District of Columbia Notice of Returned Check

Description

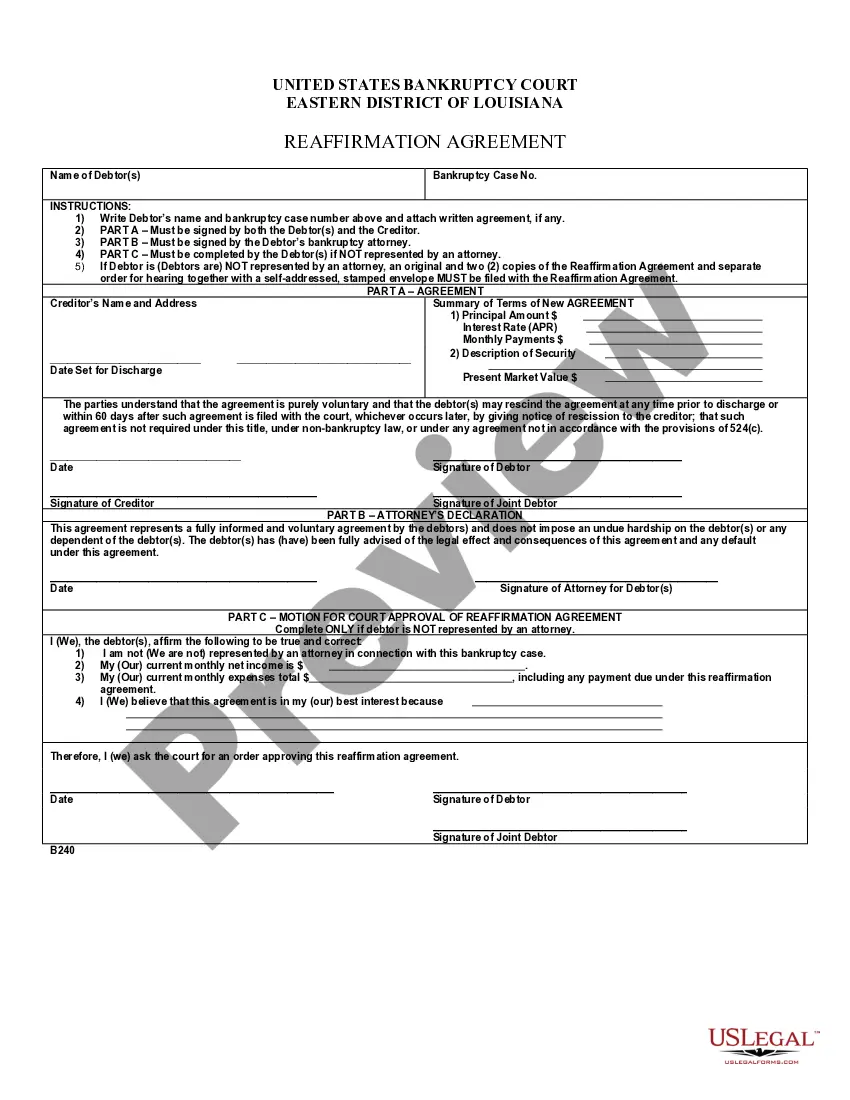

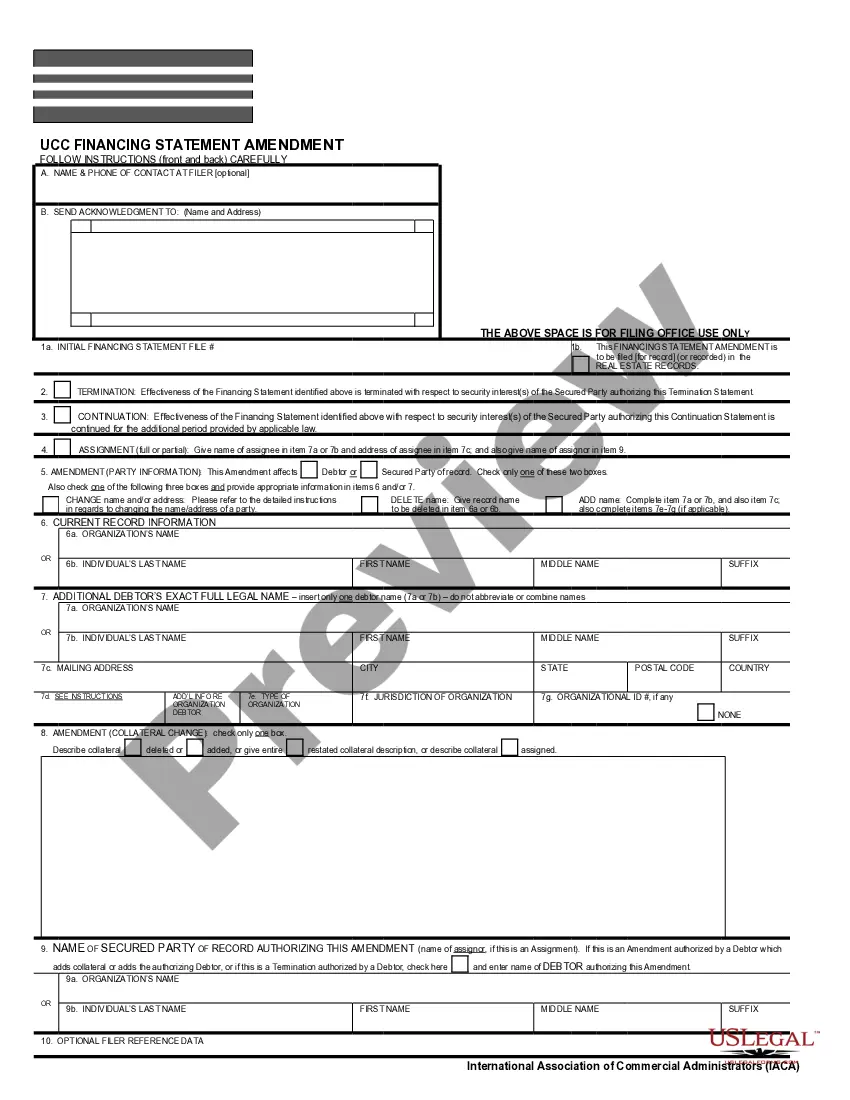

How to fill out Notice Of Returned Check?

You can dedicate hours online searching for the authentic document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast array of authentic forms that are evaluated by experts.

You can effortlessly download or print the District of Columbia Notice of Returned Check from our service.

To find another version of the form, use the Search field to locate the template that fits your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Afterward, you can complete, modify, print, or sign the District of Columbia Notice of Returned Check.

- Every authentic document template you buy belongs to you permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your desired area/city.

- Review the form details to confirm you have selected the accurate form.

Form popularity

FAQ

When a check is returned to sender in the District of Columbia, the payee usually receives a District of Columbia Notice of Returned Check, which informs them about the issue. This notice typically indicates the reason for the return, such as insufficient funds or a closed account. Once you receive this notice, it is essential to resolve the situation promptly to avoid further complications or fees. Using resources like UsLegalForms can help you understand your rights and obligations regarding returned checks and provide templates to respond appropriately.

Whether a returned check will be resubmitted depends on the agreement between the issuer and the payee. Generally, it is advisable to resolve any issues before resubmission. You may receive a District of Columbia Notice of Returned Check, which provides important details regarding the return that can help facilitate this process.

Typically, the recipient of a bounced check does not incur direct charges due to the bounced check itself. However, they may face fees from their bank, depending on their account type and bank policies. The District of Columbia Notice of Returned Check is crucial in understanding these fees and resolving the situation.

