District of Columbia Checklist - For Establishing a Website

Description

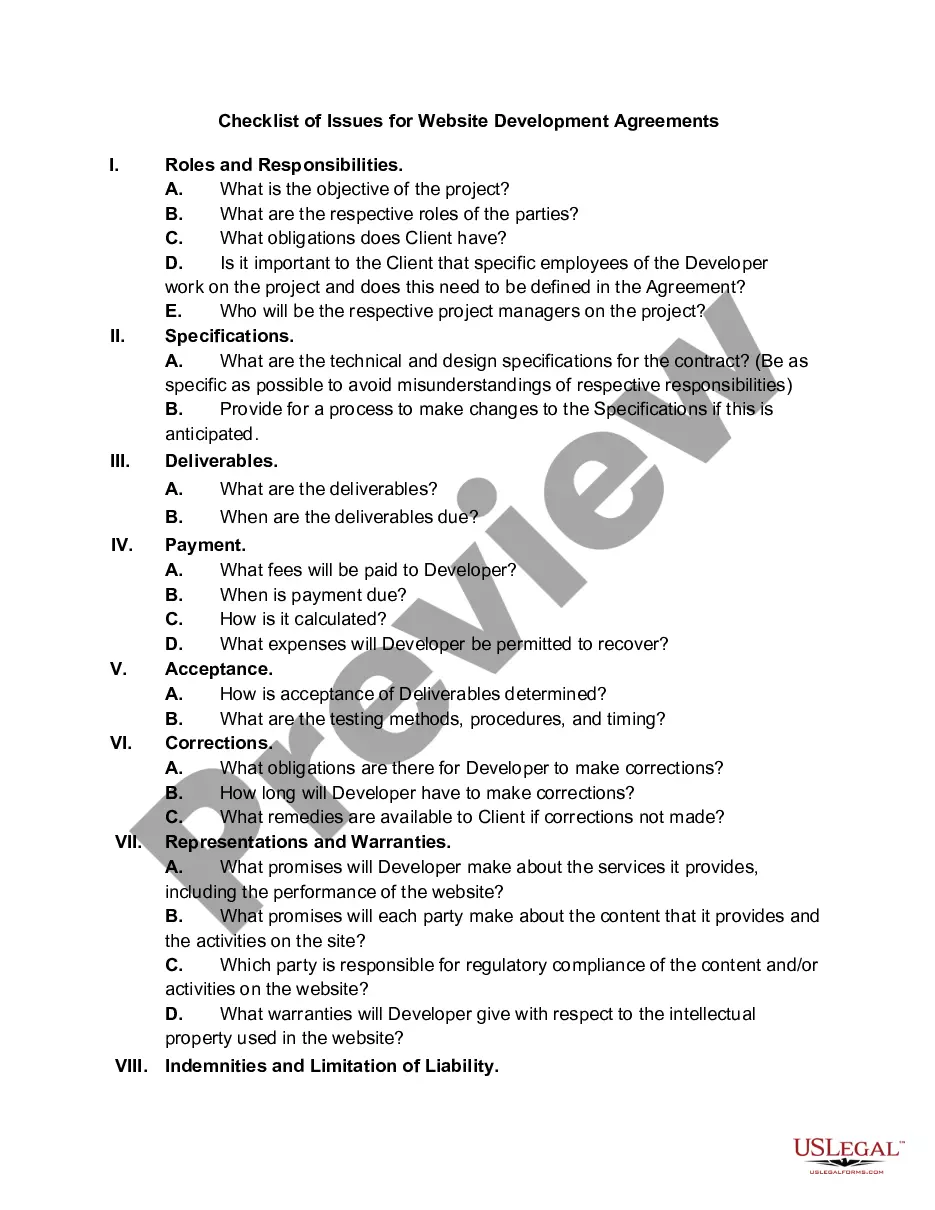

How to fill out Checklist - For Establishing A Website?

Are you currently in a situation where you frequently require documents for either professional or personal purposes almost every day.

There are numerous legal form templates available online, but finding trustworthy versions can be challenging.

US Legal Forms provides thousands of document templates, such as the District of Columbia Checklist - For Establishing a Website, designed to comply with state and federal regulations.

When you find the appropriate form, click Purchase now.

Select the pricing plan you desire, fill in the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the District of Columbia Checklist - For Establishing a Website template.

- If you do not have an account but want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct region/area.

- Utilize the Review option to examine the form.

- Check the details to confirm you have selected the correct document.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Verifying a business license in the District of Columbia can be done through the Department of Consumer and Regulatory Affairs' online portal. By entering the business name or license number, you can easily check the status of the license. This is important for ensuring that a business is compliant with local regulations. The District of Columbia Checklist - For Establishing a Website provides references for where to find this information.

Registering for FR 500 in the District of Columbia involves completing an online registration process at the Office of Tax and Revenue's website. You should ensure all business information is accurate before submitting. Once registered, you will receive further instructions regarding filing taxes. The District of Columbia Checklist - For Establishing a Website is essential for completing this task efficiently.

To obtain a clean hands certificate in the District of Columbia, you should visit the Department of Consumer and Regulatory Affairs' website. This certificate indicates that there are no tax liens or delinquencies against you. You may need to provide personal information to complete your request. Using the District of Columbia Checklist - For Establishing a Website will help ensure you have all necessary information at hand.

Registering a foreign corporation in the District of Columbia requires filing an application for a Certificate of Authority with the Department of Consumer and Regulatory Affairs. You will need to provide documentation from your home state, confirming your incorporation. This process includes paying the associated fees and designating a registered agent. Refer to the District of Columbia Checklist - For Establishing a Website for a comprehensive guide.

To establish an LLC in the District of Columbia, you must file Articles of Organization with the Department of Consumer and Regulatory Affairs. This involves selecting a unique name and designating a registered agent. Once filed, ensure you obtain an Employer Identification Number, which is vital for tax purposes. Following the District of Columbia Checklist - For Establishing a Website can simplify this process for you.

Applying for tax exemption in the District of Columbia involves submitting the appropriate forms to the Department of Tax and Revenue. You should provide the necessary details about your organization and its purposes. It may take time to process your application, so you should have your documentation in order. The District of Columbia Checklist - For Establishing a Website can help you verify that all steps are completed properly.

To file form FR 500 in the District of Columbia, you can visit the official website of the Office of Tax and Revenue. It is a straightforward process where you complete the form online or download it for physical submission. Ensure that you have all necessary documentation ready, as this will streamline your filing. Following the District of Columbia Checklist - For Establishing a Website can guide you through the requirements.

Yes, freelancers in the District of Columbia also need to obtain a business license. This requirement legitimizes your freelance work and protects your rights as a professional. Following the District of Columbia Checklist - For Establishing a Website will help you understand the specific steps for obtaining your license. USLegalForms is a helpful resource to make this licensing process easier for you.

To obtain a Basic Business License (BBL) in DC, you must complete an application that includes necessary documents and fees. The application process can be complex, but the District of Columbia Checklist - For Establishing a Website simplifies these steps. By leveraging USLegalForms, you can access resources and templates to ensure your application is accurate and complete.

To file FR 500 DC, you need to complete and submit the form through the DC Office of Tax and Revenue. This form is vital for reporting your business’s income and taxes in the District. You can find instructions by referring to the District of Columbia Checklist - For Establishing a Website. Consider using USLegalForms for assistance in completing and filing this form accurately.