District of Columbia Invoice of Handyman

Description

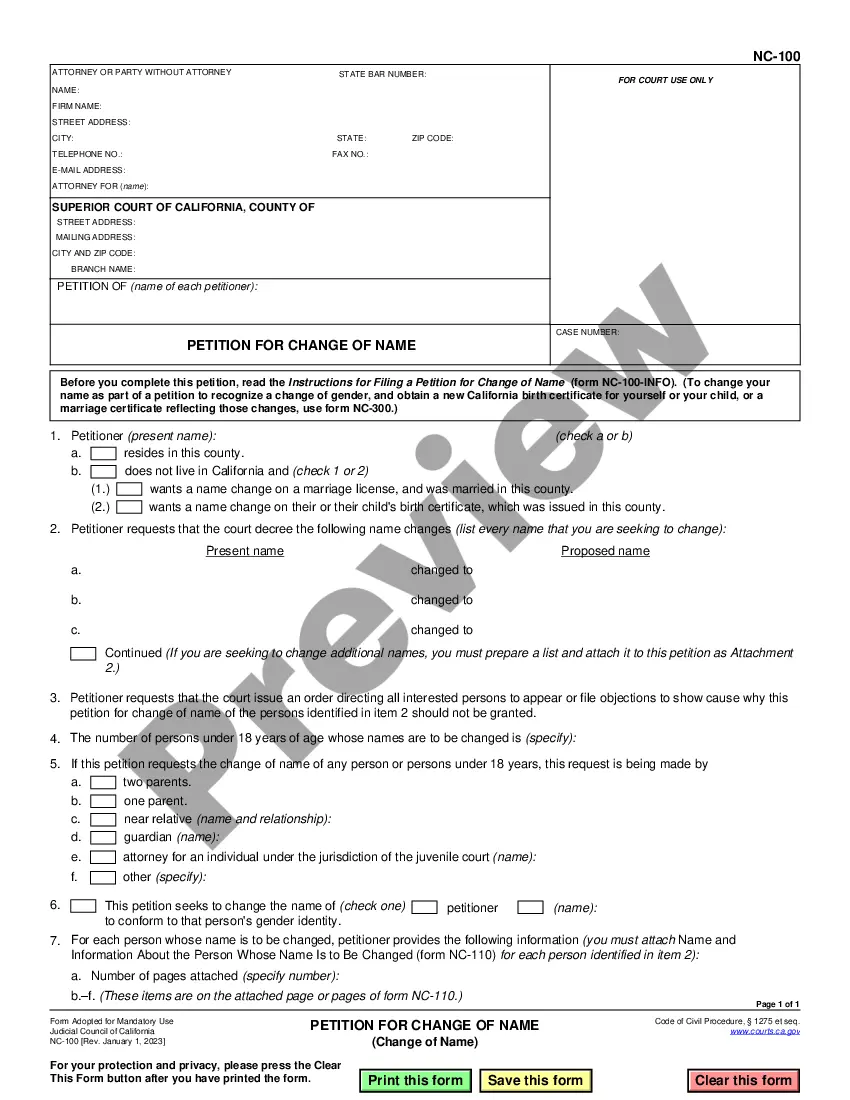

How to fill out Invoice Of Handyman?

It is feasible to devote hours online attempting to locate the authentic document template that complies with the state and federal regulations you require.

US Legal Forms offers thousands of legitimate documents that have been evaluated by professionals.

You can readily download or print the District of Columbia Handyman Invoice from our service.

If available, utilize the Preview button to skim through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- Afterward, you can fill out, modify, print, or sign the District of Columbia Handyman Invoice.

- Each legal document template you acquire is yours to keep indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and press the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to verify you have selected the correct form.

Form popularity

FAQ

No, the business license number and the Employer Identification Number (EIN) serve different purposes. The business license number identifies your business with regulatory bodies, while the EIN is used for federal tax purposes. It's crucial to have both numbers on hand when preparing the District of Columbia Invoice of Handyman for your clients, as they convey legitimacy and professionalism.

To acquire a business license in DC, you must complete an application through the DCRA. Gather necessary documents, including your business plan and identification. Once your application is processed, you will receive your license, allowing you to generate compliant District of Columbia Invoice of Handyman for your clients.

Creating a handyman invoice is simple. Start by using a template that includes your business details, the services provided, and the amount due. Ensure you include the terms of service and any relevant tax information. Utilizing services like USLegalForms can streamline the process and help you create a compliant District of Columbia Invoice of Handyman.

You can obtain a copy of your business license in DC by visiting the DCRA’s online services. Enter your business name or license number to locate your record. The District of Columbia Invoice of Handyman can be generated once you have your license information. This ensures your invoices are legitimate and professional.

To print your Washington State business license, first log in to your account on the Washington Secretary of State's website. Navigate to your business profile where you will find the option to print your license. Although this process may not directly apply to the District of Columbia Invoice of Handyman, having your documentation ready is essential for successful invoicing and operations.

To obtain a copy of your business license in the District of Columbia, visit the Department of Consumer and Regulatory Affairs (DCRA) website. Here, you can access the online portal for business licenses. You will need to provide your business details to retrieve the District of Columbia Invoice of Handyman information. If you encounter issues, the DCRA staff is available to assist.

Introduction. A contractor or subcontractor must charge sales tax to its customers if the work performed is repair, maintenance, or installation work.

In addition to federal income taxes, taxpayers in the nation's capital pay local taxes to the District of Columbia. These include a district income tax, with rates ranging from 4% to 10.75%, a 6% sales tax and property taxes on real estate. The District has an average effective property tax rate of 0.56%.

Traditional Goods or Services Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

Services to individuals and businesses things like haircuts, medical bills, consultant fees, etc. are not personal property, and most services are not subject to sales tax.