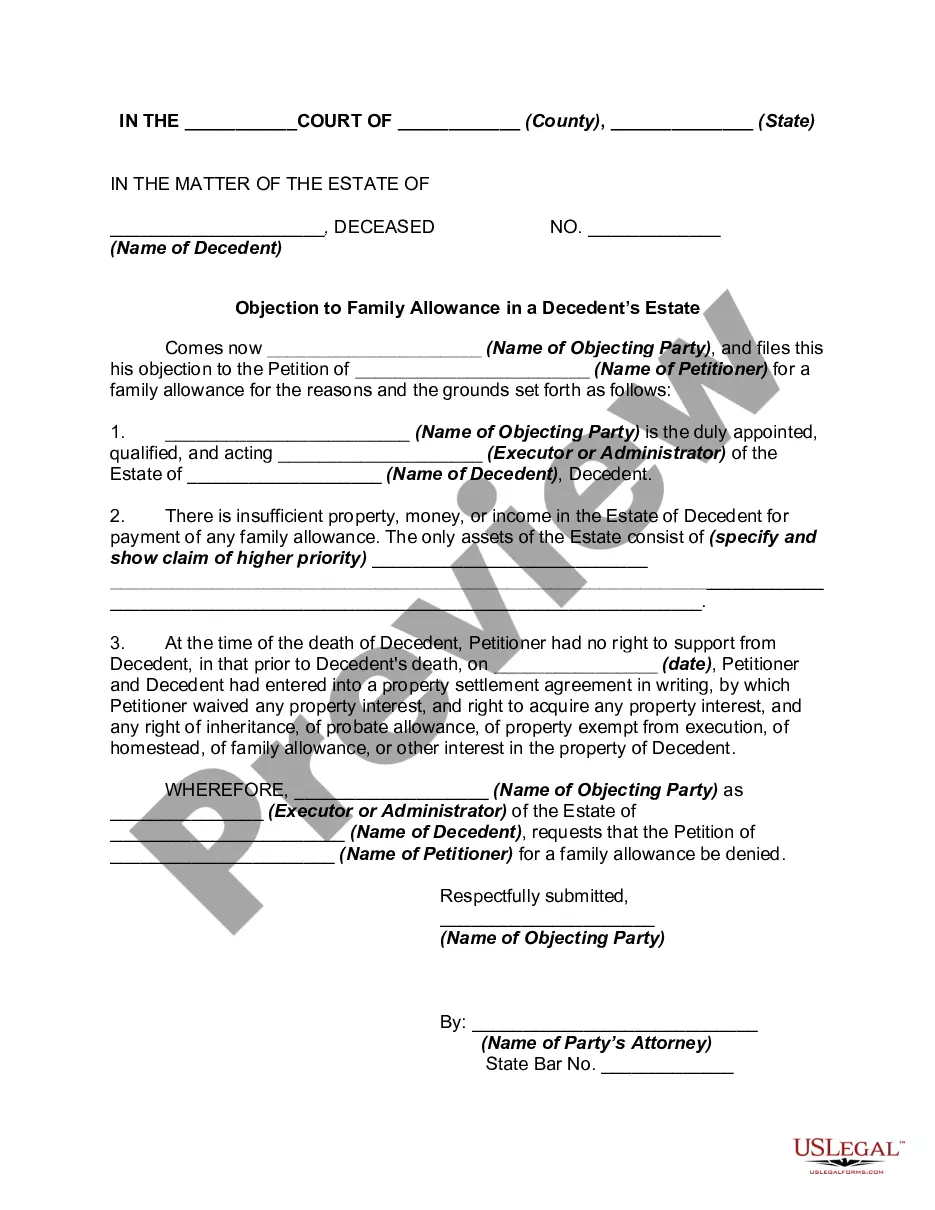

Are you in a placement that you require papers for possibly enterprise or specific purposes virtually every day time? There are a lot of legitimate record templates available on the net, but discovering ones you can rely isn`t simple. US Legal Forms offers a huge number of develop templates, like the District of Columbia Objection to Allowed Claim in Accounting, that are composed to meet state and federal specifications.

Should you be already informed about US Legal Forms site and possess your account, basically log in. Following that, it is possible to down load the District of Columbia Objection to Allowed Claim in Accounting web template.

If you do not have an bank account and would like to start using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for the correct area/region.

