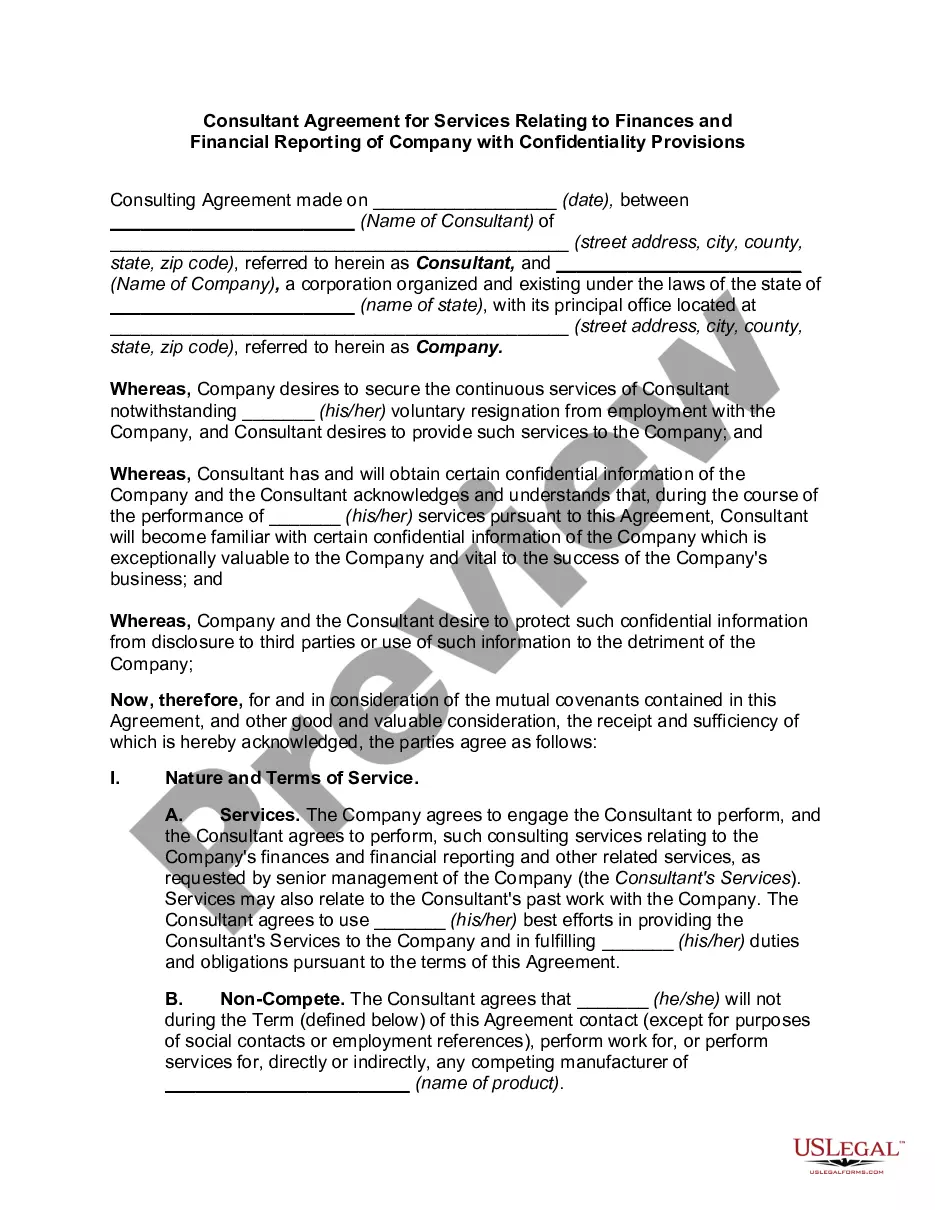

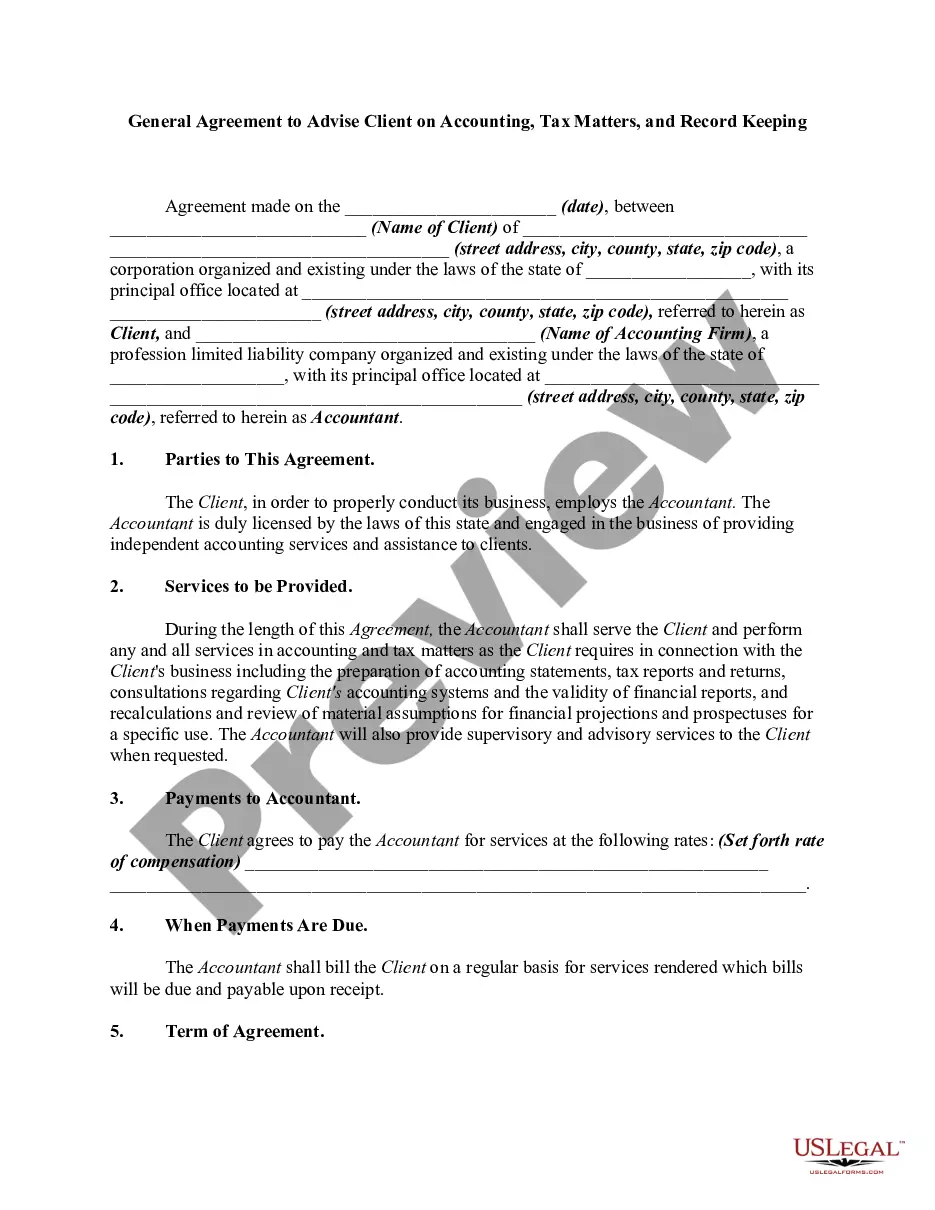

Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

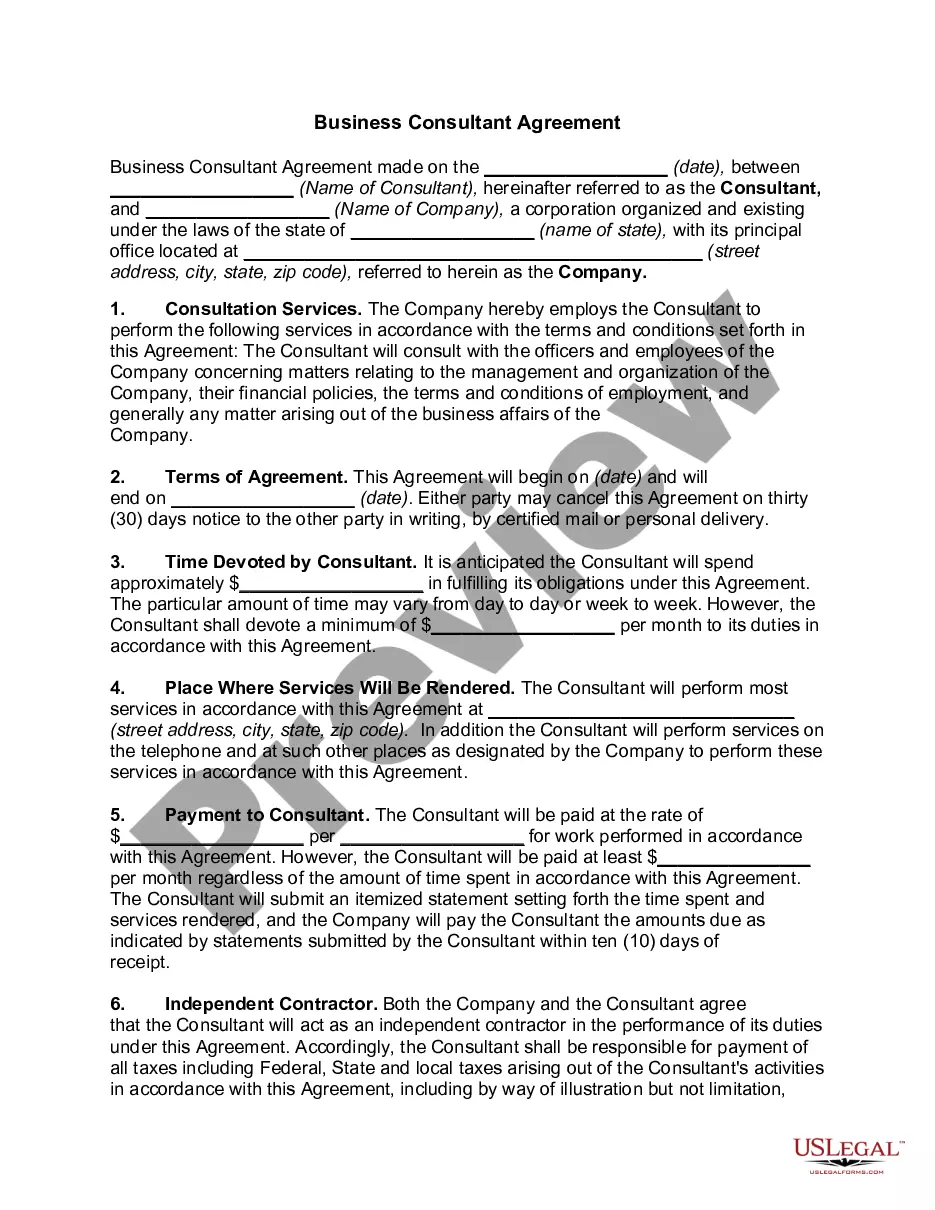

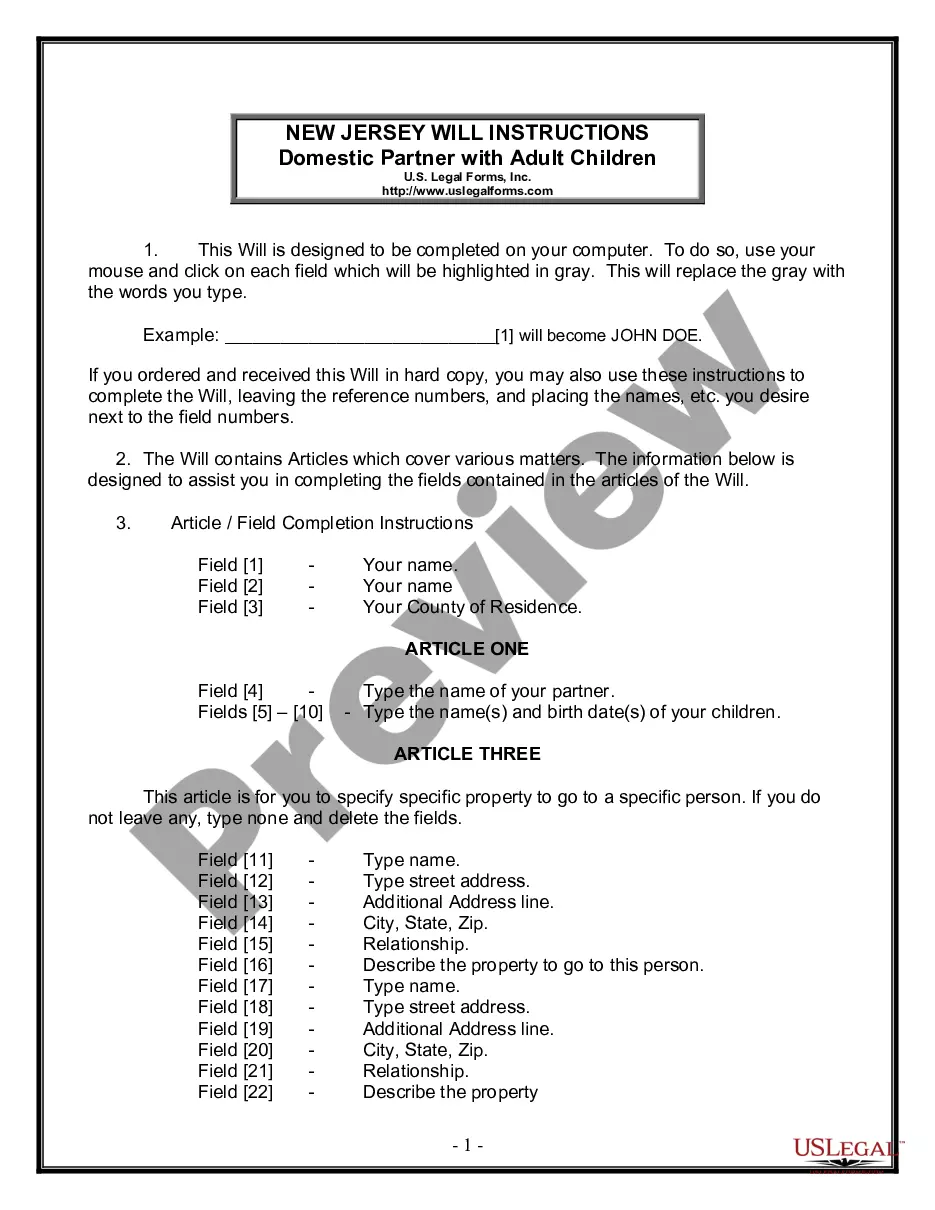

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers an extensive selection of legal template files that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the District of Columbia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping in seconds.

If you have an account, Log In and download the District of Columbia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit the form as needed. Fill it out, edit, print, and sign the saved District of Columbia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. Each form you add to your account does not have an expiration date and is yours to keep indefinitely. Thus, if you want to download or print another copy, just visit the My documents section and click on the form you need.

