A District of Columbia Subcontractor Agreement for Insurance is a legal document that outlines the terms and conditions between a contractor and a subcontractor in the insurance industry. This agreement is specific to the District of Columbia and ensures that both parties are protected and aware of their rights and responsibilities. Keywords: District of Columbia, subcontractor agreement, insurance, contractor, subcontractor, terms and conditions, legal document, rights, responsibilities. There are different types of District of Columbia Subcontractor Agreements for Insurance, including: 1. General Subcontractor Agreement for Insurance: This type of agreement establishes the general terms and conditions between a contractor and a subcontractor in the insurance field. It outlines the scope of work, payment terms, liability, and any specific requirements applicable to the District of Columbia. 2. Professional Liability Subcontractor Agreement for Insurance: This agreement focuses specifically on professional liability insurance. It sets out the obligations and responsibilities of the subcontractor in terms of providing insurance coverage for any potential professional errors or omissions committed during the subcontracted work. 3. Workers' Compensation Subcontractor Agreement for Insurance: This agreement focuses on worker's compensation insurance. It ensures that the subcontractor has appropriate coverage to protect their employees in case of any work-related injuries or accidents while performing subcontracted tasks. 4. Property & Casualty Subcontractor Agreement for Insurance: This type of agreement pertains to property and casualty insurance, which covers damages to properties and liability arising from accidents or incidents. It details the insurance requirements that the subcontractor must have in place to protect both parties involved. 5. Commercial Auto Subcontractor Agreement for Insurance: In cases where the subcontractor uses vehicles for work purposes, this agreement specifically addresses the auto liability insurance requirements. It ensures that proper coverage is in place to protect against any accidents or damages caused while using these vehicles. 6. Umbrella Liability Subcontractor Agreement for Insurance: This agreement provides an additional layer of liability coverage to the subcontractor if their existing insurance policy limits are exceeded. It outlines the details of this excess coverage and any requirements specific to the District of Columbia. By utilizing these various types of District of Columbia Subcontractor Agreements for Insurance, contractors and subcontractors can ensure that they have appropriate insurance coverage in place, protecting themselves and their businesses from potential liabilities and risks associated with their work.

District of Columbia Subcontractor Agreement for Insurance

Description

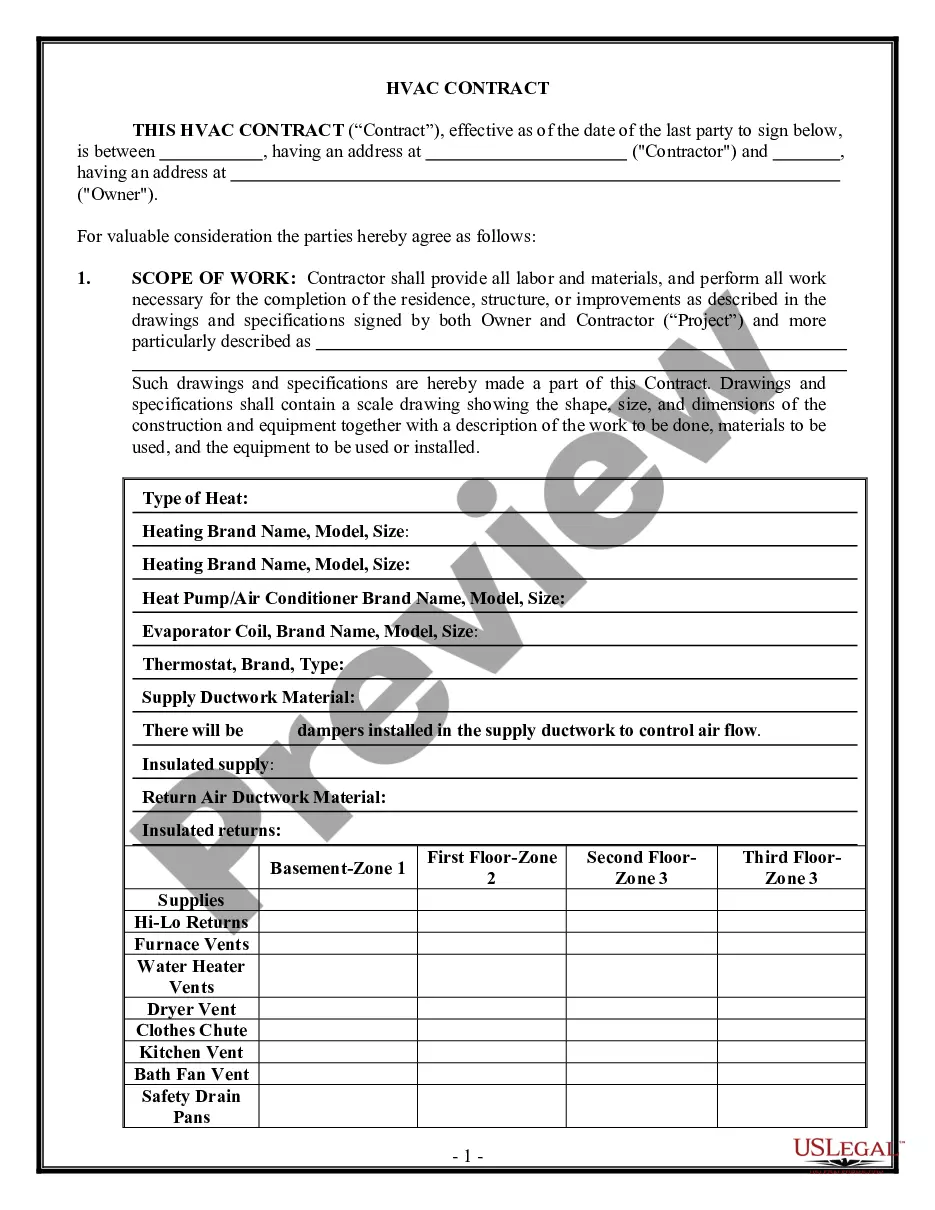

How to fill out District Of Columbia Subcontractor Agreement For Insurance?

