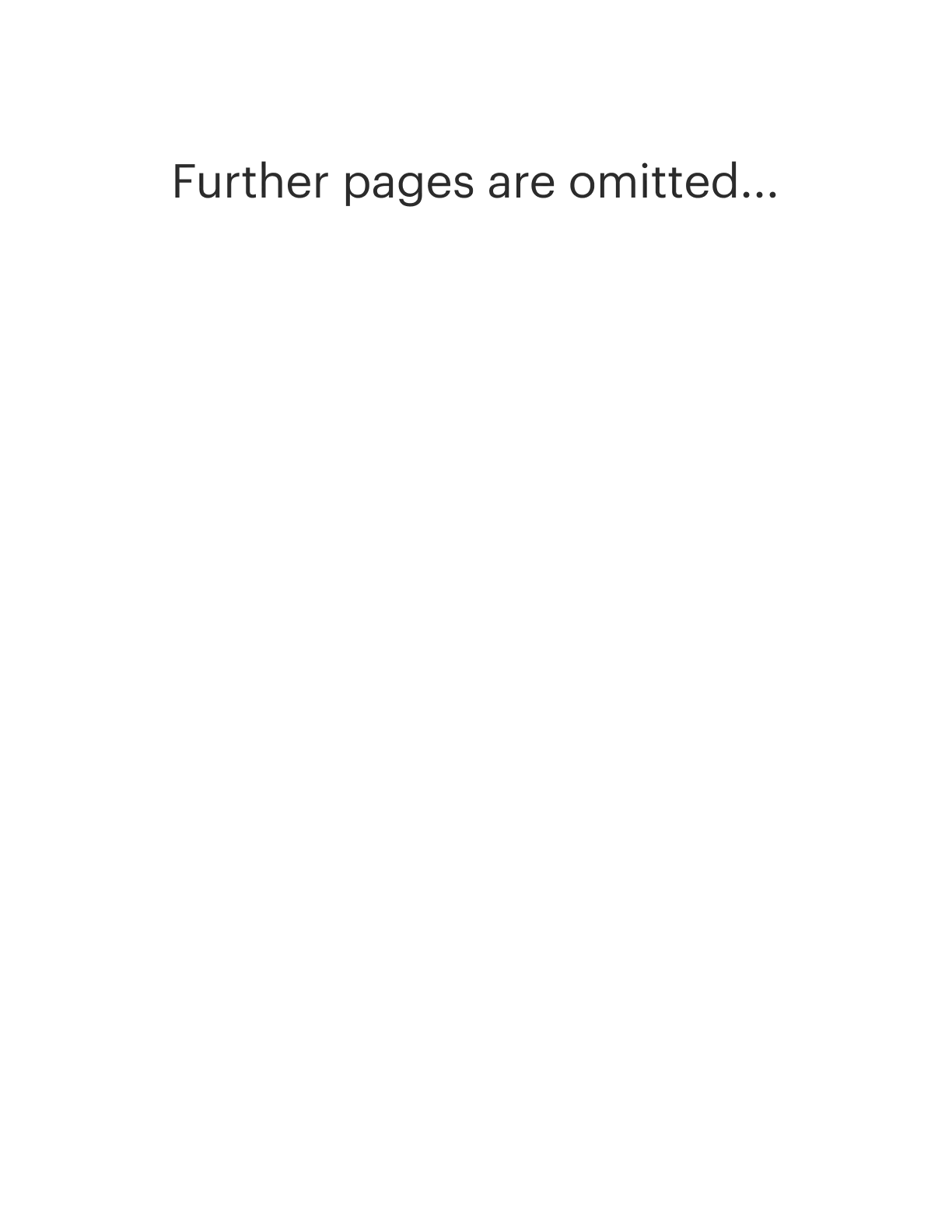

District of Columbia Irrevocable Letter of Credit

Description

How to fill out Irrevocable Letter Of Credit?

Are you currently in the place where you will need documents for either company or specific functions nearly every working day? There are a variety of legal file layouts accessible on the Internet, but getting kinds you can rely isn`t effortless. US Legal Forms delivers thousands of kind layouts, like the District of Columbia Irrevocable Letter of Credit, that happen to be written to fulfill state and federal specifications.

In case you are presently informed about US Legal Forms web site and have an account, just log in. Next, you can acquire the District of Columbia Irrevocable Letter of Credit web template.

Unless you provide an accounts and wish to start using US Legal Forms, adopt these measures:

- Find the kind you need and make sure it is for that right area/area.

- Make use of the Review switch to review the shape.

- Browse the explanation to actually have selected the appropriate kind.

- If the kind isn`t what you are searching for, utilize the Look for discipline to find the kind that meets your needs and specifications.

- Once you discover the right kind, simply click Acquire now.

