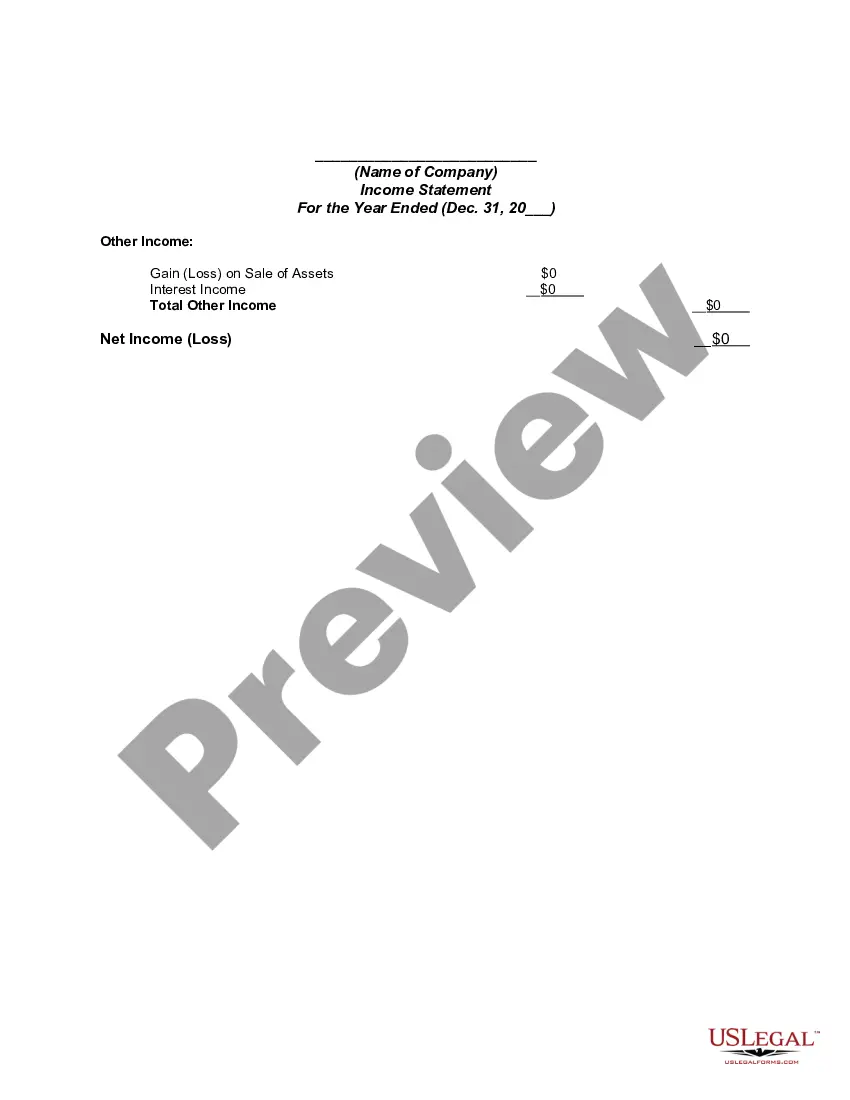

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

District of Columbia Income Statement

Description

How to fill out Income Statement?

If you need to finalize, obtain, or print sanctioned documents templates, utilize US Legal Forms, the finest collection of legal forms, accessible online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal use are organized by categories and jurisdictions, or by keywords.

Step 4. After finding the form you require, click on the Buy now button. Choose your desired payment plan and enter your details to create an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the District of Columbia Income Statement with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to access the District of Columbia Income Statement.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

- Step 2. Use the Preview feature to review the content of the form. Don't forget to read the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative types within the legal form library.

Form popularity

FAQ

If your income meets or exceeds the established thresholds, it is mandatory to file a tax return in DC. Failing to file can lead to penalties and interest charges, so filing your District of Columbia Income Statement is crucial. Platforms like US Legal Forms offer tools to guide you through the necessary steps, making the process smoother and easier.

Yes, DC operates similarly to a state and requires residents and non-residents to file a local tax return. This is known as the District of Columbia Income Statement. Ensure that you understand your filing obligations to stay compliant with DC laws and benefit from any potential tax credits or refunds.

The threshold for filing taxes in the District of Columbia varies based on your filing status and income type. Generally, if your income exceeds $12,400 for single filers or $24,800 for married couples, you need to file a DC tax return. Using the District of Columbia Income Statement can help you easily determine your filing requirements based on your specific income.

You can mail your DC income tax return to the Office of Tax and Revenue in Washington, DC. Ensure you send it to the correct address, which can vary based on whether you include a payment or not. For a smooth filing experience, utilize the District of Columbia Income Statement provided by platforms like US Legal Forms, which guides you through the mailing process.

Yes, you must file a DC income tax return if your income exceeds certain thresholds established by the District. This applies to both residents and non-residents earning income in the District. By filing your District of Columbia Income Statement, you not only fulfill your legal obligation but also keep your financial records up to date.

Residents and non-residents who earn income in the District of Columbia need to file a DC tax return. This includes individuals who receive wages, self-employment income, or other taxable earnings. If you meet the income threshold, you must complete a District of Columbia Income Statement. It's important to file to avoid penalties and ensure compliance with local laws.

To request your 1099-G from the District of Columbia, contact the agency responsible for issuing it, such as the Office of Tax and Revenue. Additionally, you can check if they have an online portal for downloading or requesting the form. Remember, your District of Columbia Income Statement is important for your records and may be useful when reviewing your income figures.

To obtain your DC tax transcript, visit the DC Office of Tax and Revenue website, where you can access their online transcript request tool. You may need to provide personal information to verify your identity. Having your District of Columbia Income Statement handy can help ensure you provide accurate information during this process.

To get your DC 1099-G, you should check your mail for the form that is typically sent out to eligible taxpayers. If you do not receive it, you can request a duplicate from the DC Office of Tax and Revenue. Always maintain your District of Columbia Income Statement, as it can assist in accurately reporting your income when you finally obtain your 1099-G.

You can obtain a copy of Form 1099-G by contacting the agency that issued it, such as the DC Office of Tax and Revenue. They may provide the form upon request through mail or email. Don't forget that having your District of Columbia Income Statement can help verify your income figures when you receive your 1099-G.