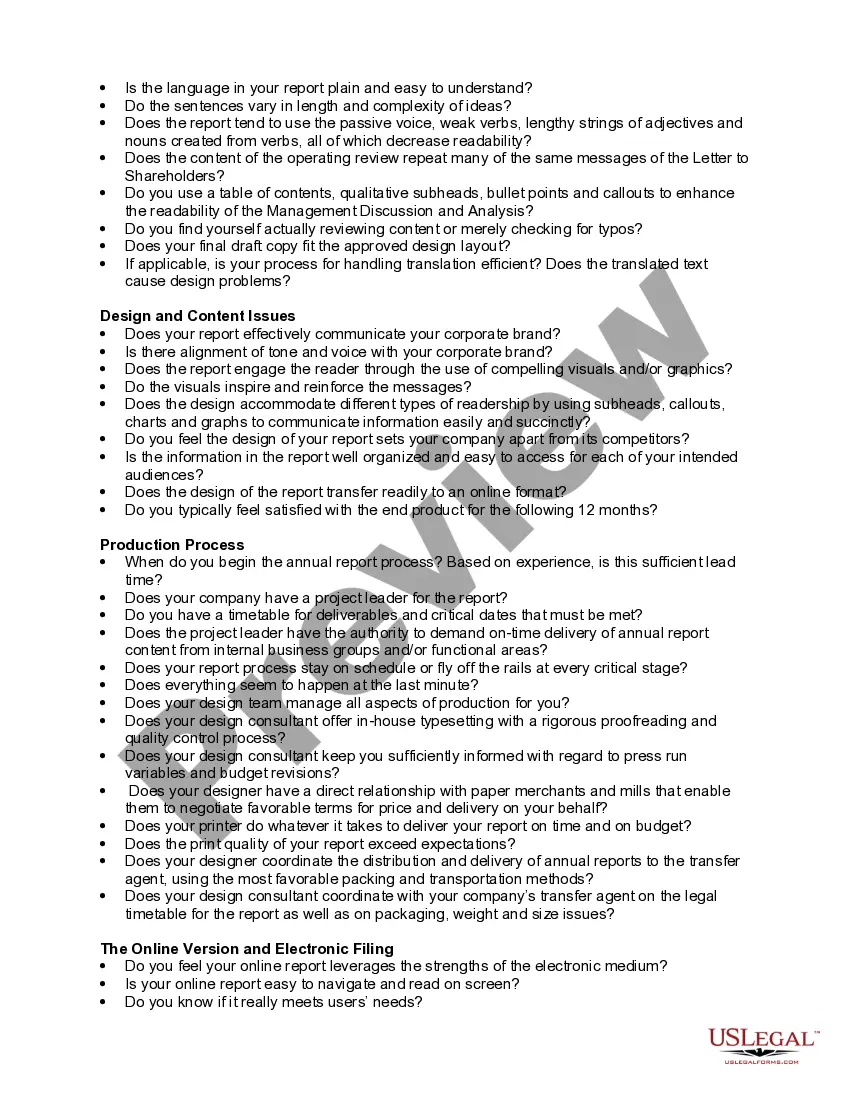

District of Columbia Checklist: Dealing with Shareholders and Investors — Preparing a User-Friendly Annual Report Introduction: The District of Columbia is not only the capital of the United States but also a thriving hub for businesses and investment opportunities. As companies in the District of Columbia strive to attract shareholders and investors, preparing a user-friendly annual report becomes crucial. This comprehensive checklist provides a detailed description of the key steps involved in creating an engaging and informative annual report that effectively communicates with stakeholders. Keywords: District of Columbia, checklist, shareholders, investors, annual report, user-friendly, engaging, informative, stakeholders. 1. Understand Your Audience: Before diving into the annual report preparation process, it is crucial to identify and understand your target audience, which includes both shareholders and investors. Consider their level of expertise, preferred communication style, and areas of interest to tailor your report effectively. 2. Define the Report's Purpose: Clearly define the purpose of your annual report to ensure a focused and concise document. Identify whether it aims to showcase financial performance, strategic initiatives, regulatory compliance, or a combination of these elements. 3. Include Key Financial Information: Shareholders and investors closely analyze financial data to assess the company's performance. Ensure your report includes essential financial statements, such as the income statement, balance sheet, and statement of cash flows, presented in a clear and understandable format. 4. Discuss Strategic Initiatives: Highlighting the company's strategic initiatives can enhance shareholder and investor confidence. Clearly outline the goals, progress, and strategic milestones achieved during the reporting period, emphasizing how they contribute to long-term growth and profitability. 5. Address Regulatory Compliance: Provide an overview of the company's compliance with relevant regulations and laws applicable to the District of Columbia. Discuss any changes or updates to compliance requirements, demonstrating a commitment to ethical conduct and corporate governance. 6. Engage Through Visuals: Incorporate visual elements, such as charts, graphs, and infographics, to present complex data in an easily digestible format. Visual representations enhance understanding and engagement, enabling shareholders and investors to grasp information quickly. 7. Provide a Management Discussion and Analysis (MDA): Include a well-written and comprehensive MDA section that analyzes the company's financial performance, opportunities, risks, and challenges. This section should provide insights into the factors affecting the company's success or shortcomings during the reporting period. 8. Incorporate a Corporate Social Responsibility (CSR) Section: Demonstrate your company's commitment to social responsibility and sustainable practices by including a dedicated CSR section. Highlight initiatives related to environmental stewardship, community involvement, diversity, and employee well-being. 9. Use Plain Language: Present information in simple and concise language to ensure understanding across various readership levels. Avoid excessive technical jargon and clarify complex concepts, making the report accessible to both financial experts and general stakeholders. Types of District of Columbia Checklist — Dealing with Shareholders and Investors — Preparing a User-Friendly Annual Report: 1. Financial Focus Checklist: This checklist specifically emphasizes financial statements, performance analysis, and regulatory compliance to meet the needs of shareholders and investors primarily interested in financial indicators and metrics. 