District of Columbia Simple Promissory Note for Personal Loan

Description

How to fill out Simple Promissory Note For Personal Loan?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a variety of legal document formats that you can download or print.

By utilizing the website, you will find numerous forms for business and individual purposes, categorized by types, states, or keywords. You can access the latest versions of forms such as the District of Columbia Simple Promissory Note for Personal Loan in seconds.

If you already have a subscription, Log In to retrieve the District of Columbia Simple Promissory Note for Personal Loan from the US Legal Forms library. The Download button will appear on each form you view. You can find all previously acquired forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the acquired District of Columbia Simple Promissory Note for Personal Loan. Each template added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the District of Columbia Simple Promissory Note for Personal Loan with US Legal Forms, the most extensive library of legal document templates. Utilize a wide range of professional and state-specific templates that cater to your business or personal needs and requirements.

- Make sure to select the correct form for your city/state.

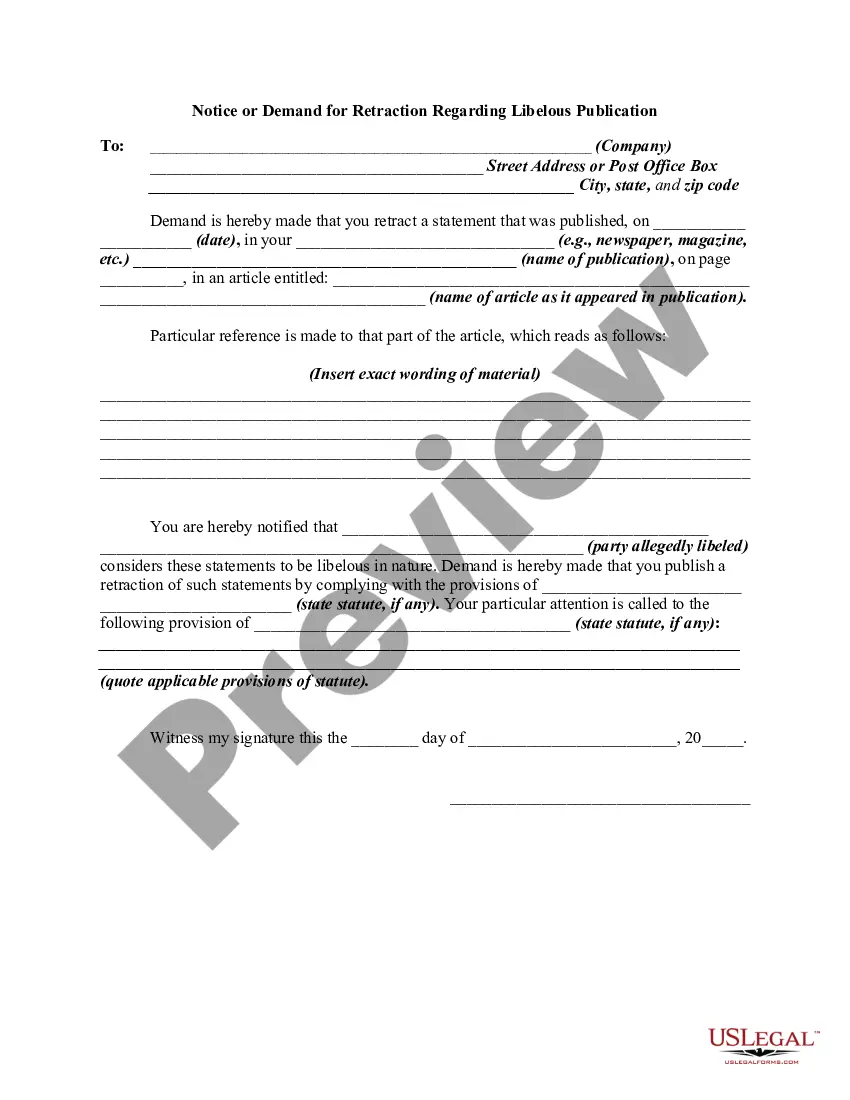

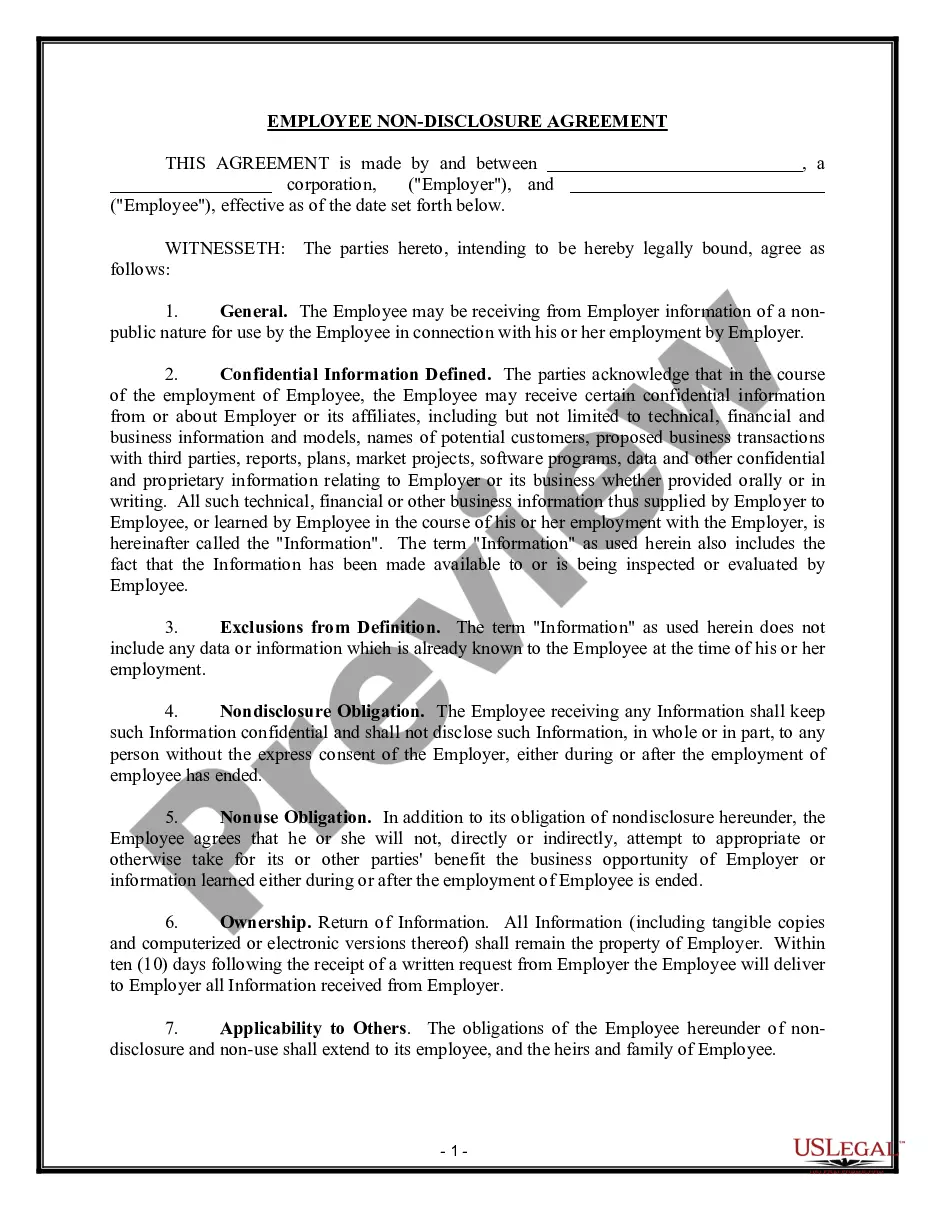

- Click on the Preview button to examine the form’s contents.

- Read the form description to confirm that you have selected the right template.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your decision by clicking the Buy now button.

- Next, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Yes, a handwritten promissory note can be legal in the District of Columbia, provided it contains all the necessary elements. A clear expression of the agreement, including the amount, terms, and signatures, is crucial. While a handwritten note is valid, using a template from a reliable platform like uslegalforms can help ensure you don’t miss any important details.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A Washington promissory note does not need to be notarized. To execute the note, the borrower should sign and date it. If there is a co-signer, the co-signer should also sign and date the document.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

Let's get straight into it! Banks are under no legal requirement to accept promissory notes. Remember that laws can fluctuate from state to state, so it's always best to check directly with your local bank or a legal professional in your region.