District of Columbia Sample Letter for Corporation Taxes

Description

How to fill out Sample Letter For Corporation Taxes?

Finding the right legitimate record format could be a have a problem. Needless to say, there are a variety of web templates accessible on the Internet, but how can you obtain the legitimate kind you want? Utilize the US Legal Forms website. The services delivers thousands of web templates, like the District of Columbia Sample Letter for Corporation Taxes, that you can use for business and private requires. All of the varieties are checked by experts and meet federal and state requirements.

When you are already registered, log in for your bank account and click on the Obtain switch to have the District of Columbia Sample Letter for Corporation Taxes. Make use of bank account to check with the legitimate varieties you might have acquired earlier. Check out the My Forms tab of your own bank account and obtain another copy from the record you want.

When you are a brand new customer of US Legal Forms, listed here are simple instructions that you can comply with:

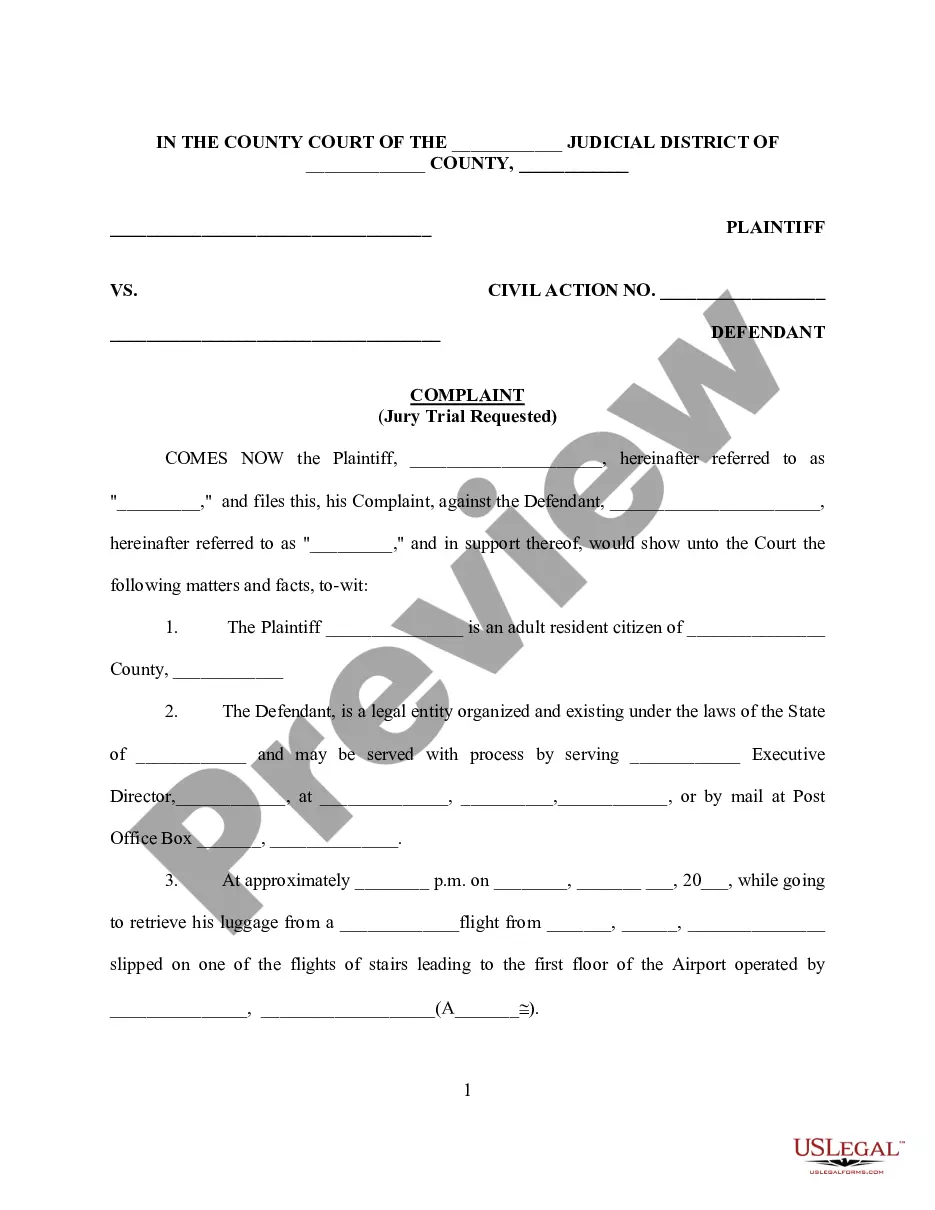

- Initially, make sure you have selected the right kind for the area/region. You are able to look over the form utilizing the Preview switch and look at the form information to guarantee this is basically the best for you.

- In the event the kind fails to meet your preferences, utilize the Seach discipline to get the correct kind.

- Once you are certain the form is acceptable, go through the Buy now switch to have the kind.

- Pick the rates plan you need and type in the needed info. Make your bank account and pay for the transaction making use of your PayPal bank account or charge card.

- Select the file file format and acquire the legitimate record format for your device.

- Total, revise and printing and indicator the attained District of Columbia Sample Letter for Corporation Taxes.

US Legal Forms is definitely the most significant library of legitimate varieties for which you can find various record web templates. Utilize the company to acquire skillfully-made documents that comply with express requirements.

Form popularity

FAQ

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year.

The District of Columbia (DC) has a graduated individual income tax, with rates ranging from 4.00 percent to 10.75 percent. DC has a flat 8.25 percent corporate income tax rate. DC also has a 6.00 percent sales tax rate. DC's tax system ranks 48th overall on our 2023 State Business Tax Climate Index.

FR-500 New Business Registration (new registrations only)

How is the 183 days residency rule applied to tax returns? Every day that a taxpayer is in the District of Columbia and maintains a place of residency for an aggregate of 183 days or more, including days of temporary absence is counted towards the 183 days residency rule.

Corporations that carry on or engage in a business or trade in D.C. or otherwise receive income from sources within D.C. must file Form D-20 with the D.C. Office of Tax and Revenue. The minimum payable tax is $250 if gross D.C. receipts are $1 million or less; $1,000 if they exceed $1 million.

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

2. FP-31 Tax Return. The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.