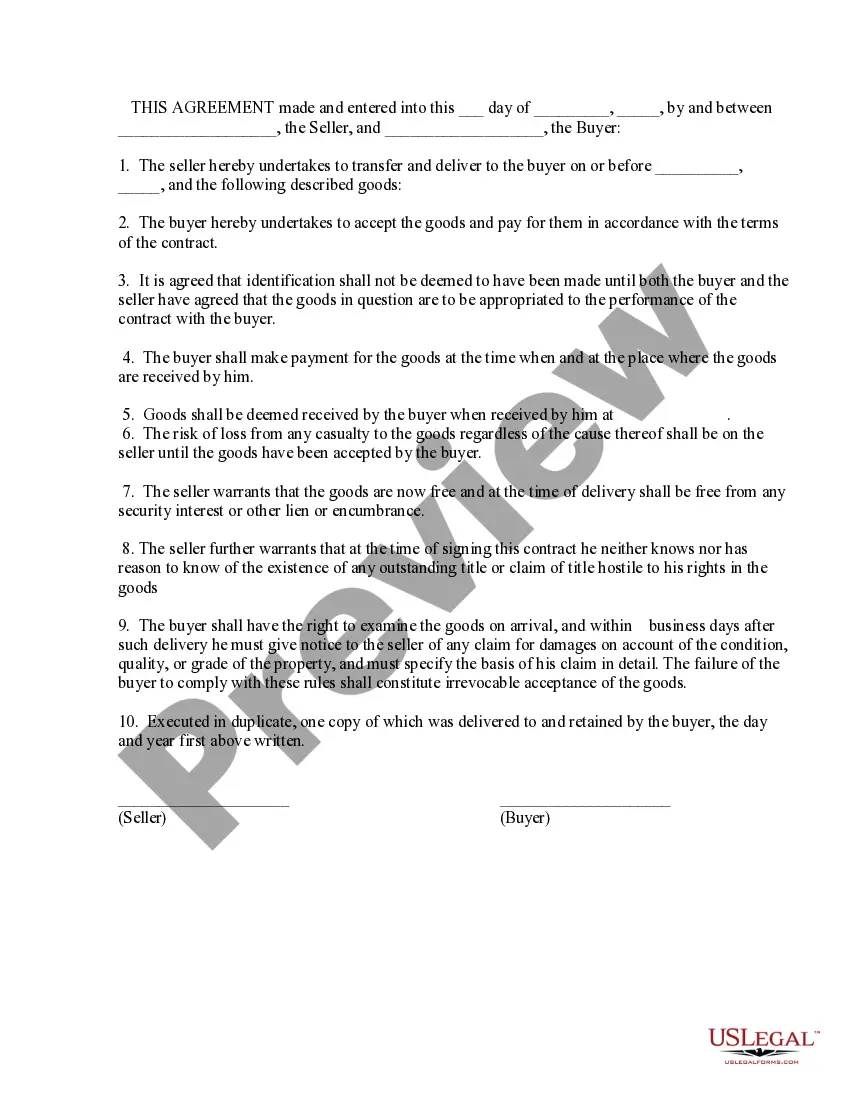

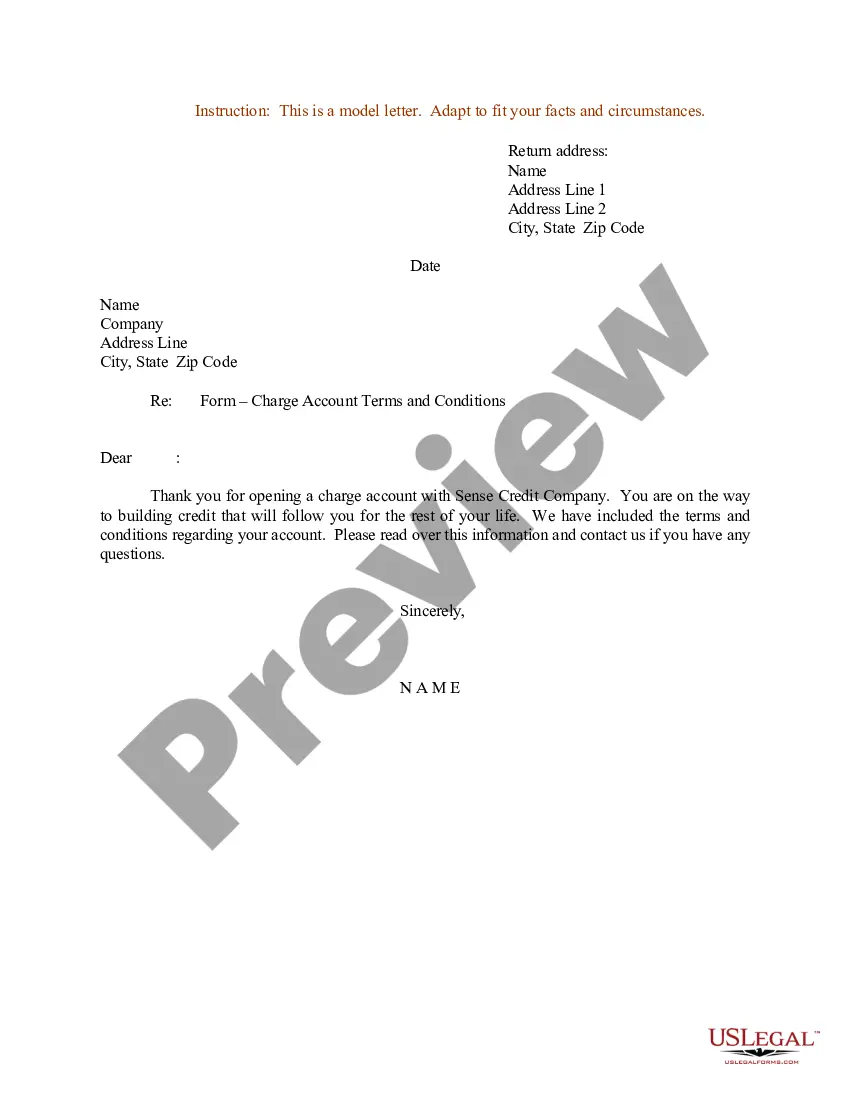

Title: District of Columbia Sample Letter for Charge Account Terms and Conditions: A Comprehensive Guide Introduction: The District of Columbia Sample Letter for Charge Account Terms and Conditions provides a standardized template that businesses can utilize when establishing a charge account agreement with their customers in the District of Columbia. This letter outlines the terms and conditions surrounding credit extensions, payment terms, and various policies related to charge accounts. This detailed description will cover key aspects of the sample letter, providing insights into its importance, components, and potential variations. 1. Importance of Charge Account Terms and Conditions: Charge account terms and conditions serve as a legally binding contract between businesses and customers, defining the rules and obligations associated with utilizing a charge account. They facilitate clarity, transparency, and dispute resolution, helping businesses maintain control over credit transactions and ensuring smooth financial operations. Moreover, adhering to specific guidelines assists businesses in avoiding legal complications and securing the interests of both parties involved. 2. Components of the District of Columbia Sample Letter for Charge Account Terms and Conditions: a) Account Establishment: The letter begins by specifying the process for opening a charge account, including submission of relevant documents, credit checks, and reference requirements. b) Credit Limit: This section outlines the approved credit limit and how it may be subject to periodic evaluations and adjustments based on the customer's creditworthiness. c) Payment Terms: The letter defines the payment period, accepted payment methods, grace periods, and penalties for late or non-payment. d) Interest Rates and Finance Charges: It details the interest rates applied to outstanding balances, finance charges for delinquencies, and the process of calculating such charges. e) Account Statements: This section clarifies the frequency and method of providing account statements, allowing customers to monitor their transactions, including purchases made and payments due. f) Returns and Refunds: It specifies the procedures and conditions for returns and refunds on items purchased using the charge account, ensuring customer satisfaction and account adjustments. g) Security Interest: If applicable, the terms and conditions describe any security interests taken on the customer's assets against the credit extended. h) Termination/Modification: These clauses outline the conditions and procedures for terminating or modifying the charge account agreement by either party. i) Dispute Resolution: The letter may include a provision for dispute resolution, addressing potential conflicts and specifying methods for negotiation or arbitration. j) Governing Law: It mentions the applicable District of Columbia laws that regulate the charge account agreement to ensure compliance. 