District of Columbia Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

If you wish to total, acquire, or print out legal papers themes, use US Legal Forms, the most important selection of legal forms, which can be found on-line. Use the site`s easy and handy look for to discover the papers you need. Various themes for organization and personal functions are sorted by classes and says, or search phrases. Use US Legal Forms to discover the District of Columbia Sample Letter to Include Article Relating to Tax Sales with a few mouse clicks.

Should you be currently a US Legal Forms buyer, log in to the bank account and click on the Obtain key to obtain the District of Columbia Sample Letter to Include Article Relating to Tax Sales. Also you can access forms you formerly saved from the My Forms tab of your bank account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

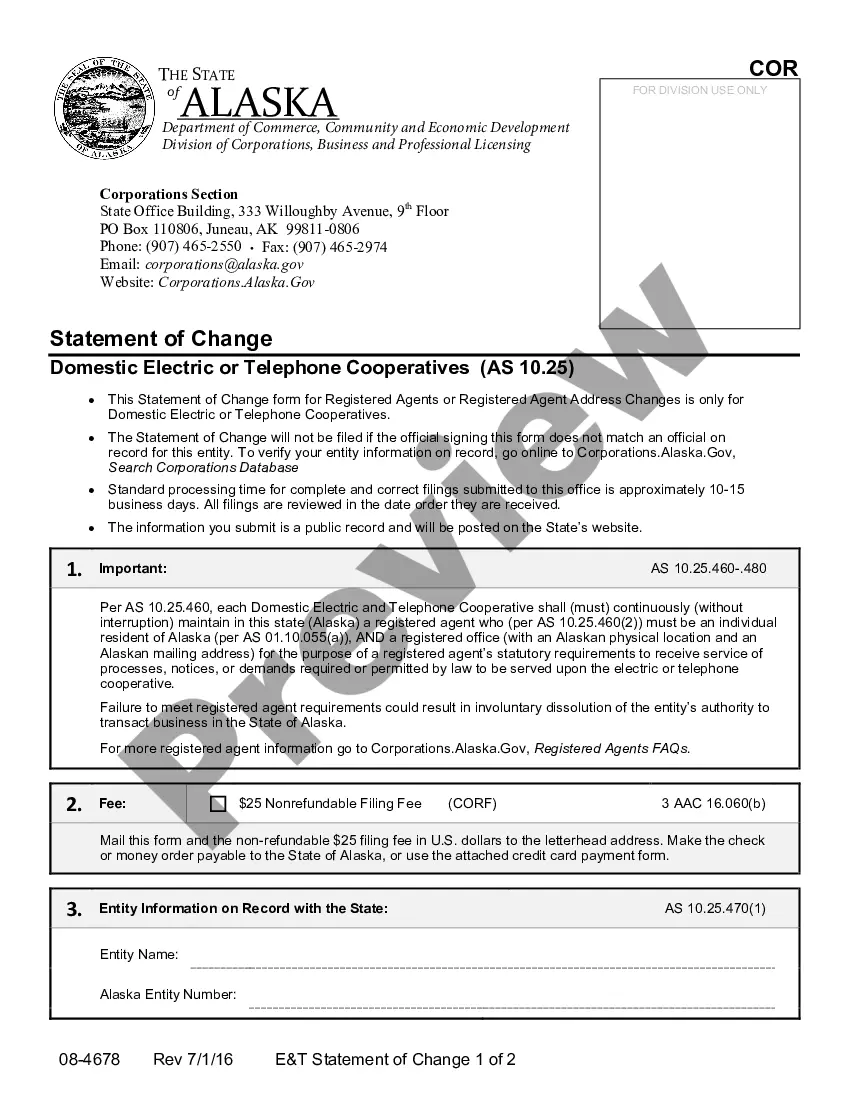

- Step 1. Be sure you have selected the shape for that proper town/land.

- Step 2. Take advantage of the Preview choice to look over the form`s information. Never neglect to read through the explanation.

- Step 3. Should you be not satisfied with the type, utilize the Research discipline towards the top of the display screen to get other models of the legal type template.

- Step 4. Once you have located the shape you need, go through the Purchase now key. Choose the rates strategy you favor and add your accreditations to register on an bank account.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the structure of the legal type and acquire it in your gadget.

- Step 7. Complete, modify and print out or indicator the District of Columbia Sample Letter to Include Article Relating to Tax Sales.

Each and every legal papers template you purchase is your own forever. You may have acces to every single type you saved within your acccount. Select the My Forms area and decide on a type to print out or acquire again.

