The District of Columbia Participation Agreement in Connection with Secured Loan Agreement refers to a legal document that outlines the terms and conditions for the involvement of the District of Columbia in a secured loan agreement. This agreement establishes a framework for the District of Columbia's participation as a lender or guarantor in a secured loan transaction, providing financial assistance or support. The District of Columbia Participation Agreement is designed to protect the interests of both parties involved and ensure clarity regarding roles, responsibilities, and repayment terms. It highlights the specific conditions applicable to loans in which the District of Columbia is participating, including specific provisions related to the secured nature of the loan. Different types of the District of Columbia Participation Agreement in Connection with Secured Loan Agreement may exist, depending on the specific purpose or nature of the loan. Some common types include: 1. Municipal Loan Participation Agreement: This type of agreement focuses on the District of Columbia's participation in loans for municipal projects or initiatives. It outlines the terms for funding public infrastructure, urban development projects, public transportation systems, or other similar ventures. 2. Small Business Loan Participation Agreement: This agreement pertains to loans where the District of Columbia participates in financing small businesses. It establishes the terms for financial support that promotes local economic development, job creation, and entrepreneurship. 3. Housing Loan Participation Agreement: This type of agreement addresses the participation of the District of Columbia in secured loans related to affordable housing projects or initiatives. It sets out the terms and conditions for loans targeting the development, renovation, or preservation of affordable housing units within the district. 4. Education Loan Participation Agreement: This agreement involves the District of Columbia's participation in secured loans related to educational programs, institutions, or initiatives. These loans may support the funding of educational facilities, scholarships, student loans, or other educational development endeavors. The District of Columbia Participation Agreement in Connection with Secured Loan Agreement plays a crucial role in facilitating financial cooperation between the District of Columbia and other parties seeking funding or guarantees for various projects or initiatives. It ensures transparency, accountability, and legal compliance throughout the loan process while safeguarding the interests of all parties involved.

District of Columbia Participation Agreement in Connection with Secured Loan Agreement

Description

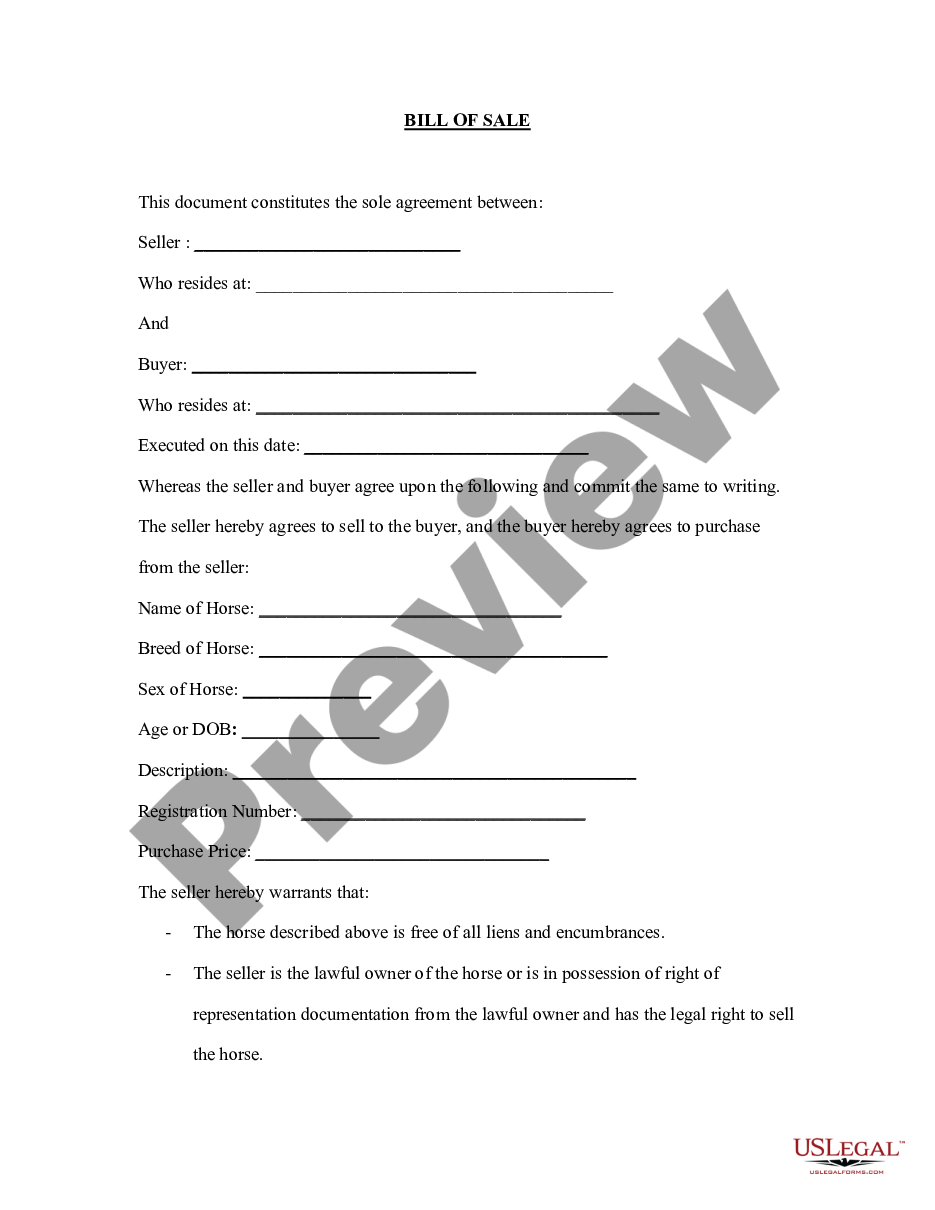

How to fill out District Of Columbia Participation Agreement In Connection With Secured Loan Agreement?

Are you presently in a position in which you will need documents for either organization or person purposes almost every working day? There are a variety of legitimate record templates accessible on the Internet, but locating kinds you can depend on is not simple. US Legal Forms offers 1000s of develop templates, just like the District of Columbia Participation Agreement in Connection with Secured Loan Agreement, which can be created to fulfill state and federal demands.

When you are already familiar with US Legal Forms website and also have an account, just log in. Afterward, you may down load the District of Columbia Participation Agreement in Connection with Secured Loan Agreement web template.

Unless you come with an bank account and wish to start using US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is for your proper town/county.

- Utilize the Preview key to examine the form.

- Read the outline to ensure that you have selected the proper develop.

- In case the develop is not what you`re seeking, make use of the Research discipline to discover the develop that suits you and demands.

- If you get the proper develop, click on Acquire now.

- Opt for the costs plan you want, submit the desired information to generate your account, and buy your order with your PayPal or credit card.

- Select a convenient document structure and down load your duplicate.

Get all the record templates you may have purchased in the My Forms food list. You can get a extra duplicate of District of Columbia Participation Agreement in Connection with Secured Loan Agreement at any time, if required. Just go through the essential develop to down load or printing the record web template.

Use US Legal Forms, probably the most considerable assortment of legitimate varieties, to conserve time as well as prevent blunders. The service offers expertly manufactured legitimate record templates that can be used for a range of purposes. Generate an account on US Legal Forms and begin generating your lifestyle a little easier.