3. Variations of District of Columbia Sample Letter for Charge Account Terms and Conditions: Different industries and businesses may require certain variations in their terms and conditions to align with specific legal requirements, industry standards, or company policies. Examples of possible variations may include letters tailored for: — Retail businesses, including specific clauses on returns, exchanges, and store credit. — Service-based businesses, detailing service-specific terms, cancellation policies, or hourly rate charges. — Wholesale or distributor businesses, outlining bulk order terms, minimum purchase thresholds, and delivery conditions. — Online businesses, addressing aspects such as privacy concerns, digital transaction security, and chargeback policies. Conclusion: Utilizing District of Columbia Sample Letter for Charge Account Terms and Conditions is crucial for businesses operating in the District of Columbia to establish a legally binding agreement with their customers. This comprehensive guide explained the importance of such documents, highlighted their essential components, and discussed potential variations to cater to diverse business needs. By implementing these terms and conditions, businesses can ensure fair and transparent charge account practices, fostering healthy customer relationships and maintaining financial stability.

District of Columbia Sample Letter for Charge Account Terms and Conditions

Description

How to fill out District Of Columbia Sample Letter For Charge Account Terms And Conditions?

US Legal Forms - one of several greatest libraries of authorized types in the United States - delivers a wide range of authorized file templates it is possible to down load or printing. Utilizing the website, you can find 1000s of types for business and specific functions, sorted by groups, states, or search phrases.You will discover the newest versions of types like the District of Columbia Sample Letter for Charge Account Terms and Conditions in seconds.

If you already possess a registration, log in and down load District of Columbia Sample Letter for Charge Account Terms and Conditions in the US Legal Forms library. The Acquire switch can look on every single kind you view. You have accessibility to all previously saved types in the My Forms tab of your bank account.

In order to use US Legal Forms for the first time, here are basic guidelines to get you started:

- Ensure you have picked out the proper kind to your city/state. Go through the Review switch to check the form`s content. Browse the kind explanation to actually have chosen the appropriate kind.

- When the kind doesn`t satisfy your needs, take advantage of the Search field near the top of the monitor to find the one which does.

- In case you are satisfied with the shape, affirm your option by clicking the Get now switch. Then, select the prices program you like and supply your references to register for an bank account.

- Process the purchase. Make use of charge card or PayPal bank account to accomplish the purchase.

- Pick the format and down load the shape on the gadget.

- Make adjustments. Complete, edit and printing and signal the saved District of Columbia Sample Letter for Charge Account Terms and Conditions.

Every design you included with your account does not have an expiry day which is yours for a long time. So, if you wish to down load or printing another duplicate, just proceed to the My Forms area and click on in the kind you will need.

Gain access to the District of Columbia Sample Letter for Charge Account Terms and Conditions with US Legal Forms, probably the most considerable library of authorized file templates. Use 1000s of professional and status-particular templates that satisfy your business or specific requires and needs.