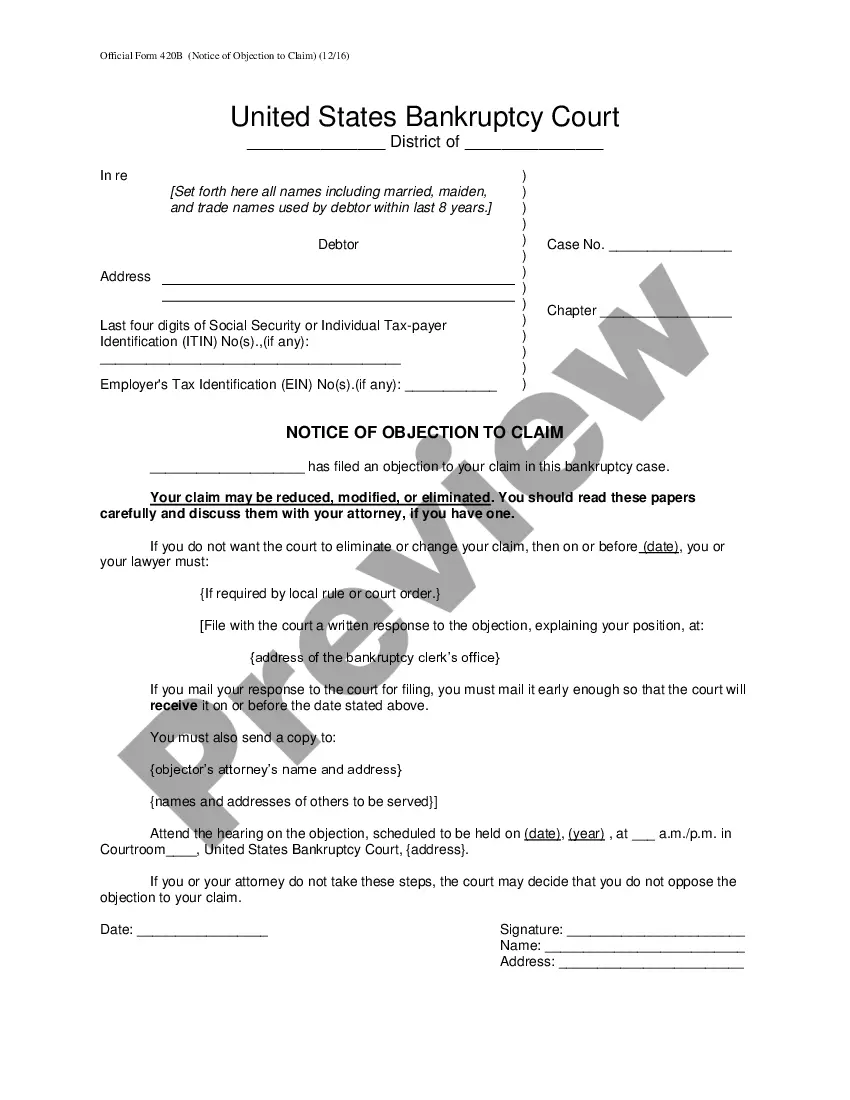

- Make use of the Review key to examine the form.

- Read the outline to actually have selected the right develop.

- When the develop isn`t what you are seeking, utilize the Search area to discover the develop that fits your needs and specifications.

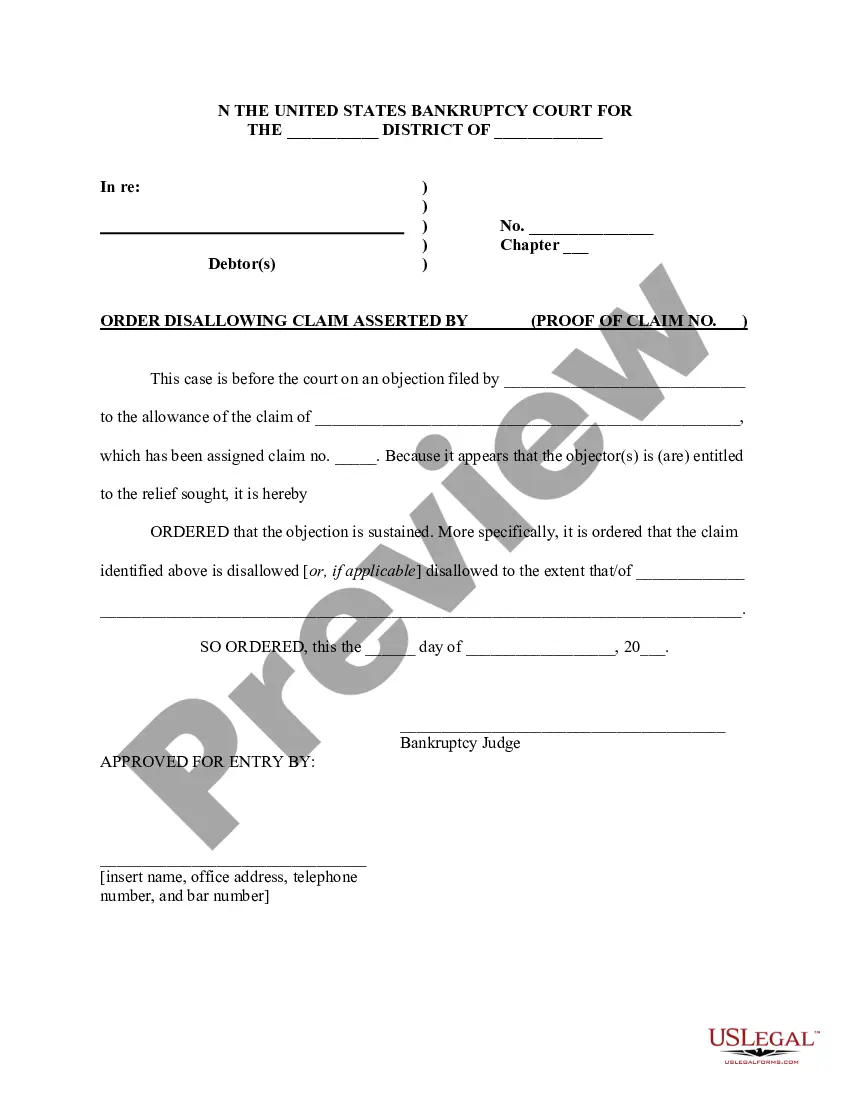

- When you obtain the correct develop, click on Buy now.

- Select the rates plan you desire, fill out the desired information to produce your account, and buy an order making use of your PayPal or bank card.

- Select a convenient file format and down load your backup.

Find all the record templates you may have bought in the My Forms menus. You can get a extra backup of District of Columbia Objection to Allowed Claim in Accounting anytime, if possible. Just click on the necessary develop to down load or produce the record web template.

Use US Legal Forms, probably the most comprehensive variety of legitimate varieties, to conserve efforts and prevent faults. The services offers expertly created legitimate record templates which you can use for an array of purposes. Produce your account on US Legal Forms and begin creating your lifestyle a little easier.