Key-person insurance benefits are often used to buy out the insured person's shares or interest in the company. Buy-sell agreements, which require the deceased executive's estate to sell its stock to the remaining shareholders, legally facilitate this process. Proceeds from key-person insurance can also be used to recruit replacement management.

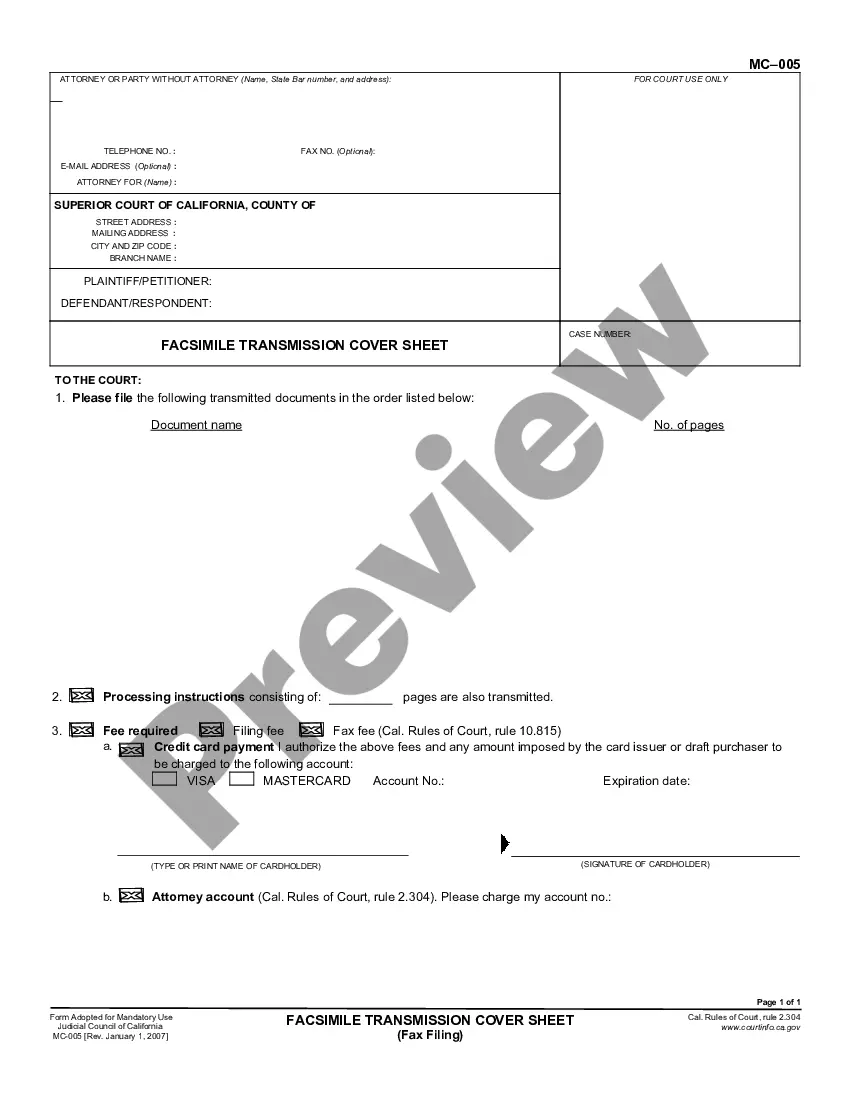

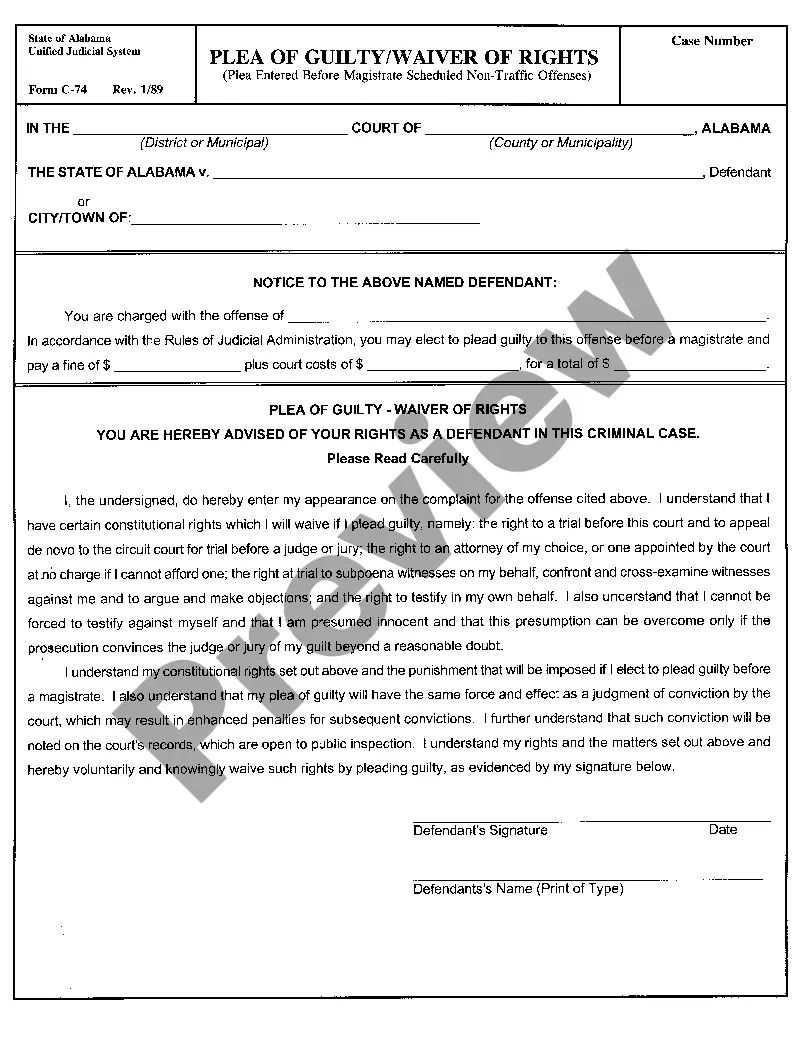

The following form contains some critical questions you should ask your agent or broker when considering this type of insurance.

District of Columbia Checklist — Key Employee Life Insurance: A Comprehensive Guide to Protecting Your Organization's Most Valuable Assets Key employee life insurance is an important aspect of ensuring the long-term stability and success of any organization operating in the vibrant District of Columbia (DC) business environment. This detailed checklist will provide you with a step-by-step guide to understanding and obtaining key employee life insurance in DC. What is Key Employee Life Insurance? Key employee life insurance is a specialized type of life insurance policy designed to protect businesses against the financial consequences of losing an essential employee. This coverage helps mitigate the potential losses incurred due to the sudden death or disability of a key employee, such as a key executive, director, or other crucial team member. District of Columbia Checklist for Key Employee Life Insurance: 1. Assessing the Value of Key Employees: Identify crucial personnel whose absence would have a significant impact on your organization's operations, revenue, or reputation. 2. Determining Insurance Coverage Needs: Calculate an appropriate coverage amount based on the key employee's contribution to the company. Consider factors such as salary, expertise, relationships, and unique skill sets. 3. Analyzing Policy Types: Familiarize yourself with the two primary types of key employee life insurance policies available in DC: employer-owned and employee-owned. Understanding the advantages and disadvantages of each will help you make an informed decision. 4. Researching Insurance Providers: Conduct thorough research to identify reputable insurance providers in DC who specialize in providing key employee life insurance. Look for providers with a track record of financial stability, strong customer service, and competitive premiums. 