The person who wrote the check is primarily responsible if it bounces. If you receive notice of a returned check, such as a District of Columbia Notice of Returned Check, it typically indicates that the payer did not have sufficient funds to cover the payment. This notice serves as a reminder of their obligation.

If you receive a check that bounces, you will need to inform the issuer and discuss how to resolve the situation. Furthermore, a District of Columbia Notice of Returned Check will provide you with documentation of the bounced check. This notice can help in discussions or any potential legal recourse.

The penalties for a returned check can vary. Typically, the individual who issued the check may face fees from their bank, as well as potential additional charges from the recipient. If you receive a District of Columbia Notice of Returned Check, it may also guide you toward your options for seeking those fees.

The responsibility for paying any fees associated with a returned check usually lies with the check writer. If you receive a District of Columbia Notice of Returned Check, it indicates that the bank has imposed fees for the returned item. It's essential to clarify payment responsibilities to avoid confusion.

When a check is returned to the sender, it typically means that the bank has rejected it for specific reasons, such as lack of funds or closed accounts. You will receive a District of Columbia Notice of Returned Check, which offers details about the return. Understanding this notice can help you address the matter effectively.

To collect a returned check, start by contacting the person who issued it. Discuss the situation and request a replacement payment or a different form of settlement. If the issue persists, the District of Columbia Notice of Returned Check may serve as a formal reminder of the debt, which can be useful in resolving disputes.

A returned check notice is a formal communication sent to notify the payee that their check has not been honored by the bank. This District of Columbia Notice of Returned Check provides specific reasons for the return, helping you understand the situation better. It is an important document for managing payment disputes and can guide your next steps.