Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

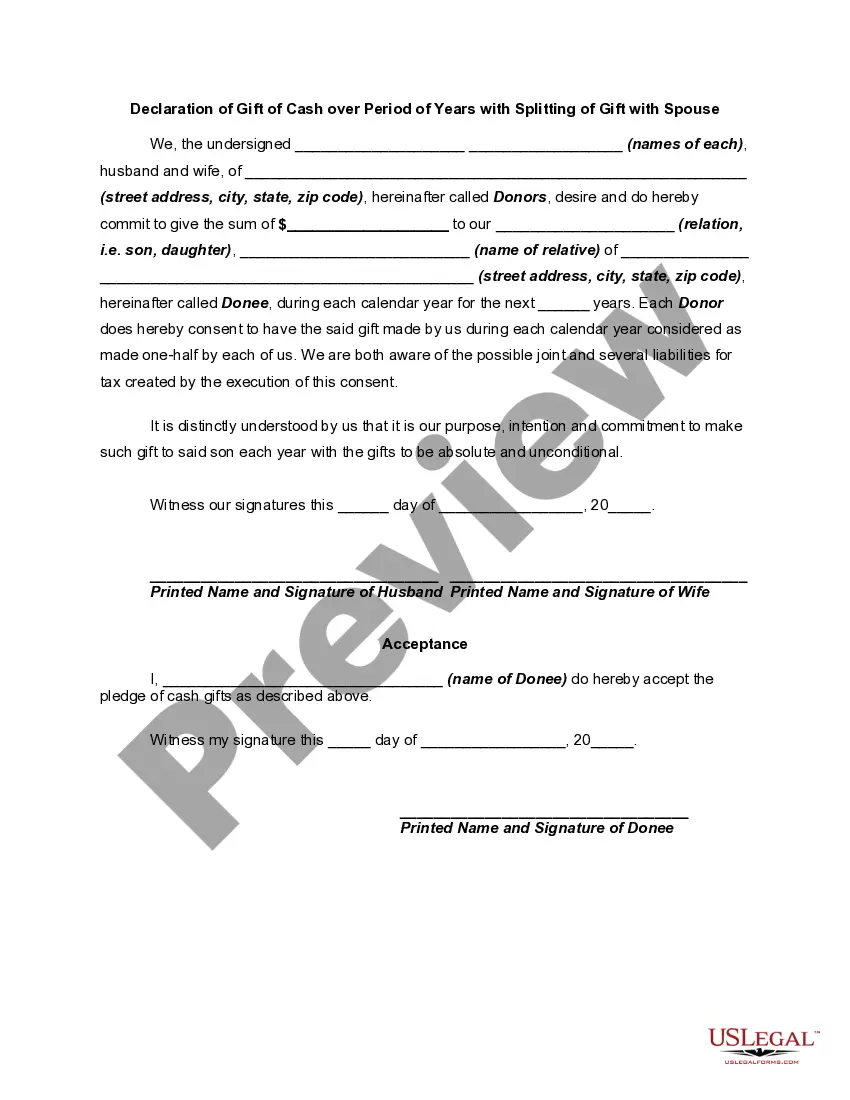

The District of Columbia Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals to make annual cash gifts over a designated period to another person, while also splitting the gift between the donor and their spouse for tax purposes. This declaration is commonly used for estate planning and tax optimization strategies in the District of Columbia. One of the main purposes of this declaration is to take advantage of the annual gift tax exclusion provided by the Internal Revenue Service (IRS). By making cash gifts within the annual exclusion limit, individuals can reduce the size of their taxable estate, while also transferring wealth to their desired recipients. The current annual exclusion amount in 2021 is $15,000 per person, which means that each individual can gift up to $15,000 per year to another person without incurring any gift tax. The declaration allows donors to specify the period over which they wish to make the cash gifts, typically spanning multiple years. This option is beneficial for individuals who want to spread out their gift transfers and manage their tax liability effectively. For example, if someone intends to gift a total of $150,000 over a ten-year period, they can make annual gifts of $15,000 to their chosen recipient, ensuring they stay within the annual exclusion limit. Additionally, this type of declaration permits the splitting of the gift with the donor's spouse. Through gift splitting, married couples can combine their annual exclusion amounts and jointly gift larger amounts without incurring any gift tax. For instance, if a couple decides to split a $30,000 gift, each individual would be considered as making a $15,000 gift, effectively utilizing both of their annual exclusions. By utilizing the District of Columbia Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse, individuals can achieve their estate planning goals, reduce their taxable estate, and retain financial control while transferring wealth to their loved ones. Estate tax laws and regulations can vary between jurisdictions, so it is essential to consult with a qualified estate planning attorney or financial advisor to understand the specific requirements and benefits of District of Columbia laws regarding gifts and estate planning. Key terms: District of Columbia, declaration of gift of cash, period of years, splitting of gift, spouse, estate planning, tax optimization, gift tax exclusion, taxable estate, annual exclusion amount, Internal Revenue Service, gift transfers, tax liability, spreading out gifts, gift splitting, married couples, gift tax, estate tax laws, estate planning attorney, financial advisor.The District of Columbia Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that allows individuals to make annual cash gifts over a designated period to another person, while also splitting the gift between the donor and their spouse for tax purposes. This declaration is commonly used for estate planning and tax optimization strategies in the District of Columbia. One of the main purposes of this declaration is to take advantage of the annual gift tax exclusion provided by the Internal Revenue Service (IRS). By making cash gifts within the annual exclusion limit, individuals can reduce the size of their taxable estate, while also transferring wealth to their desired recipients. The current annual exclusion amount in 2021 is $15,000 per person, which means that each individual can gift up to $15,000 per year to another person without incurring any gift tax. The declaration allows donors to specify the period over which they wish to make the cash gifts, typically spanning multiple years. This option is beneficial for individuals who want to spread out their gift transfers and manage their tax liability effectively. For example, if someone intends to gift a total of $150,000 over a ten-year period, they can make annual gifts of $15,000 to their chosen recipient, ensuring they stay within the annual exclusion limit. Additionally, this type of declaration permits the splitting of the gift with the donor's spouse. Through gift splitting, married couples can combine their annual exclusion amounts and jointly gift larger amounts without incurring any gift tax. For instance, if a couple decides to split a $30,000 gift, each individual would be considered as making a $15,000 gift, effectively utilizing both of their annual exclusions. By utilizing the District of Columbia Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse, individuals can achieve their estate planning goals, reduce their taxable estate, and retain financial control while transferring wealth to their loved ones. Estate tax laws and regulations can vary between jurisdictions, so it is essential to consult with a qualified estate planning attorney or financial advisor to understand the specific requirements and benefits of District of Columbia laws regarding gifts and estate planning. Key terms: District of Columbia, declaration of gift of cash, period of years, splitting of gift, spouse, estate planning, tax optimization, gift tax exclusion, taxable estate, annual exclusion amount, Internal Revenue Service, gift transfers, tax liability, spreading out gifts, gift splitting, married couples, gift tax, estate tax laws, estate planning attorney, financial advisor.