The District of Columbia Notice of Changes to Credit Card Agreement is an important document that outlines the modifications made to a credit card agreement by a credit card issuer in the District of Columbia region. This notice is mandated by law and serves to inform credit cardholders about any revisions, updates, or amendments to the terms and conditions of their credit card agreements. It is crucial for consumers to carefully review and understand the contents of this notice to ensure they are aware of their rights and responsibilities. Keywords: District of Columbia, Notice of Changes, Credit Card Agreement, modifications, credit card issuer, terms and conditions, revisions, updates, amendments, consumers, rights, responsibilities. There may be different types of District of Columbia Notice of Changes to Credit Card Agreement, depending on the nature of the alterations made by the credit card issuer. Some possible variations could include: 1. Interest Rate Changes: This type of notice could inform cardholders about modifications to the annual percentage rate (APR) charged on their credit card balances. It would disclose any increases or decreases made to the interest rates and provide details regarding the effective date of the change. 2. Fee Adjustments: This notice could outline any adjustments made to fees associated with the credit card, such as annual fees, late payment fees, or balance transfer fees. It would specify the new fee structure, including the previous and updated amounts, as well as when the changes will take effect. 3. Rewards Program Alterations: If there are any changes to the rewards program on a credit card, the notice would detail these modifications. This could include adjustments to the earning rates, redemption options, or expiration policies of reward points or cashback. 4. Account Terms and Conditions Amendment: This type of notice would cover broader changes to the overall terms and conditions of the credit card agreement. It could include modifications to payment due dates, grace periods, dispute resolution procedures, or any other contractual provisions. Regardless of the specific type of notice, credit cardholders should review the document carefully to understand the reasons behind the changes, the impact on their card usage, any consequences, and their rights in response to the adjustments mentioned. Overall, the District of Columbia Notice of Changes to Credit Card Agreement is a crucial communication that ensures transparency and provides vital information to credit cardholders in the District of Columbia region regarding modifications made by credit card issuers to their credit card agreements. Keywords: District of Columbia, Notice of Changes, Credit Card Agreement, modifications, cardholders, interest rate changes, fee adjustments, rewards program alterations, account terms and conditions amendment, transparency, communication.

