District of Columbia Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

Discovering the right legitimate file web template can be quite a struggle. Obviously, there are plenty of web templates available on the net, but how can you obtain the legitimate form you will need? Take advantage of the US Legal Forms internet site. The service delivers a large number of web templates, like the District of Columbia Line of Credit Promissory Note, that can be used for company and personal needs. Each of the types are checked out by professionals and fulfill federal and state specifications.

In case you are presently registered, log in to your accounts and click on the Download option to get the District of Columbia Line of Credit Promissory Note. Make use of your accounts to look through the legitimate types you possess bought formerly. Check out the My Forms tab of your accounts and have another backup in the file you will need.

In case you are a whole new consumer of US Legal Forms, listed below are basic directions so that you can follow:

- Initially, ensure you have selected the proper form for your city/state. You can look through the shape utilizing the Review option and look at the shape explanation to guarantee this is basically the right one for you.

- If the form will not fulfill your preferences, make use of the Seach discipline to discover the proper form.

- When you are sure that the shape is acceptable, select the Get now option to get the form.

- Opt for the rates program you desire and enter in the needed details. Design your accounts and pay for the transaction utilizing your PayPal accounts or credit card.

- Pick the document structure and acquire the legitimate file web template to your system.

- Full, change and printing and signal the received District of Columbia Line of Credit Promissory Note.

US Legal Forms is the largest local library of legitimate types for which you can discover different file web templates. Take advantage of the company to acquire professionally-made paperwork that follow express specifications.

Form popularity

FAQ

§ 28?3302. (b) Interest, when authorized by law, on judgments or decrees against the District of Columbia, or its officers, or its employees acting within the scope of their employment, is at the rate of not exceeding 4% per annum.

If a mortgage loan application is approved and executed without the information in sections 1116.1 and 1116.2, the mortgage loan application shall be voidable by the borrower(s) prior to the loan closing and any fees submitted by the borrower(s) in connection with the application shall be returned to the borrower(s) in ...

As one of the final forms you receive before you close on your new loan, the Closing Disclosure allows you to compare your loan terms and costs to the terms listed in the Loan Estimate form you were given at the beginning of the process.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

Does a closing disclosure mean your loan is approved? No, a closing disclosure does not always mean your loan is approved. You may find incorrect information or something you want to change. Your lender also has the opportunity to back out if they find something new that makes them change their mind.

Rule #5 - In order to pay off the debt, or what is called "discharging the debt"; all one has to do is write/ (or create) your own certified promissory note (a negotiable instrument under Uniform Commercial Code (UCC) Section 3- 104 paragraph (e)), with your signature on the promissory note in the amount of the ...

Required loan disclosures. (a)(1) A licensee who offers to make or procure a loan secured by a first or subordinate mortgage or deed of trust on a single to 4-family home shall provide the borrower with a financing agreement executed by the lender.

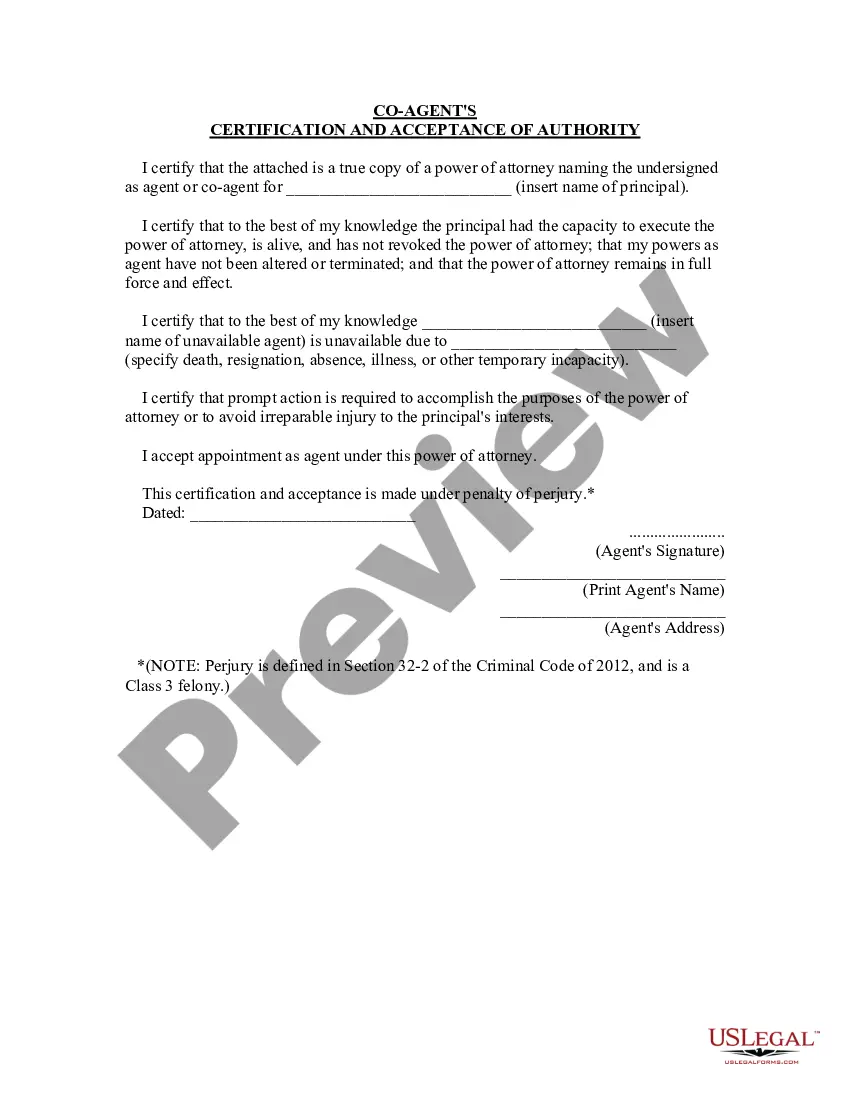

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.