The District of Columbia Simple Promissory Note for Vehicle Purchase is a legal document that outlines the terms and conditions of a loan agreement between the buyer (borrower) and the seller (lender) for the purchase of a vehicle. This promissory note establishes the borrower's obligation to repay the borrowed amount by a specified date, along with any accrued interest and additional charges as agreed upon. Keywords: District of Columbia, Simple Promissory Note, Vehicle Purchase, loan agreement, terms and conditions, buyer, seller, borrower, lender, repayment, borrowed amount, specified date, interest, additional charges. There are no specific variations or types of District of Columbia Simple Promissory Note for Vehicle Purchase. However, it is important to note that promissory notes can be customized to suit the specific needs and preferences of the parties involved. The content and clauses within the promissory note may vary depending on the agreed-upon terms, loan amount, interest rate, repayment schedule, and any additional provisions that the parties wish to include. It is essential to have a well-drafted promissory note to protect both the lender's and borrower's interests. In most cases, such promissory notes include the following key elements: 1. Identifying Information: Full names and addresses of both the borrower and lender. 2. Loan Details: The total loan amount, including any down payment made, and the agreed-upon interest rate. 3. Repayment Terms: The payment schedule, such as monthly or bi-weekly installments, and the due date for each payment. The duration of the repayment period and any penalty for late payments should also be specified. 4. Vehicle Description: Detailed information about the vehicle, including make, model, year, vehicle identification number (VIN), and any special features or conditions. 5. Security Interest: If the loan is secured by the vehicle, the promissory note should clearly state this and outline the consequences of default, such as repossession of the vehicle. 6. Additional Terms: Any additional provisions, such as whether prepayment is allowed, the rights and responsibilities of both parties, consequences of default, governing law, and dispute resolution procedures. Both parties should carefully review the promissory note and seek legal counsel if necessary before signing the agreement. It is crucial to ensure that the document accurately reflects the agreed-upon terms and protects the interests of all parties involved in the vehicle purchase.

