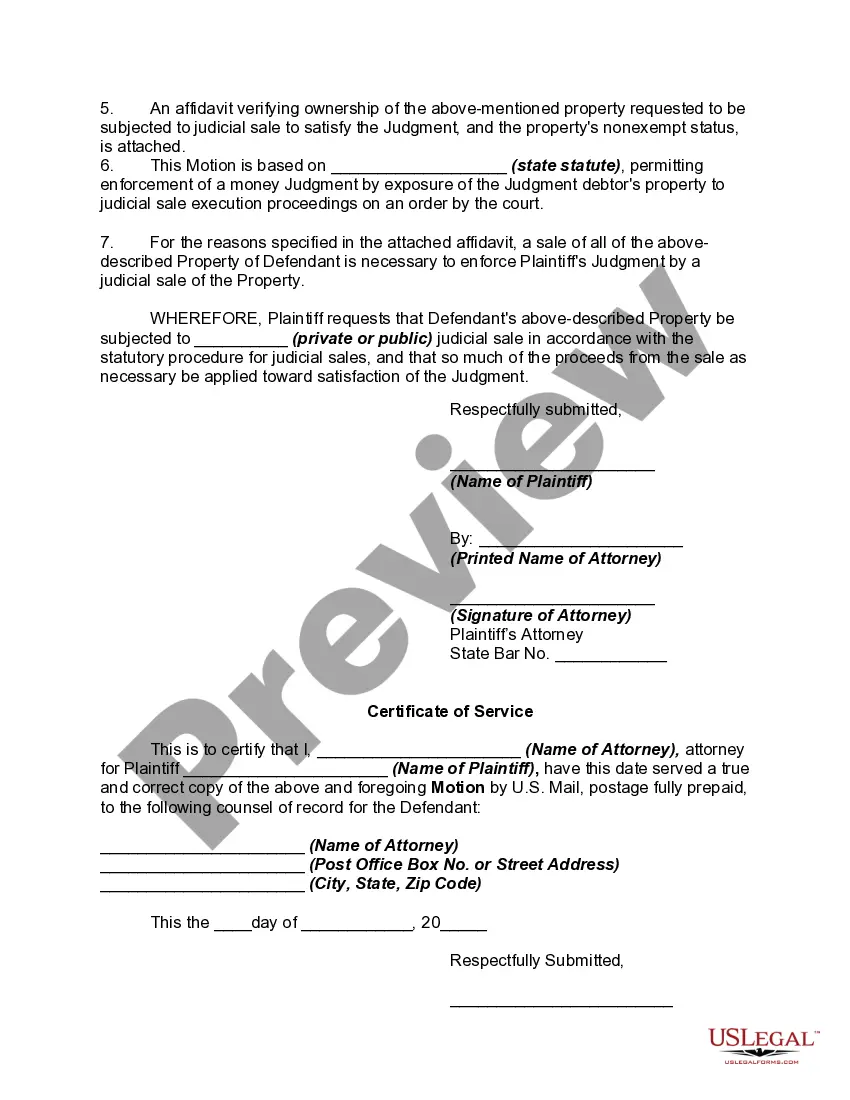

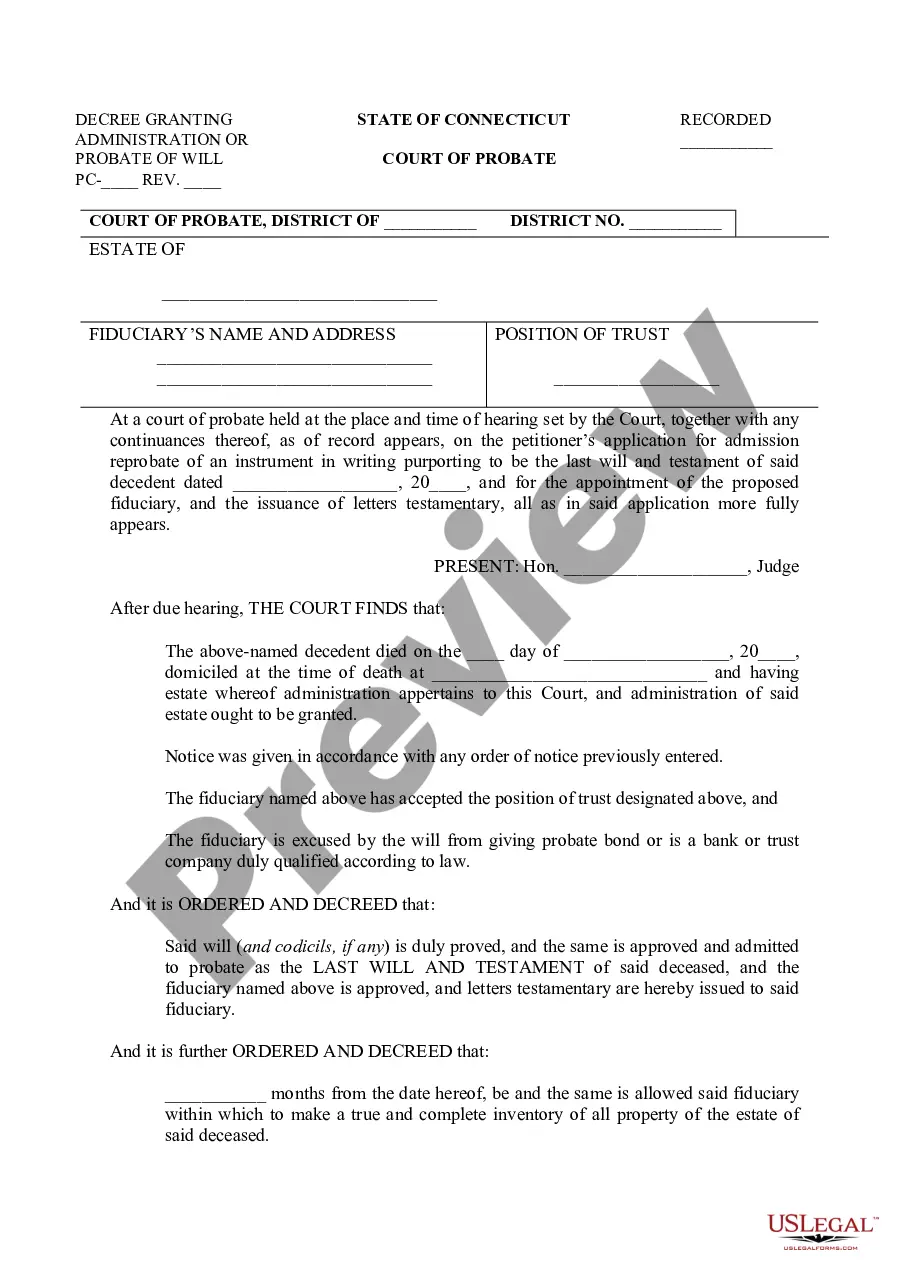

A judicial foreclosure proceeding can be initiated at any time after default on a secured obligation or a judgment which constitutes a lien on real property. The following form is a complaint that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