Contend and acquire, and print out the District of Columbia Sample Letter to Include Article Relating to Tax Sales with US Legal Forms. There are thousands of expert and condition-particular forms you can utilize for the organization or personal demands.

Form popularity

FAQ

The D-30 form will print when gross income is more then $12,000. The D-65 will print when gross income is less than $12,000. There are print options for these forms located on D.C. interview form DC1.

The D-65 Partnership Return is considered to be an information return which means no remittance is due or should be tendered with the D-65 return, or form FR-165 extension request.

Learn How to Complete the FR-500 Business Registration Application. Taxpayers who wish to register a new business in the District of Columbia can conveniently complete the ?Register a New Business: Form FR-500? application online via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov.

The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident.?

Section 47-1801.04(17) of the DC Official Code describes a statutory resident as any individual who maintains a place of abode within the District for an aggregate of 183 days or more during the taxable year, whether or not such individual is domiciled in the District.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

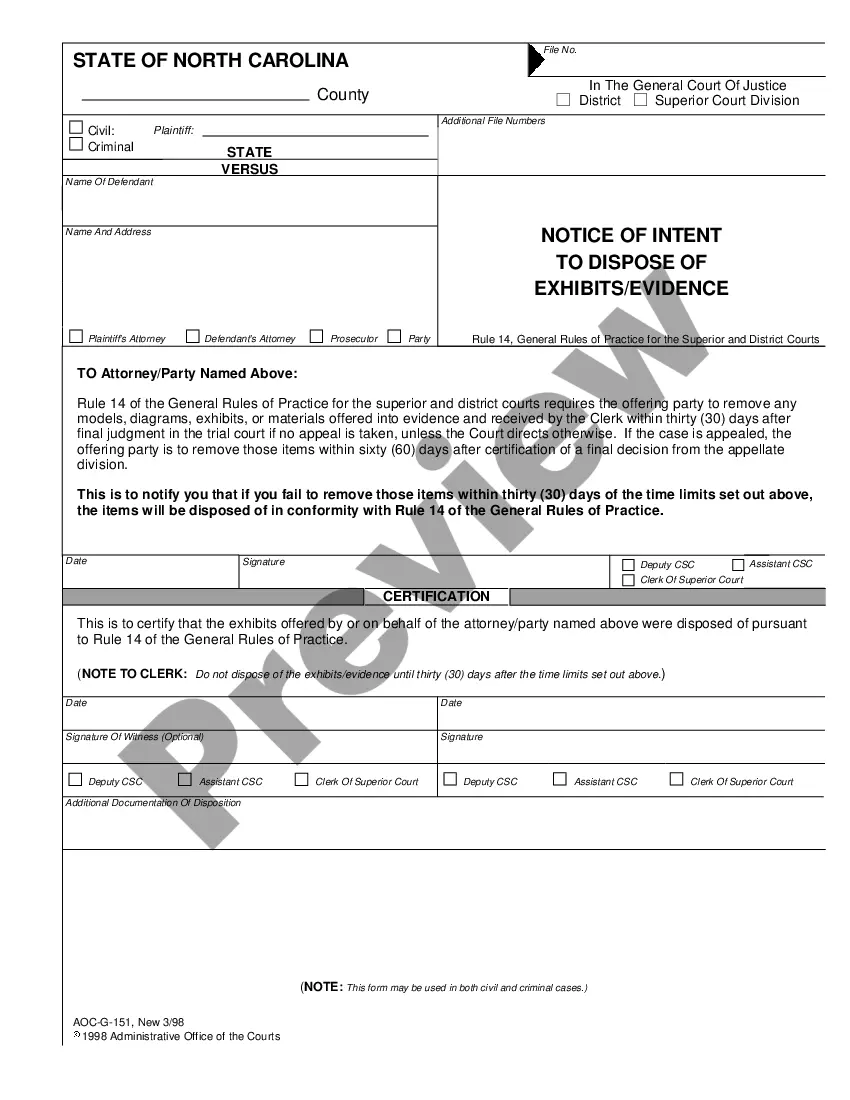

A tax certificate indicates whether real property taxes for a specific property are in arrears, as well as unpaid obligations for DC water and sewer charges, Clean City liabilities, Business Improvement District (BID) taxes, vault rents, and special assessment charges.

Who must file Form D-30? Generally, an unincorporated business, with gross income (Line 11) more than $12,000 must file a D 30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.