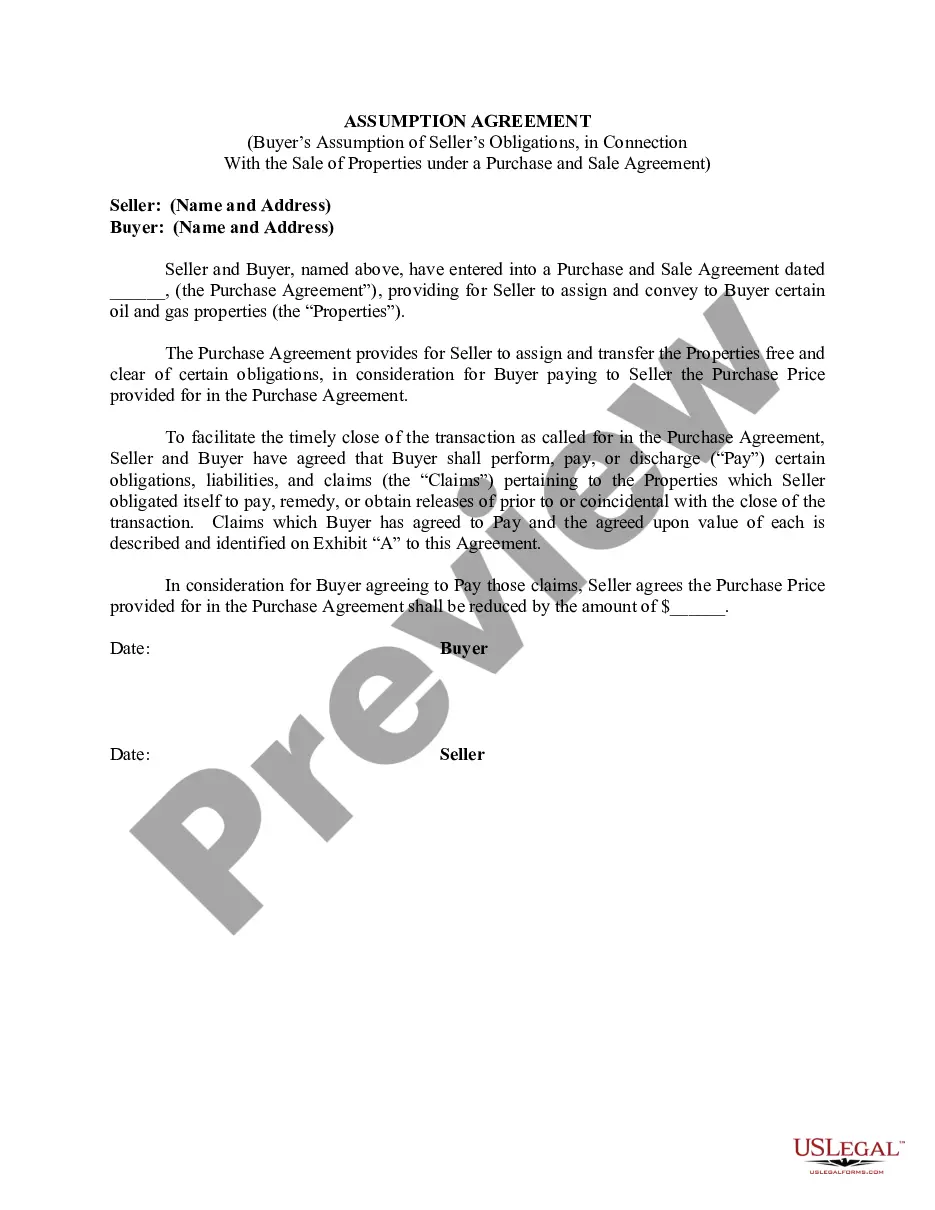

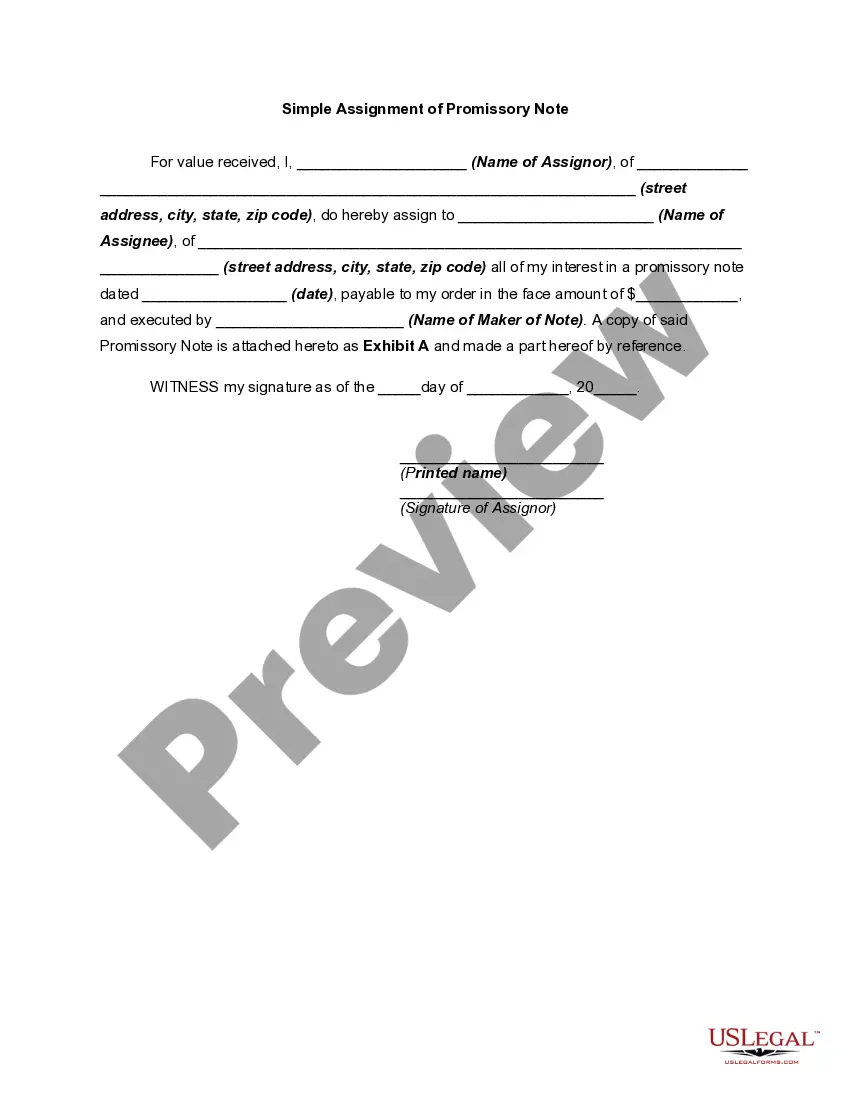

District of Columbia Simple Promissory Note for Vehicle Purchase

Description

How to fill out District Of Columbia Simple Promissory Note For Vehicle Purchase?

Discovering the right legal papers format can be a have difficulties. Naturally, there are plenty of layouts available on the net, but how can you discover the legal develop you will need? Use the US Legal Forms site. The services gives a huge number of layouts, like the District of Columbia Simple Promissory Note for Vehicle Purchase, that can be used for company and personal requirements. All of the varieties are examined by experts and meet federal and state requirements.

If you are already registered, log in in your bank account and click on the Down load button to get the District of Columbia Simple Promissory Note for Vehicle Purchase. Make use of your bank account to look throughout the legal varieties you possess acquired earlier. Go to the My Forms tab of your bank account and acquire one more copy of your papers you will need.

If you are a new user of US Legal Forms, listed below are straightforward guidelines that you should stick to:

- First, ensure you have selected the proper develop for the town/state. You can check out the shape utilizing the Preview button and browse the shape description to ensure it is the right one for you.

- If the develop is not going to meet your preferences, make use of the Seach industry to find the correct develop.

- When you are positive that the shape would work, click the Purchase now button to get the develop.

- Opt for the costs prepare you need and enter in the necessary details. Build your bank account and purchase the order making use of your PayPal bank account or charge card.

- Choose the document formatting and down load the legal papers format in your system.

- Complete, change and print and indication the acquired District of Columbia Simple Promissory Note for Vehicle Purchase.

US Legal Forms will be the greatest library of legal varieties where you can find different papers layouts. Use the company to down load professionally-created papers that stick to state requirements.