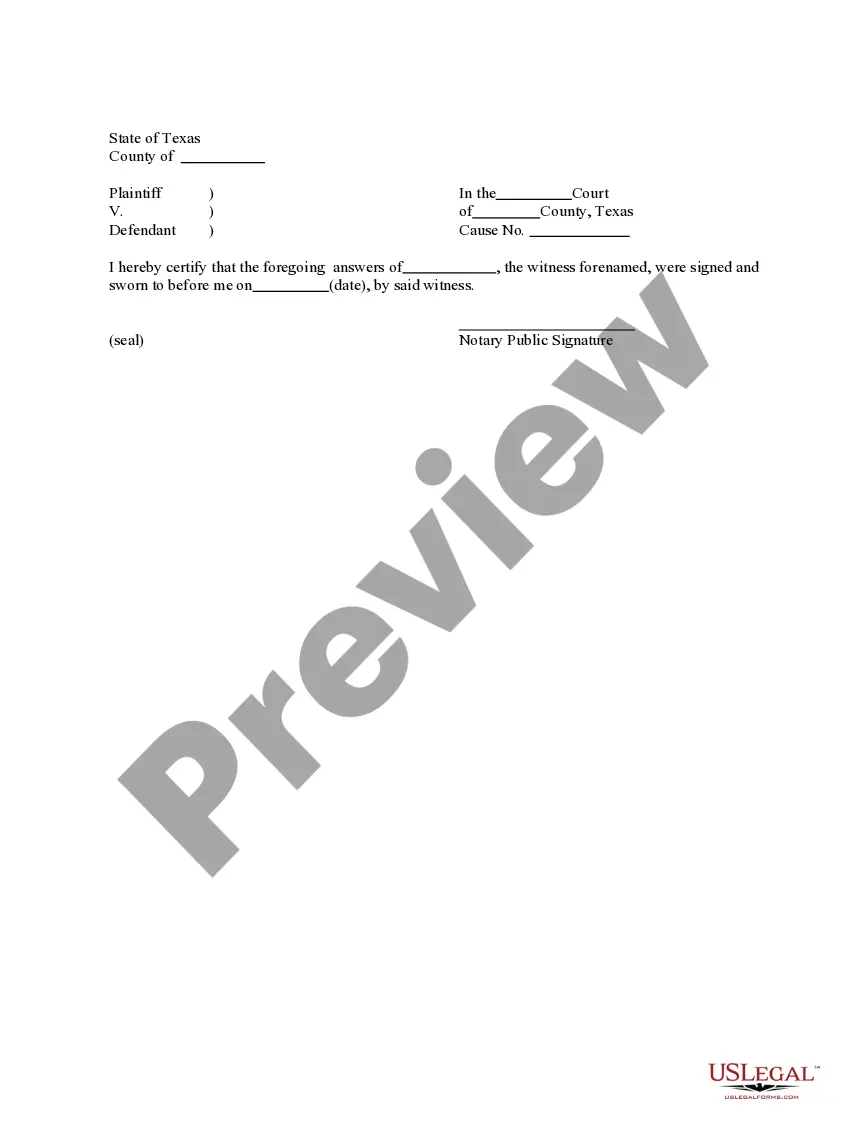

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The District of Columbia Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document used in the District of Columbia to facilitate the transfer of ownership of personal property and assume any outstanding debt associated with it. This document provides clarity and protection for both the buyer and the seller involved in the transaction. Keywords: District of Columbia, Bill of Sale, Assumption of Debt, Personal Property, Purchased, Ownership, Transfer, Legal Document, Debt, Buyer, Seller, Transaction. There are different types of District of Columbia Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. Some common types include: 1. General Bill of Sale and Assumption of Debt: This type of bill of sale is used when there is a transfer of ownership for various personal property items, along with the agreement to assume any related debts. It can cover a wide range of personal property, including vehicles, furniture, electronics, and more. 2. Vehicle Bill of Sale and Assumption of Debt: This specific type of bill of sale is used when transferring ownership of a motor vehicle, such as a car, motorcycle, or boat, in the District of Columbia. It includes provisions for assuming any outstanding debt secured by the vehicle, such as auto loans or liens. 3. Real Estate Bill of Sale and Assumption of Debt: Although not technically classified as personal property, this type of bill of sale and assumption of debt is used in real estate transactions within the District of Columbia. It involves the transfer of ownership of real property along with the assumption of any associated debts, such as mortgages or outstanding liens. 4. Business Assets Bill of Sale and Assumption of Debt: This type of bill of sale is used when buying or selling business assets in the District of Columbia. It covers the transfer of ownership of specific personal property items and the assumption of any debts linked to those assets, like business loans or outstanding financial obligations. It is essential to consult an attorney or legal professional to ensure the correct type of District of Columbia Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is used for a specific transaction, as each scenario may have unique requirements and considerations.The District of Columbia Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document used in the District of Columbia to facilitate the transfer of ownership of personal property and assume any outstanding debt associated with it. This document provides clarity and protection for both the buyer and the seller involved in the transaction. Keywords: District of Columbia, Bill of Sale, Assumption of Debt, Personal Property, Purchased, Ownership, Transfer, Legal Document, Debt, Buyer, Seller, Transaction. There are different types of District of Columbia Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. Some common types include: 1. General Bill of Sale and Assumption of Debt: This type of bill of sale is used when there is a transfer of ownership for various personal property items, along with the agreement to assume any related debts. It can cover a wide range of personal property, including vehicles, furniture, electronics, and more. 2. Vehicle Bill of Sale and Assumption of Debt: This specific type of bill of sale is used when transferring ownership of a motor vehicle, such as a car, motorcycle, or boat, in the District of Columbia. It includes provisions for assuming any outstanding debt secured by the vehicle, such as auto loans or liens. 3. Real Estate Bill of Sale and Assumption of Debt: Although not technically classified as personal property, this type of bill of sale and assumption of debt is used in real estate transactions within the District of Columbia. It involves the transfer of ownership of real property along with the assumption of any associated debts, such as mortgages or outstanding liens. 4. Business Assets Bill of Sale and Assumption of Debt: This type of bill of sale is used when buying or selling business assets in the District of Columbia. It covers the transfer of ownership of specific personal property items and the assumption of any debts linked to those assets, like business loans or outstanding financial obligations. It is essential to consult an attorney or legal professional to ensure the correct type of District of Columbia Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is used for a specific transaction, as each scenario may have unique requirements and considerations.