2. Strategic Planning Checklist: This checklist goes beyond financials and focuses on outlining the company's strategic initiatives, future goals, and progress. It caters to shareholders and investors interested in the company's growth potential and long-term strategic vision. 3. Sustainability and CSR Checklist: This checklist provides guidance on incorporating a comprehensive CSR section within the annual report. It addresses shareholders and investors concerned about the company's environmental and social impact and its adherence to sustainable business practices. By following this comprehensive District of Columbia checklist, companies can effectively communicate with their shareholders and investors through a user-friendly annual report that efficiently presents key information, engages stakeholders, and enhances the company's reputation.

District of Columbia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report

Description

How to fill out District Of Columbia Checklist - Dealing With Shareholders And Investors - Preparing A User-Friendly Annual Report?

US Legal Forms - among the biggest libraries of legal forms in the States - provides a wide array of legal document layouts you can download or printing. While using site, you can find thousands of forms for enterprise and specific purposes, categorized by groups, claims, or search phrases.You can get the most recent types of forms like the District of Columbia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report in seconds.

If you currently have a registration, log in and download District of Columbia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report through the US Legal Forms catalogue. The Down load switch can look on each and every type you perspective. You have accessibility to all formerly acquired forms in the My Forms tab of the profile.

In order to use US Legal Forms initially, listed below are easy instructions to obtain began:

- Make sure you have chosen the correct type for your personal area/area. Go through the Preview switch to analyze the form`s content material. Browse the type outline to ensure that you have selected the appropriate type.

- When the type does not satisfy your needs, utilize the Look for area towards the top of the screen to find the one which does.

- If you are happy with the shape, affirm your choice by simply clicking the Purchase now switch. Then, select the costs program you like and provide your references to register to have an profile.

- Approach the deal. Make use of credit card or PayPal profile to finish the deal.

- Choose the file format and download the shape on your product.

- Make adjustments. Complete, change and printing and indicator the acquired District of Columbia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report.

Each and every web template you included in your money lacks an expiration date which is your own property for a long time. So, if you want to download or printing an additional version, just check out the My Forms section and click on the type you will need.

Obtain access to the District of Columbia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report with US Legal Forms, probably the most considerable catalogue of legal document layouts. Use thousands of expert and state-specific layouts that meet up with your organization or specific demands and needs.