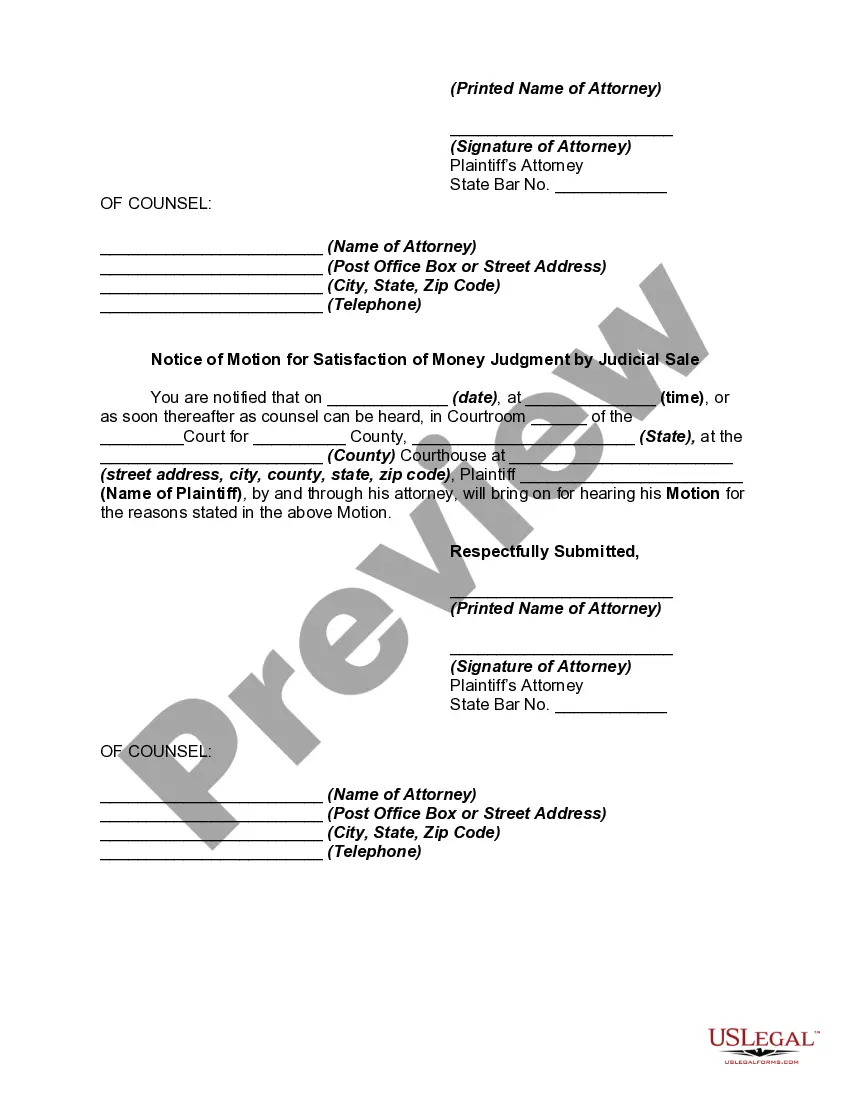

District of Columbia Motion for Satisfaction of Money Judgment by Judicial Sale

Description

How to fill out Motion For Satisfaction Of Money Judgment By Judicial Sale?

Are you currently inside a position that you require papers for sometimes enterprise or personal purposes virtually every day? There are a variety of legal file templates available on the net, but discovering ones you can rely on is not straightforward. US Legal Forms offers thousands of develop templates, like the District of Columbia Motion for Satisfaction of Money Judgment by Judicial Sale, that happen to be composed to satisfy federal and state specifications.

Should you be previously informed about US Legal Forms site and also have a merchant account, simply log in. Following that, you can obtain the District of Columbia Motion for Satisfaction of Money Judgment by Judicial Sale template.

Should you not come with an bank account and want to start using US Legal Forms, adopt these measures:

- Get the develop you need and ensure it is for the proper metropolis/region.

- Utilize the Preview option to examine the shape.

- Read the outline to ensure that you have chosen the right develop.

- In case the develop is not what you are trying to find, make use of the Research area to find the develop that suits you and specifications.

- Whenever you find the proper develop, just click Get now.

- Opt for the rates plan you need, complete the specified details to make your account, and purchase the transaction using your PayPal or charge card.

- Decide on a convenient document file format and obtain your backup.

Locate each of the file templates you may have bought in the My Forms menu. You can obtain a further backup of District of Columbia Motion for Satisfaction of Money Judgment by Judicial Sale whenever, if possible. Just select the essential develop to obtain or printing the file template.

Use US Legal Forms, one of the most substantial collection of legal kinds, in order to save some time and avoid faults. The service offers skillfully created legal file templates that can be used for an array of purposes. Create a merchant account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

(a) In any case in which a writ of attachment is issued, the plaintiff may submit interrogatories in writing, in such form as may be allowed by the rules or special order of the court, to be served upon any garnishee, asking about any property of the defendant in his possession or charge, or indebtedness of his to the ...

2000.2No person shall fail or refuse to comply with any lawful order or direction of any police officer, police cadet, or civilian crossing guard invested by law with authority to direct, control, or regulate traffic.

No later than 28 days after the entry of judgment, the court, on its own, may order a new trial for any reason that would justify granting one on a party's motion. After giving the parties notice and an opportunity to be heard, the court may grant a timely motion for a new trial for a reason not stated in the motion.

DISTRICT OF COLUMBIA A final judgment is enforceable for twelve years. D.C. Code § 15-101. An order of revival extends the effect of the judgment for another twelve years from the date of the revival order.

If the losing party does not pay the winning party, the winning party may apply for a writ of attachment on a judgment. A writ of attachment is a form issued by the Court that allows the winning party to get monies from the losing party's wages and/or bank account and other property owed to the winning party.

§ 15?101. The time during which the judgment creditor is stayed from enforcing the judgment, by written agreement filed in the case, or other order, or by the operation of an appeal, may not be computed as a part of the period within which the judgment is enforceable by execution.

DISTRICT OF COLUMBIA A final judgment is enforceable for twelve years. D.C. Code § 15-101. An order of revival extends the effect of the judgment for another twelve years from the date of the revival order.

Execution of Judgment: Execution refers to an official document that directs a sheriff to take possession of a judgment debtor's property so that it either (a) may be turned over to the judgment creditor or (b) may be sold at public sale so that the proceeds may be turned over to the judgment creditor.