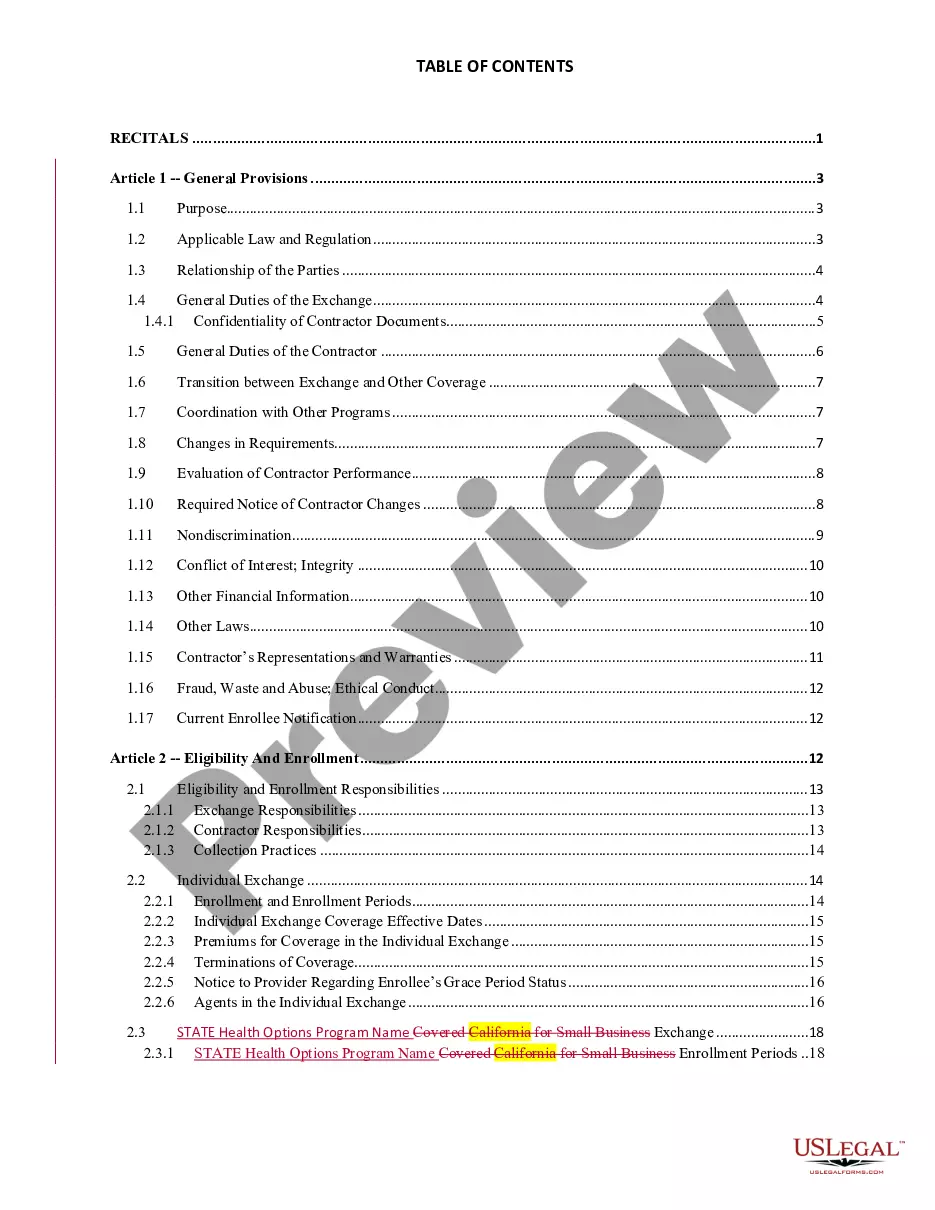

The District of Columbia Comprehensive Commercial Deed of Trust and Security Agreement is a legal document that serves as a binding contract between parties involved in commercial real estate transactions within the District of Columbia. This agreement outlines the terms and conditions of the deed of trust, which is a legal instrument that secures the repayment of a commercial loan or mortgage. In the District of Columbia, there are different types of Comprehensive Commercial Deed of Trust and Security Agreements, each catering to specific commercial real estate transactions. Some key variants of these agreements include: 1. Purchase Money Deed of Trust: This type of agreement is commonly used when a buyer purchases a commercial property with the assistance of a loan or mortgage. The agreement specifies the terms of the loan, including the interest rate, repayment schedule, and consequences of default. 2. Construction Deed of Trust: When a commercial property is being constructed or renovated, this agreement is used to secure the loan provided by a lender. It outlines the terms, disbursement schedule, and conditions necessary for the release of funds during the construction process. 3. Subordination Agreement: This agreement is entered into when an existing lien holder agrees to subordinate their claim to a new lender, granting the new lender priority in case of default. It is often used in situations where a property owner seeks additional financing. 4. Modification Agreement: If the terms of an existing Comprehensive Commercial Deed of Trust and Security Agreement need to be modified, this agreement is used to establish the revised terms between the borrower and lender. It may include changes to interest rates, payment schedules, or loan amounts. The District of Columbia Comprehensive Commercial Deed of Trust and Security Agreement is a crucial legal document for protecting the rights and interests of all parties involved in commercial real estate transactions. It ensures that lenders are secured in their loan or mortgage investments, while borrowers have clear guidelines for their repayment obligations.

Security Agreement From

Description

How to fill out District Of Columbia Comprehensive Commercial Deed Of Trust And Security Agreement?

US Legal Forms - one of the most significant libraries of legal types in the USA - provides a wide array of legal file templates you are able to acquire or produce. While using site, you can find 1000s of types for enterprise and specific purposes, categorized by groups, says, or keywords.You can find the most recent types of types like the District of Columbia Comprehensive Commercial Deed of Trust and Security Agreement in seconds.