US Legal Forms - one of many greatest libraries of authorized forms in the United States - delivers an array of authorized document themes you can down load or printing. Making use of the internet site, you may get 1000s of forms for company and individual reasons, categorized by classes, says, or key phrases.You will find the latest versions of forms such as the District of Columbia Subcontractor Agreement for Insurance within minutes.

If you have a registration, log in and down load District of Columbia Subcontractor Agreement for Insurance in the US Legal Forms library. The Obtain button will appear on every single develop you perspective. You gain access to all formerly saved forms from the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed here are basic directions to help you started off:

- Make sure you have chosen the right develop to your area/county. Select the Review button to analyze the form`s content. Look at the develop information to ensure that you have selected the proper develop.

- If the develop doesn`t satisfy your specifications, take advantage of the Search field on top of the screen to get the the one that does.

- In case you are happy with the form, confirm your option by clicking the Buy now button. Then, select the costs prepare you prefer and supply your credentials to sign up for the bank account.

- Approach the purchase. Make use of your bank card or PayPal bank account to perform the purchase.

- Find the structure and down load the form in your product.

- Make changes. Fill out, change and printing and indicator the saved District of Columbia Subcontractor Agreement for Insurance.

Each format you put into your money lacks an expiry day which is the one you have eternally. So, if you would like down load or printing another duplicate, just check out the My Forms area and then click about the develop you need.

Obtain access to the District of Columbia Subcontractor Agreement for Insurance with US Legal Forms, one of the most extensive library of authorized document themes. Use 1000s of skilled and condition-certain themes that fulfill your business or individual needs and specifications.

Form popularity

FAQ

If a vendor does not have insurance, you could face significant risks if problems arise during their work. This lack of coverage may expose you to liabilities, including legal claims or unexpected costs. To protect yourself, a District of Columbia Subcontractor Agreement for Insurance should be implemented, which can specify insurance requirements for all parties involved. This proactive approach minimizes the likelihood of disputes and financial loss.

Yes, subcontractors need to have insurance to protect both themselves and the general contractor. Insurance coverage helps in managing risks that arise from accidents, injuries, or damages during a project. Requiring insurance is a common practice detailed in a District of Columbia Subcontractor Agreement for Insurance, ensuring all parties understand their responsibilities. This safeguard contributes to smoother project execution and peace of mind.

An uninsured subcontractor is a worker who does not have liability insurance coverage for their business operations. Engaging with such subcontractors presents potential risks, as you could be liable for any injuries or damages that occur during their work. It is vital to confirm that all subcontractors carry adequate insurance, as emphasized in a District of Columbia Subcontractor Agreement for Insurance. This verification process protects your interests and ensures compliance.

If your subcontractor does not have insurance, you could be held liable for any accidents or damages that occur during their work. This situation could lead to significant financial burdens and legal challenges. To mitigate these risks, always require proof of insurance before work begins, ideally outlined in your District of Columbia Subcontractor Agreement for Insurance. This approach ensures you and your subcontractors are adequately protected.

As an independent contractor, you can acquire general liability insurance by researching providers in your area and comparing their offerings. Start by assessing your specific coverage needs, then gather quotes from multiple insurers. You must review policy terms closely to ensure they align with a District of Columbia Subcontractor Agreement for Insurance. This coverage protects your business and your clients from unforeseen events.

If an uninsured contractor gets hurt on your property, you may face significant liability issues. You could be responsible for their medical bills and other related expenses. Moreover, if the contractor files a lawsuit, the costs could escalate quickly. To protect yourself from such risks, a District of Columbia Subcontractor Agreement for Insurance is essential, ensuring all parties are covered.

For hiring a subcontractor, you will need essential paperwork, including a written agreement detailing the scope of work, payment terms, and insurance documentation. The District of Columbia Subcontractor Agreement for Insurance is a critical document that outlines these requirements. Additionally, you may need tax forms and any necessary licenses. Gathering these documents helps ensure compliance and avoids potential legal complications.

A subcontractor agreement should include key details like project scope, payment structure, timelines, and required insurance coverage. Specifically, a District of Columbia Subcontractor Agreement for Insurance will outline insurance clauses to clarify coverage expectations. This clarity helps eliminate misunderstandings and ensures that both the subcontractor and contractor are on the same page. Thus, a comprehensive agreement is crucial for smooth project execution.

The contract clause for a subcontractor generally specifies the roles, responsibilities, and obligations of the parties involved. It often includes sections on payment terms, project timelines, and insurance requirements. Most importantly, the District of Columbia Subcontractor Agreement for Insurance includes clauses that highlight necessary coverages, ensuring that both parties are protected. A well-structured contract is vital for successful subcontractor relationships.

Yes, subcontractors typically need to carry insurance. This requirement helps safeguard against potential risks and liabilities that could arise during construction projects. A well-crafted District of Columbia Subcontractor Agreement for Insurance often outlines the necessity of insurance coverage, ensuring compliance. By having insurance, subcontractors can work confidently, knowing they are protected.