5. Comparing Policy Offerings: Once potential insurance providers have been identified, compare policy offerings, terms, conditions, and premiums to find the best fit for your organization's needs and budget. 6. Determining Payment Responsibility: Decide whether the organization or the key employee will be responsible for paying the premiums. This decision may influence the tax implications for both parties. 7. Evaluating Tax Implications: Understand the tax implications associated with key employee life insurance in the District of Columbia. Seek advice from tax professionals to make the most advantageous decisions for your organization's financial strategy. 8. Completing the Application Process: Gather all necessary documentation, complete the application forms provided by the selected insurance provider, and submit them in a timely manner. 9. Reviewing Policy Regularly: Once the policy is in place, periodically reassess coverage needs as your organization evolves. Be proactive in adjusting coverage levels to match any changes in key employees' roles or responsibilities. Types of Key Employee Life Insurance in the District of Columbia: 1. Employer-Owned Key Employee Life Insurance: In this type, the business becomes the policyholder and beneficiary. The organization pays premiums and receives the death benefit if the key employee passes away. It provides financial stability to the company during the transition period after the loss of a key employee. 2. Employee-Owned Key Employee Life Insurance: Here, the key employee owns the policy, paying premiums and designating beneficiaries. This coverage can serve as a valuable personal asset, providing financial security for the key employee's family while still serving the interests of the business. Securing key employee life insurance is a proactive and strategic measure that helps protect a business from the unforeseen loss of critical personnel. By following this comprehensive District of Columbia Checklist, you can ensure that your organization is adequately prepared to navigate unexpected challenges and maintain its competitive edge in the dynamic DC market.