- Check that you have selected the correct form for your city/county.

- Click on the Preview button to review the content of the form.

- Review the form description to ensure that you have selected the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

A DC 30 form is an essential tax document for corporations in Washington, D.C. It serves to report income and determine tax liabilities for the business entity. Completing this form accurately is crucial to ensure compliance with local tax laws. If you're unsure about the specifics of the DC 30, the US Legal Forms platform can provide you with the information and support you need.

Every corporation and business entity operating in the District must file a DC franchise tax return. This requirement includes both profit and non-profit organizations. Filings should reflect accurate financial information to ensure compliance with local regulations. If you need help with understanding the filing requirements, consider using the comprehensive resources on US Legal Forms.

Entities such as certain non-profit organizations may not be subject to franchise tax in the District of Columbia. Additionally, specific charitable organizations have exemptions based on their status. Understanding these nuances helps you avoid unnecessary tax liabilities. To learn more about your specific situation, consulting resources available on US Legal Forms can be beneficial.

The DC 30 filing requirement pertains to the annual tax reporting obligations of corporations in the District of Columbia. This filing indicates your corporation's financial performance and ensures compliance with local tax laws. Meeting this requirement is essential, as failing to do so could result in penalties or negative repercussions. If you seek clarity on the filing process, resources like US Legal Forms can help simplify it.

The DC FR-500 form is required for businesses that exceed a certain income level. This includes corporations, partnerships, and limited liability companies that have business income and do not fall under exemptions. Ensuring compliance with this requirement protects your business's legal standing. For help with navigating these specifics, consider exploring resources on US Legal Forms.

Generally, any individual or business entity that earns income in the District of Columbia must file a DC tax return. This obligation applies whether you operate as a sole proprietor, corporation, or other business type. Filing ensures you meet local tax laws and avoids potential penalties. If you find this process overwhelming, the US Legal forms platform can guide you through the requirements.

If you are a corporation or a unincorporated business operating in the District of Columbia, you must file DC form D-30. This filing is essential if your business conducts activities that generate income. Additionally, any partnership or limited liability company should also meet this requirement. Understanding these duties is critical for compliance and financial health.