District of Columbia Guaranty of a Lease

Description

How to fill out Guaranty Of A Lease?

Are you in a situation where you need documents for either business or personal purposes almost all the time.

There are many valid document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a vast array of form templates, including the District of Columbia Guaranty of a Lease, designed to comply with federal and state regulations.

Once you have the correct form, click Buy now.

Select the pricing plan you want, enter the required information to create your account, and complete the order using your PayPal or Credit Card. Choose a convenient format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the District of Columbia Guaranty of a Lease anytime if needed. Click on the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the District of Columbia Guaranty of a Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/county.

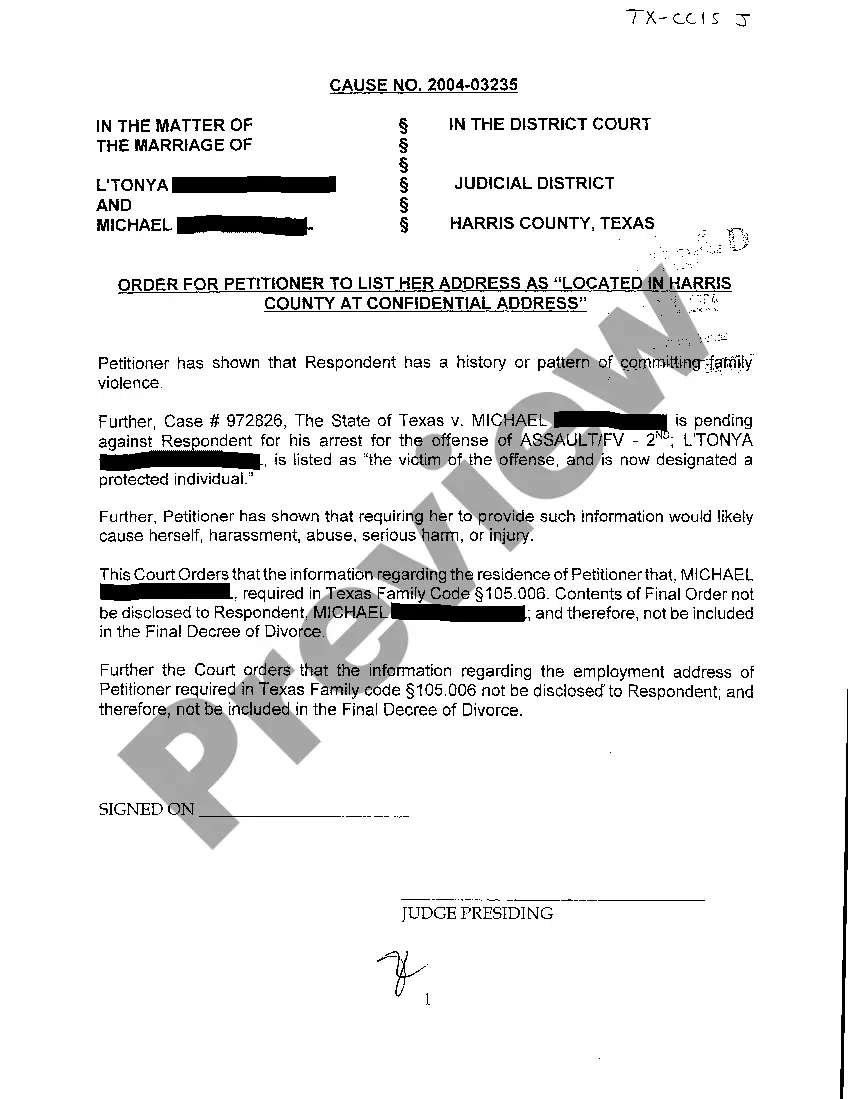

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the right form.

- If the form does not meet your needs, utilize the Search box to find a form that satisfies your requirements.

Form popularity

FAQ

The guarantee in a lease, especially in the District of Columbia Guaranty of a Lease, refers to the party that guarantees the performance of the lease terms if the primary tenant fails to comply. This is often a person or business entity willing to take on the risk of the lease obligations. Understanding the dynamic between the tenant and the guarantor is crucial, as it ensures that landlords can enforce the lease even when unexpected issues arise. For comprehensive legal forms or advice, referring to uslegalforms can streamline the process.

Under the District of Columbia Guaranty of a Lease, a guarantor holds specific rights related to the lease agreement. These rights typically include the ability to receive notices regarding lease defaults and the right to be informed about changes in lease terms. Although a guarantor does bear the financial responsibility, they should also understand how their rights protect them in case of disputes. Consulting legal documentation and firm platforms like uslegalforms can clarify these rights.

In the context of the District of Columbia Guaranty of a Lease, a guarantor can be a family member, friend, or a business entity with strong financial standing. Landlords often prefer guarantors who possess good credit histories and stable incomes, as this reduces their risk. It is essential to check the specific requirements of the landlord or leasing agency when selecting an appropriate guarantor. If you're unsure, legal resources like uslegalforms can provide valuable guidance.

Dealing with an irresponsible landlord can be frustrating, but assertiveness is crucial. Start by documenting every instance of neglect or bad behavior, and communicate your concerns clearly. If issues persist, you may want to reference the District of Columbia Guaranty of a Lease for your rights, and consider seeking legal advice or using platforms like uslegalforms to assist in resolutions.

To file a complaint against a landlord in the District of Columbia, gather all necessary documents, including your lease agreement and any correspondence with your landlord. Visit the Department of Consumer and Regulatory Affairs website for the procedures and forms needed. Including details about the District of Columbia Guaranty of a Lease can help clarify your rights.

If you face issues with your landlord, you can file a complaint with the Department of Consumer and Regulatory Affairs in the District of Columbia. They handle various landlord-tenant disputes and can provide assistance. Referencing the District of Columbia Guaranty of a Lease in your complaint may strengthen your case.

Landlords in the District of Columbia have the right to receive timely rent payments, access the property for necessary repairs, and maintain the property’s condition. However, they must respect tenant privacy and follow legal procedures when initiating eviction. Being aware of these rights and the District of Columbia Guaranty of a Lease can help ensure a fair rental experience.

Breaking a lease early in the District of Columbia can lead to legal consequences and financial penalties. You may still be responsible for rent until the lease ends or until your landlord finds a new tenant. Understanding the specifics of the District of Columbia Guaranty of a Lease can help you navigate this situation better.

In most cases, a lease guaranty in the District of Columbia does not require notarization, but it is a good practice. Having a notarized lease guaranty can add an extra layer of validity, ensuring all parties have verified signatures. If you want to be protected under the District of Columbia Guaranty of a Lease, consider having the document notarized to avoid disputes in the future.

If you confront your landlord about issues like neglect or lease violations, be clear and direct. Document your communications and keep copies of any relevant correspondence. You may consider sending a formal letter indicating your intent to take legal action if the issues remain unresolved, referencing the District of Columbia Guaranty of a Lease, which helps protect your rights as a tenant.