District of Columbia Amendment to Sales Contract of Real Property

Description

How to fill out Amendment To Sales Contract Of Real Property?

If you aim to accumulate, obtain, or produce authorized document templates, utilize US Legal Forms, the primary repository of legal forms, which can be accessed online.

Employ the website's user-friendly and straightforward search feature to locate the documents you require. Various templates for businesses and personal purposes are organized by categories and suggestions, or keywords.

Use US Legal Forms to find the District of Columbia Amendment to Sales Contract of Real Property within a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Complete and download, and print the District of Columbia Amendment to Sales Contract of Real Property with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms client, Log In to your account and click on the Download option to access the District of Columbia Amendment to Sales Contract of Real Property.

- You can also retrieve forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct jurisdiction.

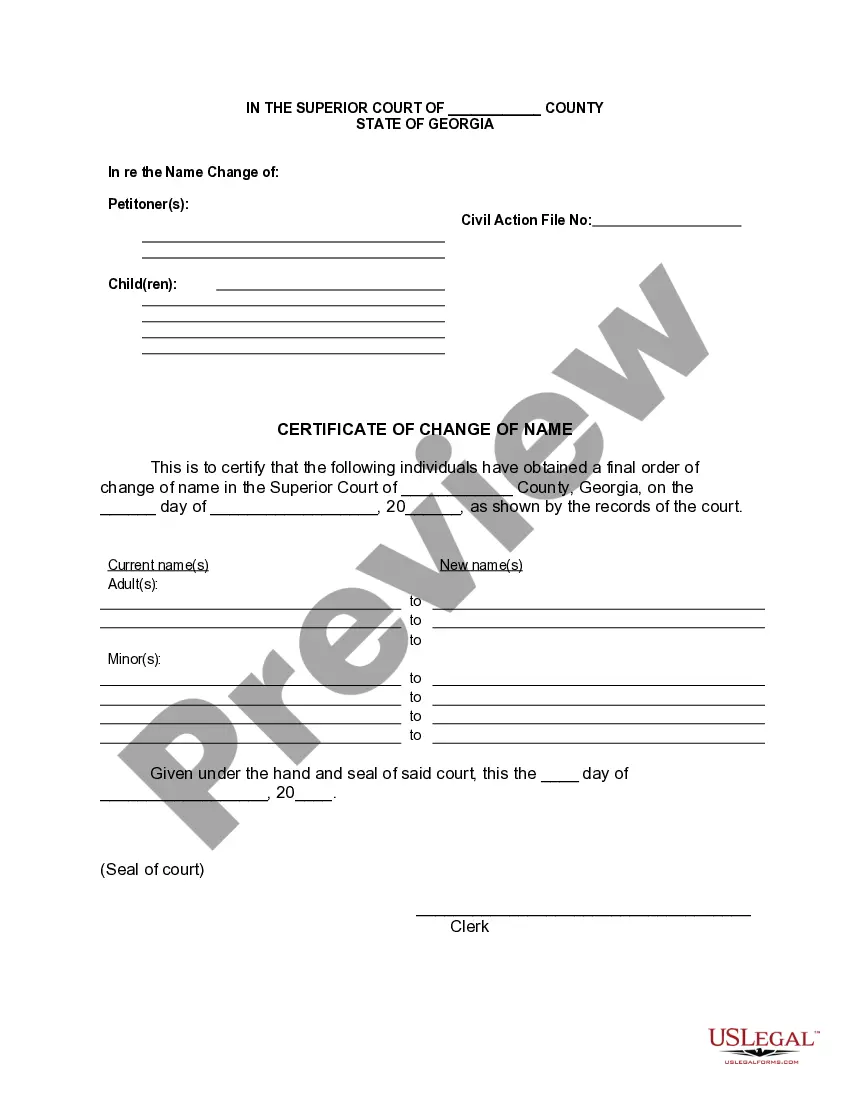

- Step 2. Utilize the Preview feature to review the content of the form. Be sure to examine the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other examples of the legal form design.

- Step 4. Once you have found the form you need, click the Buy now option. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the District of Columbia Amendment to Sales Contract of Real Property.

Form popularity

FAQ

To find out who owns a property in Washington, D.C., you can start by visiting the D.C. Office of Tax and Revenue's website. They provide a property search tool that allows you to input the property's address for ownership information. Additionally, you can refer to the District of Columbia Amendment to Sales Contract of Real Property for details related to ownership transfer. Using uslegalforms can streamline this process by offering forms and guidance that help clarify property ownership matters in D.C.

In the District of Columbia, the law requires that sales of real property are documented in a written contract, as specified in the DC Code 42 1301. This requirement helps protect both buyers and sellers and ensures transparency during the transaction. Proper documentation is essential for enforcing the terms of the contract in any future disputes.

An amendment to a contract of sale is a modification made to the original agreement, often to update terms or address changes in circumstances. In the District of Columbia, such amendments must be documented in writing and signed by both parties to maintain legal enforceability. This process helps ensure that all modifications are clear and agreed upon.

For a real estate contract to be enforceable in the District of Columbia, it must meet several criteria, including being in writing and signed by the involved parties. Additionally, the contract must contain essential elements such as offer, acceptance, and consideration. Ensuring these components are present can significantly reduce potential legal disputes.

To sell real property legally through a contract under the District of Columbia Amendment to Sales Contract of Real Property, the agreement must be in writing, signed by both parties. The contract must also describe the property being sold clearly. Additionally, the transaction must involve valid consideration, ensuring both parties acknowledge the exchange.

DC Code 42 1301 outlines the requirements for the sale and transfer of real property in the District of Columbia. It includes essential guidelines for creating legally binding contracts in real estate transactions. Understanding this code is crucial when dealing with amendments to sales contracts, ensuring compliance with local regulations.

For a contract to be legally enforceable in the context of the District of Columbia Amendment to Sales Contract of Real Property, it must include an offer, acceptance, consideration, and mutual consent. Both parties should have the legal capacity to enter into a contract and intend to create a legal obligation. Additionally, the contract must be specific and clear in its terms to avoid ambiguity.

Writing an amendment to a real estate contract requires clear and concise language that specifies the changes being made. Include details such as the parties involved, the original contract date, and a description of the amendments. When dealing with a District of Columbia Amendment to Sales Contract of Real Property, it's important to ensure that both parties agree and sign the document. Utilizing tools from USLegalForms can simplify this process, ensuring compliance and clarity.

To legally avoid taxes on property transfer in Washington, D.C., consider exemptions or reductions that may apply based on your circumstances. For instance, certain transfers between family members or charitable organizations may qualify. Consulting the District of Columbia Amendment to Sales Contract of Real Property can reveal specific ways to navigate these regulations. Furthermore, our platform, USLegalForms, offers resources to assist you in understanding tax implications.

The property tax rate in the District of Columbia is approximately 1.1% of the assessed value of residential properties. This rate can differ for commercial properties, so it is essential to understand how it applies to your situation. A thorough review of your obligations is crucial when you are working with the District of Columbia Amendment to Sales Contract of Real Property. Being informed helps avoid unexpected tax bills.