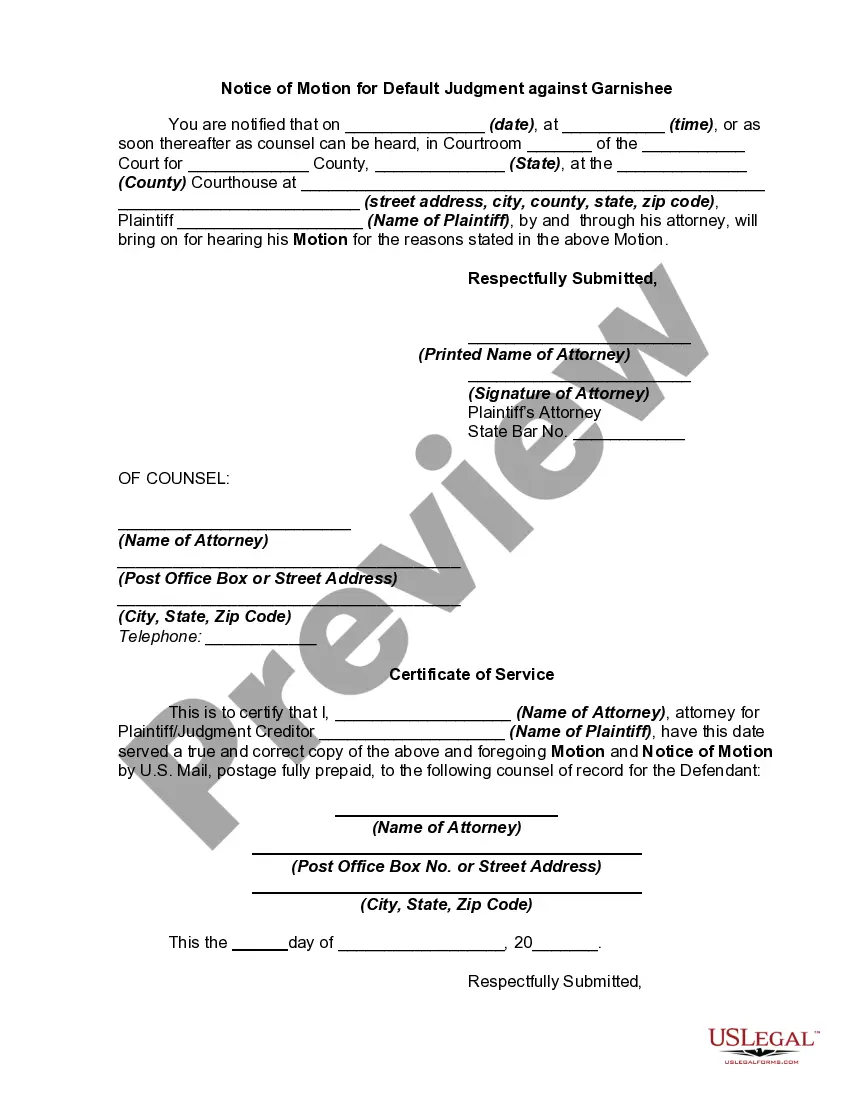

Most states have laws that provided that if a garnishee, personally summoned, shall fail to answer as required by law, the court shall enter a judgment against him for the amount of plaintiff's demand.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: District of Columbia Motion for Default Judgment against Garnishee: A Comprehensive Overview Introduction: In the legal process of collecting a debt, a District of Columbia Motion for Default Judgment against Garnishee can be a crucial tool. This article provides a detailed description of what this motion entails, its purpose, and its various types. Understanding the District of Columbia Motion for Default Judgment against Garnishee: A District of Columbia Motion for Default Judgment against Garnishee is a legal document filed in a civil court seeking a judgment in the plaintiff's favor when the garnishee (a third party holding the debtor's property or assets) fails to respond or comply with their obligations. It serves as a powerful means for creditors to enforce debt recovery. Key Elements and Process: 1. Initiation: The motion is typically filed after the garnishee fails to answer interrogatories or fulfill obligations within the specified timeframe. 2. Legal Basis: The motion is supported by relevant statutes and rules of civil procedure of the District of Columbia. 3. Notice Requirements: The plaintiff must serve the necessary notice to the garnishee, indicating their intent to file a Motion for Default Judgment if compliance is not achieved within a reasonable timeline. 4. Filing the Motion: The motion must be drafted in compliance with the court's requirements and include all pertinent information, such as the cause of action, the garnishment process, details of the garnishee's failure to comply, and requested relief. 5. Court Hearing: Upon filing the motion, a court hearing is scheduled to evaluate the merits of the case and assess if the garnishee's noncompliance warrants a default judgment. Different Types of District of Columbia Motion for Default Judgment against Garnishee: Although the underlying purpose remains the same, there can be several types of District of Columbia Motions for Default Judgment against Garnishee. Some common examples include: 1. District of Columbia Motion for Default Judgment against Garnishee in Wage Garnishment: This motion is specific to cases involving the garnishment of wages, where the garnishee (usually the employer) fails to fulfill their withholding obligations. 2. District of Columbia Motion for Default Judgment against Garnishee in Bank Account Garnishment: This motion is applicable when a financial institution, as a garnishee, fails to comply with court orders regarding withholding or releasing funds from a debtor's bank account. 3. District of Columbia Motion for Default Judgment against Garnishee in Property Garnishment: In situations where the garnishee, commonly a third-party holding a debtor's property, fails to comply with court orders regarding the seizure or disposal of the property. Conclusion: District of Columbia Motion for Default Judgment against Garnishee plays a pivotal role in debt recovery, enabling creditors to enforce their rights. Understanding the various types of motions helps legal professionals and interested parties navigate the complex process, increasing their chances of securing a