A District of Columbia Invoice Template for Writer is a document designed to assist writers in preparing professional invoices for their services rendered in the District of Columbia. This template serves as a standardized format that includes all the necessary details and information needed by both the writer and their clients. The District of Columbia Invoice Template for Writer typically contains the following key elements: 1. Heading: The template starts with a clear heading mentioning "Invoice" or "Bill" followed by the writer's name, address, contact information, and the date the invoice was issued. 2. Client Information: Next, the template includes an area to input the client's details, including their name, address, contact information, and any specific identification number or reference provided by the client. 3. Invoice Number and Date: An invoice number and date are essential to track and identify each invoice uniquely. The template provides sections to input this information, streamlining record-keeping and organization. 4. Description of Services: This section is crucial, as it allows the writer to list the specific services provided to the client. It should be detailed, including the title, quantity, rate per unit or hourly rate (if applicable), and the total amount for each service rendered. 5. Payment Terms: The template includes a dedicated space to outline the payment terms agreed upon between the writer and client. This section may include the due date, accepted payment methods, late payment charges (if any), and any additional information regarding the payment process. 6. Subtotal, Taxes, and Total Amount: To calculate the total payable amount, the template includes a subtotal field where all service charges are added. If applicable, taxes such as sales tax or value-added tax (VAT) can be included before arriving at the final total amount due. 7. Notes or Terms and Conditions: For any additional information, notes, or specific terms and conditions agreed upon by both parties, the template provides space to include such details. This area can be used to mention any special arrangements made for the services or any other relevant messages. Different types of District of Columbia Invoice Templates for Writer may include variations in design layouts, color schemes, or additional features or sections to suit the individual writer's preferences and specific business needs. However, the core elements mentioned above remain essential in any District of Columbia Invoice Template for Writer.

