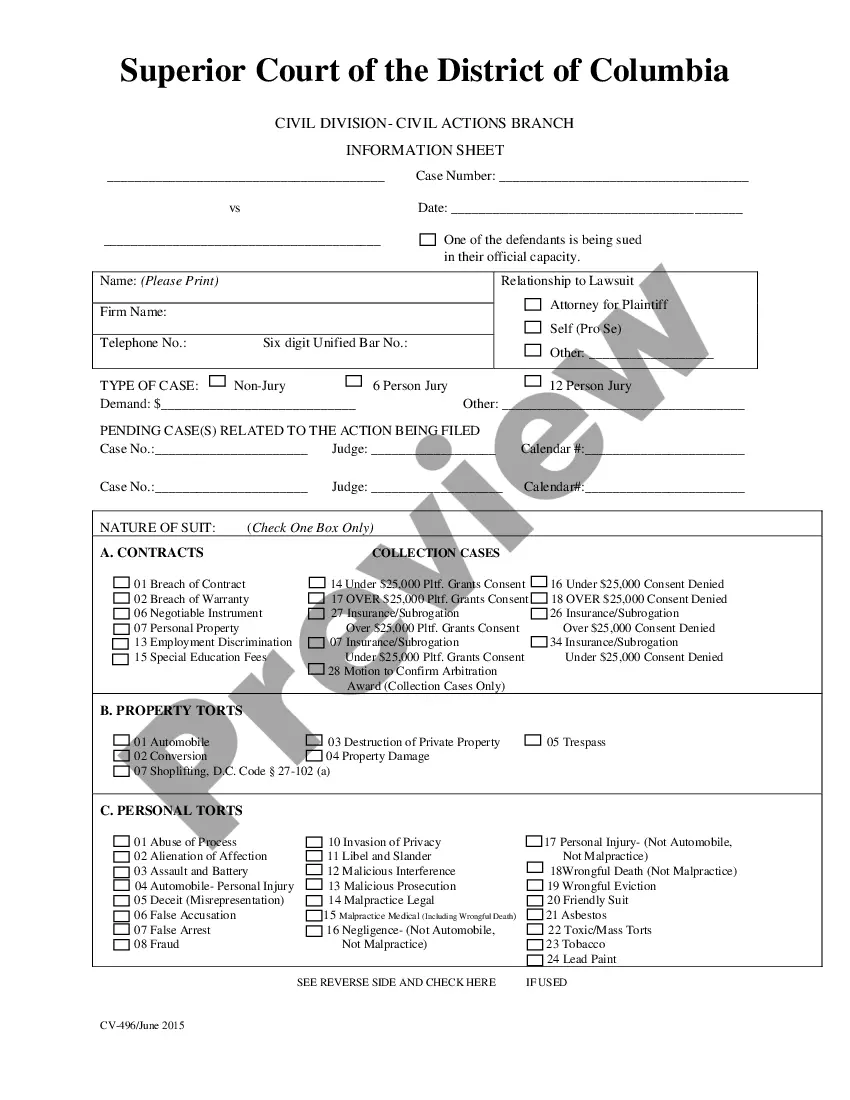

District of Columbia Prepayment Agreement

Description

How to fill out District Of Columbia Prepayment Agreement?

You are able to spend hours on the Internet trying to find the lawful papers template that suits the state and federal needs you will need. US Legal Forms supplies 1000s of lawful varieties that are evaluated by specialists. You can actually down load or print out the District of Columbia Prepayment Agreement from our support.

If you currently have a US Legal Forms account, you can log in and click the Download switch. Next, you can complete, edit, print out, or indicator the District of Columbia Prepayment Agreement. Every lawful papers template you acquire is your own eternally. To have one more backup of the obtained develop, check out the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms internet site the first time, follow the straightforward directions below:

- Very first, make sure that you have chosen the correct papers template for that state/metropolis that you pick. Browse the develop information to ensure you have selected the proper develop. If offered, use the Preview switch to look with the papers template as well.

- If you wish to find one more variation from the develop, use the Search area to discover the template that meets your needs and needs.

- When you have discovered the template you need, simply click Buy now to proceed.

- Select the costs strategy you need, type your references, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to fund the lawful develop.

- Select the formatting from the papers and down load it to the device.

- Make adjustments to the papers if required. You are able to complete, edit and indicator and print out District of Columbia Prepayment Agreement.

Download and print out 1000s of papers web templates making use of the US Legal Forms website, that provides the biggest assortment of lawful varieties. Use professional and condition-distinct web templates to deal with your company or specific demands.

Form popularity

FAQ

The prepayment penalty shall be equal to the interest on the principal amount of the loan from the date of settlement to the date of sale or transfer, at the rate of interest on the First Mortgage Loan.

A mortgage prepayment penalty is a fee that some lenders charge when you pay all or part of your mortgage loan off early. The penalty fee is an incentive for borrowers to pay back their principal slowly over a longer term, allowing mortgage lenders to collect interest.

If a mortgage loan application is approved and executed without the information in sections 1116.1 and 1116.2, the mortgage loan application shall be voidable by the borrower(s) prior to the loan closing and any fees submitted by the borrower(s) in connection with the application shall be returned to the borrower(s) in ...

Does a closing disclosure mean your loan is approved? No, a closing disclosure does not always mean your loan is approved. You may find incorrect information or something you want to change. Your lender also has the opportunity to back out if they find something new that makes them change their mind.

§ 28?3302. (b) Interest, when authorized by law, on judgments or decrees against the District of Columbia, or its officers, or its employees acting within the scope of their employment, is at the rate of not exceeding 4% per annum.

Required loan disclosures. (a)(1) A licensee who offers to make or procure a loan secured by a first or subordinate mortgage or deed of trust on a single to 4-family home shall provide the borrower with a financing agreement executed by the lender.

As one of the final forms you receive before you close on your new loan, the Closing Disclosure allows you to compare your loan terms and costs to the terms listed in the Loan Estimate form you were given at the beginning of the process.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).