The District of Columbia General Letter of Credit with Account of Shipment is a financial instrument that helps facilitate smooth transactions between different parties involved in trade. It provides assurance to exporters and sellers, as it guarantees payment for goods or services, while also protecting the interests of the importer or buyer. This specific type of letter of credit is commonly used in international trade transactions within the District of Columbia. It serves as a contract, where a bank or financial institution acts as a neutral intermediary between the seller and the buyer. The bank ensures that the seller is paid once the agreed-upon conditions are met, such as the proper shipment of goods. The General Letter of Credit with Account of Shipment can be further classified into different types based on certain variations in terms and conditions: 1. Revocable Letter of Credit: This type of letter of credit can be modified or canceled by the issuing bank without prior notice to the beneficiary (seller). However, it is not widely used due to its lack of security for sellers. 2. Irrevocable Letter of Credit: A more common type, this letter of credit cannot be modified or revoked without the agreement of all parties involved. It provides a higher level of security for exporters, as it assures them of payment as long as they comply with the specified terms. 3. Confirmed Letter of Credit: In this case, a confirming bank adds its confirmation to the letter of credit, guaranteeing the payment to the seller. This provides an additional layer of security to the beneficiary, especially when dealing with less familiar or high-risk markets. 4. Standby Letter of Credit: While not limited to the District of Columbia, this type of letter of credit is often used in international trade. It functions as a backup assurance to the beneficiary in case the buyer fails to fulfill their contractual obligations. The standby letter of credit is typically utilized when there is uncertainty surrounding the buyer's ability to pay. District of Columbia businesses engaging in international trade transactions often benefit from utilizing the General Letter of Credit with Account of Shipment. It allows for secure and reliable financial transactions, ensuring that both parties are protected throughout the process. Whether it is a revocable, irrevocable, confirmed, or standby letter of credit, choosing the right type depends on the specific needs and circumstances of the trade agreement.

District of Columbia General Letter of Credit with Account of Shipment

Description

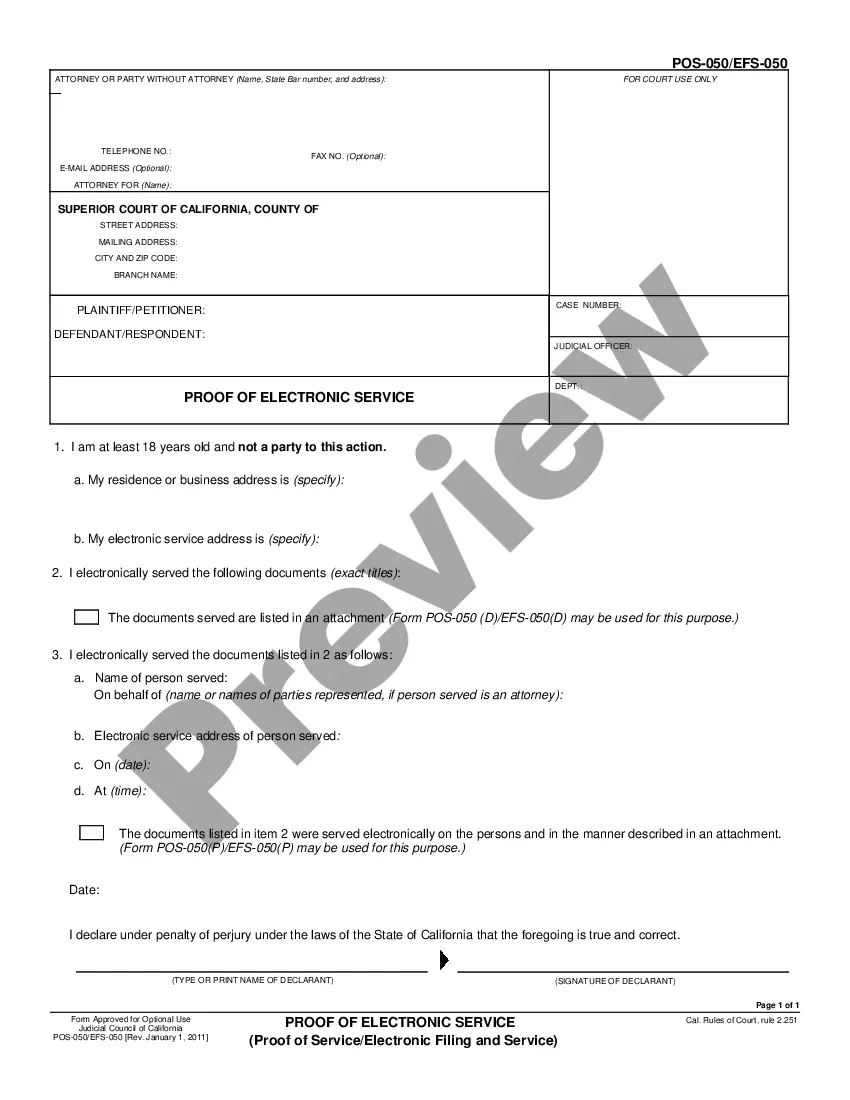

How to fill out District Of Columbia General Letter Of Credit With Account Of Shipment?

If you have to full, obtain, or print authorized record themes, use US Legal Forms, the most important selection of authorized kinds, which can be found on the Internet. Make use of the site`s easy and handy search to obtain the documents you will need. Different themes for enterprise and person purposes are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to obtain the District of Columbia General Letter of Credit with Account of Shipment in a few click throughs.

When you are already a US Legal Forms consumer, log in to your account and click the Down load button to find the District of Columbia General Letter of Credit with Account of Shipment. You may also access kinds you formerly acquired in the My Forms tab of your respective account.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that right metropolis/land.

- Step 2. Utilize the Preview choice to check out the form`s information. Do not forget to read the outline.

- Step 3. When you are not happy with all the develop, use the Lookup discipline on top of the display to find other variations of the authorized develop format.

- Step 4. When you have located the form you will need, click on the Buy now button. Select the prices prepare you like and add your references to sign up for the account.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Select the structure of the authorized develop and obtain it on your own product.

- Step 7. Full, change and print or signal the District of Columbia General Letter of Credit with Account of Shipment.

Each and every authorized record format you acquire is yours eternally. You may have acces to every develop you acquired inside your acccount. Select the My Forms section and pick a develop to print or obtain again.

Contend and obtain, and print the District of Columbia General Letter of Credit with Account of Shipment with US Legal Forms. There are many expert and state-specific kinds you may use for your enterprise or person needs.

Form popularity

FAQ

This is where a letter of credit or LC comes in handy. It is a guarantee issued by a bank for payment to the buyer while ensuring that the goods are shipped in good order.

You can open an LC and choose to make it available again in its original amount after the goods have been shipped, documents presented and credit is settled. Such an LC is a revolving LC. Under a revolving LC the amount is reinstated or renewed without any specific amendments to the LC.

A letter of credit or LC is a written document issued by the importer's bank (opening bank) on importer's behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.

A letter of credit, also known as a documentary credit, is a payment system that protects the exporter and the importer in a contract of sales. In short, the letter of credit is used to prove the importer's credit worthiness and guarantees payment of goods upon receipt.

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several other types of letters of credit.

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.