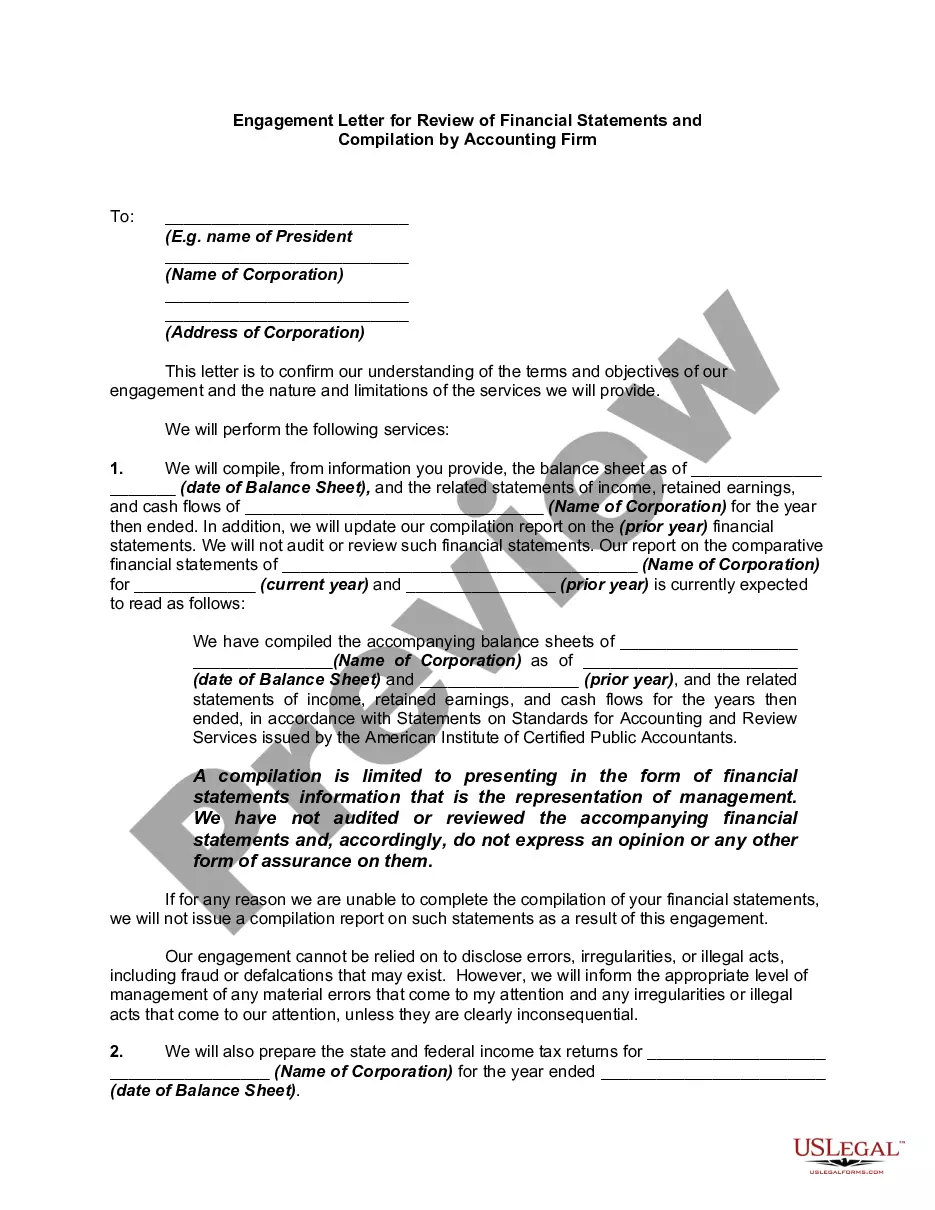

In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm

Description

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

If you wish to finish, download, or print legal document templates, utilize US Legal Forms, the top choice of legal forms, available online.

Employ the site’s straightforward and user-friendly search function to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Select your preferred payment plan and input your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to swiftly locate the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm.

- If you are already a US Legal Forms customer, sign in to your account and select the Download option to retrieve the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm.

- You can also access forms you previously submitted electronically from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative templates in the legal document collection.

Form popularity

FAQ

You can see the financial statements of a company on its official website, specifically in the investor relations section where annual reports are provided. Regulatory filings, such as those featured in the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm, are also accessible through the SEC website. These documents provide valuable insights into a company's financial trajectory.

To find financial statements of US companies, start by exploring resources like the SEC’s EDGAR database or the companies’ official websites. These platforms frequently upload required reports, including the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm, that give a comprehensive overview of financial performance. You may also consider third-party financial analysis tools for additional insights.

Companies often publish their financial statements in the investor section of their websites or through financial services like EDGAR. Additionally, you might find the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm beneficial for in-depth analysis. These resources are essential for investors seeking to make informed decisions.

You can access financial statements of a company through various online platforms, including official corporate websites and financial news websites. Many companies publish their annual reports, which include detailed financial statements. Furthermore, the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm can provide critical insights into specific financial metrics.

This review process involves evaluating financial records and statements to confirm their accuracy and completeness. An accounting firm conducts this review to verify that the financial data aligns with the principles of sound accounting and reporting. Understanding this can help you appreciate the value of the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm.

You can usually find a company’s audited financial statements on its official website, particularly in the investor relations section. Additionally, financial documents, including the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm, can often be accessed through regulatory bodies like the SEC. These sources typically provide the most reliable and up-to-date information on a company's financials.

To check a company’s financials, you can access various public records and third-party financial reporting services. These records may feature the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm which provides insights into a company's financial health. Always consider looking into the firm's official website or financial databases to obtain the latest data.

A review of financial statements is an analytical process that helps determine the accuracy and completeness of financial data. It goes beyond basic bookkeeping, as accounting firms assess the statements to ensure they conform to generally accepted accounting principles. This process supports transparency and can be crucial for stakeholders when evaluating the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm.

There are generally two main types of reviews: a compilation and a full review. A compilation involves organizing data without expressing an opinion, while a full review offers an assurance level on the financial statements. Understanding these distinctions is important when dealing with the District of Columbia Report from Review of Financial Statements and Compilation by Accounting Firm. Utilizing services like uslegalforms can simplify the selection of the appropriate review type for your needs.

To check financial statements of a company, you should start by reviewing their public filings, which often include audited financial statements. Furthermore, accessing databases or platforms that offer financial reports can provide detailed insights. Additionally, consider consulting with accounting firms that specialize in District of Columbia reports to analyze these statements comprehensively.