- Select the rates program you want, submit the specified info to produce your account, and purchase the transaction with your PayPal or charge card.

- Pick a hassle-free file format and acquire your duplicate.

Get each of the file layouts you have purchased in the My Forms food list. You can obtain a additional duplicate of District of Columbia Irrevocable Letter of Credit whenever, if necessary. Just go through the essential kind to acquire or printing the file web template.

Use US Legal Forms, one of the most considerable assortment of legal forms, in order to save time as well as stay away from mistakes. The support delivers professionally made legal file layouts which you can use for an array of functions. Produce an account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

An irrevocable letter of credit must be obtained through the bank. You should not try to craft a letter or adapt somebody else's letter of credit. Doing so can put you at risk of an expensive legal battle, potentially overseas.

A generic ILOC is usually priced in the range of 1-2% of the amount covered in the contract. The cost depends on the type of ILOC used, customer credit history, tenure, safeguarding clauses, and various other factors.

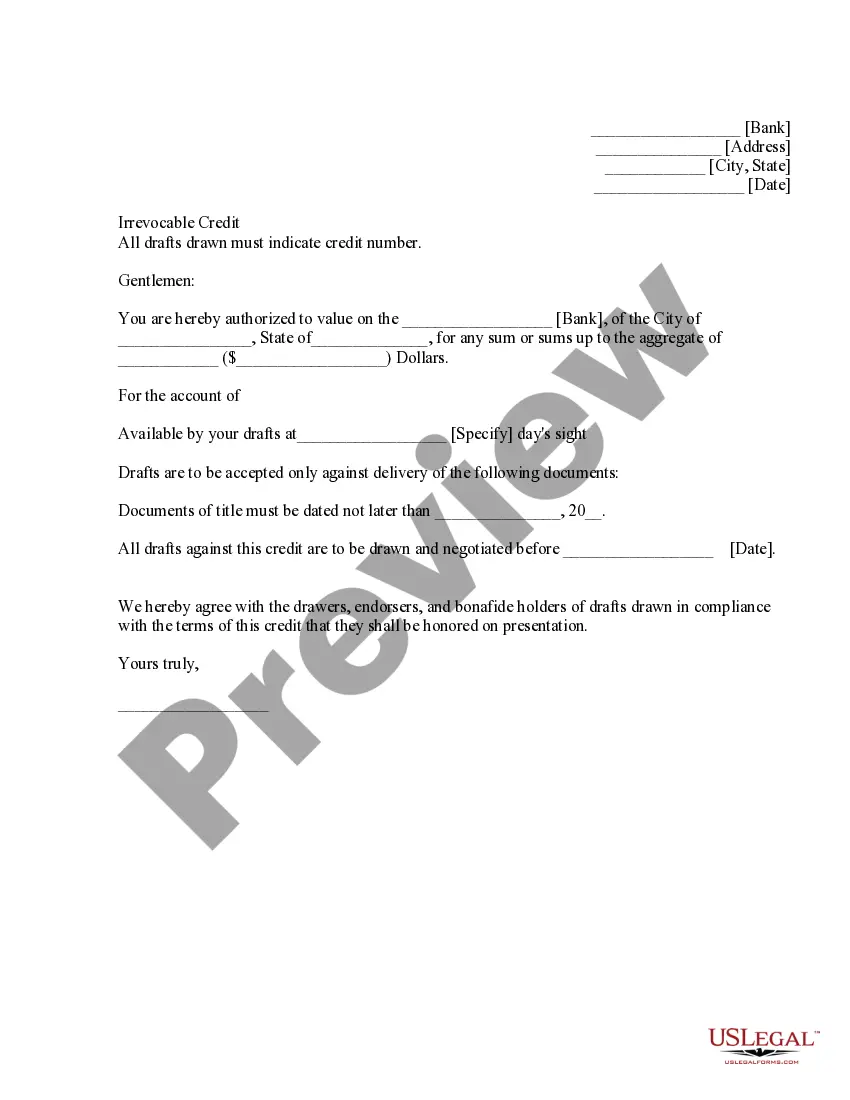

Common types of letters of credit A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

A confirmed ILOC offers additional risk protection for the seller by providing a guarantee of payment from both the buyer's bank and the seller's bank. A buyer benefits from an ILOC as it enhances the creditworthiness of their position by leveraging the creditworthiness of the institution.

An irrevocable letter of credit is a guarantee from a bank, issued in the form of a letter. It creates an agreement where the buyer's bank agrees to pay the seller as soon as certain conditions of the transaction are met.

An irrevocable letter of credit must be obtained through the bank. You should not try to craft a letter or adapt somebody else's letter of credit. Doing so can put you at risk of an expensive legal battle, potentially overseas.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.