favorable judgment. Consulting with an experienced attorney is crucial to ensure compliance with the District of Columbia's rules and regulations.Title: District of Columbia Motion for Default Judgment against Garnishee: A Comprehensive Overview Introduction: In the legal process of collecting a debt, a District of Columbia Motion for Default Judgment against Garnishee can be a crucial tool. This article provides a detailed description of what this motion entails, its purpose, and its various types. Understanding the District of Columbia Motion for Default Judgment against Garnishee: A District of Columbia Motion for Default Judgment against Garnishee is a legal document filed in a civil court seeking a judgment in the plaintiff's favor when the garnishee (a third party holding the debtor's property or assets) fails to respond or comply with their obligations. It serves as a powerful means for creditors to enforce debt recovery. Key Elements and Process: 1. Initiation: The motion is typically filed after the garnishee fails to answer interrogatories or fulfill obligations within the specified timeframe. 2. Legal Basis: The motion is supported by relevant statutes and rules of civil procedure of the District of Columbia. 3. Notice Requirements: The plaintiff must serve the necessary notice to the garnishee, indicating their intent to file a Motion for Default Judgment if compliance is not achieved within a reasonable timeline. 4. Filing the Motion: The motion must be drafted in compliance with the court's requirements and include all pertinent information, such as the cause of action, the garnishment process, details of the garnishee's failure to comply, and requested relief. 5. Court Hearing: Upon filing the motion, a court hearing is scheduled to evaluate the merits of the case and assess if the garnishee's noncompliance warrants a default judgment. Different Types of District of Columbia Motion for Default Judgment against Garnishee: Although the underlying purpose remains the same, there can be several types of District of Columbia Motions for Default Judgment against Garnishee. Some common examples include: 1. District of Columbia Motion for Default Judgment against Garnishee in Wage Garnishment: This motion is specific to cases involving the garnishment of wages, where the garnishee (usually the employer) fails to fulfill their withholding obligations. 2. District of Columbia Motion for Default Judgment against Garnishee in Bank Account Garnishment: This motion is applicable when a financial institution, as a garnishee, fails to comply with court orders regarding withholding or releasing funds from a debtor's bank account. 3. District of Columbia Motion for Default Judgment against Garnishee in Property Garnishment: In situations where the garnishee, commonly a third-party holding a debtor's property, fails to comply with court orders regarding the seizure or disposal of the property. Conclusion: District of Columbia Motion for Default Judgment against Garnishee plays a pivotal role in debt recovery, enabling creditors to enforce their rights. Understanding the various types of motions helps legal professionals and interested parties navigate the complex process, increasing their chances of securing a favorable judgment. Consulting with an experienced attorney is crucial to ensure compliance with the District of Columbia's rules and regulations.