District of Columbia Notice of Changes to Credit Card Agreement

Description

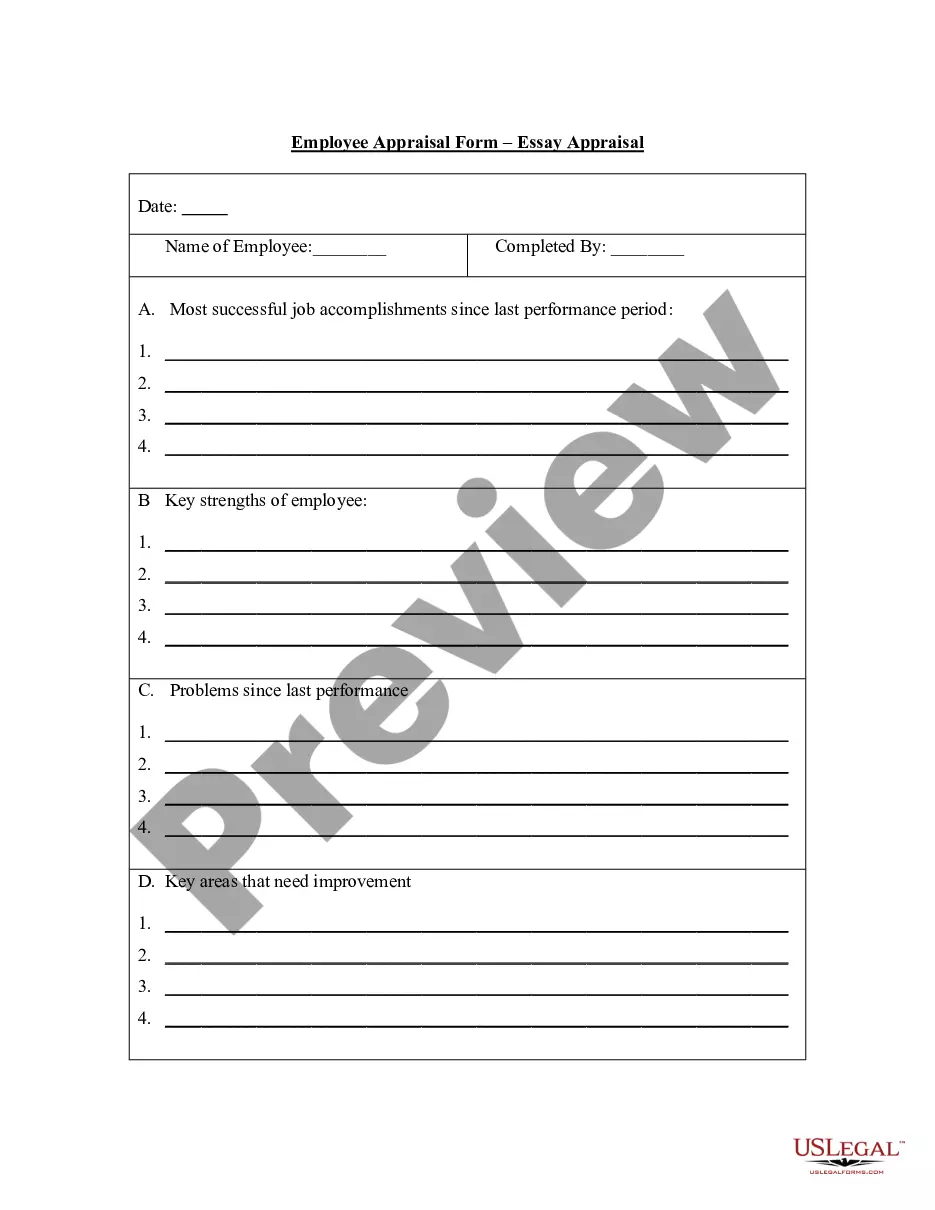

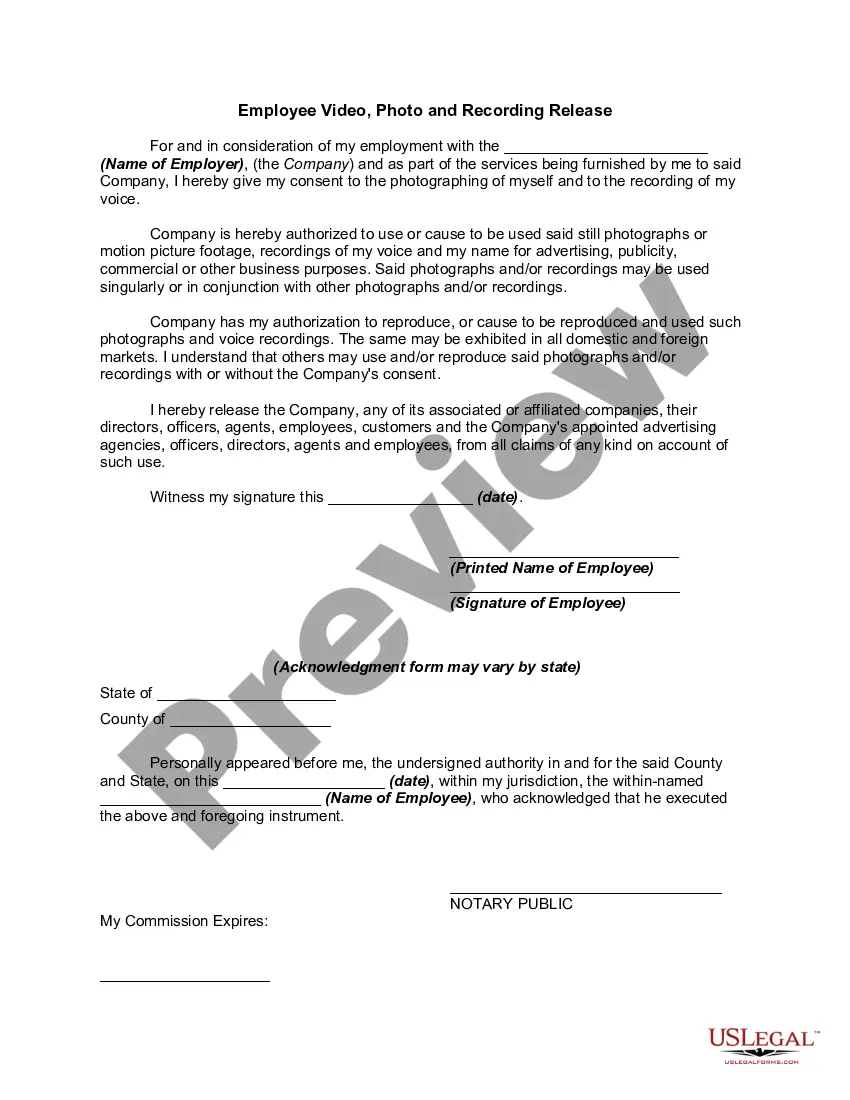

How to fill out Notice Of Changes To Credit Card Agreement?

Are you in the position the place you need to have papers for possibly company or individual functions almost every time? There are plenty of legal file themes available on the Internet, but locating kinds you can depend on is not easy. US Legal Forms provides 1000s of type themes, like the District of Columbia Notice of Changes to Credit Card Agreement, that happen to be published to meet federal and state demands.

Should you be previously knowledgeable about US Legal Forms website and get a free account, basically log in. After that, it is possible to acquire the District of Columbia Notice of Changes to Credit Card Agreement format.

If you do not provide an profile and want to begin using US Legal Forms, adopt these measures:

- Discover the type you need and make sure it is for your appropriate city/area.

- Utilize the Review option to analyze the shape.

- Browse the description to ensure that you have selected the right type.

- When the type is not what you are seeking, utilize the Search field to discover the type that fits your needs and demands.

- Whenever you get the appropriate type, click on Acquire now.

- Opt for the pricing program you need, submit the necessary details to make your bank account, and buy an order using your PayPal or Visa or Mastercard.

- Select a convenient data file file format and acquire your copy.

Discover all of the file themes you have bought in the My Forms food selection. You may get a more copy of District of Columbia Notice of Changes to Credit Card Agreement anytime, if possible. Just click on the required type to acquire or print the file format.

Use US Legal Forms, one of the most considerable assortment of legal types, in order to save time and steer clear of mistakes. The services provides appropriately produced legal file themes which can be used for an array of functions. Generate a free account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

