District of Columbia Assignment of Shares refers to a legal document that allows a shareholder to transfer their ownership of shares in a company to another person or entity. This process involves officially assigning all rights, benefits, and responsibilities associated with the shares to the assignee. The District of Columbia recognizes several types of Assignment of Shares, each with unique characteristics and purposes. Understanding these types is crucial for shareholders and businesses alike. Here are some key variations: 1. Voluntary Assignment of Shares: This type occurs when a shareholder willingly transfers their shares to another party. It may result from various reasons, such as a change in investment strategy, retirement, or the need to raise capital. Voluntary assignment requires the consent of both the assignor and assignee, as well as compliance with the company's governing documents and relevant laws. 2. Involuntary Assignment of Shares: In certain cases, shares may be involuntarily assigned due to legal proceedings or court orders. Examples include bankruptcy, divorce settlements, or enforcement of judgments. In these situations, the court may determine the assignment process and any limitations or conditions involved. 3. Restricted Assignment of Shares: Some shares have restrictions on their transferability, as specified in the company's articles of incorporation or bylaws. These restrictions may cover aspects like preemptive rights, rights of refusal, or requirements for board approval. Shareholders must comply with these restrictions when assigning their shares to others. 4. Inter Vivos Assignment of Shares: This type of assignment takes place during the shareholder's lifetime. It allows shareholders to transfer their shares to another person or entity without waiting for specific events, such as death or incapacity. Inter vivos assignments often occur in scenarios like mergers, acquisitions, or when a shareholder decides to transfer ownership to family members or business partners. 5. Testamentary Assignment of Shares: Testamentary assignments become effective upon the death of the shareholder. They are typically accomplished through a will or trust, designating the designated beneficiary or beneficiaries who will inherit the shares. District of Columbia laws govern the specific processes and specifications for testamentary assignments, safeguarding the interests of all parties involved. When executing a District of Columbia Assignment of Shares, shareholders should ensure compliance with the requirements set forth by the District of Columbia's Business Organizations Code, as well as adhere to any additional specifications outlined in the company's governing documents. Seeking legal counsel or professional assistance is always advisable to navigate the complexities involved in the assignment process accurately. In summary, District of Columbia Assignment of Shares refers to the legal mechanism through which shareholders transfer their ownership rights and responsibilities to another party. While various types of assignments exist, including voluntary, involuntary, restricted, inter vivos, and testamentary assignments, it is essential to understand and follow the specific requirements and regulations associated with each type to ensure the validity and enforceability of the assignment.

District of Columbia Assignment of Shares

Description

How to fill out District Of Columbia Assignment Of Shares?

US Legal Forms - one of several most significant libraries of legitimate varieties in the USA - offers a wide range of legitimate papers templates you can down load or produce. While using web site, you can find a huge number of varieties for enterprise and specific uses, categorized by classes, claims, or search phrases.You will discover the newest versions of varieties such as the District of Columbia Assignment of Shares within minutes.

If you currently have a registration, log in and down load District of Columbia Assignment of Shares from the US Legal Forms library. The Download option can look on each and every type you see. You gain access to all earlier delivered electronically varieties from the My Forms tab of your respective accounts.

In order to use US Legal Forms the first time, listed below are simple directions to obtain started out:

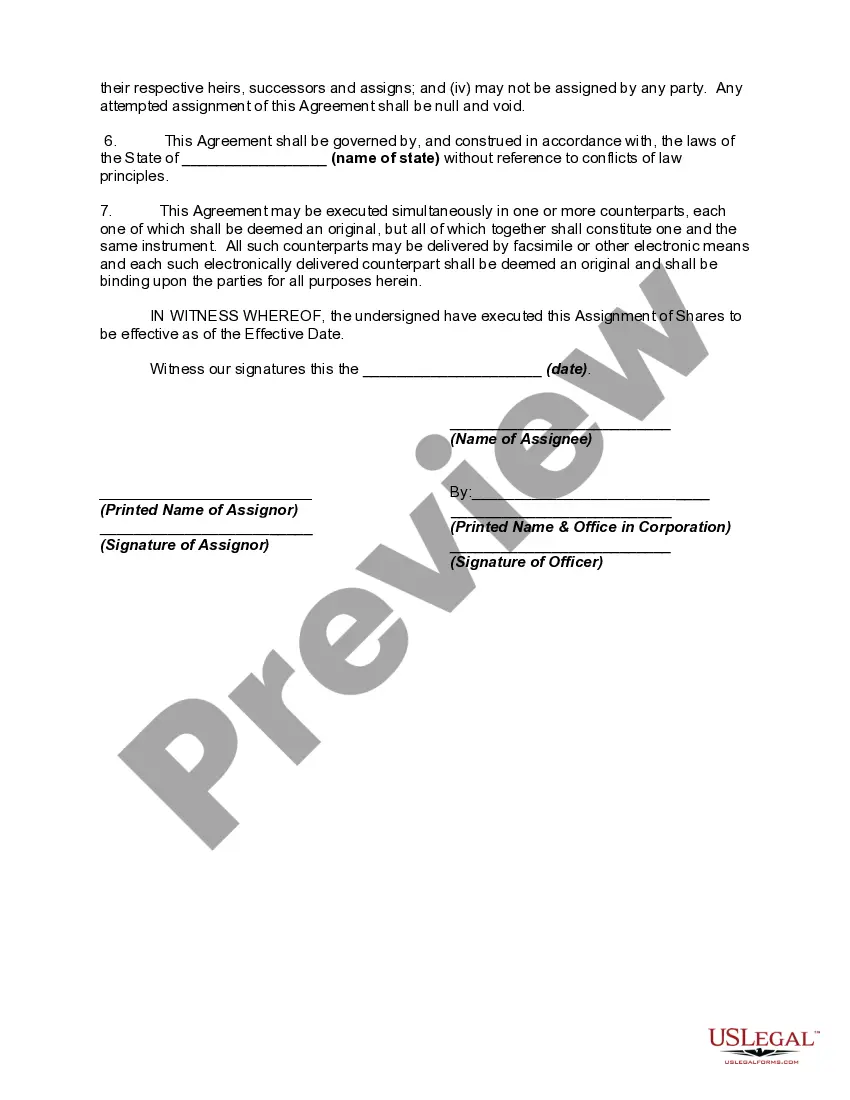

- Make sure you have selected the right type for your personal town/state. Select the Review option to check the form`s articles. Read the type explanation to ensure that you have selected the appropriate type.

- If the type does not fit your demands, use the Look for area near the top of the screen to discover the one who does.

- If you are pleased with the shape, validate your selection by clicking on the Purchase now option. Then, choose the costs strategy you want and offer your credentials to register for an accounts.

- Procedure the purchase. Make use of your charge card or PayPal accounts to finish the purchase.

- Choose the format and down load the shape on your gadget.

- Make alterations. Fill up, revise and produce and indicator the delivered electronically District of Columbia Assignment of Shares.

Each and every design you included with your account lacks an expiration day which is the one you have permanently. So, if you wish to down load or produce another copy, just proceed to the My Forms segment and then click in the type you require.

Obtain access to the District of Columbia Assignment of Shares with US Legal Forms, probably the most substantial library of legitimate papers templates. Use a huge number of skilled and status-certain templates that meet up with your small business or specific demands and demands.