District of Columbia Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

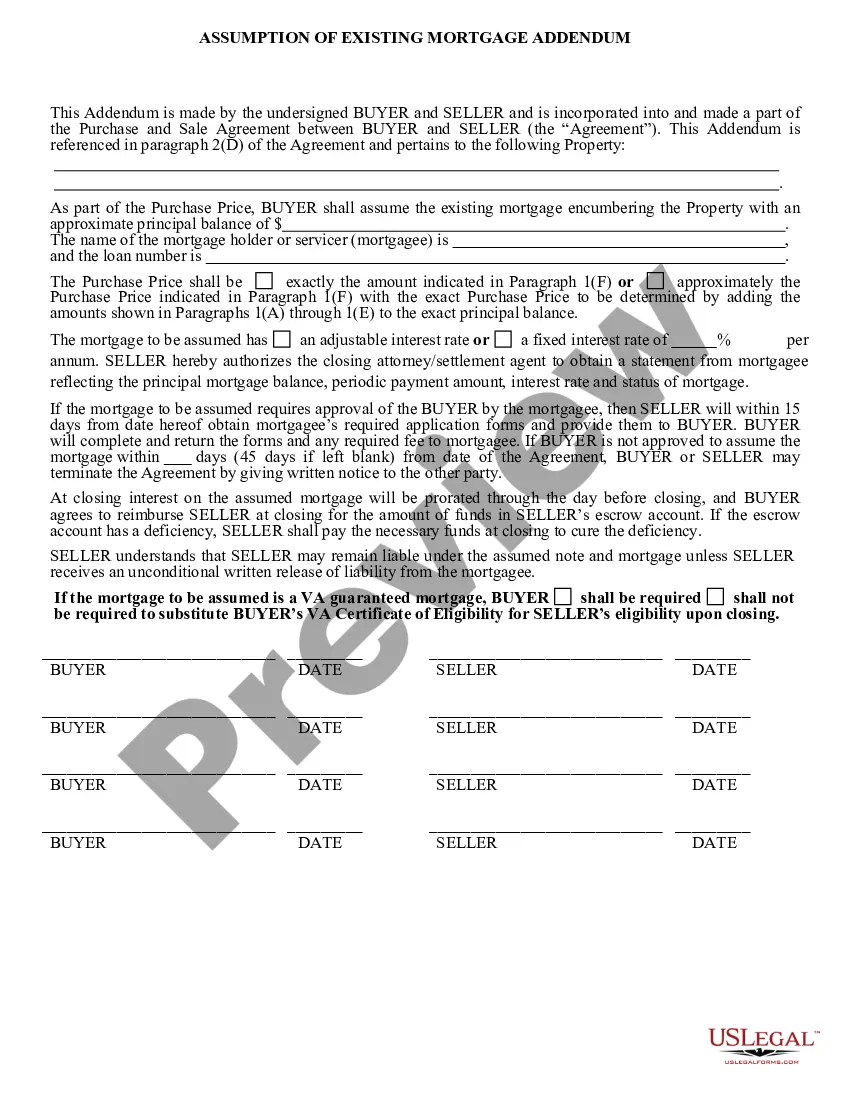

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

It is possible to spend hrs on the web trying to find the legitimate document web template which fits the federal and state demands you require. US Legal Forms gives thousands of legitimate forms that happen to be examined by experts. It is simple to obtain or produce the District of Columbia Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage from your assistance.

If you have a US Legal Forms accounts, it is possible to log in and click on the Download button. Afterward, it is possible to full, edit, produce, or indicator the District of Columbia Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage. Each and every legitimate document web template you purchase is your own property permanently. To obtain one more backup of the purchased kind, proceed to the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms web site the very first time, adhere to the simple recommendations under:

- Initially, ensure that you have chosen the right document web template to the region/area of your liking. See the kind outline to make sure you have picked out the correct kind. If available, take advantage of the Review button to search with the document web template at the same time.

- In order to discover one more variation in the kind, take advantage of the Look for area to find the web template that meets your needs and demands.

- Upon having located the web template you want, simply click Purchase now to carry on.

- Choose the rates program you want, type your credentials, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal accounts to purchase the legitimate kind.

- Choose the file format in the document and obtain it to the device.

- Make changes to the document if possible. It is possible to full, edit and indicator and produce District of Columbia Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

Download and produce thousands of document layouts using the US Legal Forms Internet site, that offers the largest collection of legitimate forms. Use professional and state-specific layouts to handle your organization or person requirements.

Form popularity

FAQ

TL;DR: The primary mortgage market is used for homebuyers and lenders. Lenders finance a borrower's purchase of a home. The secondary mortgage market is between lenders and mortgage investors. Lenders will sell the debt to the investor who will buy it to make a profit.

How to Combine Two Mortgages Review Your Refinance Options. Before you start the consolidation process, read up on the different refinancing options available. ... Apply for the Refinance Loan. ... Get an Appraisal. ... Close on the New Loan. ... Lower Interest Rate. ... Switch From ARM to Fixed-Rate. ... Shorter Loan Term. ... Lower Monthly Payments.

First Mortgagee means any person named as a mortgagee or beneficiary in any First Mortgage, or any successor to the interest of any such person under such First Mortgage.

A second mortgage is a loan made in addition to the homeowner's primary mortgage. Home equity lines of credit (HELOCs) are often used as second mortgages. Homeowners might use a second mortgage to finance large purchases like college, a new vehicle, or even a down payment on a second home.

Key Takeaways. A first mortgage is a primary lien on the property that secures the mortgage. The second mortgage is money borrowed against home equity to fund other projects and expenditures.