With respect to a consumer credit sale or direct installment loan the agreement may provide for the payment by the consumer of reasonable attorney's fees not in excess of 15% of the unpaid balance of the obligation.

DC Code Section 48-904.01(a) states that it is illegal for an individual to knowingly make or sell controlled substances. Furthermore, it is just as illegal for an individual to possess controlled substances for the purpose of making or selling controlled substances.

§ 28?3801. This subchapter applies to actions to enforce rights arising from a consumer credit sale or a direct installment loan.

Debt collection. (a)(1) This section applies to conduct and practices in connection with the collection of obligations arising from any consumer debt (other than a loan directly secured on real estate or a direct motor vehicle installment loan covered by Chapter 36 of this title).

The District of Columbia will soon have in place what may be the most progressive law in the nation protecting consumers from unfair and abusive debt collection practices. On June 7, 2022, the DC Council passed the Protecting Consumers from Unjust Debt Collection Practices Amendment Act of 2021 (B24-0357).

The District of Columbia's general consumer protection law, which prohibits a wide variety of deceptive and unconscionable business practices, is called the Consumer Protection Procedures Act or ?CPPA.? It is codified at DC Official Code §§ 28-3901 to 28-3913.

In finance, consumer protection laws seek to prevent predatory lending, housing discrimination, securities fraud, privacy violations, and other unethical practices.

Protecting Consumers from Unjust Debt Collection Practices Amendment Act of 2022. BE IT ENACTED BY THE COUNCIL OF THE DISTRICT OF COLUMBIA, That this act may be cited as the "Protecting Consumers from Unjust Debt Collection Practices Amendment Act of 2022".