District of Columbia Invoice Template for Writer

Description

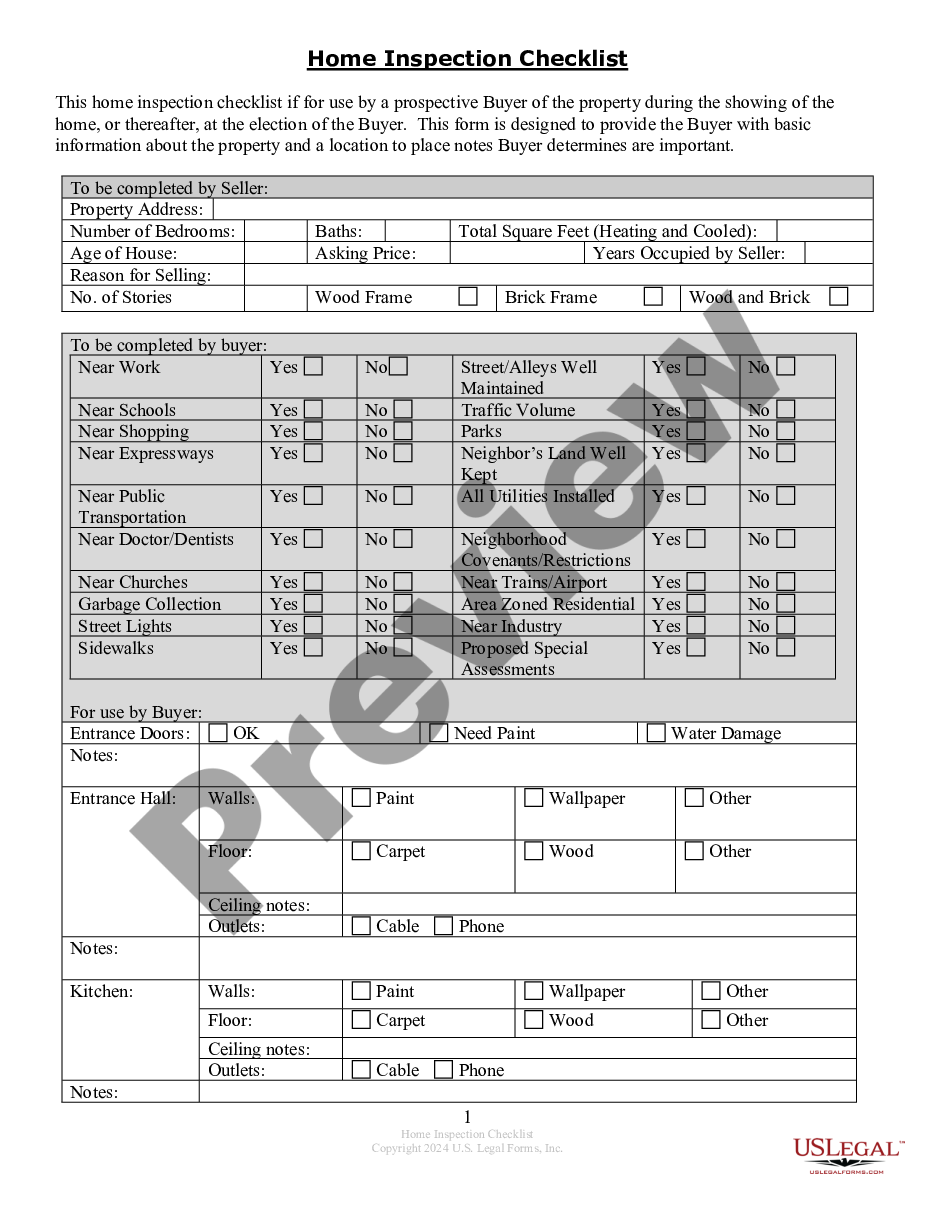

How to fill out District Of Columbia Invoice Template For Writer?

If you have to total, acquire, or printing legitimate document web templates, use US Legal Forms, the most important selection of legitimate varieties, which can be found on the web. Use the site`s simple and convenient search to get the documents you need. A variety of web templates for company and personal purposes are categorized by classes and says, or keywords and phrases. Use US Legal Forms to get the District of Columbia Invoice Template for Writer in just a handful of clicks.

In case you are already a US Legal Forms customer, log in to your profile and click on the Down load button to find the District of Columbia Invoice Template for Writer. Also you can entry varieties you previously acquired in the My Forms tab of your profile.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form to the right town/land.

- Step 2. Use the Preview solution to examine the form`s information. Never forget about to read the explanation.

- Step 3. In case you are unsatisfied with all the develop, take advantage of the Search discipline towards the top of the display screen to find other variations of your legitimate develop design.

- Step 4. After you have located the form you need, select the Buy now button. Choose the costs plan you prefer and add your accreditations to register for an profile.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal profile to accomplish the purchase.

- Step 6. Choose the file format of your legitimate develop and acquire it in your system.

- Step 7. Total, change and printing or indication the District of Columbia Invoice Template for Writer.

Every legitimate document design you buy is your own for a long time. You might have acces to every develop you acquired inside your acccount. Go through the My Forms portion and pick a develop to printing or acquire once again.

Compete and acquire, and printing the District of Columbia Invoice Template for Writer with US Legal Forms. There are thousands of specialist and condition-distinct varieties you can use for your company or personal requires.

Form popularity

FAQ

You can find Google invoices within your Google account settings or billing section if you are looking for invoices related to Google services. For creating your own invoices, consider using the District of Columbia Invoice Template for Writer available in Google Docs. This template allows you to issue professional invoices with ease, ensuring you keep proper records for your business.

Finding templates in Google Docs is simple. Open Google Docs and select 'Template Gallery' on the homepage. You can browse through various categories, including the business section, where you may find the District of Columbia Invoice Template for Writer suitable for your invoicing needs. This access helps streamline your document creation process.

To find an invoice template in Google Docs, start by opening a new document. Click on 'File' and look for 'New' followed by 'From template.' This will lead you to the template gallery, where you can search for the District of Columbia Invoice Template for Writer, making it easy to create professional invoices that meet local standards.

Setting up an invoice template is straightforward. First, select an existing template from Google Docs or create one from scratch. Customize the District of Columbia Invoice Template for Writer by adding your details, such as your name, business address, and client information. Then, adjust any necessary fields, like item descriptions and amounts, to fit your services.

You can easily find an invoice template in Google Docs by navigating to the template gallery. Just open Google Docs, click on 'Template Gallery' at the top, and browse the available options. Look specifically for the business category, where you will find various invoice templates, including the District of Columbia Invoice Template for Writer, which suits your needs perfectly.

To create a freelance writing invoice, begin by selecting a suitable District of Columbia Invoice Template for Writer. Input your name and contact information, as well as the client's details. Clearly outline the writing services provided, the total amount due, and any payment terms. This organized approach makes invoicing straightforward and professional.

Freelancers typically issue invoices by sending a professional document to their clients. Using a District of Columbia Invoice Template for Writer is an effective approach for many. This template helps freelancers create clear, concise invoices that include all necessary details. This professionalism can enhance relationships with clients and support timely payments.

Yes, you certainly can create an invoice as a freelancer. Using a District of Columbia Invoice Template for Writer gives you a professional framework to follow. This template provides the necessary structure for adding your services, client information, and payment details. With this tool, you can easily manage your freelance billing.

Filling out invoice details requires attention to accuracy. Start with your name and contact information on the District of Columbia Invoice Template for Writer. Next, include the client's information, a detailed description of the services, the total amount charged, and payment due date. Clarity in these details prevents misunderstandings and helps in timely payments.

Filling out an invoice template involves inputting specific information accurately. First, personalize the District of Columbia Invoice Template for Writer with your business and contact information. Then, populate the client's details, describe the services rendered, and outline the payment terms. This process ensures transparency and clarity in your billing.