If you already possess a monthly subscription, log in and acquire District of Columbia Comprehensive Commercial Deed of Trust and Security Agreement from your US Legal Forms library. The Download option can look on each develop you perspective. You have access to all previously delivered electronically types from the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, allow me to share straightforward recommendations to help you started:

- Make sure you have picked out the best develop for the area/county. Go through the Preview option to examine the form`s information. Browse the develop outline to actually have chosen the right develop.

- In the event the develop doesn`t match your needs, make use of the Lookup industry towards the top of the screen to obtain the the one that does.

- If you are pleased with the form, verify your option by visiting the Buy now option. Then, pick the costs program you like and supply your accreditations to sign up on an bank account.

- Procedure the financial transaction. Make use of Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Choose the structure and acquire the form on your own product.

- Make alterations. Fill out, revise and produce and sign the delivered electronically District of Columbia Comprehensive Commercial Deed of Trust and Security Agreement.

Each design you included with your money lacks an expiry date and is also yours forever. So, in order to acquire or produce one more version, just visit the My Forms segment and click about the develop you require.

Obtain access to the District of Columbia Comprehensive Commercial Deed of Trust and Security Agreement with US Legal Forms, probably the most substantial library of legal file templates. Use 1000s of skilled and condition-specific templates that meet your company or specific demands and needs.

Form popularity

FAQ

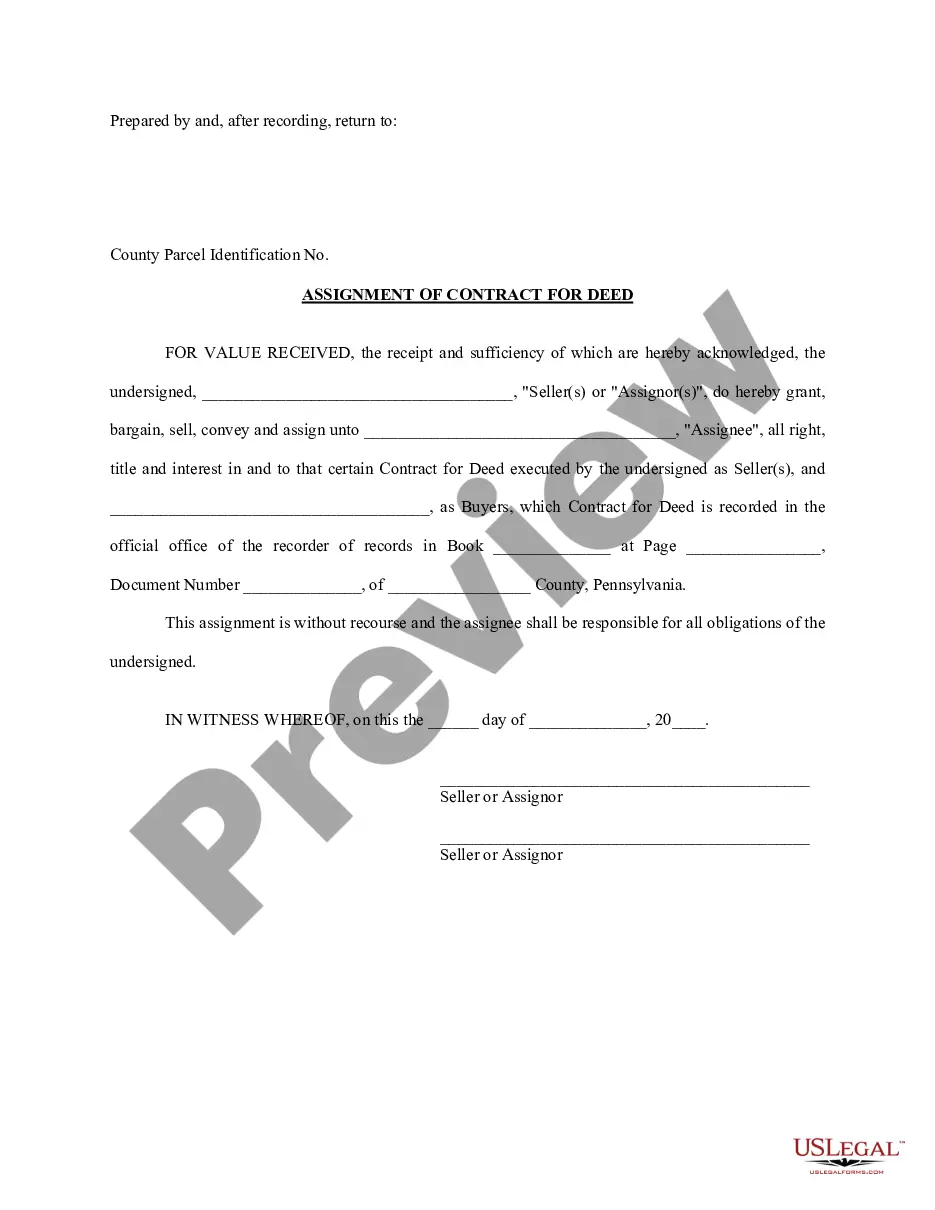

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A Security Deed can have many names. In some cases, it's known as a Deed to Secure Debt, Warranty Deed, or even a Loan Deed. It provides a full and direct legal title transfer from the borrower to the lender, leaving the equitable title with the borrower. The lender then provides the loan.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

A trust deed is a legal agreement between you and your creditors to pay back part of what you owe over a set period. This is usually four years, but may vary.

A Security Affidavit is required on all Residential Deeds of Trust and Modifications. All Judgments, Orders, etc. must be certified by the DC Superior Court. All notarized documents must include the notary seal (if applicable), signature, name and expiration date.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).